Executive Summary:

Flywire Corporation is a global financial technology company specializing in facilitating complex international payments. They combine their own payment network, software platform, and industry-specific solutions to offer a comprehensive service they call the “Flywire Advantage”. This allows their clients, typically in education, healthcare, and travel sectors, to accept payments in various currencies from a wide range of countries. Flywire prides itself on its customer support with features like multilingual communication and shipment tracking. The company is publicly traded on the Nasdaq exchange under the ticker symbol FLYW and has its headquarters in Boston, USA.

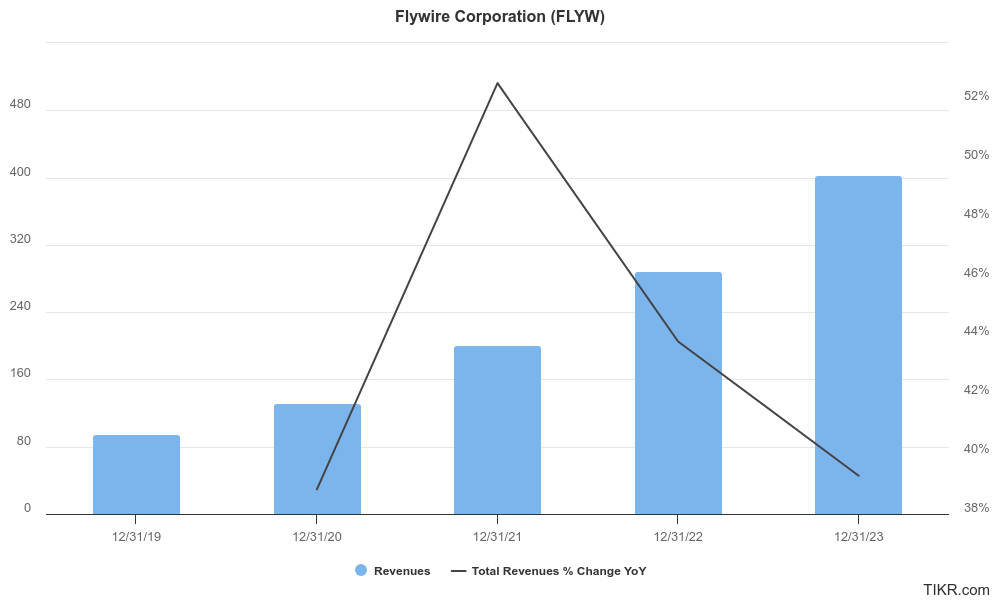

Revenue reached $100.5 million, reflecting a 37.6% increase year-over-year. Flywire managed to swing to a net income of $1.29 million, marking a significant improvement over the net loss of $1.13 million in Q4 2022. This translates to an EPS (earnings per share) of $0.01, indicating a 100% year-over-year growth

