Executive Summary:

QuantumScape is an battery company developing solid-state lithium metal batteries specifically designed for electric vehicles. Their goal is to create batteries that hold more energy, charge faster, and are safer than current lithium-ion batteries. They believe this will be a major factor in widespread electric vehicle adoption. The company was founded in 2010 and is headquartered in San Jose, California.

Stock Overview:

| Ticker | $QS | Price | $6.13 | Market Cap | $3.04B |

| 52 Week High | $13.86 | 52 Week Low | $4.99 | Shares outstanding | 441.14M |

Company background:

QuantumScape was founded by Jagdeep Singh, Tim Holme, and Fritz Prinz. T. QuantumScape is notable for its investors, which include Bill Gates and Volkswagen.

The company batteries aim to address limitations of current lithium-ion batteries by offering greater energy density, enabling faster charging times, and featuring enhanced safety. QuantumScape believes this technology is crucial for wider adoption of electric vehicles.

Solid-state battery technology is still under development, and QuantumScape faces competition from other companies like Solid Power, Samsung SDI, and LG Chem. QuantumScape’s partnership with Volkswagen positions them well for potential future production and adoption of their batteries in electric vehicles.

Recent Earnings:

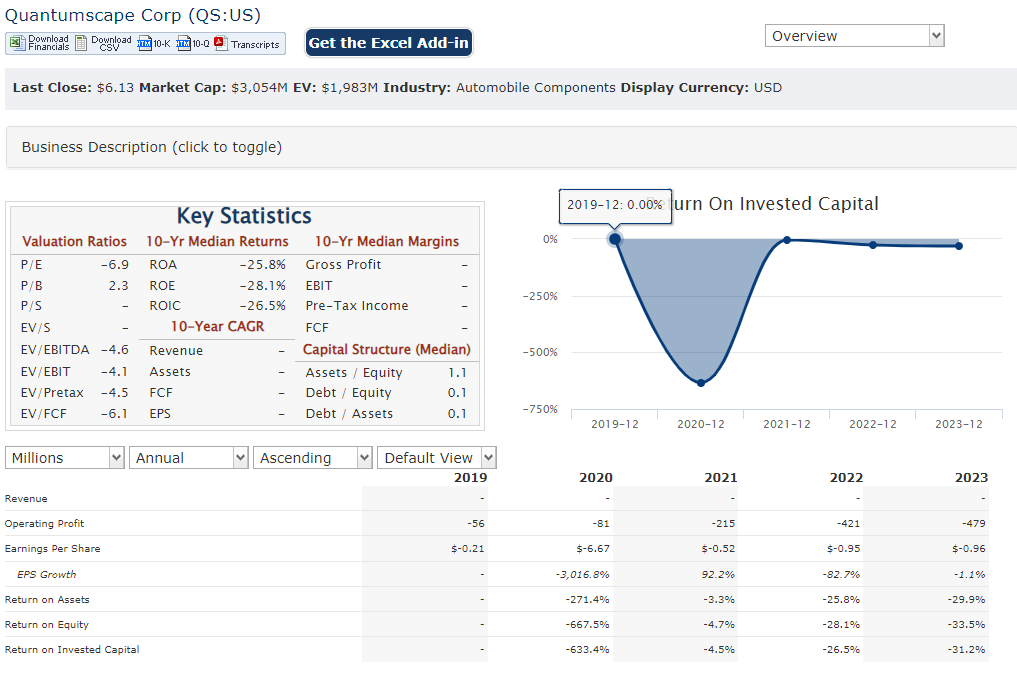

QuantumScape reported a loss per share of -$0.23. This showed an improvement of 8% year-over-year. Analysts are expecting a further improvement to -$0.21 EPS for Q1 2024. Investors are particularly interested in their anticipated timeline for commercializing their solid-state battery technology and their future production capacity.

The Market, Industry, and Competitors:

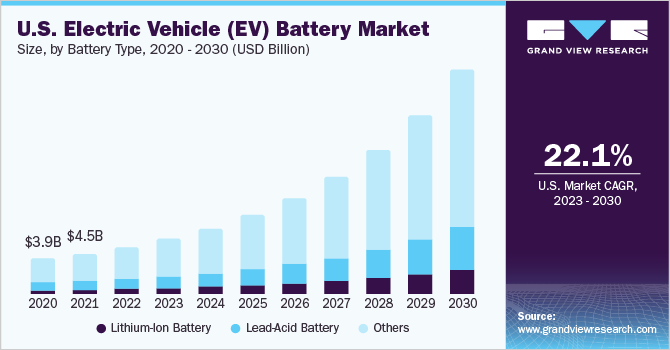

QuantumScape operates in the electric vehicle (EV) battery market. This market is expected to experience significant growth in the coming decades, driven by factors such as increasing government regulations on emissions, growing consumer demand for EVs, and falling battery costs. The global EV battery market is expected to reach $250 billion by 2030, growing at a CAGR (compound annual growth rate) of 30% from 2020.

