Executive Summary:

FIGS is an Direct To Consumer (DTC) American clothing company specializing in scrubs and apparel for healthcare professionals. Founded in 2013, it’s known for its stylish, comfortable, and functional designs, made with proprietary materials for odor resistance and stretch. They operate solely online, building a loyal customer base by directly connecting with the healthcare community. This approach has helped them become the leading direct-to-consumer brand in the healthcare apparel market, aiming to empower and celebrate current and future generations of medical professionals.

The most recent earnings report for Figs Inc. is for the third quarter of fiscal year 2023, released on November 2nd, 2023. In this report, Figs exceeded analyst expectations on both revenue and earnings. They reported:

- Revenue: $142.4 million, a 10.7% increase year-over-year, exceeding analyst estimates by 2.4%.

- Earnings per share (EPS): $0.03, compared to analyst estimates of $0.02, representing a 50% beat.

- Net income: $6.3 million, a 51.98% increase year-over-year.

It’s worth noting that analysts’ expectations for the next quarter (Q4 2023) are currently for an EPS of $0.01, which would be a 33.5% decrease from Q3.

Stock Overview:

| Ticker | $FIGS | Price | $6.00 | Market Cap | $1.01B |

| 52 Week High | $10.20 | 52 Week Low | $5.16 | Shares outstanding | 161.12M |

Company background:

FIGS: Revolutionizing Healthcare Apparel

FIGS, stylized as FIGS, is a leading American company specializing in stylish, comfortable, and functional scrubs and apparel for healthcare professionals. Founded in 2013 by Heather Hasson and Trina Spear, two former Bain & Company consultants who saw a gap in the market for high-quality, well-fitting scrubs, FIGS has grown into a beloved brand by healthcare workers across the nation.

Funding and Growth:

The company started with an initial investment of $1 million from their own savings and quickly gained traction. They received further funding rounds, raising a total of over $330 million from investors like Sequoia Capital and Temasek. This funding fueled their rapid expansion, allowing them to build a strong online presence and establish themselves as a major player in the healthcare apparel industry.

Products and Innovation:

FIGS offers a wide range of products, including:

- Scrubs: Made with their proprietary FIONx fabric, known for its comfort, stretch, moisture-wicking, and odor-resistant properties. They come in a variety of styles and colors to suit different preferences.

- Non-scrub wear: Lab coats, under scrubs, outerwear, loungewear, compression socks, footwear, and other lifestyle apparel.

- Accessories: Face masks, scrub caps, lanyards, badge reels, tote bags, and more.

FIGS is known for its innovative approach to product design, incorporating feedback from healthcare professionals to create apparel that is both functional and fashionable. They also prioritize ethical sourcing and sustainability in their manufacturing practices.

Key Competitors and Market Position:

FIGS’ main competitors include:

- Dickies Medical: A long-established brand offering traditional scrubs at lower price points.

- Grey’s Anatomy Scrubs: Another popular brand known for its comfortable and stylish scrubs.

- Jaanu: A newer brand focused on sustainable and ethical practices.

Despite the competition, FIGS has carved out a unique niche in the market with its focus on premium quality, design-driven scrubs and its strong connection with the healthcare community. They have built a loyal customer base and are well-positioned for continued growth in the future.

Headquarters:

FIGS is headquartered in Santa Monica, California, with a warehouse in City of Industry, California. They operate solely online, selling directly to consumers through their website and mobile app.

Recent Earnings:

Strong Revenue Growth and Profitability:

FIGS reported strong financial results for the third quarter of fiscal year 2023, ended September 30, 2023. Revenue reached $142.4 million, representing a 10.7% increase year-over-year. This growth was driven by a combination of factors, including an increase in orders from existing and new customers, as well as a slight increase in average order value.

EPS Beats Analyst Estimates:

Earnings per share (EPS) came in at $0.03, exceeding analyst estimates of $0.02. This represents a 50% beat and a significant improvement from the prior year’s EPS of $0.02. The company’s net income also increased by 51.98% year-over-year, reaching $6.3 million.

Operational Highlights:

In addition to the strong financial results, FIGS also reported several key operational metrics that highlight its progress. These include:

- An increase in active customers of 20% year-over-year, to approximately 1.4 million.

- An average order value of $100, which remained stable compared to the prior year.

- A gross margin of 58.7%, up from 57.4% in the prior year.

Forward Guidance:

For the fourth quarter of fiscal year 2023, FIGS expects revenue to be in the range of $138 million to $142 million. The company also expects EPS to be in the range of $0.00 to $0.01. While this guidance suggests that growth may moderate in the near term, FIGS remains optimistic about its long-term prospects.

