Executive Summary:

Extreme Networks designs, develops, and manufactures wired and wireless network infrastructure equipment. They also create software for network management, security, and access control. Founded in 1996, the company is based in Morrisville, North Carolina and has over 50,000 customers worldwide. Extreme Networks focuses on cloud-driven networking solutions and leverages technologies like machine learning and artificial intelligence to provide services that connect devices, applications, and people.

For the most recent report, earnings per share (EPS) of $0.11, fell short of the analysts’ consensus estimate of $0.16, representing a 31.25% negative surprise. Revenue reached $353.1 million, marking a 19% increase year-over-year.

Stock Overview:

| Ticker | $EXTR | Price | $12.11 | Market Cap | $1.56B |

| 52 Week High | $32.73 | 52 Week Low | $11.61 | Shares outstanding | 126.73M |

Company background:

The company was established by Gordon Stitt, Herb Schneider, and Stephen Haddock. Unlike many startups that rely on venture funding rounds, Extreme Networks went public in 1999.

The cloud-driven solutions are built to be scalable and adaptable, catering to the needs of various industries.

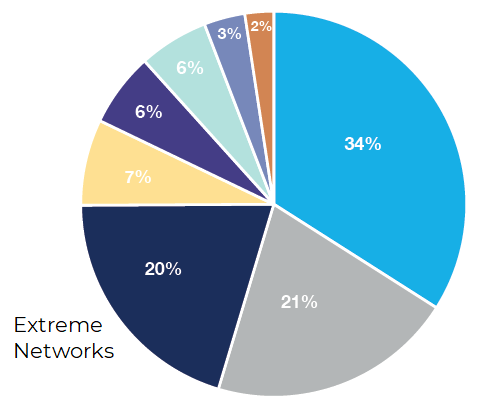

Extreme Networks faces competition from several established technology giants in the networking space, including Cisco Systems, Aruba Networks, Juniper Networks, Huawei, and Hewlett Packard Enterprise (HPE). Despite this competitive landscape, Extreme Networks has carved out a niche for itself by focusing on price competitiveness. It has less than 2% market share in the networking equipment market overall, but 20% share within the hyper segmentation fabric category.

Operational Metrics:

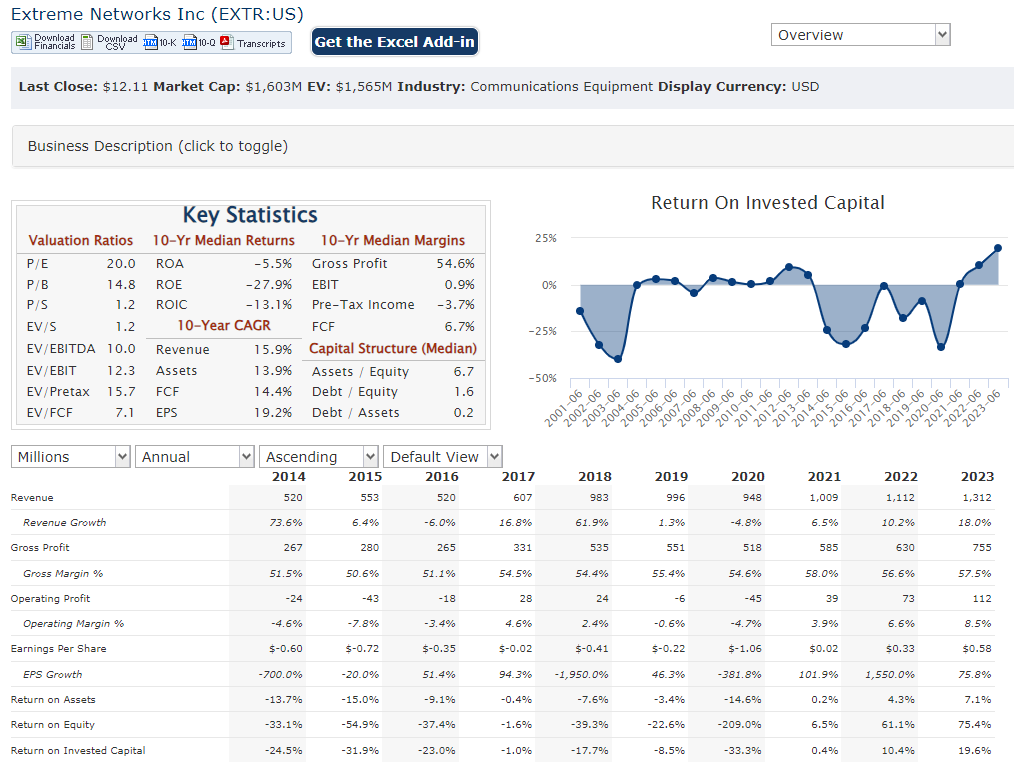

- Gross Margin: Extreme Networks’ gross margin for Q1 FY24 was 60.3%, compared to 56.0% in the same quarter last year. This improvement indicates the company’s efficiency in managing its costs.