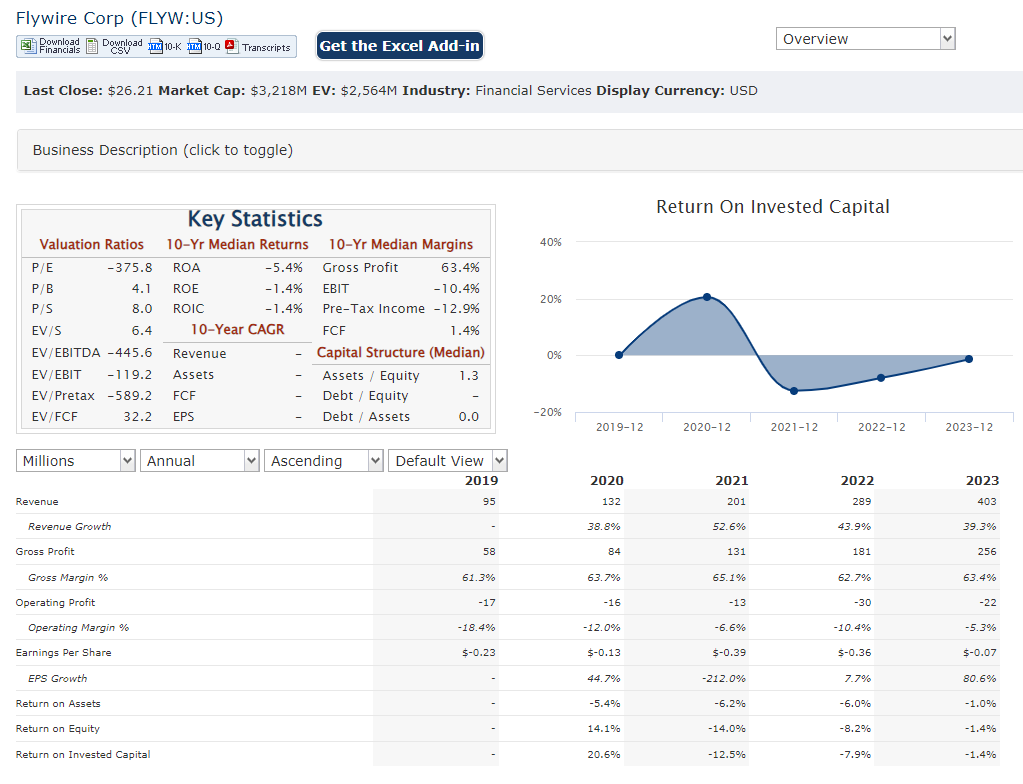

Stock Overview:

| Ticker | $FLYW | Price | $26.21 | Market Cap | $3.22B |

| 52 Week High | $35.80 | 52 Week Low | $18.65 | Shares outstanding | 120.95M |

Company background:

The company has secured over $200 million in funding throughout multiple rounds.

Flywire caters to a niche market but faces competition from established players like Western Union, MoneyGram, and PayPal. They differentiate themselves by providing features like:

- Integration with client systems through the Flywire Platform

- Multilingual communication

- Shipment tracking capabilities

Flywire boasts a global offices around the world. Their team of over 1200 employees, representing over 40 nationalities, reflects their commitment to providing a seamless international payment experience.

Recent Earnings:

Compared to the previous quarter, revenue declined by 18.47%. This indicates some potential short-term volatility. While Flywire’s revenue growth surpassed some analyst predictions, the EPS fell short of certain expectations. Analysts projected a higher EPS based on the year-over-year comparison. The company issued guidance for the first quarter and full year of 2024. They project revenue to be in the range of $85 million to $90 million for Q1 and $400 million to $420 million for the entire year.

The Market, Industry, and Competitors:

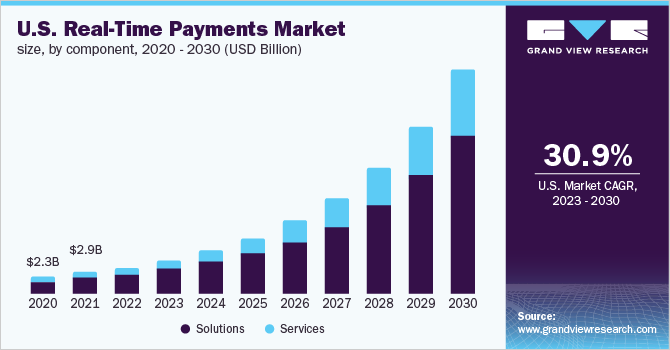

Flywire Corporation operates in the global cross-border payments market, a sector anticipated to witness significant growth in the coming years. According to Mordor Intelligence, a market research firm, this market is expected to flourish at a Compound Annual Growth Rate (CAGR) of 10.2% by 2030.

- Rising globalization: Businesses are increasingly expanding their international reach, leading to a surge in cross-border transactions.

- Growing e-commerce: The flourishing online retail industry is driving the demand for efficient international payment solutions.

- Technological advancements: Advancements in fintech are making cross-border payments faster, cheaper, and more transparent.

Flywire Corporation is well-positioned to benefit from this projected market growth. Their focus on niche sectors like education, healthcare, and travel aligns with the increasing internationalization within these industries.

