Executive Summary:

Veritiv Ord Shs (VRTV) is the stock for Veritiv Corporation, a distributor of packaging, facility supplies and print and publishing products. They also offer logistics and supply chain management solutions. The company primarily serves customers in North America but has a global presence.

Veritiv generated strong free cash flow of nearly $160 million during the first half of 2023.

Stock Overview:

| Ticker | $VRTV | Price | $2050 | Market Cap | $2.3B |

| 52 Week High | $170.02 | 52 Week Low | $101.50 | Shares outstanding | 13.57M |

Company background:

Veritiv Ord Shs (VRTV) was founded in 1968 as a subsidiary of International Paper Company, Veritiv went public in 2014.

Veritiv offers packaging, facility supplies, print and publishing products, and etc. The company faces competition from other distributors like Unisource Worldwide, Inc., Staples Inc., and WESCO International, Inc.

Recent Earnings:

Veritiv did not release traditional financial guidance or hold an earnings call to discuss their second quarter 2023 results (most recent).

Veritiv did announce that they generated nearly $160 million in strong free cash flow during the first half of 2023 [Veritiv Announces Second Quarter 2023 Financial Results].

The Market, Industry, and Competitors:

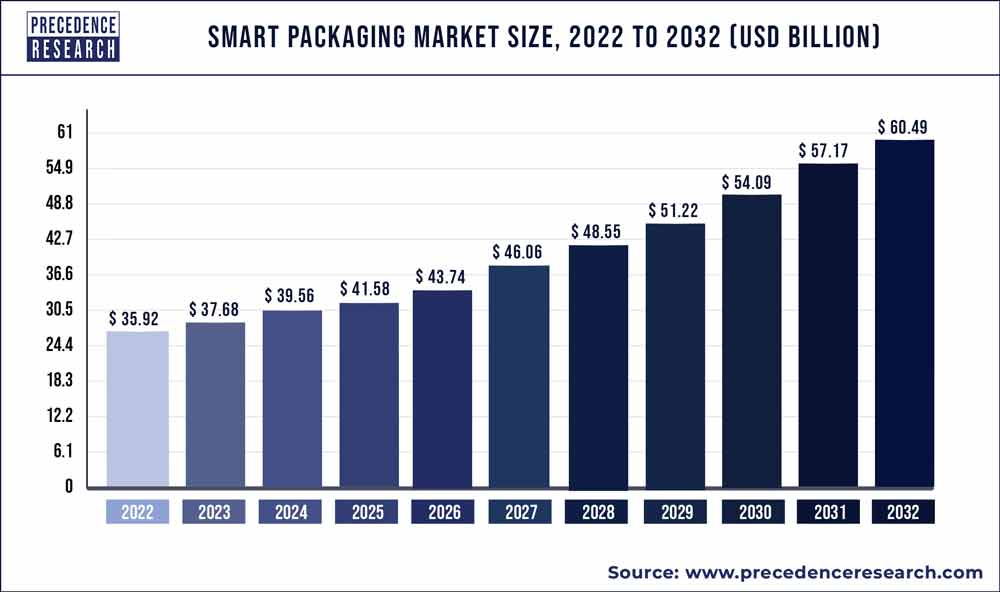

Veritiv Ord Shs operates in the Industrial Packaging Distribution market, which is expected to experience modest growth in the coming years. This growth is likely to be driven by several factors, including the increasing demand for e-commerce fulfillment, the growing importance of automation in warehousing, and the ongoing need for durable and sustainable packaging solutions [Industrial Packaging Market – Growth, Trends, COVID-19 Impact, and Forecasts (2022-2027)].

The Veritiv is currently undergoing a planned acquisition, which makes it difficult to assess specific growth expectations for the company itself [Veritiv Announces Second Quarter 2023 Financial Results]. The acquisition could impact Veritiv’s market position and future growth trajectory.

