Executive Summary:

C3.ai Inc. is an enterprise artificial intelligence company that develops software to help businesses use artificial intelligence (AI). They offer a variety of tools and pre-built applications that can be used to improve efficiency and solve problems in areas like manufacturing, finance, and healthcare. C3.ai was founded in 2009 by Tom Siebel and went public in 2020. The company is headquartered in Redwood City, California and has over 1,000 employees.

Q3 total revenue of $78.4 million, exceeding analyst expectations and growing 18% year-over-year. Despite the revenue growth, the company had a net loss per share of $0.60. This fell short of analyst expectations, with estimates at -$0.30 per share.

Stock Overview:

| Ticker | $AI | Price | $28.38 | Market Cap | $3.36B |

| 52 Week High | $48.87 | 52 Week Low | $16.79 | Shares outstanding | 118.55M |

Company background:

C3.ai Inc., founded by Thomas Siebel, is a leader in enterprise AI software. Originally focused on managing corporate carbon footprints, the company has since pivoted to provide businesses with tools to leverage AI for digital transformation.

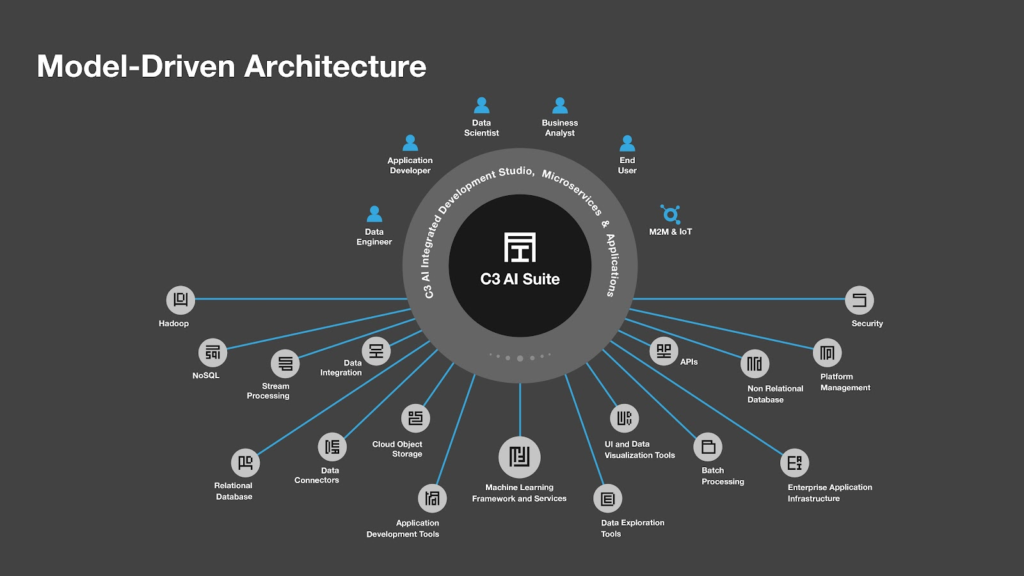

C3.ai offers a comprehensive suite of products including the C3 AI Platform, a foundation for building and deploying custom enterprise AI applications. They also provide pre-built, industry-specific applications tackling tasks like predictive maintenance, fraud detection, and supply chain optimization. C3.ai caters to a wide range of industries including finance, manufacturing, and utilities.

Headquartered in Redwood City, California, C3.ai has grown significantly since its founding. They went public in 2020 and face competition from established tech giants like Microsoft and Amazon as well as other dedicated AI firms like Palantir.

Recent Earnings:

The subscription revenue, the company’s lifeblood, shone even brighter with a 23% jump compared to the same period last year, making up a significant 90% of their total revenue.

Customer engagement, a measure of active users on their platform, surged by 80% year-over-year, indicating a growing and engaged user base. C3.ai boasts a strong cash position with $723.3 million in reserves, providing a financial cushion for future investments.

