Executive Summary:

Sterling Infrastructure is a prominent infrastructure services provider in the United States. They specialize in building, servicing, and maintaining transportation and water infrastructure projects across the nation. Their services encompass various aspects like designing, assessing, maintaining, and renewing these vital structures. Sterling operates through subsidiaries focusing on three core areas: electrical infrastructure, building solutions, and transportation solutions. They prioritize sustainable practices and emphasize giving back to their communities while fostering a culture of diversity and innovation within the company.

- Earnings per share (EPS): Achieved an adjusted EPS of $1.26, reflecting a significant 40% growth compared to the previous year.

- Revenue: Total revenue reached $1.97 billion, representing an 11% increase year-over-year.

Stock Overview:

| Ticker | $STRL | Price | $111.98 | Market Cap | $3.46B |

| 52 Week High | $116.36 | 52 Week Low | $34.23 | Shares outstanding | 30.93M |

Company background:

Sterling Infrastructure boasts a history dating back to 1955. Sterling operates through a self-funded model, reinvesting profits back into the business to fuel growth and expansion. Their primary focus lies in delivering a comprehensive suite of infrastructure services.

Products and Services:

- E-Infrastructure Solutions: Sterling caters to the electrical grid, encompassing tasks like building, maintaining, and repairing power transmission lines and substations.

- Building Solutions: Their expertise extends to constructing and servicing various structures, including commercial buildings, industrial facilities, and healthcare institutions.

- Transportation Solutions: Sterling tackles transportation infrastructure projects, including building, repairing, and maintaining roads, bridges, and other crucial components.

Key Competitors:

- AECOM: A multinational engineering firm offering similar services across various infrastructure sectors.

- Fluor Corporation: An industrial engineering and construction company with a presence in the U.S. infrastructure landscape.

- Tutor Perini Corporation: A specialty contractor focusing on civil, building, and electrical construction projects.

Headquarters:

Sterling Infrastructure is headquartered in Houston, Texas. This central location allows them to effectively manage their nationwide operations with subsidiaries strategically positioned across the country.

Recent Earnings:

- Analysts’ Expectations:

- Initial EPS estimate: $1.25

- Revised EPS estimate (as of March 2024): $0.82.

- Increased profitability: Net income reached $138.7 million, up from $96.7 million in the previous year.

- Strong cash flow: Operating cash flow surpassed $478 million, indicating healthy financial liquidity.

The Market, Industry, and Competitors:

Sterling Infrastructure operates in the vast U.S. Infrastructure Services market, encompassing various services related to building, maintaining, and repairing critical infrastructure assets:

- Aging infrastructure: A significant portion of America’s infrastructure, including roads, bridges, and electrical grids, is nearing the end of its lifespan, necessitating upgrades and replacements.

- Increased government focus: The U.S. government has prioritized infrastructure spending in recent years, with initiatives like the Bipartisan Infrastructure Law allocating significant funds towards improving the nation’s infrastructure.

- Growing demand for renewable energy: The transition towards renewable energy sources like wind and solar power will require investments in building new infrastructure to support these emerging technologies

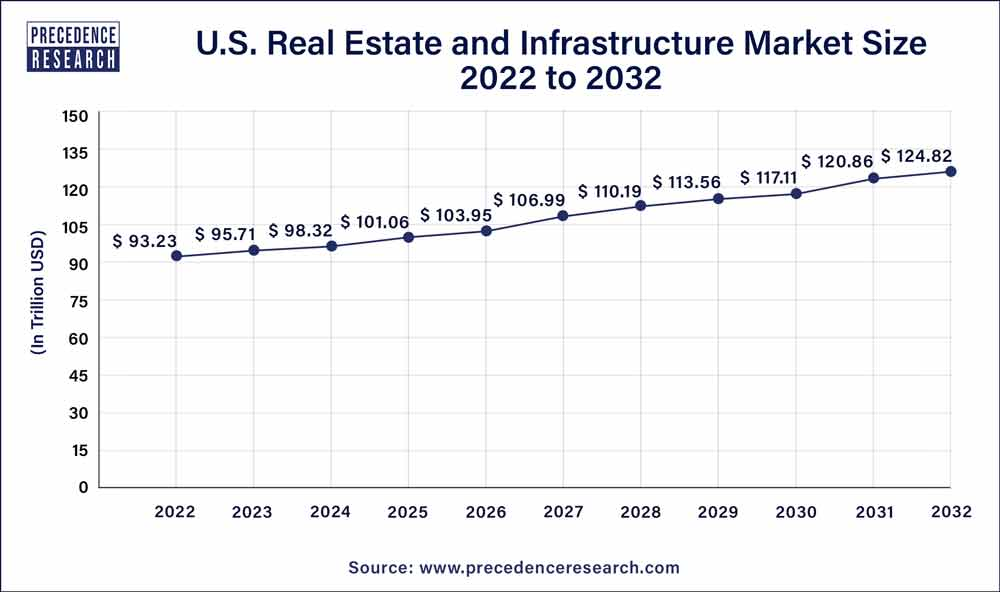

Growth Expectations (2023-2030):

