Executive Summary:

Alkami Technology was founded in 2009 and offers cloud-based digital banking solutions for financial institutions in the United States. Their platform helps regional banks and credit unions compete with larger institutions by providing tools for retail and business banking, account opening, loans, and fraud prevention.

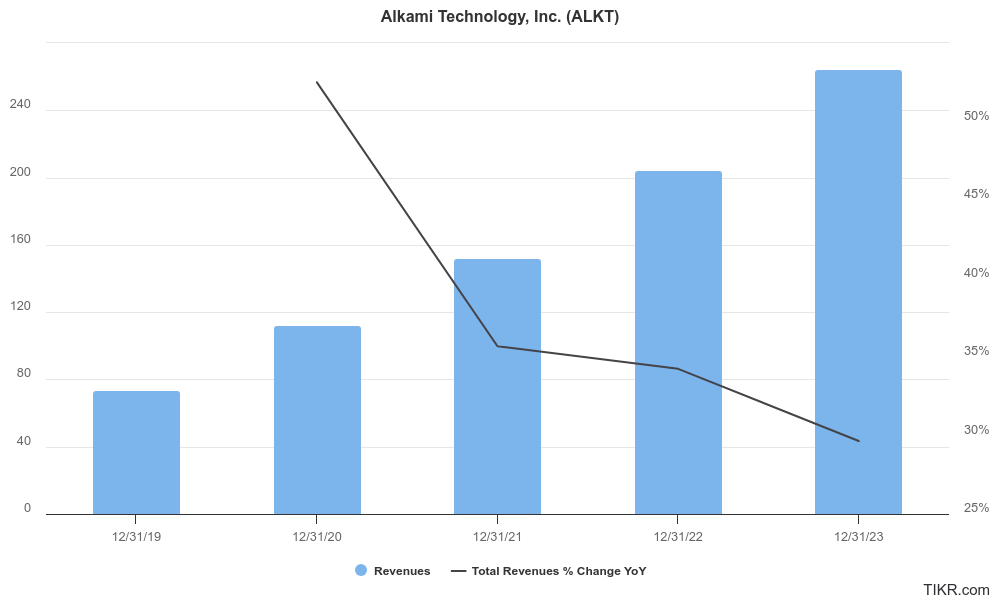

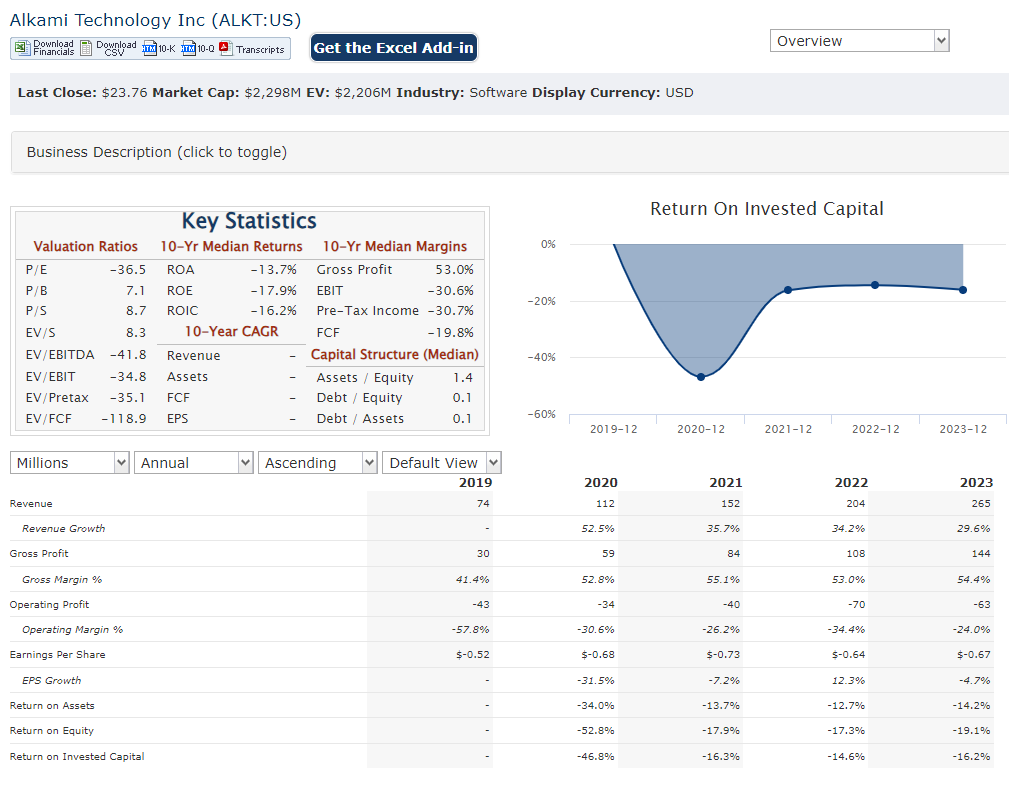

Q4 2023, total revenue was $71.4 million, a year-over-year increase of 29%. Alkami is not yet profitable, and reported a net loss of $12.7 million for the quarter. This was an improvement compared to a loss of $4.9 million in the same period of 2022. Revenue did come in slightly above the 28% growth rate estimated.

Stock Overview:

| Ticker | $ALKT | Price | $23.76 | Market Cap | $2.29B |

| 52 Week High | $26.75 | 52 Week Low | $10.93 | Shares outstanding | 96.76M |

Company background:

Alkami Technology, founded by Ethan Pierse and Diego Flores, is headquartered in Plano, Texas. Alkami’s platform empowers these financial institutions to compete with larger banks by providing a suite of tools for retail and business banking, including account opening, loan origination, and etc. Their focus on user experience and security helps financial institutions improve customer satisfaction and grow their customer base.

