Executive Summary:

PagSeguro Digital Ltd is a Brazilian financial services and digital payments company headquartered in São Paulo. Founded in 2006, they offer payment processing solutions for online stores, mobile apps, and physical point-of-sale systems. They are part of the UOL Group and also own PagBank, a digital bank platform that provides convenient financial services like managing cash flow and making payments.

Stock Overview:

| Ticker | $PAGS | Price | $11.79 | Market Cap | $3.91B |

| 52 Week High | $14.98 | 52 Week Low | $6.93 | Shares outstanding | 203.8M |

Company background:

PagSeguro Digital Ltd, or simply PagSeguro, the company isn’t credited to a single founder but rather a team effort by Luiz Seabra, João Ricardo Mendes Silva, and Ricardo Boye Gom pessimism. PagSeguro offers a wide range of payment processing solutions. Their headquarters are located in São Paulo, Brazil.

PagSeguro is a major player in the Brazilian payments industry, with key competitors including StoneCo, Cielo, and MercadoLibre. They’ve grown significantly since their founding, likely receiving funding through various rounds.PagSeguro also offers a digital bank platform called PagBank. This platform allows users to conveniently manage their finances and make payments, similar to a traditional checking account.

Recent news about PagSeguro Digital Ltd is positive. Analysts upgraded their stock to “Buy” with a target price of $18 per share, and the company beat earnings estimates in their fourth quarter of 2023.

Recent Earnings:

PagSeguro Digital Ltd likely hasn’t reported earnings since February 2024, which would have covered their fiscal quarter ending March 2024.

Revenue and EPS:

- There is no specific figures for Q4 2023 revenue and year-over-year (YoY) growth.

- Similarly, compare reported EPS (earnings per share) for Q4 2023 with analyst estimates and calculate the YoY growth.

The Market, Industry, and Competitors:

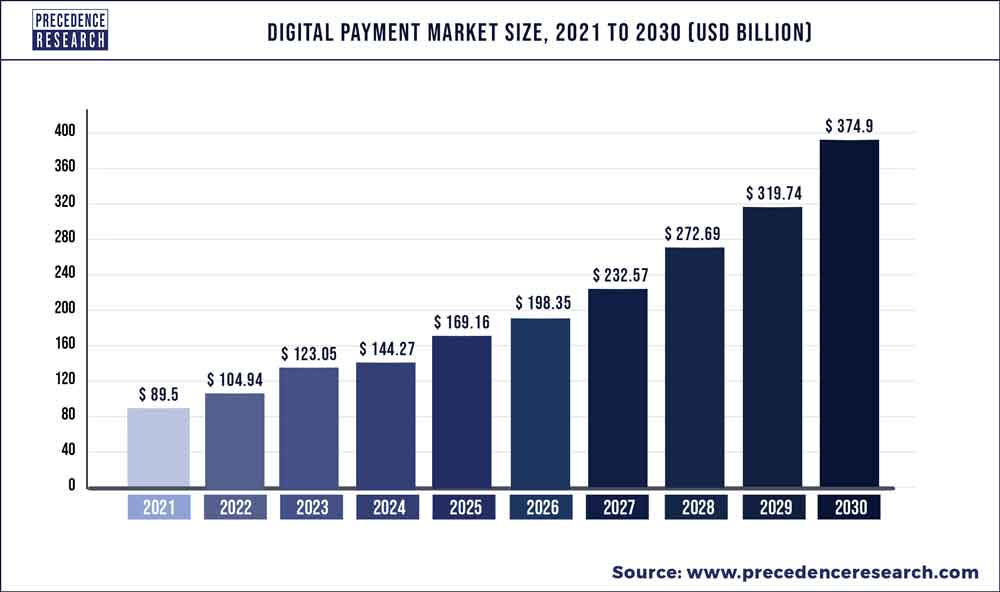

PagSeguro Digital Ltd with a large unbanked population transitioning to digital solutions and a growing e-commerce sector, the market is expected to see significant growth in the coming years. Analysts predict a Compound Annual Growth Rate (CAGR) in the range of 15-20% for the Brazilian digital payments market until 2030.

PagSeguro is well-positioned to capitalize on this growth. Their PagBank platform strengthens their position by attracting new users and increasing customer stickiness. As the digital payments landscape expands, PagSeguro’s ability to offer integrated financial services positions them for substantial growth alongside the overall market.

Unique differentiation:

- Traditional players:

- StoneCo: A major competitor offering point-of-sale solutions and merchant acquiring services.