Unique differentiation:

Veritiv Ord Shs faces competition from a variety of players in the industrial and facility supplies distribution market:

- National Distributors: These include companies like Unisource Worldwide, Inc. and WESCO International, Inc. They offer similar product lines to Veritiv, including packaging, facility supplies, and MRO (Maintenance, Repair, and Operations) products. The national reach of these competitors allows them to compete for large, multi-location customers.

- Regional Distributors: Many regional distributors focus on specific geographic areas or product categories. They may offer more specialized products and services tailored to the needs of their local customer base. These competitors can be nimble and responsive to local needs, but may lack the scale and resources of national players.

- Manufacturer-Direct Sales: Some manufacturers of packaging, facility supplies, and other relevant products also sell directly to end-users. This can put pressure on Veritiv’s margins, especially for standardized products.

- Online Retailers: The rise of online retailers like Amazon Business has made it easier for businesses to purchase a wide variety of industrial and facility supplies directly online. While Veritiv has also developed an online presence, they continue to face competition from this growing e-commerce channel.

While Veritiv Ord Shs (VRTV) competes on price and product availability like many distributors:

- Integrated Solutions and Supply Chain Expertise: Veritiv goes beyond just selling products. They offer a range of logistics and supply chain management solutions to help customers optimize their operations and reduce costs.

- Industry-Specific Knowledge: Veritiv caters to a variety of industries, and their salesforce has expertise in the specific needs of each sector.

Management & Employees:

Salvatore Abbate (CEO): Abbate has been with Veritiv since 2018 and previously served as Senior Vice President & Chief Commercial Officer.

Mark W. Hianik (Senior Vice President, General Counsel & Corporate Secretary): Hianik oversees legal matters and corporate governance for Veritiv.

Financials:

