Executive Summary:

Clear Secure Inc. is an American company focused on identity verification using biometrics. Their technology is used to streamline security processes at airports, stadiums, and other venues. CLEAR offers a secure identity platform that verifies users through facial recognition and other biometric technologies, aiming to create a frictionless travel experience while maintaining security. The company went public in 2021 and has partnered with over 100 organizations across North America.

They reported earnings per share (EPS) of $0.17 and revenue of $170.96 million. This represents a year-over-year revenue growth of 33.3%.

Stock Overview:

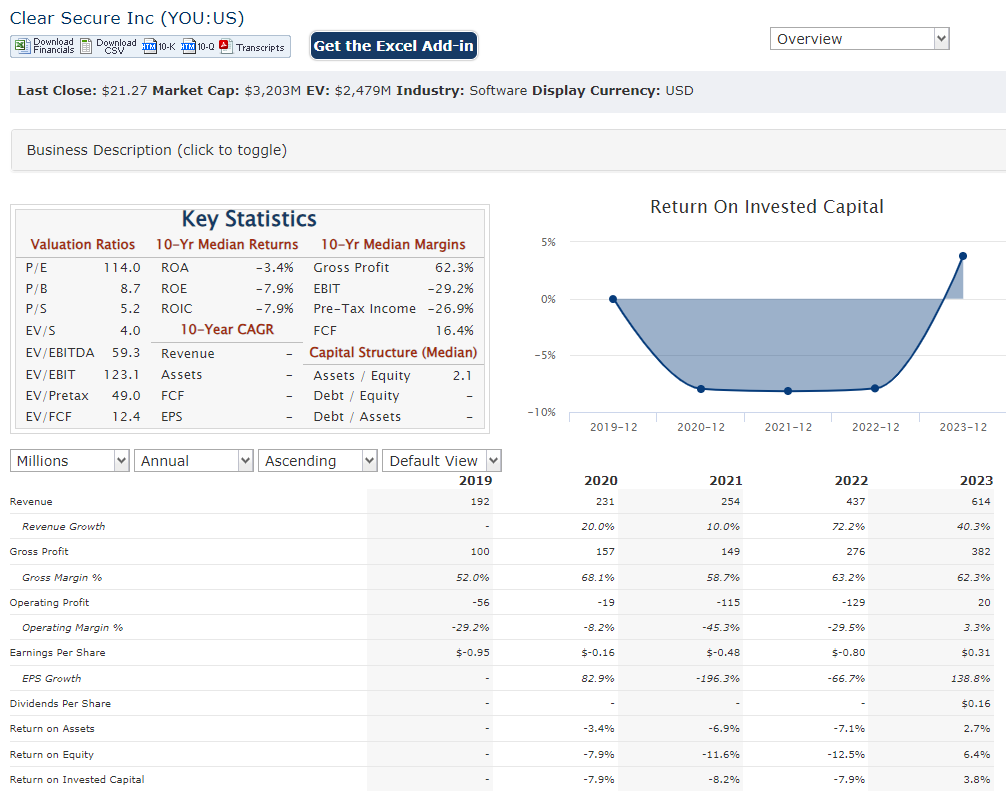

| Ticker | $YOU | Price | $21.27 | Market Cap | $3.24B |

| 52 Week High | $14.64 | 52 Week Low | $26.59 | Shares outstanding | 93.31M |

Company background:

Clear Secure Inc., known commercially as CLEAR. The initial CLEAR, founded in 2003 by Steven Brill and Ajay Amlani, filed for bankruptcy in 2009.

The current iteration of Clear Secure Inc. emerged in 2010 with a focus on revolutionizing security procedures through biometrics. Caryn Seidman-Beckner and Todd Motto are credited as the founders. This technology is currently being utilized at various locations including airports, stadiums, and other venues. Their mission is to establish a frictionless travel experience while maintaining high security standards.

Clear Secure faces challenges from companies like TSA PreCheck and Global Entry, which also offer expedited security screening options.