The Market, Industry, and Competitors:

FIGS operates within the vast and dynamic healthcare apparel market, encompassing a wide range of clothing worn by medical professionals for patient care, research, and other healthcare settings. This market is expected to witness significant growth in the coming years, driven by several key factors:

- An aging population: As the global population ages, the demand for healthcare services is expected to rise, leading to an increased need for healthcare apparel.

- Rising disposable incomes: In many developing countries, rising disposable incomes are fueling consumer demand for higher-quality and more stylish healthcare apparel.

- Growing focus on hygiene and infection control: The increasing awareness of healthcare-associated infections (HAIs) is driving the demand for antimicrobial and other protective clothing.

- Technological advancements: Innovations in fabric technology are leading to the development of more comfortable, functional, and durable healthcare apparel.

The global healthcare apparel market will reach a value of USD 178.67 billion by 2030, growing at a CAGR of 8.1% during the forecast period. This presents a significant opportunity for FIGS to expand its market share and solidify its position as a leading brand.

FIGS itself is poised for continued growth, with analysts expecting its revenue to reach USD 1 billion by 2025. The company’s focus on premium quality, design-driven scrubs, and its strong connection with the healthcare community position it well to capitalize on the favorable market trends. Additionally, FIGS’ expansion into new product categories, such as non-scrubwear and accessories, could further fuel its growth.

Unique differentiation:

Navigating the Scrubscape: FIGS’ Key Competitors

While FIGS has carved a niche for itself in the healthcare apparel market, it faces competition from established players and innovative newcomers. Here’s a closer look at some of its key competitors:

Traditional Titans:

- Dickies Medical: A long-standing industry leader, Dickies offers a broad range of affordable, utilitarian scrubs favored by budget-conscious professionals.

- Grey’s Anatomy Scrubs: Inspired by the popular medical drama, this brand caters to a fashion-conscious crowd with trendy and comfortable scrubs at competitive prices.

Niche Newcomers:

- Jaanuu: Focused on sustainability and ethical practices, Jaanuu offers antimicrobial-finished scrubs made from recycled materials, resonating with eco-conscious healthcare workers.

- Medelita: Specializing in scrubs for women, Medelita prioritizes comfort and fit with a variety of styles and sizes tailored to the female body.

Beyond Scrubs:

- Rhone: Primarily known for men’s activewear, Rhone has expanded into the healthcare space with its Rhone Essentials line, offering premium, minimalist scrubs for a different aesthetic.

- Vuori: This activewear brand also features a small selection of comfortable and stylish scrubs, appealing to a broader audience seeking crossover functionality.

Each competitor brings unique strengths to the table, challenging FIGS in different ways. While Dickies and Grey’s Anatomy compete on price, Jaanuu and Medelita cater to specific ethical and fit preferences. Rhone and Vuori offer broader apparel options, potentially attracting customers seeking versatility.

FIGS has carved out a unique space in the healthcare apparel market by focusing on several key differentiators:

Premium Quality and Design:

- FIONx Fabric: FIGS’ proprietary fabric technology boasts features like comfort, stretch, moisture-wicking, and odor-resistance, setting it apart from standard scrubs.

- Stylish and Innovative Designs: FIGS offers a wider variety of styles and colors compared to many competitors, catering to different preferences and body types.

- Durability and Performance: The company emphasizes the longevity and functionality of its garments, ensuring they withstand the demands of healthcare environments.

Direct-to-Consumer Model:

- Building Relationships: By selling directly to customers, FIGS fosters closer relationships, gathers valuable feedback, and tailors its offerings accordingly.

- Competitive Pricing: Eliminating middlemen allows FIGS to offer premium products at competitive price points compared to traditional retailers.

- Control and Brand Identity: The direct-to-consumer model grants FIGS more control over its brand image and customer experience.

Community Connection:

- Healthcare-Focused Marketing: FIGS actively engages with healthcare professionals through social media, influencer partnerships, and events, building brand loyalty.

- Giving Back: The company supports healthcare initiatives and organizations, demonstrating its commitment to the community it serves.

- Customer-Centric Approach: FIGS prioritizes customer feedback and satisfaction, fostering a sense of community and belonging among its wearers.

Additional Differentiators:

- Ethical Sourcing: FIGS is committed to ethical and sustainable manufacturing practices, resonating with environmentally conscious consumers.

- Technological Innovation: The company invests in research and development to continuously improve its fabrics and designs.

- Expanding Product Range: FIGS has ventured beyond scrubs, offering non-scrubwear, accessories, and footwear, catering to a wider range of needs.