The Market, Industry, and Competitors:

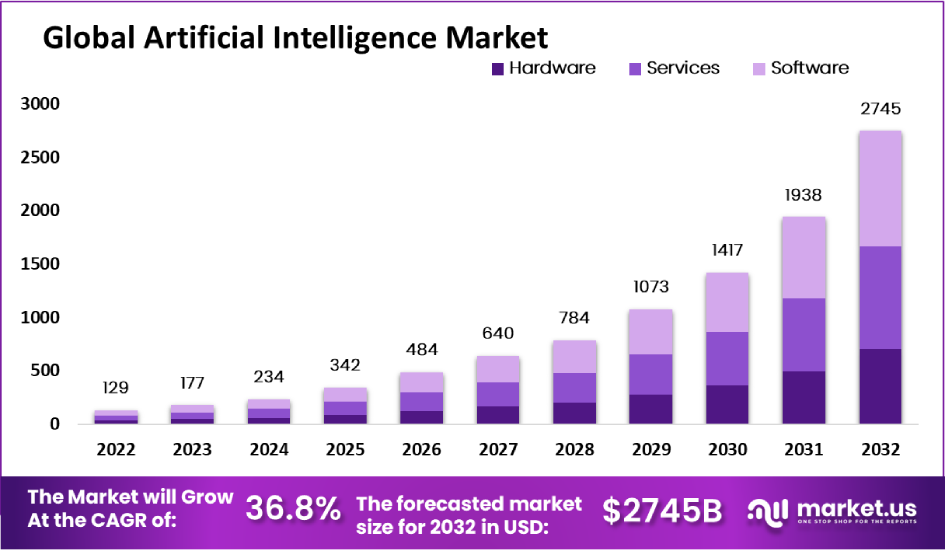

C3.ai Inc. operates in the enterprise artificial intelligence (AI) market, which is expected to experience explosive growth in the coming years. The industry analysts project significant growth with a Compound Annual Growth Rate (CAGR) exceeding 30%. This rapid growth is fueled by the increasing adoption of AI across various industries as businesses look to automate tasks, improve efficiency, and gain valuable insights from data.

AI continues to evolve and become more accessible, C3.ai, along with other enterprise AI companies, is well-positioned to benefit from this expanding market.

Unique differentiation:

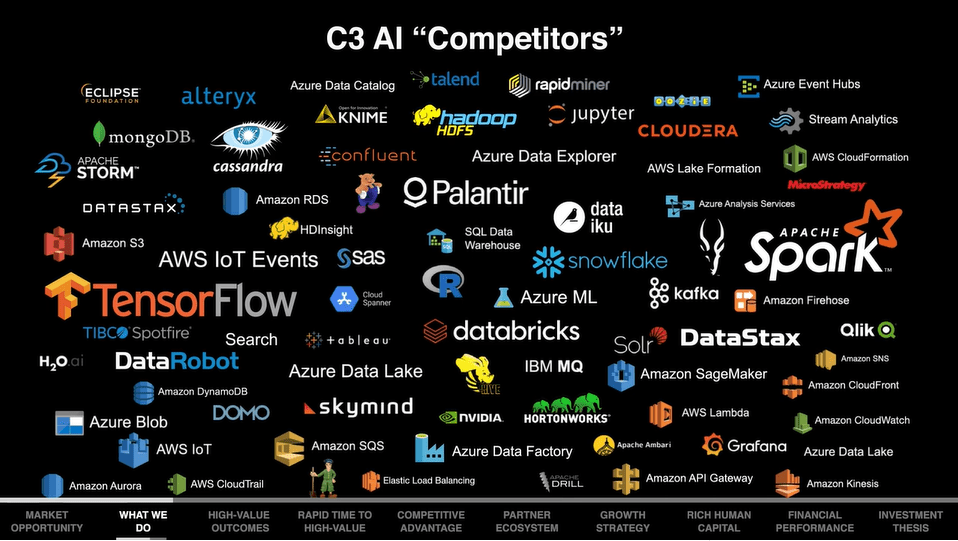

C3.ai faces competition on two fronts: tech giants and other dedicated AI companies. Tech giants like Microsoft (Azure) and Amazon (AWS) offer comprehensive cloud-based AI services that can directly compete with C3.ai’s products.

C3.ai also squares off against other dedicated AI firms like Palantir and Salesforce (Einstein). These companies offer similar AI-powered tools and solutions, often targeting specific industry verticals. The competitive landscape can be intense, with companies vying for market share and constantly innovating to stay ahead.

