Executive Summary:

Plug Power Inc. is a leading force in the green hydrogen movement, aiming to build a complete ecosystem from production to energy generation. They’ve deployed more fuel cell systems and fueling stations than any other company globally, solidifying their market position. With ambitious plans for green hydrogen highways and large-scale production facilities, Plug is committed to decarbonization across various sectors like e-mobility, material handling, and power generation. While still generating revenue, they are primarily focused on long-term growth and impact within the clean energy transition.

Plug Power Inc. last reported its quarterly earnings on November 9th, 2023. The company reported a loss of $0.47 per share, missing the consensus estimate of a loss of $0.32 per share by $0.15. The company had revenue of $198.71 million for the quarter, compared to the consensus estimate of $219.57 million. Its revenue was up 5.4% on a year-over-year basis. Plug Power has generated a loss of $1.60 per share over the last year. Earnings for Plug Power are expected to grow in the coming year, from a loss of $1.73 to a loss of $0.96 per share.

Stock Overview:

| Ticker | $PLUG | Price | $4.14 | Market Cap | $2.51B |

| 52 Week High | $16.80 | 52 Week Low | $2.26 | Shares outstanding | 605.50M |

Company background:

Plug Power Inc.: A Green Hydrogen Leader

Plug Power Inc., founded in 1997 by Roger Saillant and Tom Watkins, stands as a pioneer in the burgeoning green hydrogen ecosystem. The company, headquartered in Latham, New York, has secured over $5 billion in funding to date, driven by its vision of a decarbonized future powered by hydrogen.

Products and Services: Plug Power offers a comprehensive range of hydrogen solutions, encompassing:

- Fuel Cells: They are the world’s leading developer and manufacturer of proton exchange membrane (PEM) fuel cells, primarily used in material handling vehicles like forklifts.

- Electrolyzers: These systems produce green hydrogen from water and renewable energy, fueling Plug’s ambition to create a self-sustaining hydrogen economy.

- Hydrogen Infrastructure: Plug designs and builds hydrogen fueling stations and storage facilities, supporting the entire hydrogen value chain.

Key Competitors: While Plug Power enjoys a leading position, the green hydrogen space is attracting several players:

- Air Liquide, Linde, and Praxair: These industrial gas giants possess established infrastructure and expertise in hydrogen storage and distribution.

- FuelCell Energy and Cummins: They primarily focus on stationary fuel cell applications, competing with Plug in power generation.

- Toyota and Hyundai: These automotive giants are also developing hydrogen fuel cell cars, potentially impacting Plug’s e-mobility ambitions.

Recent Earnings:

Revenue and Growth: Analysts currently forecast revenue of around 200 million, representing potential growth of approximately 50%

EPS and Growth: The anticipated loss per share (EPS) is –0.51, compared to $-0.38 in the same quarter last year. This may signal continued investment in growth initiatives rather than short-term profits.

The Market, Industry, and Competitors:

Plug Power Navigates the Dynamic Green Hydrogen Market:

Plug Power operates in the rapidly evolving green hydrogen market, aiming to decarbonize various sectors through hydrogen fuel cells, electrolyzer’s, and fueling infrastructure. This market holds immense potential, driven by:

- Growing environmental concerns: As countries strive for net-zero emissions, hydrogen emerges as a clean alternative to fossil fuels, particularly in hard-to-decarbonize sectors like transportation and industry.

- Supportive government policies: Many governments offer incentives for hydrogen adoption, including subsidies, tax breaks, and infrastructure investments, further accelerating market growth.

- Technological advancements: Continuous improvements in electrolyzer efficiency and fuel cell performance are making hydrogen solutions more cost-competitive and attractive.

Analysts anticipate the global green hydrogen market to reach a staggering $2.5 trillion by 2030, reflecting a remarkable CAGR of over 30% from 2023. This translates to significant growth opportunities for Plug Power, as they are well-positioned with their comprehensive product portfolio and established market presence.