Alkami has received funding from several investment firms, including Bain Capital Ventures, Georgian Partners, and Meritech Capital. While the company is not yet profitable, it has shown strong year-over-year revenue growth, indicating a promising future.

Alkami’s key competitors include other financial technology companies offering digital banking solutions, such as Fiserv, Fidelity National Information Services (FIS), and Temenos.

Recent Earnings:

Revenues increased 28% in the most recent quarter over the year ago period. It’s important to note that Alkami is still in the investment phase and not yet profitable. They reported a net loss of $12.7 million for the quarter, in the same period of 2022.

The Market, Industry, and Competitors:

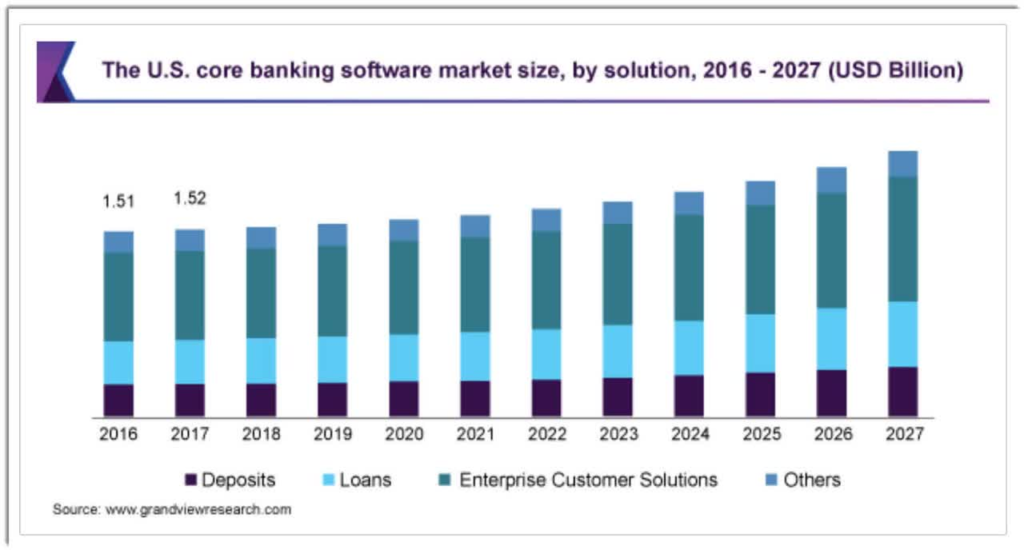

The company market is expected to experience significant growth due to two key factors:

- Rising demand for convenient and user-friendly banking experiences: Customers are increasingly seeking online and mobile banking options that are efficient and easy to navigate.