Unique differentiation:

Established Money Transfer Players:

- Western Union and MoneyGram: These giants have a vast global presence and offer traditional money transfer services. While they cater to a broad customer base, their offerings might not be as sophisticated as Flywire’s solutions designed for specific industries.

Fintech and Payment Processing Companies:

- Stripe: A prominent player offering a comprehensive suite of payment solutions, including international payments. Stripe focuses primarily on e-commerce transactions and might not possess the deep industry expertise Flywire holds in sectors like education and healthcare.

- Global Payments: A leading payment processor providing various international payment services. Their offerings might be more generic compared to Flywire’s specialized solutions and global payment network.

- Deep Industry Expertise: Flywire goes beyond just transferring funds. They focus on understanding the specific payment challenges within education, healthcare, and travel sectors. This translates to:

- Industry-tailored solutions: They offer features that directly address these sectors’ needs, such as:

- Integrated payment platforms: Seamless integration with existing client systems in respective industries.

- Compliance solutions: Addressing the intricate regulatory requirements within education, healthcare, and travel.

- Industry-tailored solutions: They offer features that directly address these sectors’ needs, such as:

- Proprietary Global Payment Network: Unlike relying solely on third-party networks, Flywire leverages its own infrastructure to potentially offer:

- Faster processing times: Transactions might flow quicker due to less reliance on external networks.

- Greater control over costs: Operating their own network could potentially allow for more competitive pricing.

- Value-added services: Flywire goes beyond just moving money. They provide additional features that enhance the customer experience, such as:

- Multilingual communication: Supporting various languages allows for smoother communication with international clients.

- Shipment tracking: Providing real-time visibility into the movement of goods associated with payments, particularly relevant in the education and healthcare sectors.

Management & Employees:

- Mike Massaro (CEO): Leads the company’s overall strategy and growth initiatives. He brings over 20 years of experience in global payments, mobile software, and e-billing.

- Rob Orgel (President & COO): Oversees Flywire’s day-to-day operations and execution.

- Cosmin Pitigoi (CFO): Heads the finance department, responsible for financial planning, analysis, and reporting. His background includes leadership roles at PayPal and eBay.

Financials:

Revenue Growth: Flywire has experienced significant revenue growth over the past five years. They reported a 53% increase in revenue from 2020 to 2021 and continued growth in 2022. However, the recent Q4 2023 earnings report showed an 18.47% decline in revenue compared to the previous quarter.

CAGR (Compound Annual Growth Rate): Calculating a precise CAGR for the entire 5-year period would require specific revenue figures. However, based on reported growth percentages, Flywire’s revenue growth likely falls well above the industry average for cross-border payments, which is estimated at around 10.2% CAGR.

Technical Analysis:

A bull flag on the weekly chart is forming, which is setting up well. On the daily chart the stock will test the $25 range, which is the previous resistance and should form a support there. An entry in the $25 range would be a good one for a move to the $28 in the short to medium term.

Bull Case:

- Industry-Specific Solutions: Flywire caters to niche sectors like education, healthcare, and travel, offering specialized solutions that address their unique payment needs. This focus could lead to strong customer relationships and recurring revenue streams.

- Proprietary Network: Their own global payment network allows for potentially faster processing times and greater cost control, making them competitive compared to relying solely on third-party networks.

- Value-Added Services: Features like multilingual support and shipment tracking enhance the customer experience, potentially increasing their attractiveness to businesses seeking a comprehensive solution.

Bear Case:

- Dependence on Niche Markets: Focusing primarily on education, healthcare, and travel sectors makes Flywire vulnerable to downturns in these specific industries. Economic fluctuations or regulatory changes could negatively impact their business.

- Recent Earnings Performance: The recent Q4 2023 report presented mixed signals with revenue decline compared to the previous quarter. This could raise concerns about the sustainability of their growth trajectory.

- Valuation Concerns: Flywire’s stock price might be trading at a premium based on its current earnings and future growth potential. If the company fails to meet investor expectations, a correction in the stock price could occur.