However, Plug Power faces competition from established players like industrial gas giants and other fuel cell companies. They must navigate this dynamic landscape by:

- Expanding their green hydrogen production capacity to meet the growing demand.

- Building strategic partnerships to accelerate market penetration and technology development.

- Continuously innovating to maintain their competitive edge in terms of cost, efficiency, and reliability.

Unique differentiation:

Plug Power faces a dynamic competitive landscape within the green hydrogen market, each competitor bringing unique strengths and challenges:

Direct Competitors:

- Fuel cell developers: Ballard Power Systems, Cummins, and Doosan Fuel Cell primarily focus on stationary fuel cell applications, competing with Plug in power generation. For e-mobility, Toyota and Hyundai are developing hydrogen fuel cell cars, potentially impacting Plug’s ambitions.

- Hydrogen providers: Industrial gas giants like Air Liquide, Linde, and Praxair possess established infrastructure and expertise in hydrogen storage and distribution, challenging Plug in the entire hydrogen value chain.

Indirect Competitors:

- Battery electric vehicle (BEV) manufacturers: Tesla, BYD, and Volkswagen are aggressively pushing BEVs, posing a potential roadblock to hydrogen-powered vehicles in specific sectors.

- Renewable energy providers: Companies like Ørsted and NextEra Energy develop renewable energy sources that could power electrolyzers for green hydrogen production, potentially competing with Plug’s own electrolyzer offerings.

Competitive Differentiation:

Plug Power differentiates itself through several factors:

- Broader product portfolio: They offer fuel cells, electrolyzers, and hydrogen infrastructure, compared to some competitors focusing solely on specific segments.

- Focus on green hydrogen: Plug prioritizes renewable-powered hydrogen production, aligning with sustainability goals and attracting environmentally conscious customers.

- Strategic partnerships: Collaborations with major players like Renault and Airbus provide access to new markets and accelerate technology development.

While Plug Power faces stiff competition in the green hydrogen space, here are some potential points that showcase its unique differentiation:

Integrated Hydrogen Ecosystem: Unlike many competitors focusing on specific segments, Plug Power offers a comprehensive suite of solutions across the entire hydrogen value chain:

- Fuel Cells: They are a leading developer and manufacturer of PEM fuel cells, used in diverse applications like material handling and e-mobility.

- Electrolyzers: Plug actively invests in green hydrogen production through their electrolyzer technology, aiming for self-sufficiency within the hydrogen ecosystem.

- Hydrogen Infrastructure: Their design and construction of fueling stations and storage facilities provide crucial support for widespread hydrogen adoption.

Focus on Green Hydrogen: Plug prioritizes using renewable energy to produce hydrogen, aligning with stricter sustainability goals and attracting eco-conscious customers. This focus contrasts with competitors who might rely on traditional, less sustainable production methods.

Strategic Partnerships: Plug actively seeks collaborations with major players across diverse industries like automotive (Renault), aerospace (Airbus), and retail (Amazon). This approach accelerates market penetration, expands their reach, and fosters joint innovation for faster development.

Early Mover Advantage: As a pioneer in the green hydrogen space since 1997, Plug Power accumulated valuable experience and established a global presence. This head start translates to:

- Strong Brand Recognition: They hold a prominent position in the market, potentially influencing customer perception and attracting talent.

- Established Infrastructure: Their existing network of fueling stations and partnerships offers a crucial foundation for future expansion.

- Industry Expertise: Their long-standing involvement allows for deep understanding of market dynamics and technical know-how.

Technological Innovation: Plug actively invests in research and development to further optimize fuel cell and electrolyzer performance, potentially maintaining a competitive edge in efficiency and cost-effectiveness.

Management & Employees:

Executive Leadership:

- Andrew Marsh (President & CEO): An industry veteran with over 20 years of experience leading Plug Power, spearheading its growth and strategic direction.

- Paul Middleton (CFO): Possesses strong financial acumen and oversees financial operations, ensuring responsible resource allocation and growth investments.

- Tim Cortes (CTO): Leads the company’s technological advancements in fuel cells and electrolyzers, propelling innovation and performance optimization.