Considering these driving forces, analysts anticipate the U.S. Infrastructure Services market to exhibit a Compound Annual Growth Rate (CAGR) of around 5% over the next seven years. This translates to a projected market size of approximately $1.2 trillion by 2030, up from an estimated $935 billion in 2023.

Unique differentiation:

Sterling Infrastructure faces competition from various established players in the U.S. infrastructure services market:

- AECOM: A multinational engineering firm with a global presence, AECOM offers a comprehensive range of infrastructure services similar to Sterling. They possess extensive expertise in designing, constructing, and managing various infrastructure projects across transportation, water, buildings, and environmental sectors.

- Fluor Corporation: Primarily known for its engineering and construction services across various industries, Fluor also holds a significant presence in the U.S. infrastructure landscape. Their portfolio encompasses similar offerings to Sterling, including building, repairing, and maintaining infrastructure assets in transportation, power, and telecommunications sectors.

- Focus on Sustainability: While other companies offer similar services, Sterling prioritizes sustainable practices throughout their operations. This could involve using eco-friendly materials, adopting energy-efficient construction methods, and minimizing waste generation.

- Self-funded Model: Unlike some competitors who rely on external funding for expansion, Sterling operates on a self-funded model.

- Nationwide Presence with Strategic Subsidiaries: Sterling has strategically placed subsidiaries across the U.S., enabling them to efficiently cater to regional infrastructure needs and establish strong local relationships.

Management & Employees:

- Joseph Cutillo (CEO): Mr. Cutillo assumed the role of CEO in 2017. He previously held positions within the company like Vice President of Strategy & Business Development and Chief Business Development Officer.

- Noelle Dilts (Vice President, Investor Relations & Corporate Communications): Ms. Dilts is responsible for managing investor relations, financial communication, and corporate communications activities.

- Candace C. (Director, SOX Compliance): Ms. C. oversees the company’s adherence to the Sarbanes-Oxley Act (SOX) regulations, ensuring financial reporting accuracy and internal control effectiveness.

Financials:

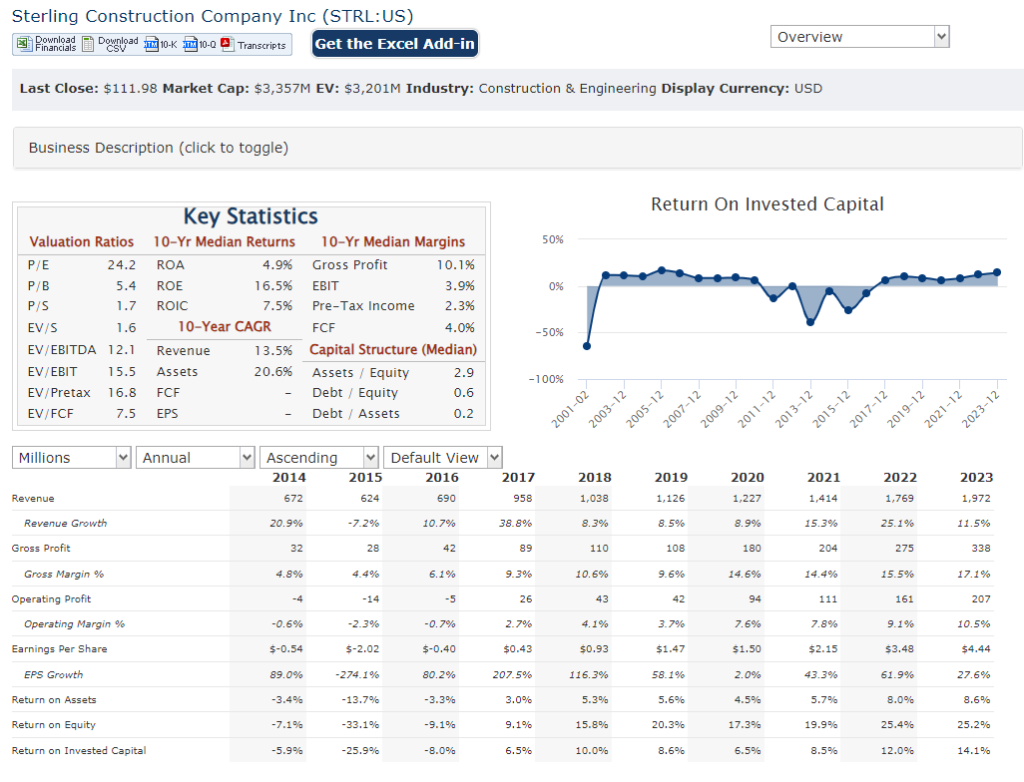

Sterling Infrastructure: Financial Performance over the Past 5 Years (2019-2023)