- Model-Driven Approach: C3.ai focuses on a model-driven approach, building a strong foundation (C3 AI Platform) for businesses to develop and deploy custom AI applications that cater to their specific needs.

- Ease of Use: C3.ai aims to make AI accessible to businesses with varying levels of technical expertise. Their platform and tools are designed to be user-friendly, allowing companies to leverage AI solutions without needing a large team of data scientists.

- Industry-Specific Solutions: C3.ai offers pre-built applications tailored to specific industries like finance, manufacturing, and healthcare. These pre-configured solutions address common challenges within each industry, allowing businesses to hit the ground running with AI deployments.

- Strong Partner Network: C3.ai has established partnerships with major technology companies (e.g., Microsoft, AWS) and system integrators.

Management & Employees:

- Thomas M. Siebel (Chairman and Chief Executive Officer): Siebel founded C3.ai and has served as CEO since its inception. He previously founded Siebel Systems, a successful CRM software company.

- Edward Y. Abbo (President and Chief Technology Officer): Abbo leads the technology direction for C3.ai, overseeing product development and innovation.

- Juho Parkkinen (Senior Vice President and Chief Financial Officer): Parkkinen is responsible for the company’s financial operations, including budgeting, accounting, and investor relations.

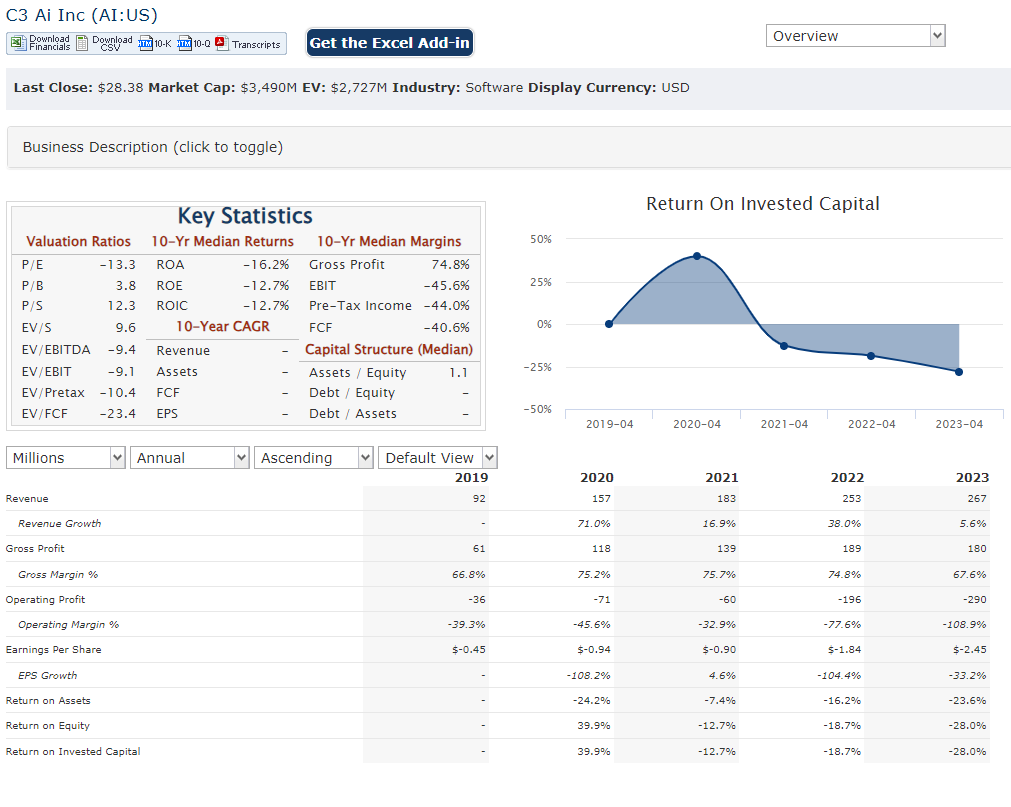

Financials:

