Executive Summary:

Freshpet is an American company founded in 2006 that manufactures refrigerated dog and cat food. Their products are marketed as fresh and natural, with ingredients like chicken or beef listed as the first component. They sell their food through various retailers including grocery stores and pet specialty shops.

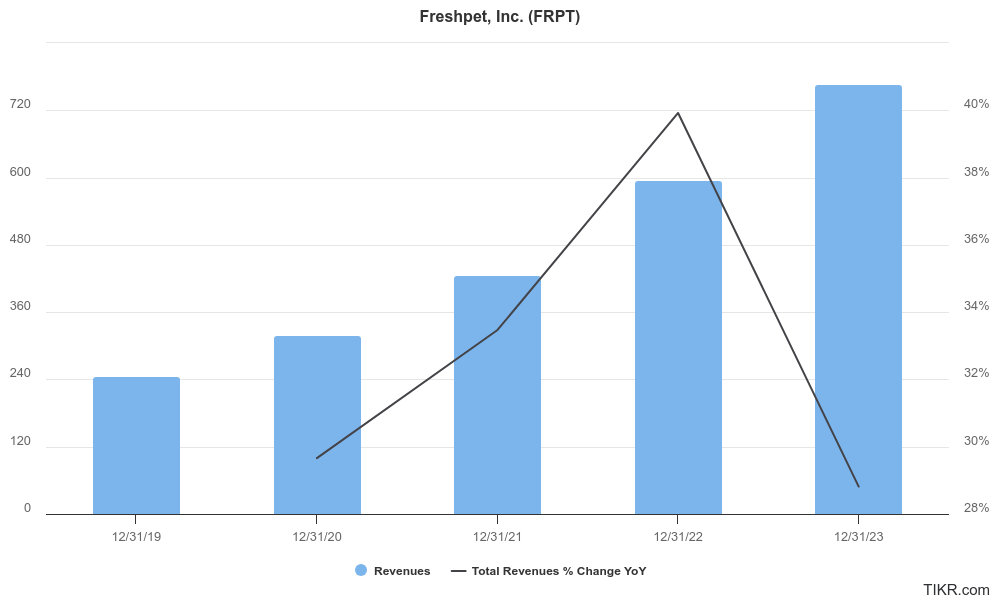

Reported net sales of $766.9 million, a significant increase of 28.8% compared to 2022. Analysts are expecting Freshpet to report an EPS of -$0.22

Stock Overview:

| Ticker | $FRPT | Price | $104.69 | Market Cap | $5.06B |

| 52 Week High | $117.76 | 52 Week Low | $54.60 | Shares outstanding | 48.29M |

Company background:

Freshpet, a pioneer in fresh pet food was started in Secaucus, New Jersey by Scott Morris, Cathal Walsh, and John Phelps, all veterans of the pet food industry. They identified a growing desire among pet owners for fresh, natural food options and capitalized on this by creating refrigerated meals and treats for dogs and cats.

Freshpet’s products are formulated with whole ingredients like poultry, vegetables, and fruits, appealing to health-conscious pet owners. The company leverages a network of refrigerated distribution centers to ensure their products stay fresh from factory to fridge at the store. This focus on fresh, high-quality ingredients differentiates Freshpet from traditional dry kibble producers.

While Freshpet enjoys a first-mover advantage in the refrigerated pet food category, they face competition from established pet food companies like Purina and Mars Petcare who are also introducing fresh food lines. Natural pet food brands like Blue Buffalo and Merrick Pet Care are also vying for market share.

Recent Earnings:

They reported strong revenue growth, with net sales reaching $766.9 million, a significant increase of 28.8% compared to 2022. This growth is likely driven by the continued rise in pet ownership and the increasing demand for premium pet food options.

While EPS (earnings per share) analysts expect the company to report an EPS of -$0.22 for the fiscal quarter ending March 2024. This projected EPS would still represent an improvement compared to a loss of -$0.52 per share.