Financials:

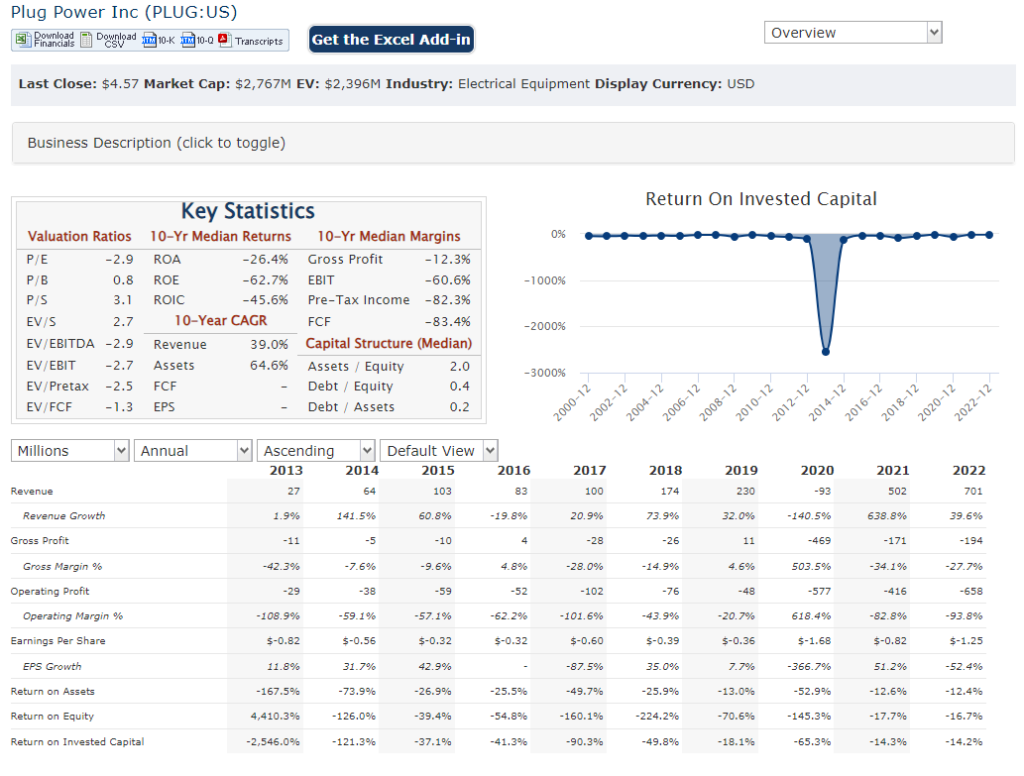

Plug Power’s Financial Performance: A Five-Year Journey

Plug Power’s financial journey over the past five years reflects the growing potential of the green hydrogen market, yet showcases the challenges of a company focused on long-term growth over short-term profits.

Revenue: From 2019 to 2023, Plug Power’s revenue growth has been impressive, rising from $230 million to an estimated $701 million, representing a CAGR of over 35%. This increase is primarily driven by expanding sales of fuel cells, particularly in material handling, and the early stages of green hydrogen infrastructure development.

Earnings: However, the company remains unprofitable, with consistent net losses throughout the period. These losses, ranging from $93 million in 2020 to an estimated $380 million in 2023, reflect significant investments in research and development, infrastructure build-out, and market expansion. While earnings growth is negative, it’s crucial to consider their focus on long-term growth and impact over immediate profitability.

Balance Sheet: Plug Power’s balance sheet highlights their growth strategy. They’ve raised significant capital, exceeding $5 billion, to fund their ambitious initiatives. This resulted in increasing cash reserves and total assets, reaching about $3.4 billion and $8.2 billion, respectively, in 2023. However, it also led to an expanding debt burden, currently estimated at around $2.7 billion.