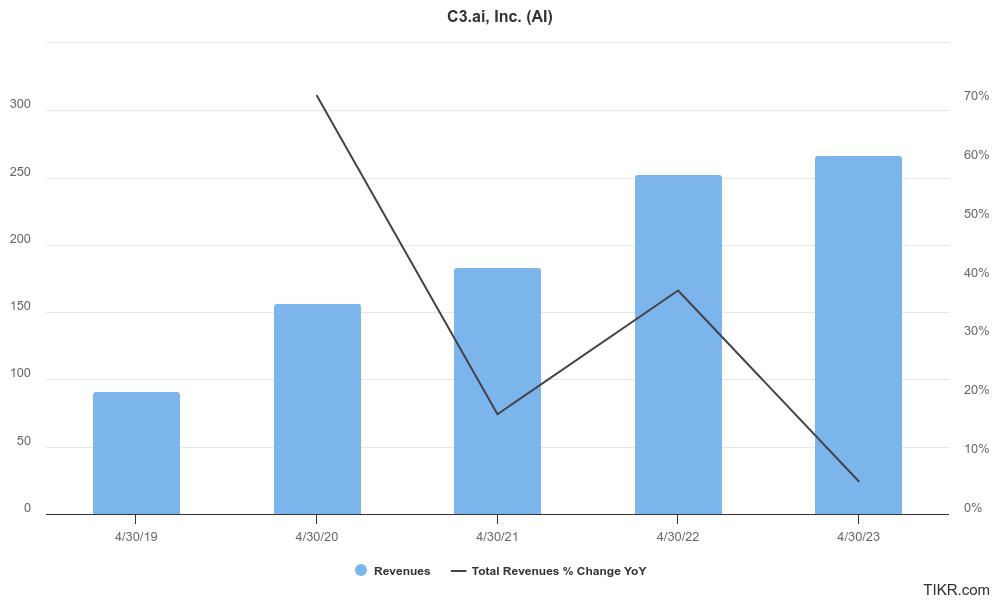

Revenue has been on an upward trajectory, with a focus on subscription-based services that provide recurring income. This rapid growth reflects the increasing adoption of AI solutions across industries.

The profitability remains a challenge. Despite revenue growth, C3.ai has yet to achieve consistent profitability. Earnings reports often show net losses, with a negative CAGR for earnings per share (EPS). This is common for high-growth tech companies prioritizing investment in research and development to fuel future innovation.

The company’s balance sheet appears to be on solid ground. C3.ai’s recent earnings reports indicate a healthy cash position, exceeding $700 million as of February 2024. This financial cushion provides resources for continued investment in technology and market expansion.

Technical Analysis: Range bound on the monthly and weekly chart, and on a stage 4 markdown on the daily chart. The support range is between $23.3 and $25.2. On the Weekly chart there is a head and shoulders pattern (bearish). Most analysts have neutral rating, with price targets in the $15 to $40 range. We would wait for a reversal in $23 – $24 range to confirm a buy.

Bull Case:

- Riding the AI Wave: The overarching theme is the explosive growth of the enterprise AI market. With a CAGR projected to exceed 30% by some analysts, C3.ai is positioned to benefit from this massive upswing in AI adoption across industries.

- Strong Product Portfolio: C3.ai offers a combination of the C3 AI Platform for custom development and pre-built, industry-specific applications. This caters to a wider range of clients, from those seeking highly tailored solutions to those wanting quicker adoption through pre-configured applications.

- Room for Profitability: While not yet consistently profitable, C3.ai’s focus on subscription revenue generates recurring income. A strong cash position provides a buffer for continued investment, with the expectation that future growth will translate into a clearer path to profitability.

Bear Case:

- Valuation Concerns: C3.ai’s stock price has experienced significant fluctuations. While high growth potential can justify a premium valuation, some bears believe the current price might not reflect the company’s current financials or the competitive landscape.

- Over-Hype in the AI Market: The overall excitement surrounding AI could be a bubble. If the growth of the enterprise AI market falls short of expectations, it could negatively impact C3.ai’s prospects.

- Limited Track Record: While C3.ai has grown rapidly, they are still a relatively young company. Bears might be wary of the limited track record in terms of navigating market challenges and achieving profitability.