Recent Earnings:

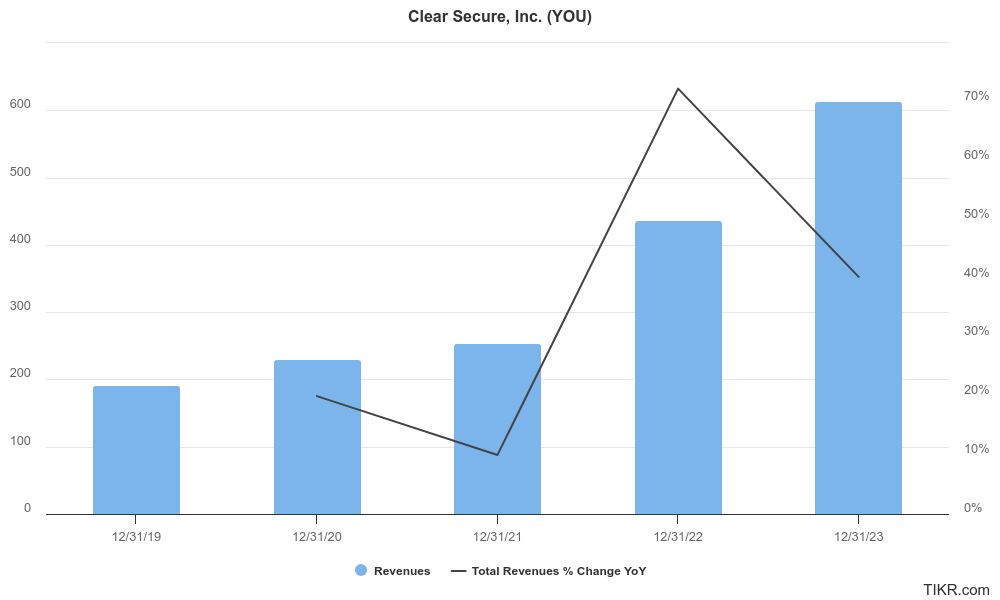

Clear Secure reported a revenue of $170.96 million, reflecting a year-over-year increase of 33.3%. This growth suggests the company is experiencing healthy market traction for its biometric identity verification technology.

Earnings per share (EPS) came in at $0.17. While analyst expectations for this specific report are unavailable, estimates for the current quarter sat around $0.12.

The Market, Industry, and Competitors:

Clear Secure Inc. the market is booming due to the increasing focus on security and privacy, especially in travel and everyday life. Clear Secure uses biometrics to streamline the verification process, offering a faster and more convenient experience. Their target audience includes frequent travelers, security-conscious individuals, and businesses looking for smoother access control solutions.

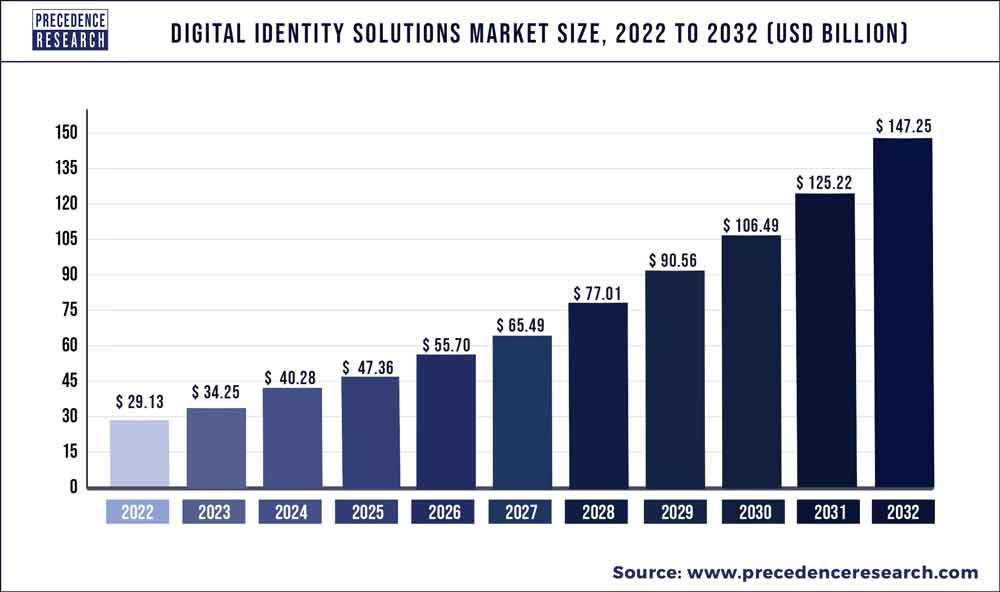

Growth expectations for Clear Secure are positive. The global identity verification market is projected to reach $21.5 billion by 2030, with a Compound Annual Growth Rate (CAGR) of over 16%. This growth is fueled by factors like rising government regulations, increasing cyber threats, and the growing adoption of cloud-based solutions. Clear Secure, as a leader in biometric identity verification, is well-positioned to capitalize on this trend. Their focus on both consumer and business segments further strengthens their position for continued growth.