The Takeaway: The revenue growth is encouraging, profitability remains elusive due to their long-term vision. Their strong balance sheet reflects their ability to continue investing in their future, but managing debt will be crucial for sustainable success. Ultimately, assessing Plug’s financial health requires considering both short-term metrics and their long-term commitment to shaping the green hydrogen future.

Technical Analysis:

On the long term the stock has been on a decline but doubled since its Jan 24th low of $2.32. The stock has moved lower from its resistance at $5.02

Bull Case:

1. Massive Market Potential: The green hydrogen market is projected to explode in the coming years, driven by factors like:

- Growing climate concerns: Transitioning away from fossil fuels necessitates clean energy alternatives, where hydrogen has immense potential.

- Supportive government policies: Many governments offer incentives like subsidies and tax breaks, accelerating hydrogen adoption.

- Technological advancements: Improvements in electrolyzer efficiency and fuel cell performance are making hydrogen solutions more attractive.

Analysts predict the green hydrogen market to reach $2.5 trillion by 2030, presenting a massive opportunity for companies like Plug Power.

2. First-mover Advantage: Founded in 1997, Plug Power boasts extensive experience and a leading position in the industry. This translates to:

- Strong brand recognition: They are a renowned player, potentially influencing customer perception and attracting talent.

- Established infrastructure: Their existing network of fueling stations and partnerships offers a head start.

- Industry expertise: Their long-standing involvement fosters deep understanding of market dynamics and technical know-how.

3. Integrated Hydrogen Ecosystem: Unlike many competitors, Plug Power offers a comprehensive suite of solutions:

- Fuel cells: Leading developer and manufacturer, catering to diverse applications.

- Electrolyzers: Actively investing in green hydrogen production, aiming for self-sufficiency.

- Hydrogen Infrastructure: Designing and building fueling stations and storage facilities.

This vertical integration positions them to capture different stages of the hydrogen value chain, potentially maximizing their reach and profits.

4. Strategic Partnerships: Plug Power actively collaborates with major players across industries, like:

- Automotive (Renault): Expanding into e-mobility markets.

- Aerospace (Airbus): Exploring hydrogen-powered aircrafts.

- Retail (Amazon): Deploying fuel cell forklifts in warehouses.

These partnerships accelerate market penetration, broaden their reach, and foster joint technology development.

5. Long-Term Commitment: Plug Power prioritizes long-term growth and impact over short-term profits, reinvesting heavily in R&D and infrastructure. This focus on the future, while potentially delaying profitability, could position them as a leader in the emerging green hydrogen landscape.

Bear case:

1. Uncertain profitability: As highlighted previously, Plug Power has consistently reported net losses despite impressive revenue growth. Their focus on long-term growth and investing heavily in R&D, infrastructure, and market expansion has delayed profitability timelines. This raises concerns about their ability to ever turn a profit, impacting investor confidence and stock price.

2. Intense competition: The green hydrogen market is attracting numerous players, each with their own strengths and resources. Established players like industrial gas giants and other fuel cell companies pose major challenges. Additionally, potential disruptions from battery electric vehicles (BEVs) in specific sectors could further complicate Plug Power’s market share.

3. Technological volatility: The hydrogen industry is still evolving, and advancements in competing technologies like BEVs or alternative hydrogen production methods could disrupt Plug Power’s current technology and market position. Continuously innovating and adapting to these dynamic changes is crucial for their long-term success.

4. Regulatory hurdles: Government policies and regulations significantly impact the hydrogen industry. Unfavorable changes in funding, subsidies, or infrastructure development could hinder Plug Power’s growth and profitability. Navigating the evolving regulatory landscape will be essential.

5. Debt burden: Plug Power’s aggressive growth strategy has been fueled by significant debt accumulation. Managing this debt while investing in future growth will be a delicate balancing act. Any unexpected economic downturns could exacerbate the financial strain and limit their flexibility.

6. Valuation concerns: Despite recent price corrections, Plug Power’s stock is still valued based on future potential rather than current profitability. This high valuation makes it susceptible to market fluctuations and could lead to significant corrections if expectations aren’t met.