- Operating Margin: The operating margin also improved year-over-year, rising from 5.8% to 10.2% in Q1 FY24. This suggests a stronger overall financial health for the company.

The Market, Industry, and Competitors:

Extreme Networks operates in the networking equipment market, which is expected to be a significant growth market in the coming years. The market is anticipated to reach a value of $282.4 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030. This growth is driven by factors such as the increasing demand for cloud-based networking solutions, the growing adoption of new technologies like artificial intelligence and the Internet of Things (IoT), and the need for businesses to have reliable and secure networks to support their digital transformation initiatives.

Analysts are optimistic about Extreme Networks’ future in this growing market, predicting a CAGR of 10.0% for the company’s revenue between 2023 and 2030. This growth is expected to be driven by Extreme Networks’ focus on cloud-driven networking solutions, its commitment to innovation, and its strong customer base.

Unique differentiation:

- Industry giants: Cisco Systems and Hewlett Packard Enterprise (HPE) are dominant players in the overall networking market, offering a wide range of products and services. While their vast resources can be an advantage, their broad focus might not allow them to cater to specific needs addressed by Extreme Networks.

- Focused competitors: Arista Networks and Juniper Networks are more direct competitors, specializing in similar areas as Extreme Networks, such as cloud networking and data center solutions. This can lead to intense competition in specific product categories. However, Extreme Networks differentiates itself through its focus on customer service and its commitment to open networking standards.

- Emerging players: Smaller companies and startups are constantly innovating and bringing new solutions to the market. While they might not pose an immediate threat, they have the potential to disrupt the market in the long run. Extreme Networks needs to stay agile and adaptable to maintain its competitive edge.

Extreme Networks attempts to differentiate itself from competitors in the networking equipment market:

1. “One Network” Approach: Extreme Networks emphasizes its unified wired and wireless management platform. This allows customers to manage their entire network, from core to edge, under a single interface, simplifying network operations and potentially reducing costs. They claim this “One Network” approach offers a clear advantage over competitors with separate wired and wireless solutions.

2. Commitment to Open Networking: Extreme Networks advocates for open networking standards, allowing customers to choose different vendors for various components within their network infrastructure. This approach contrasts with some competitors who might promote proprietary solutions, potentially locking customers into their ecosystem.

3. Focus on Customer Service: Extreme Networks prides itself on its highly rated customer support, offering in-sourced support with a high first-call resolution rate. This commitment to customer satisfaction aims to differentiate them from competitors who might offer less personalized or responsive support.

4. Cloud-Driven Networking Solutions: Similar to many competitors, Extreme Networks emphasizes cloud-based networking solutions. However, they aim to differentiate by focusing on scalability and adaptability, catering to the diverse needs of different industries and businesses.

5. Innovation: Extreme Networks invests in research and development to bring innovative solutions to the market. They believe this focus on pushing boundaries allows them to stay ahead of the curve and offer customers cutting-edge networking technologies.

Management & Employees:

- Ed Meyercord: President & CEO, responsible for overseeing the company’s overall strategy and execution.

- Norman J. Rice: Chief Commercial Officer, leading sales, partner, services, and supply chain organizations to drive revenue growth.

- Nabil Bukhari: Chief Product and Technology Officer, GM of Subscription Business, responsible for product development, innovation, and the company’s subscription business growth.

- Kevin Rhodes: Executive Vice President and Chief Financial Officer, leading financial operations, strategy, and investor relations.

