Executive Summary:

Fastly is a cloud computing company that specializes in edge cloud services. Their platform helps developers build and deliver high-performing websites and applications. Fastly’s network is designed to process information closer to users, resulting in faster loading times and a smoother overall experience. They offer a variety of services including content delivery, image optimization, video streaming, and security protection.

Revenue of $137.8 million, reflecting an 8% increase compared to the previous quarter and 15% year-over-year growth. This fell short of analyst expectations of $140 million. Despite the revenue miss, the company did manage to swing to a profit, reporting a GAAP net loss of $23.4 million, which is a significant improvement over the $46.7 million loss in Q4 2022. Analysts had actually predicted a larger loss of -$0.30 per share, but Fastly came in at -$0.18 per share.

Stock Overview:

| Ticker | $FSLY | Price | $13.95 | Market Cap | $1.87B |

| 52 Week High | $25.87 | 52 Week Low | $11.61 | Shares outstanding | 134.2M |

Company background:

Fastly Inc was founded in 2011 by Artur Bergman, a Swedish-American entrepreneur with experience as the CTO of Wikia (now Fandom). The company describes its offerings as an “edge cloud platform” designed to extend core cloud infrastructure closer to users at the network’s edge. This translates to faster loading times and improved performance for websites and applications.

Fastly’s edge cloud platform incorporates a variety of services that developers can leverage to build high-performing digital experiences. These services include a Content Delivery Network (CDN) for efficient cloud security services that encompass denial-of-service attack protection, bot mitigation, and a web application firewall.

The company is headquartered in San Francisco, California and continues to innovate in the cloud computing space.

The Market, Industry, and Competitors:

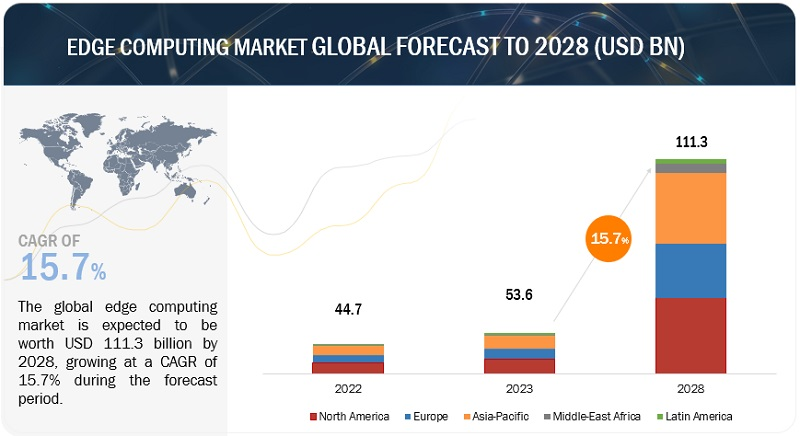

This market is expected to experience significant growth in the coming years due to the increasing demand for:

- Faster loading times for websites and applications

- Improved performance for geographically distributed users

- Enhanced security for online applications

Analysts predict the global edge cloud market to reach a value of over $80 billion ro $11 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of more than 25%. This rapid growth is fueled by the increasing adoption of cloud-based solutions, the rise of internet-of-things (IoT) devices, and the growing importance of online security.

Fastly, as a leading player in this space, is well-positioned to benefit from this growth trend. Their edge cloud platform offers developers the tools they need to build high-performing digital experiences. However, the company faces stiff competition from established players like Cloudflare, Akamai Technologies and Amazon Web Services, and new entrants are constantly emerging. Continued innovation will be crucial for Fastly to maintain market share and capture the full potential of the booming edge cloud market.

Unique differentiation:

- Established giants: Akamai Technologies and Cloudflare are well-recognized players with extensive global networks and a wide range of cloud services, including edge computing solutions. They offer strong competition for Fastly, especially with larger enterprises that value established brands and comprehensive service offerings.

- Cloud behemoths: Companies like Amazon Web Services (AWS) and Microsoft Azure are major players in the cloud computing market and are increasingly offering edge computing services as part of their broader cloud platform packages. Their vast resources and existing customer base pose a significant threat to Fastly, particularly for cost-conscious businesses.

- Emerging players: The edge computing market is constantly evolving, with new startups and niche players offering innovative solutions. These companies may target specific functionalities or cater to a particular market segment, potentially chipping away at Fastly’s market share in focused areas.

- Developer Focus: Fastly positions itself heavily towards developers. Their platform boasts a user-friendly interface and robust developer tools, allowing for greater customization and control compared to some competitors.

- Security Expertise: Security is a growing concern for businesses, and Fastly emphasizes its advanced security solutions. Their platform incorporates features like bot mitigation, denial-of-service protection, and a web application firewall. T

- Performance Optimization: Speed is a core value for Fastly. Their edge cloud network is specifically designed to deliver content closer to users, resulting in faster loading times and improved overall performance.