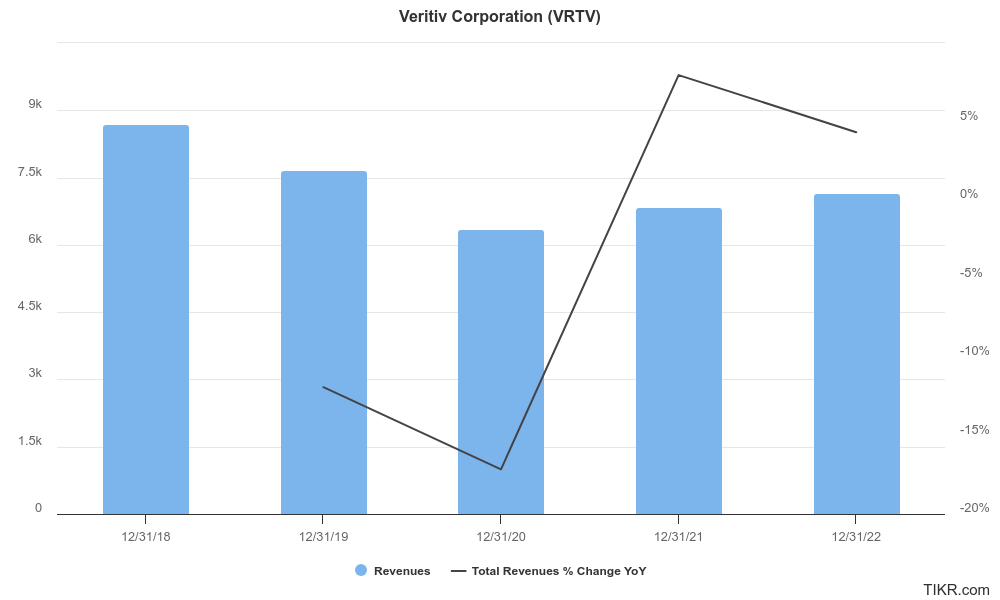

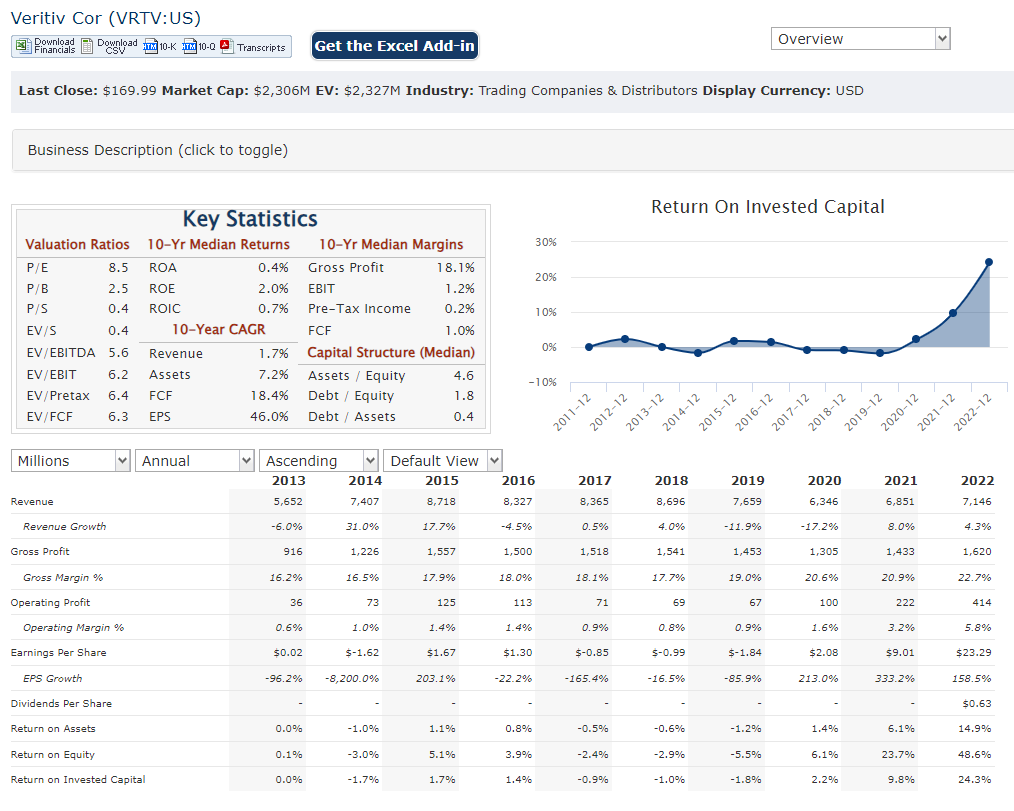

Revenue Growth: The industrial packaging distribution market itself has seen modest growth, but Veritiv could have faced challenges specific to their company that impacted their revenue trajectory.

Earnings Growth: Similar to revenue, earnings growth for Veritiv over the past five years is uncertain due to the acquisition.

Balance Sheet: Veritiv likely focused on managing their debt levels in the past five years. The industrial distribution market is competitive, and maintaining a healthy balance sheet is crucial.

Technical Analysis: A combination of low volume and inconsistent pricing makes us avoid this stock.

Bull Case:

- Market Growth Tailwinds: The industrial packaging distribution market is expected to see modest but steady growth in the coming years, driven by factors like e-commerce and automation. A rising tide could lift all boats, and Veritiv is well-positioned to benefit from these trends if they can capture their share of the market growth.

- Strength in Value-Added Services: Veritiv’s focus on integrated solutions and supply chain management expertise can be a significant advantage. If they can continue to develop and deliver superior value-added services to their customers, it can differentiate them from competitors and lead to higher customer retention and loyalty.

- Improved Profitability: The acquisition could also lead to cost-saving opportunities and improved operational efficiencies.

Bear Case:

- Limited Market Growth: While some growth is expected, the industrial packaging distribution market is predicted to see modest gains, not explosive expansion. If Veritiv cannot outpace the overall market growth, it could lead to stagnant or even declining stock prices.

- Macroeconomic Headwinds: A weakening economy or a downturn in manufacturing could negatively impact demand for Veritiv’s products and services. This could lead to lower revenue and profitability.

- Uncertainty Around Future Strategy: Due to the ongoing acquisition, Veritiv’s long-term strategic plans might be unclear. This lack of clarity could make investors hesitant to buy VRTV stock.