Financials:

Extreme Networks: Financial Performance Overview (2019-2023)

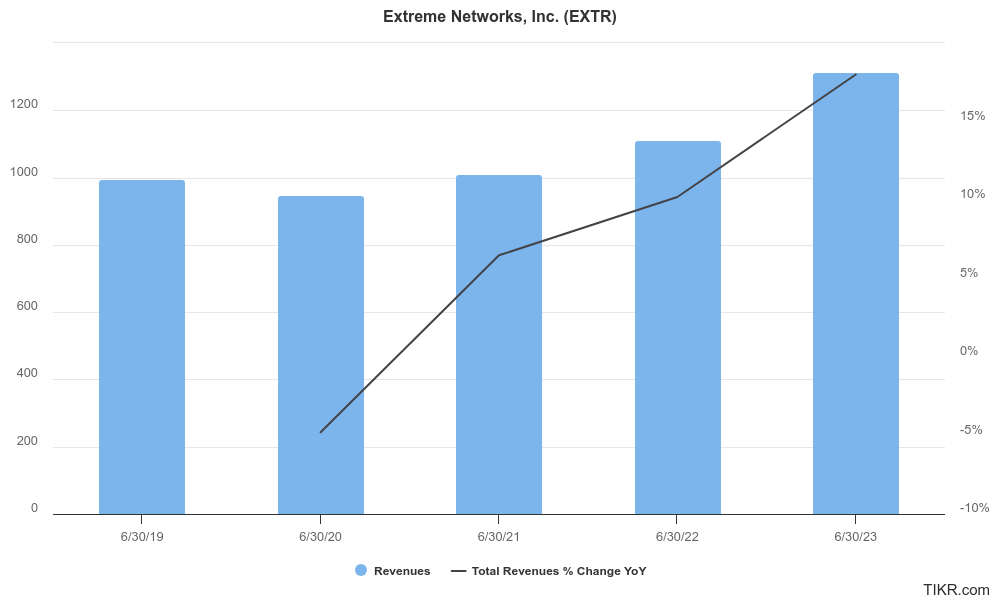

Revenue Growth: Extreme Networks has experienced steady revenue growth over the past five years. From 2019 to 2023, the company’s revenue increased from $996 million to $1.3 billion, representing a CAGR of approximately 5.4%. This growth indicates a positive trend, although it may not be as significant as some competitors in the rapidly expanding networking equipment market.

Earnings Growth: While revenue has shown consistent growth, Extreme Networks’ earnings picture has been more volatile. The company has experienced fluctuations in net income and EPS over the past five years. However, looking at the bigger picture, their net income in 2023 was $140.8 million compared to $84.6 million in 2019, reflecting a CAGR of approximately 12.1%. This suggests improvement in profit generation despite some year-to-year variations.

Balance Sheet: Extreme Networks’ balance sheet shows a mix of positive and cautious aspects. The company has seen its cash and cash equivalents increase steadily, reaching $426.5 million at the end of 2023 compared to $104.6 million in 2019. This indicates improved financial liquidity.

Technical Analysis: A bear flag on the weekly, a head and shoulders (bearish) pattern on the monthly and a consolidation pattern on the daily chart, makes this stock an easy avoid now.

Bull Case:

1. Growth in the Networking Equipment Market: The overall networking equipment market is expected to experience significant growth in the coming years, driven by factors like cloud adoption, IoT, and digital transformation. This rising tide could lift all boats, benefitting Extreme Networks as well.

2. Strong Differentiators: Extreme Networks emphasizes its “One Network” approach, commitment to open networking, focus on customer service, and cloud-driven solutions as key differentiators. If these factors resonate with customers and the company can effectively leverage them, it could gain a competitive edge and capture a larger market share.

3. Increasing Adoption of Cloud-Based Solutions: Extreme Networks’ focus on scalable and adaptable cloud-based networking solutions aligns well with the industry’s growing shift towards cloud adoption. If they can successfully cater to this demand, it could be a significant driver of future growth.

4. Potential for Acquisitions: The networking industry is constantly evolving, and there might be opportunities for Extreme Networks to acquire smaller players or complementary technologies to expand its product portfolio and strengthen its market position.

Bear Case:

1. Intense Competition: The networking equipment market is highly competitive, with established giants like Cisco and emerging players vying for market share. Extreme Networks might struggle to differentiate itself effectively and secure a significant portion of the growing market.

2. Execution Challenges: Even with a strong strategy and promising solutions, challenges in execution can hinder progress. Delays in product development, issues with integrating new technologies, or difficulties in scaling operations could impact the company’s ability to capitalize on market opportunities.

3. Dependence on Subscription Business Growth: Extreme Networks is increasingly focusing on its subscription business model. However, if they fail to attract and retain customers for these offerings, it could limit their revenue growth and negatively impact their financial performance.