Management & Employees:

- Todd Nightingale: CEO and Director, responsible for the company’s overall direction and strategy.

- Kip Compton: Chief Product Officer, leading the development and innovation of Fastly’s edge cloud platform.

- Karen Greenstein: General Counsel, overseeing legal matters and ensuring compliance.

Financials:

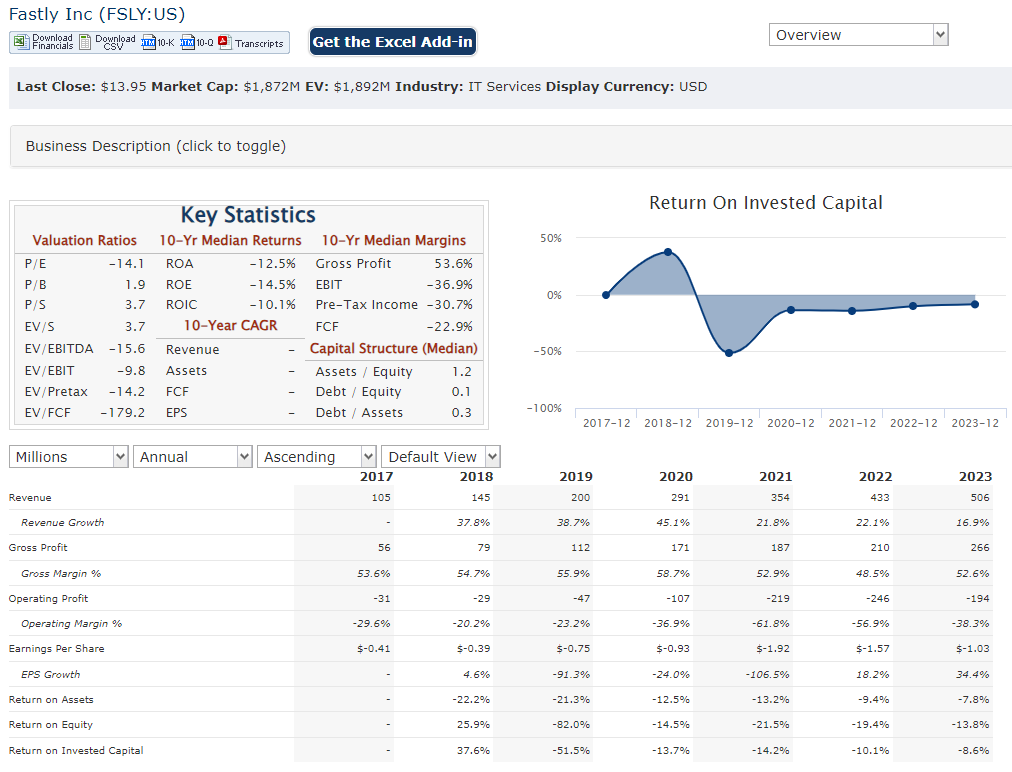

Revenue Growth: Revenue has seen a steady upward trajectory, with a Compound Annual Growth Rate (CAGR) exceeding 20%. This growth reflects the increasing demand for edge cloud services and Fastly’s ability to capture a share of that market.

Earnings Growth: Despite healthy revenue growth, Fastly has yet to turn a consistent profit. The company has experienced year-over-year losses, although the magnitude of these losses has narrowed in recent years.

The company reported quarterly sales of $137.78 million, missing the analyst consensus estimate of $139.46 million by 1.21% and representing a 15.47% increase over sales of $119.32 million year-over-year.

Fastly reported quarterly earnings of 1 cent per share, which beat the analyst consensus estimate of a 2 cent loss. It is an increase over losses of 8 cents per share from the same period last year.

Technical Analysis:

$FSLY is mostly flat and range-bound on the monthly and weekly chart. After earnings, and a strong move down, the stock seems to be reversing in the $13.11 zone and should get to $15 range soon. While this is a good reversal play, the slowing revenue growth, combined with under $2B market cap, size gives us pause on the stock.

Bull Case:

- Riding the Edge Cloud Wave: The market for edge computing services is expected to experience explosive growth in the coming years, driven by factors like the need for faster loading times, improved performance for global audiences, and enhanced security. Fastly, as a leading player in this space, is well-positioned to benefit from this trend.

- Valuation Opportunity: Following recent stock price drops, some analysts believe Fastly might be undervalued. If the company can deliver on its growth potential and achieve profitability, the stock price could rebound significantly.

Bear Case:

- Fierce Competition: Fastly faces stiff competition from established giants like Akamai Technologies and Amazon Web Services, along with new startups entering the edge computing space. These competitors offer similar or broader services, making it difficult for Fastly to stand out and capture significant market share.

- Focus on Developers Over Enterprise: While developer focus can be an advantage, it might limit Fastly’s appeal to larger enterprises that prioritize established brands and comprehensive service offerings.

- Macroeconomic Headwinds: A broader economic downturn could dampen demand for cloud services, impacting Fastly’s growth prospects.