Revenue Growth: Sterling Infrastructure has exhibited a positive revenue trajectory over the past five years.

Revenue steadily increased from $1.2 billion in 2019 to $1.97 billion in 2023. This reflects an overall growth of around 64% over the five-year period.

Earnings Growth:

- Sterling Infrastructure has also witnessed significant growth in profitability.

- CAGR: The estimated CAGR for earnings per share (EPS) over the past five years is around 32%.

- EPS grew from $0.47 in 2019 to $1.26 in 2023, representing a substantial increase of over 168%.

Balance Sheet:

- Assets: Sterling’s total assets have grown steadily over the past five years, indicating expansion and investment in the business.

- Liabilities: Liabilities have also increased, reflecting the company’s financing activities to support its growth initiatives.

- Shareholder Equity: Shareholder equity has grown positively, demonstrating an increase in the company’s net worth.

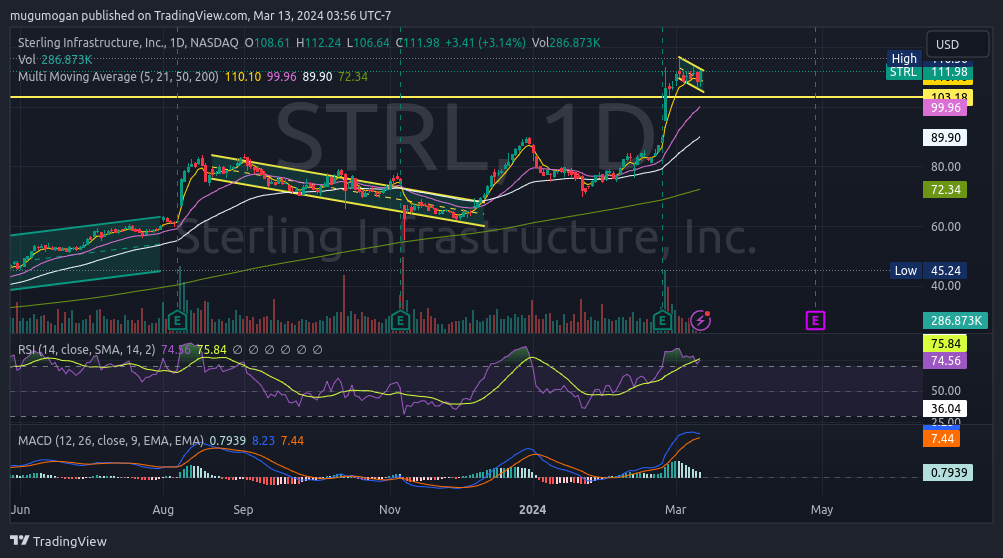

Technical Analysis: With a bull flag on the daily chart and a stop loss at $103, this stock represents a good opportunity to move higher to the $120 zone before their next earnings on April 29th. The ideal long term investor can enter in the $89 range (100 day moving average) but the shares may get to $99 within a few weeks for an entry as well.

Bull Case:

- Market Growth Potential: The U.S. infrastructure services market is anticipated to experience steady growth due to factors like aging infrastructure, increased government spending, and the renewable energy transition. Sterling Infrastructure is well-positioned to benefit from this expanding market.

- Strong Recent Performance: Sterling’s recent financial performance has been positive, with increasing revenue and profitability. This indicates their ability to capitalize on market opportunities and effectively manage their operations.

Bear Case:

- Increased Competition: The U.S. infrastructure services market is witnessing the entry of new players, putting pressure on profit margins and making it challenging for Sterling to secure lucrative contracts, potentially hindering future growth.

- Project Delays or Cost Overruns: Large infrastructure projects are susceptible to delays due to unforeseen circumstances or unexpected complications. Such delays can lead to cost overruns, impacting profitability and potentially damaging investor confidence.

- Reliance on Government Spending: A significant portion of Sterling’s business depends on government infrastructure spending. Any unexpected changes in government policies or budget cuts could negatively impact the company’s revenue stream.