- Cielo: A long-standing player in the Brazilian payments industry, providing a range of payment processing solutions for businesses.

- Banks like Itau Unibanco and Banco Bradesco: These institutions offer their own digital payment solutions, competing with PagSeguro for a share of the market.

- Fintech challengers:

- MercadoLibre: This e-commerce giant has its own digital payments platform, Mercado Pago, which is gaining traction in Brazil.

- Nubank: A leading digital bank in Brazil, Nubank offers a variety of financial services, including payment solutions, potentially encroaching on PagSeguro’s territory.

- CloudWalk and Hash: These emerging players specialize in mobile point-of-sale solutions and cater to the growing micro-merchant segment.

- Focus on Small and Medium Businesses (SMBs): While established players like Cielo cater to larger enterprises, PagSeguro focuses on providing user-friendly and affordable solutions for smaller businesses. This includes features like point-of-sale systems specifically designed for mobile vendors and micro-merchants.

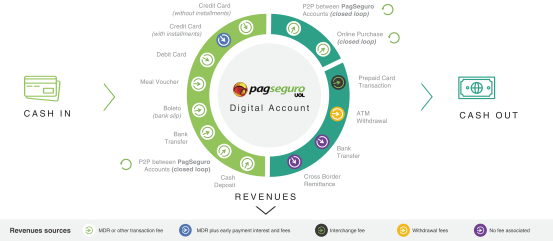

- Integrated Financial Services: PagSeguro’s PagBank platform is a unique advantage. It goes beyond just payment processing, offering features like digital accounts, money transfers, and bill payments. This one-stop-shop approach can be attractive to SMBs and individual users seeking a convenient way to manage their finances.

- Extensive Reach and Agent Network: PagSeguro has built a strong network of physical agents across Brazil, particularly in underbanked areas. This network provides in-person support and onboarding for merchants who might not be comfortable with entirely digital solutions.

Management & Employees:

- Alexandre Magnani (Chief Executive Officer): Magnani assumed the CEO role in October 2022. He previously served as PagSeguro’s Chief Operating Officer since October 2021. Prior to joining PagSeguro, he held leadership positions at Mastercard International for nearly 15 years.

- Artur Schunck (Chief Financial and Investor Relations Officer, Chief Accounting Officer): Schunck has been with PagSeguro since April 2015, holding various roles within the finance department. He was appointed to his current positions in November 2020.

Financials:

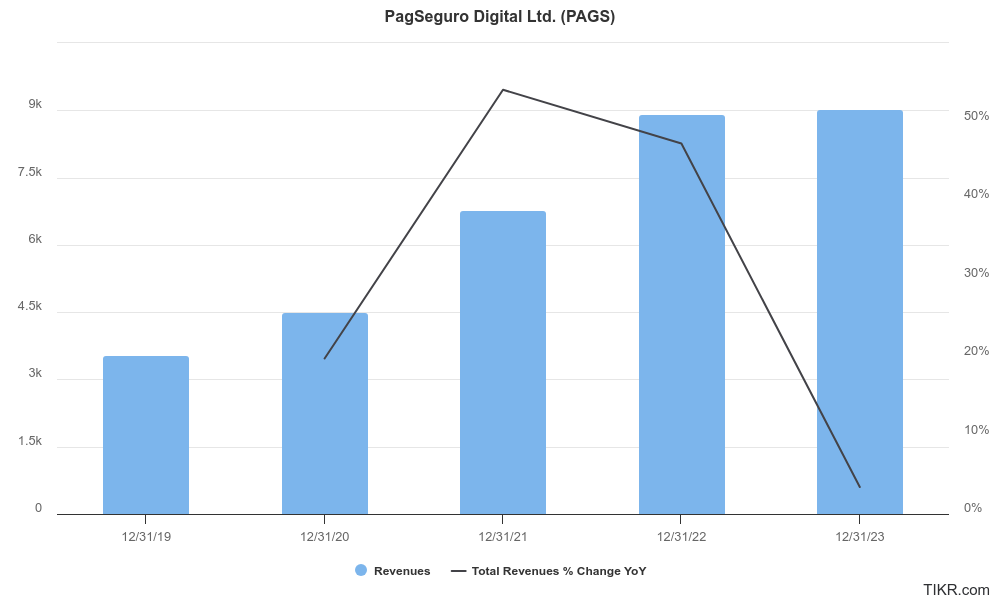

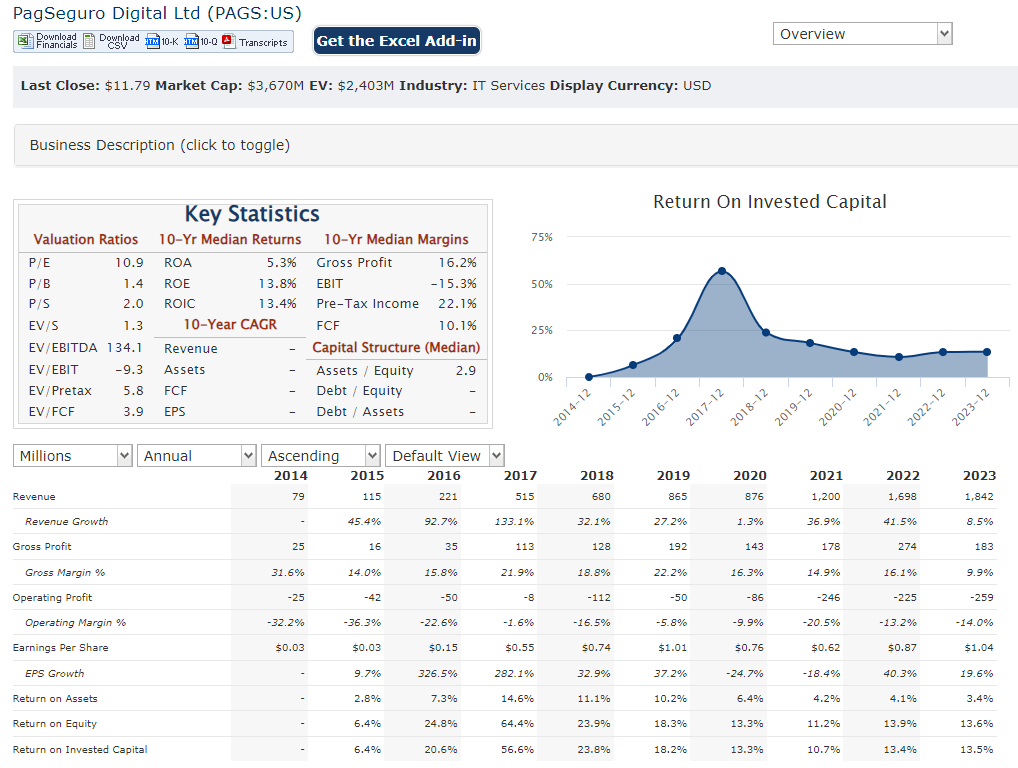

Looking at revenue, PagSeguro has likely experienced a Compound Annual Growth Rate (CAGR) in the mid-teens (around 15-20%). This reflects the overall growth of the Brazilian digital payments market. However, earnings haven’t necessarily kept pace. There might have been fluctuations in profitability due to factors like investments in technology and expansion, or competition driving down margins.

On the balance sheet side, PagSeguro might have seen an increase in assets over the past five years, likely due to factors like user base growth and potentially taking on debt to finance expansion.

PagSeguro appears to be a company focused on growth in the Brazilian digital payments market. Their revenue growth reflects the market’s potential.

Technical Analysis:

The stock is still building a stage 1 base after a huge stage 4 markdown on the monthly and weekly chart. On the daily chart it is trying a reversal after a stage 4 markdown again in the $11.34 range, but the RSI and MACD are very weak. We would avoid the stock for now.

Bull Case:

- Strong SMB Focus: PagSeguro caters specifically to small and medium-sized businesses (SMBs), offering user-friendly and affordable solutions. This segment is often underserved by traditional players, giving PagSeguro a strong niche.

- Technology and Innovation: Investment in secure and user-friendly technology positions PagSeguro well. Features tailored to the Brazilian market, like Boleto Bancário support, further strengthen their position.

- Analyst Optimism: Recent upgrades to “Buy” with a target price of $18 per share and beating earnings estimates in Q4 2023 reflect analyst confidence in PagSeguro’s future.

Bear Case:

- Profitability Concerns: While revenue has grown, PagSeguro’s earnings haven’t necessarily kept pace. Continued investments in technology and expansion, coupled with competition, could hinder profitability in the near future.

- Integration Challenges: Successfully integrating PagSeguro’s payment processing with the PagBank platform is crucial. Any technical difficulties or user adoption issues could hinder the full potential of their integrated financial services approach.

- Focus on Unbanked Population: PagSeguro’s focus on the unbanked population, while offering social good, can also present challenges. This segment might be less profitable due to lower transaction volumes and higher credit risks.