- Need for regional banks and credit unions to compete with larger institutions: Cloud-based solutions can help smaller financial institutions offer competitive features and functionality to stay relevant to their customer base.

The market for cloud-based digital banking solutions for regional banks and credit unions is anticipated to grow at a Compound Annual Growth Rate (CAGR) of around 25% by 2030.

Unique differentiation:

Alkami Technology faces competition from several established players in the FinTech space offering digital banking solutions:

- Large, Full-Service FinTech Providers: Fiserv, Fidelity National Information Services (FIS), and Temenos are all major forces in the FinTech industry, offering a wide range of financial technology products and services, including digital banking solutions. These companies can leverage their extensive resources and client base to pose a significant challenge to Alkami.

- Cloud-Based Digital Banking Specialists: Companies like Q2 and Backbase specialize in cloud-based digital banking platforms, similar to Alkami’s core offering. They may appeal to regional banks and credit unions looking for a modern and scalable solution specifically designed for their needs.

Alkami targets a specific niche within the FinTech market. By focusing on regional banks and credit unions, they can tailor their solutions and marketing efforts to the unique needs of these institutions.

Alkami Technology differentiates itself from competitors in the FinTech space through a combination of factors:

- Focus on Regional Banks and Credit Unions: Unlike large FinTech providers like Fiserv or FIS that cater to a broad range of financial institutions, Alkami specifically targets regional banks and credit unions.

- Cloud-Based and User-Friendly Platform: Alkami’s cloud-based platform offers several advantages. It eliminates the need for regional banks and credit unions to invest in expensive hardware and software infrastructure, making it a more cost-effective solution.

- Security and Scalability: Security is a top priority for financial institutions, and Alkami emphasizes robust security features within their platform.

Management & Employees:

- Alex Shootman (CEO): Shootman brings over 20 years of experience leading and scaling enterprise technology companies. He steers the overall direction of Alkami.

- Stephen Bohanon (Chief Strategy & Sales Officer, Co-founder): Bohanon co-founded Alkami and plays a dual role. He oversees the company’s strategic direction and spearheads sales efforts.

- Bryan Hill (Chief Financial Officer): Hill manages Alkami’s financial operations, ensuring financial health and growth.

Financials:

Alkami Technology has demonstrated consistent revenue growth, positioning itself as a promising player in the FinTech space. While specific revenue figures for each year might require referring to their financial statements, we can analyze trends. Reports indicate Alkami’s annual revenue has grown steadily year-over-year, culminating in a strong 29.65% increase in 2023. This upward trajectory suggests a healthy Compound Annual Growth Rate (CAGR) for the past five years.

Technical Analysis:

Alkami shares have formed a strong base on the monthly chart, after a double bottom in the $11 range. After earnings on Feb 28th, shares have trended lower, forming a new channel, with support in the $21-$22 range. There is a head and shoulders pattern on the 4 hour / daily chart, so the temporary bounce off the $23.09 range may be tested again. We would watch for an entry back to $26, but expect a move lower soon.

Bull Case:

- Large Target Market with High Growth: The market for cloud-based digital banking solutions for regional banks and credit unions is expected to experience significant growth due to rising demand for user-friendly banking experiences and the need for smaller institutions to compete effectively.

- Targeted Niche with Competitive Advantage: Alkami focuses specifically on regional banks and credit unions. This allows them to tailor their solutions and marketing to their unique needs, potentially giving them an edge over broader FinTech companies.

- Strong Revenue Growth and Potential Profitability: Alkami has demonstrated consistent year-over-year revenue growth, suggesting a healthy CAGR. While not yet profitable, their losses are decreasing as a percentage of revenue, indicating progress towards profitability.

Bear Case:

- Customer Acquisition Costs: Reaching and acquiring new regional bank and credit union customers can be expensive. If Alkami’s customer acquisition costs are high, it could eat into their profitability and limit their ability to scale effectively.

- Integration Challenges: Implementing a new digital banking platform can be complex and time-consuming for regional banks and credit unions. Integration challenges could lead to delays, customer dissatisfaction, and lost revenue for Alkami.

- Macroeconomic Factors: A broader economic downturn could lead regional banks and credit unions to tighten their budgets, potentially impacting Alkami’s sales and growth.