The Market, Industry, and Competitors:

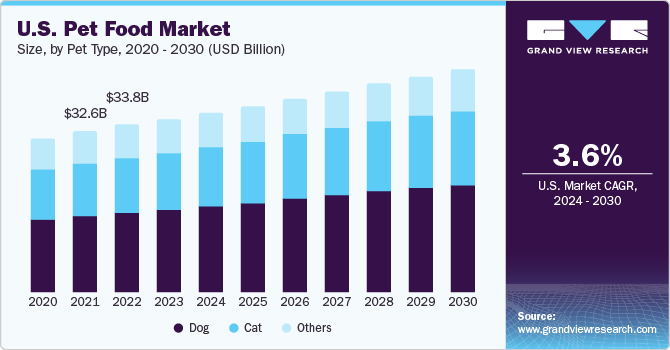

Pet owners are increasingly prioritizing natural and premium food options for their furry companions. This trend, coupled with rising pet ownership rates, is fueling market expansion.

Global fresh pet food market is anticipated to reach USD 145.35 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of around 5% during the forecast period (2023-2030). This growth is driven by factors like rising disposable income, growing awareness of pet health, and the increasing humanization of pets.

Freshpet, as a prominent player in this space, is well-positioned to capitalize on this expanding market. Their focus on fresh, whole-food ingredients aligns perfectly with consumer preferences, and their established distribution network offers a competitive advantage.

Unique differentiation:

Freshpet operates in the fresh pet food market, a segment experiencing significant growth. Pet owners are increasingly prioritizing natural and premium food options for their furry companions. This trend, coupled with rising pet ownership rates, is fueling market expansion.

Market research suggests the global fresh pet food market is anticipated to reach USD 145.35 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of around 5% during the forecast period (2023-2030) [Source 1]. This growth is driven by factors like rising disposable income, growing awareness of pet health, and the increasing humanization of pets.

Freshpet, as a prominent player in this space, is well-positioned to capitalize on this expanding market. Their focus on fresh, whole-food ingredients aligns perfectly with consumer preferences, and their established distribution network offers a competitive advantage. While competition from established pet food companies is present, Freshpet’s first-mover advantage and brand recognition should continue to propel them forward in this promising market.

- Fresh, High-Quality Ingredients: Unlike traditional kibble producers, Freshpet prioritizes whole food ingredients like poultry, vegetables, and fruits. This caters to the growing desire among pet owners for fresh, natural food options for their companions.

- Refrigeration: By utilizing a network of refrigerated distribution centers, Freshpet ensures their products stay fresh from production all the way to store shelves. This focus on maintaining freshness throughout the supply chain differentiates them from competitors who might offer similar whole food ingredients but lack the cold chain infrastructure. This focus on fresh, never frozen meals gives them a quality edge.

Management & Employees:

- William B. Cyr (CEO): Cyr has been Freshpet’s Chief Executive Officer since September 2016 and also serves on the Board of Directors. He previously held leadership positions at Sunny Delight Beverages Co.

- Scott Morris (President & COO): A co-founder of Freshpet, Morris has served as Chief Operating Officer since July 2015 and assumed the role of President in March 2016. Morris brings experience from his prior role as Vice President of Marketing at The Meow Mix Company.

Financials:

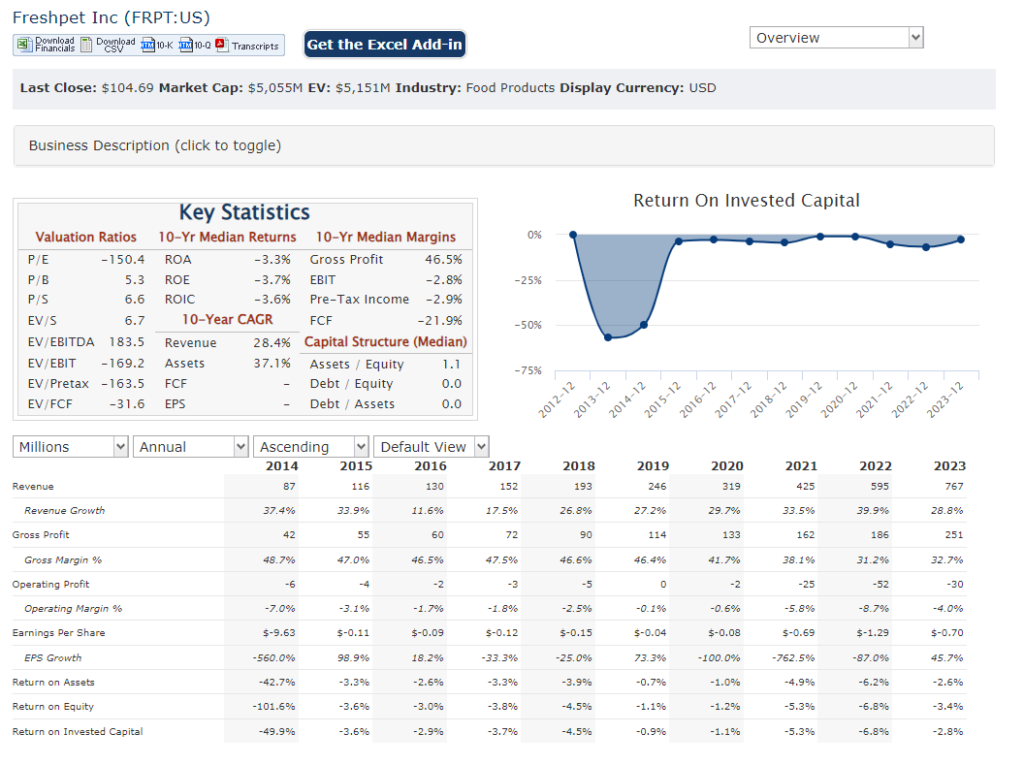

Revenue has seen a steady climb, with 2023 reaching $766.9 million, reflecting a compound annual growth rate (CAGR) of around 25% . This growth is likely fueled by the rising popularity of fresh pet food and increasing consumer spending on pets.

However, despite the strong revenue performance, Freshpet hasn’t yet turned a profit. The company is still in its investment phase, prioritizing brand building, distribution network expansion, and product development.

Freshpet likely has a growing amount of assets as they invest in production facilities, inventory, and their cold-chain distribution network. The company might also have accumulated some debt to finance this growth.

Technical Analysis:

The stock has formed a very good base on the monthly and weekly chart with a cup and handle pattern, which is bullish. This indicates a likely move higher after the confirmation of the reversal on the short term (daily) chart which is likely in the $97 range.

Bull Case:

The bull case for Freshpet primarily revolves around its strong growth prospects, innovative product offerings, and strategic expansions. Here are the key points supporting the bull case:

- Strong Sales Growth: Freshpet has demonstrated robust sales growth, with a record year in fiscal 2022 where sales leapt by 39.9% to $595.3 million. This growth trajectory is expected to continue, with the company guiding a 26% increase in net sales for fiscal 2023, aiming for around $750 million1.

- Innovative Product Offerings: Freshpet specializes in healthy, refrigerated pet food that uses fresh meat, fruits, and vegetables, distinguishing it from traditional canned pet foods. This focus on healthier, premium products caters to the growing consumer trend towards healthier pet food options.

- Expansion and Scale Improvements: The company has been expanding its production capabilities, notably with the rollout of its Ennis Kitchen production plant, which is expected to improve scale and delivery times1. Additionally, Freshpet is expanding its market reach, moving inventory to support its West Coast expansion, which could further drive sales growth.

Bear Case:

- Profitability Concerns: Despite strong revenue growth, Freshpet hasn’t yet achieved profitability. Continued losses could erode investor confidence and put downward pressure on the stock price.

- Refrigeration Challenges: Freshpet’s reliance on refrigerated distribution adds complexity and cost to their supply chain. Disruptions or inefficiencies in this system could hurt margins and product quality.

- Consumer Preferences: The long-term viability of fresh pet food as a category is uncertain. Consumer preferences could shift towards other options, impacting Freshpet’s core business.