Unique differentiation:

In the identity verification space, Clear Secure battles established players like Yoti, Daon, and Callsign. These companies offer various digital identity solutions, from facial recognition for online verification to mobile authentication for secure logins. While Clear Secure focuses on biometrics for physical access, these competitors might challenge their dominance in broader identity verification markets.

The Transportation Security Administration (TSA) PreCheck and Global Entry programs are strong alternatives. These government-backed programs offer pre-screening for trusted travelers, eliminating the need for lengthy security lines. While Clear boasts a wider network of airports and partners, TSA programs often come at a lower cost, posing a significant point of competition.

Clear Secure Inc. carves out its niche in the identity verification and access control market through a combination of:

Focus on Biometrics for Physical Access: Unlike some competitors offering digital identity verification for online purposes, Clear Secure prioritizes biometrics for physical spaces. Their fingerprint and iris scan technology streamlines physical access control, making it ideal for airports, stadiums, and other high-security environments.

Frictionless User Experience: Clear Secure prides itself on a user-friendly experience. Their biometric system eliminates the need for physical IDs or cumbersome verifications, creating a faster and more convenient experience compared to traditional methods.

Network and Partnerships: Clear Secure has built a robust network of airports, airlines, and other venues that accept their verification system. This extensive network offers users more widespread access and convenience compared to competitors with a limited reach.

Management & Employees:

- Caryn Seidman-Becker (Chairman & CEO): As co-founder and CEO, Caryn steers the overall vision and strategy for Clear Secure. Her experience in business leadership is crucial for the company’s growth.

- Kenneth Cornick (President & CFO): Kenneth, the company’s co-founder, holds the dual role of President and CFO. His financial expertise is vital for managing resources and driving profitability.

- Nicholas Peddy (Chief Technology Officer): Nicholas leads the technological innovation behind Clear Secure’s biometric systems. His technical knowledge ensures the security and efficiency of their verification platform.

Financials:

The revenue has seen a significant upward trajectory, with reports suggesting a jump from $253 million in 2018 to over $613 million by the end of 2023. This translates to a Compound Annual Growth Rate (CAGR) exceeding 20% during this period. This strong revenue growth can be attributed to a rising number of members and increased usage of their platform, particularly with travel ramping back up post-pandemic.

Clear Secure appears to be in a healthy position. The strategic initiatives like share repurchases and dividends. Clear Secure’s financial performance paints a picture of a company experiencing rapid growth, working towards consistent profitability, and prioritizing shareholder value.

Technical Analysis:

Stock is range bound (stage 3) in the monthly chart, but heading lower. On the daily chart, the stock is in stage 4 (heading lower, bearish) as well. The stock experienced some reversal in the short term chart, from the $19 zone to the $21 zone. There is an inverse head and shoulders pattern, which is bullish. We would wait for a pullback to the $19.98 zone for an entry for a 12-18 month period to move to $25 – $30 zone.

Bull Case:

- Market Boom: The global identity verification market is expected to experience significant growth in the coming years, fueled by rising security concerns and digital adoption. Clear Secure, as a leader in biometric verification, is well-positioned to capitalize on this expanding market.

- Unique Value Proposition: Clear Secure differentiates itself through its focus on frictionless user experience with biometrics for physical access control. This offers a faster and more convenient alternative to traditional methods, appealing to both consumers and businesses.

- Improving Financials: Recent reports suggest Clear Secure is on the path to consistent profitability. Revenue growth has been strong, and their focus on free cash flow generation bodes well for future shareholder value creation.

Bear Case:

- Government Programs: Government-backed expedited travel programs like TSA PreCheck offer a strong alternative to Clear Secure. While Clear boasts a wider network, these programs often come at a lower cost, potentially limiting Clear Secure’s user base.

- Technological Advancements: Biometric technology is constantly evolving. If a competitor develops a more efficient or secure verification method, Clear Secure could be left behind. The need for consistent investment in research and development is crucial.

- Privacy Concerns: The use of biometrics for identification raises privacy issues. Clear Secure will need to navigate these concerns effectively to maintain user trust and avoid regulatory scrutiny.