Executive Summary:

Boot Barn Holdings is a company that operates retail stores specializing in Western and work-related apparel and footwear. Founded in 1978, the company offers products for men, women, and children, including boots, denim, hats, and accessories. Boot Barn Holdings has over 170 stores across the United States and carries popular brands like Ariat, Wrangler, and Lucchese. The company is headquartered in Irvine, California and employs over 8,400 people.

They delivered earnings per share (EPS) of $1.81, exceeding analyst expectations of $1.74 for the same period last year. Revenue also grew slightly to $520.4 million, a 1.1% increase compared to the prior year. The same-store sales, which measure sales at stores open for at least a year, decreased by 9.7%

Stock Overview:

| Ticker | $BOOT | Price | $91.40 | Market Cap | $2.77B |

| 52 Week High | $104.91 | 52 Week Low | $64.33 | Shares outstanding | 30.30M |

Company background:

Boot Barn was founded in 1978 and has grown to become the largest western and work wear retailer in the United States. The company began with a focus on the western lifestyle but has since expanded its brands to cater to a variety of customers and their diverse lifestyles. Boot Barn serves the American cowboy, the worker in industries such as oil & gas and agriculture, the outdoorsman, and fashion enthusiasts with a mix of mainstream and western-inspired fashion. They also offer commercial accounts to support businesses with large quantity purchases.

Their stores carry popular brands like Ariat, Wrangler, and Lucchese catering to both western enthusiasts and those seeking workwear essentials. Boot Barn Holdings faces competition from other retailers like Cavender’s, Sheplers, Rocky Mountain ATV/MC, and Tractor Supply Company.

Recent Earnings:

Boot Barn reported its financial results for the third fiscal quarter ended December 30, 2023. The company announced total sales of $520.4 million, a 1.1% increase from the previous year, with earnings of $1.81 per share, which was a 4% increase from $1.74 reported in the year-ago quarter and beat consensus estimate by a penny. Same-store sales, however, declined by 9.7% in the fiscal third quarter, with retail store same-store sales and e-commerce same-store sales plunging 9.5% and 11.5%, respectively.

The Market, Industry, and Competitors:

Boot Barn Holdings operates in the Western and work-related apparel and footwear market. This market is expected to experience modest growth in the coming years, driven by factors such as increasing disposable income and a growing interest in outdoor activities.

The Boot Barn Holdings faces competition from various players, including other brick-and-mortar stores and online retailers. The company’s success will depend on its ability to differentiate itself through factors like brand recognition, customer service, and product selection.

Unique differentiation:

Boot Barn Holdings faces competition from several players in the Western and work-related apparel and footwear market:

- Direct competitors: These companies offer similar product lines and target a similar customer base as Boot Barn Holdings. They include:

- Cavender’s: A leading retailer specializing in Western wear, with a focus on boots, jeans, and accessories.

- Rocky Mountain ATV/MC: While primarily focusing on powersports vehicles and apparel, they also carry a selection of workwear and Western-style clothing and boots.

- Tractor Supply Company: Carries workwear apparel and footwear alongside farm and ranch supplies, targeting a slightly broader customer base compared to Boot Barn Holdings’ core Western audience.

- Indirect competitors: These companies may not offer exactly the same products but compete for a portion of Boot Barn Holdings’ customer spending, especially for workwear needs:

- Department stores: Major department stores like Walmart, Kohl’s, and JCPenney offer a wider selection of clothing and footwear, including some workwear options.

- Workwear specialty stores: Stores like Dickies and Carhartt focus specifically on workwear apparel and footwear, catering to professionals in various trades.

1.Specialized Focus: Unlike some competitors like Tractor Supply Company with a broader focus, Boot Barn Holdings primarily targets the specific niche of Western and work-related apparel and footwear.

2. Brand Recognition: With over 40 years of experience, Boot Barn Holdings has established itself as a well-recognized brand in the Western and workwear market. This established reputation can attract customers seeking quality products and a trustworthy shopping experience.

3. Customer Service: Boot Barn Holdings emphasizes personal and knowledgeable customer service. Their staff often possesses expertise in the Western and workwear categories, offering informed advice and assistance to customers.

4. Community Engagement: Boot Barn Holdings frequently engages with the Western and workwear communities through various sponsorships, events, and partnerships.

Management & Employees:

Boot Barn Holdings boasts a seasoned management team:

- James Conroy: President and Chief Executive Officer (CEO) since 2012, bringing extensive experience from previous leadership roles in retail companies like Claire’s Stores and Blockbuster Entertainment Group.

- Laurie Grijalva: Chief Merchandising Officer (CMO) since 2014, responsible for overseeing product selection, sourcing, and inventory management, with a strong background in the retail industry.

- Gregory Hackman: Chief Financial Officer (CFO) and Secretary since 2015, leading the company’s financial operations and reporting, with expertise in accounting and finance.

Financials:

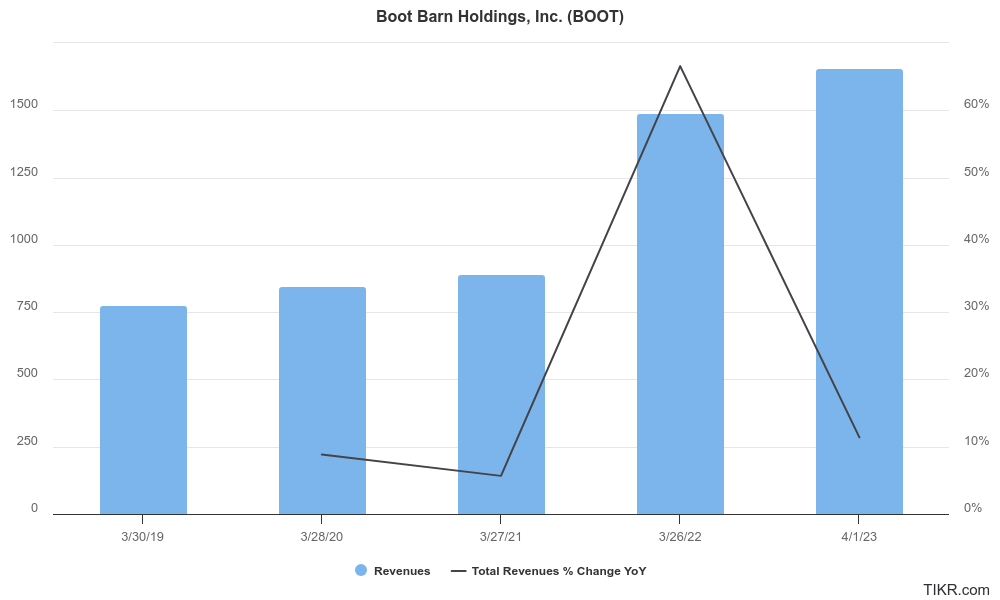

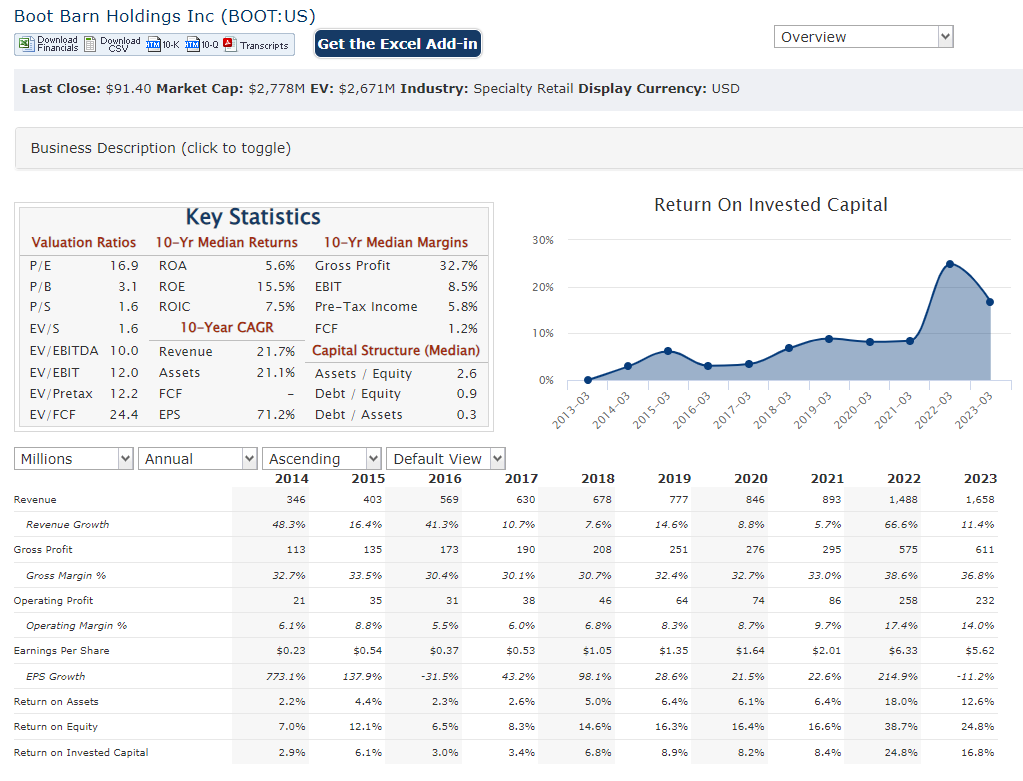

Boot Barn Holdings has exhibited consistent revenue growth. Their annual revenue has increased steadily, with a Compound Annual Growth Rate (CAGR) exceeding 7%. This indicates a positive trajectory in terms of sales generation.

The earnings growth has been less consistent. While the company has experienced periods of strong earnings growth, there have also been instances of year-over-year declines. This results in a CAGR for earnings that is lower than the revenue CAGR, highlighting some volatility in profitability.

The company’s balance sheet, their financial position has generally improved over the past five years. They have maintained a healthy level of debt and have consistently grown their shareholders’ equity, indicating a strong financial foundation for future growth.

Technical Analysis: The monthly chart shows the early formation of a head and shoulders pattern (bearish) but that needs confirmation. The weekly chart confirms that, but the daily chart is more bullish with an uptrend. The rejection at the $94 price is telling, which means we are more cautious on the stock. We would not initiate a long position in the stock at this point.

Bull Case:

1. Growth in Core Market: The Western and workwear apparel and footwear market is expected to experience modest but consistent growth in the coming years, driven by factors like increasing disposable income and a growing interest in outdoor activities.

2. Continued Store Expansion: The company’s ongoing focus on strategic store expansion can contribute to future growth. By opening new stores in targeted locations, Boot Barn Holdings can reach a wider customer base and increase brand awareness.

3. Potential for E-commerce Growth: While Boot Barn Holdings has a brick-and-mortar focus, their e-commerce platform offers another avenue for growth. By enhancing their online presence and investing in digital marketing.

Bear Case:

1. Declining Same-Store Sales: Despite overall revenue growth, Boot Barn Holdings has recently experienced declines in same-store sales, which measure sales at existing stores. This suggests a potential weakening in customer demand for their products at established locations.

2. Intense Competition: The Western and workwear apparel and footwear market is highly competitive, with established players like Cavender’s and Sheplers vying for market share.

3. Limited Market Growth: While the core market is expected to experience modest growth, the rate of growth might not be substantial enough to significantly propel Boot Barn Holdings’ sales and profitability.