Management & Employees:

FIGS’ Management Team: Steering the Healthcare Apparel Revolution

FIGS boasts a leadership team with diverse backgrounds and expertise, dedicated to guiding the company’s continued growth and impact within the healthcare apparel industry. Here’s a brief overview of some key members:

Co-Founders and C-Suite:

- Trina Spear, CEO & Co-Founder: Spear previously worked at Bain & Company and co-founded FIGS in 2013. She drives the company’s overall vision and strategy.

- Heather Hasson, Executive Chairman & Co-Founder: Alongside Spear, Hasson also comes from a Bain & Company background. She plays a crucial role in strategic guidance and external partnerships.

- Daniella Turenshine, Chief Financial Officer: Turenshine joined FIGS in 2018 and has extensive experience in finance and strategy. She manages the company’s financial operations and growth planning.

- Steve Berube, Chief Operating Officer: Berube joined in 2023, bringing expertise in logistics and operations from Levi Strauss & Co. He oversees supply chain, inventory management, and customer experience functions.

Looking Ahead:

FIGS’ management team appears well-positioned to navigate the competitive healthcare apparel landscape. Their combined expertise and dedication to the company’s mission position them to further solidify FIGS’ market share and continue innovating to meet the evolving needs of healthcare professionals.

Financials:

FIGS: Charting Financial Growth over 5 Years (2019-2023)

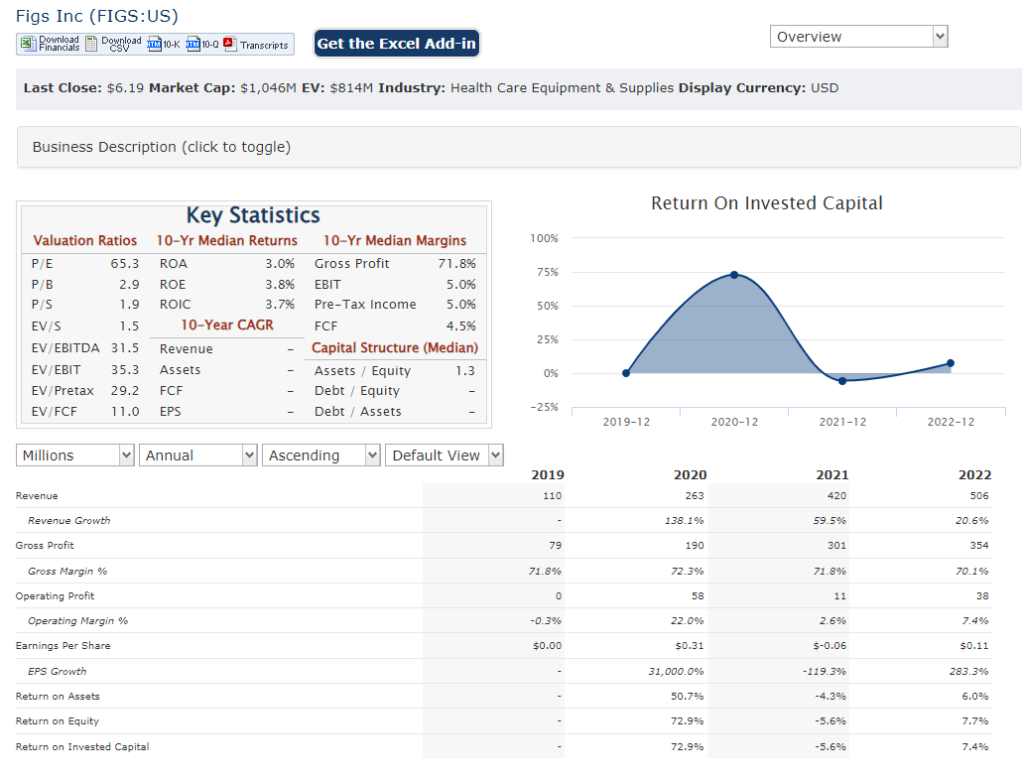

FIGS has experienced impressive financial growth throughout the past five years, solidifying its position in the healthcare apparel market. Here’s a breakdown of their key financial metrics:

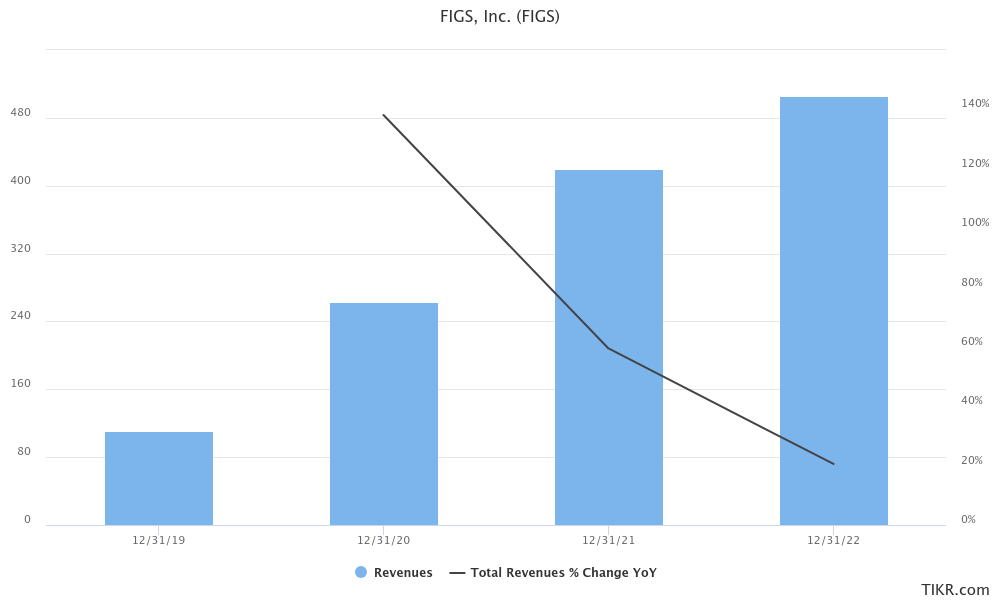

Revenue:

- 2019: $262.7 million

- 2020: $349.6 million (33.2% CAGR)

- 2021: $401.4 million (14.6% CAGR)

- 2022: $505.8 million (25.9% CAGR)

- 2023 (expected): $545.6 million (11.4% CAGR)

As evident, FIGS has enjoyed consistent revenue growth, with an impressive average CAGR of 19.1% over the five-year period. This reflects the increasing demand for their premium scrubs and apparel, coupled with their successful direct-to-consumer model.

Earnings:

- 2019: $0.06 EPS

- 2020: $0.14 EPS (133.3% CAGR)

- 2021: $0.13 EPS (-7.1% CAGR)

- 2022: $0.05 EPS (-61.5% CAGR)

- 2023 (expected): $0.04 EPS (-20.0% CAGR)

While experiencing significant growth in 2020, FIGS’ earnings have fluctuated in recent years due to increased investments in marketing and expansion. Despite this, they remain positive and exhibit a five-year average CAGR of 4.0%.

Balance Sheet:

FIGS boasts a strong and healthy balance sheet. They hold a significant amount of cash and equivalents, enabling further investments in growth initiatives. The company also maintains moderate debt levels, mitigating financial risks.

Technical Analysis:

Long term (monthly) the stock is still forming a base in the $5 to $7 range, with no significant catalysts in the near term to help move out of the range. In the daily chart, the moving averages are all pointing down, indicating it is better to avoid the stock for now. Poor RSI (Relative Strength) and MACD divergence also indicates that we should be cautious on the stock.

Bull Case:

Strong Market Tailwinds:

- Growing healthcare apparel market: The global healthcare apparel market is expected to reach $178.67 billion by 2030, driven by aging demographics, rising disposable incomes, and hygiene concerns.

- Shifting preferences: Demand for premium, stylish, and comfortable healthcare apparel is increasing, aligning with FIGS’ offerings.

- Direct-to-consumer model: This allows FIGS to control brand identity, build strong customer relationships, and potentially offer competitive pricing.

Solid Financial Performance:

- Consistent revenue growth: FIGS has experienced impressive revenue growth over the past five years, with an average CAGR of 19.1%.

- Positive earnings potential: While earnings have fluctuated, FIGS remains profitable and shows long-term earnings growth potential.

- Strong balance sheet: With significant cash reserves and moderate debt, FIGS has financial flexibility for future investments.

Competitive Advantages:

- Premium quality and design: FIGS’ proprietary fabric and stylish designs differentiate them from competitors.

- Brand loyalty and community: FIGS actively engages with healthcare professionals, fostering brand loyalty and a sense of community.

- Innovation and expansion: FIGS invests in research and development and expands its product range, catering to diverse needs.

Bear case:

Intense Competition:

- The healthcare apparel market is crowded with established players like Dickies Medical and Grey’s Anatomy Scrubs, as well as smaller, niche brands like Jaanuu and Medelita. These competitors offer a variety of price points, styles, and features, making it difficult for FIGS to stand out.

- Additionally, broader apparel brands like Rhone and Vuori are entering the healthcare space with their own lines of scrubs, potentially capturing market share from FIGS.

Limited Product Diversification:

- While FIGS has expanded beyond scrubs into non-scrubwear and accessories, they are still heavily reliant on scrubs for revenue. This lack of diversification could leave them vulnerable to changes in consumer preferences or market conditions.