QuantumScape’s solid-state lithium metal batteries have the potential to revolutionize the EV battery market by offering longer range, faster charging times, and improved safety compared to current lithium-ion batteries.

Unique differentiation:

QuantumScape faces competition from several companies developing solid-state batteries and vying for a piece of the future electric vehicle (EV) battery market:

- Established Incumbents: Traditional battery giants like LG Chem, Samsung SDI, and CALB Group are actively researching and developing solid-state batteries. They leverage their experience in mass production and existing relationships with automakers, potentially giving them an edge in scaling up production quickly.

- Solid-State Focused Startups: Several well-funded startups like Solid Power, SES, and Ion Storage Systems are also working on solid-state battery technology. These companies often have unique approaches and may possess a speed advantage due to their nimble structure.

- Alternative Battery Technologies: Companies developing alternative battery technologies like lithium-sulfur or zinc-air could also pose indirect competition. While not strictly solid-state, these technologies aim to address similar challenges of range and charging times in EVs.

- Solid-State Battery Design: QuantumScape’s approach utilizes a lithium metal anode and a solid-state separator.

- Higher Energy Density: This could translate to longer driving range for electric vehicles equipped with QuantumScape batteries.

- Faster Charging Times: Compared to traditional lithium-ion batteries, QuantumScape’s batteries could potentially recharge significantly faster.

- Improved Safety: Solid-state design eliminates the flammable liquid electrolyte present in lithium-ion batteries, potentially leading to safer operation.

- Manufacturing Scalability: QuantumScape emphasizes the potential for their technology to be manufactured using existing lithium-ion battery production lines. This could be a significant advantage if they can achieve this, as it would speed up commercialization and reduce costs compared to entirely new production processes.

- Partnership with Volkswagen: QuantumScape has a strategic partnership with Volkswagen, a major automaker with a significant investment in the company. This partnership could provide QuantumScape with a clear path to commercialization by integrating their batteries into future Volkswagen EVs.

Management & Employees:

- Dr. Sivaram: President and Chief Executive Officer, responsible for overall company strategy and execution. Brings extensive experience in technology development and commercialization from his prior roles at Western Digital and SanDisk.

- Jagdeep Singh: Co-founder and Board Chairman and Chief Development Officer, leads research, development, and engineering efforts. Possesses a strong scientific background with a focus on solid-state battery technology.

- JB Straubel: Founder & CEO of Redwood Materials, Co-founder Tesla (brings experience and connections within the EV industry).

Financials:

Looking at the balance sheet, QuantumScape is in a strong position with no debt. They have a healthy amount of cash runway, estimated to be sufficient for over 3 years based on their current spending rate. This financial stability allows them to focus on research and development without immediate pressure to generate revenue.

Technical Analysis: On the monthly and weekly chart, the stock is still forming a base. This is a very speculative stock, which means a very long term outlook 3+ years is necessary. On the daily chart, there is a head and shoulder formation (bearish) and a bounce is possible with an early reversal underway.

We expect shares to move slightly higher and stay range bound in the $5 to $8 range for another year or more.

Bull Case:

- Technological Breakthrough: If QuantumScape successfully brings its batteries to market, they could offer significant advantages over current lithium-ion batteries:

- Increased Range: QuantumScape’s batteries have the potential to hold more energy, allowing electric vehicles to travel farther on a single charge.

- Market Opportunity: The EV market is expected to experience explosive growth in the coming decade. QuantumScape, with a first-mover advantage in solid-state battery technology, could be perfectly positioned to capture a significant share of this rapidly expanding market.

Bear Case:

- Technological Hurdles: Solid-state battery technology is still under development, and QuantumScape faces several technical hurdles.

- Manufacturing Scalability: Their ability to mass-produce batteries at a commercially viable cost and scale remains unproven.

- Safety Concerns: Even with a solid-state design, ensuring complete safety and eliminating all potential risks in large-scale battery production is crucial.

- Execution Risk: Even with a strong team and promising technology, successfully navigating the complexities of research, development, manufacturing, and commercialization is a major challenge. Delays, setbacks, or execution errors could significantly impact their progress.

- Unproven Financials: Since QuantumScape is a pre-revenue company, their long-term financial viability is uncertain. Investors will need to see a clear path to profitability before the stock price reflects a significant valuation.