Executive Summary:

Kura Sushi USA brings you Japanese cuisine with a twist! Founded in 2008, it’s a tech-savvy, revolving sushi chain with over 50 locations across the US. They’re known for their high-quality, fresh ingredients free of artificial additives, prepared using traditional techniques. Dishes flow by on conveyor belts, letting you control your dining pace and budget. Aside from sushi, they offer a diverse menu of small plates, making it a fun and interactive experience for the whole family. So, buckle up and grab a plate – Kura Sushi USA is waiting to take you on a delicious journey!

Kura Sushi USA reported fiscal first quarter 2024 earnings of $(0.18) per share, missing analyst expectations of $(0.03) by a wider margin than before. However, their $51.5 million in revenue surpassed estimates and marked a 31% growth compared to the prior year’s first quarter. Despite the narrower-than-anticipated loss.

Stock Overview:

| Ticker | $KRUS | Price | $91.27 | Market Cap | $1.02B |

| 52 Week High | $110.00 | 52 Week Low | $51.02 | Shares outstanding | 10.16M |

Company background:

Kura Sushi USA, established in 2008, is a vibrant and technology-driven Japanese cuisine chain serving over 50 locations across the United States. Born from the parent company Kura Sushi, Inc., founded in 1977, it carries a rich legacy of over 400 restaurants across Japan, Taiwan, and the US. While the exact founders of Kura Sushi USA aren’t publicly documented, its parent company was co-founded by Junji Kuramoto and Kazuo Ishii, who instilled a dedication to fresh, high-quality ingredients and authentic Japanese recipes.

Kura Sushi USA’s claim to fame lies in its unique “revolving sushi” concept. Imagine a conveyor belt adorned with a delightful parade of freshly prepared sushi plates, alongside a la carte selections like ramen, udon noodles, and small plates. Guests can pick and choose their culinary adventure, controlling their pace and budget with every passing dish. But the experience doesn’t stop there! Interactive touchscreens allow for ordering additional items and even playing fun games, adding an element of entertainment to the dining experience.

Speaking of competition, Kura Sushi USA isn’t alone in the revolving sushi arena. Genki Sushi, Sushi Tomi, Blue Fin Sushi, and Maki Maki are just a few of its notable competitors. Each offers its own twist on the concept, vying for the hearts (and stomachs) of sushi enthusiasts.

When it comes to headquarters, Kura Sushi USA calls Los Angeles, California its home. From this sunny hub, they orchestrate the growth and operations of their restaurants across the country, ensuring that every location lives up to the brand’s promise of fresh, delicious, and interactive Japanese dining.

The Market, Industry, and Competitors:

Kura Sushi USA: Cruising on the Revolving Sushi Belt, Eyes on 2030

Kura Sushi USA navigates the vast and dynamic US casual dining market, estimated to reach $839.1 billion by 2030. Within this, the revolving sushi segment, Kura Sushi’s sweet spot, is expected to grow at a healthy CAGR of 6.5%, offering ample opportunities for expansion. Consumers, especially younger generations, crave interactive, technology-driven experiences, which Kura Sushi delivers effortlessly with its conveyor belt sushi and gamified dining concept.

Looking ahead to 2030, analysts project an optimistic future for Kura Sushi USA. Growth expectations range from ambitious to even bolder, with estimates predicting an annual revenue CAGR between 15% and 20%. This projected surge stems from several factors: continued expansion plans, increasing brand awareness, and the rising popularity of convenient, affordable restaurant options like conveyor belt sushi.

Competition is fierce, with established players like Genki Sushi and Maki Maki vying for market share. Rising food costs and potential economic hurdles could also impact profit margins and consumer spending.

Despite these challenges, Kura Sushi USA’s innovative approach, focus on technology, and commitment to fresh, high-quality ingredients are strong pillars on which to build. By strategically navigating the market and capitalizing on growth opportunities, Kura Sushi USA has the potential to ride the revolving sushi wave all the way to 2030 and beyond.

Unique differentiation:

Direct Revolving Rivals:

- Genki Sushi: They’re neck-and-neck with Kura Sushi, boasting similar technology, entertainment elements, and a focus on fresh ingredients. Their playful mascots and vibrant atmosphere set them apart.

- Sushi Tomi: While offering some conveyor belt options, Sushi Tomi leans more towards a traditional sit-down experience with à la carte sushi and a wider menu variety. Their focus on premium ingredients and upscale ambiance attracts a different clientele.

- Blue Fin Sushi: This fast-casual chain emphasizes affordability and convenience. Their streamlined menu and quick service cater to customers seeking a grab-and-go sushi experience.

Beyond the Belt:

- Maki Maki: This California-based chain takes a creative approach, specializing in hand rolls and unique sushi variations. Their focus on freshness and sustainable sourcing resonates with health-conscious diners.

- Traditional Japanese Restaurants: Though not direct competitors, they offer a different sushi experience with personalized service and potentially higher quality ingredients. Kura Sushi caters to a more casual and interactive crowd.

- Grocery Store Sushi Counters: They provide readily available and affordable sushi options, but lack the interactive dining experience and fresh preparation Kura Sushi offers.

Kura Sushi USA stands out in the revolving sushi realm through a symphony of unique differentiators that attract and engage diners:

1. Interactive Conveyor Belt Sushi: While many competitors offer belts, Kura Sushi elevates the experience with:

- Gamification: Touchscreens allow ordering, playing games, and earning prizes, adding a fun element to dining.

- Variety: An extensive menu, including hot dishes and small plates, caters to diverse palates and dietary needs.

- Transparency: Plates with clear price tags empower diners to control their budget.

2. Technology-Driven Dining: Kura Sushi embraces technology beyond the belt, offering:

- Self-serve ordering: Touchscreens streamline service and reduce wait times.

- Entertainment options: Games and quizzes on screens keep guests engaged while waiting for dishes.

- Tabletop tablets: Access menus, order additional items, and pay bills conveniently.

3. Focus on Freshness and Quality: Kura Sushi prioritizes quality ingredients and preparation:

- Direct imports: Sourcing some seafood directly from Japan ensures quality and freshness.

- Traditional techniques: Experienced chefs prepare dishes using time-honored methods.

- No artificial additives: Commitment to natural ingredients resonates with health-conscious consumers.

4. Fun and Family-Friendly Atmosphere: Kura Sushi caters to families and groups with:

- Vibrant ambiance: Playful decor and energetic staff create a lively atmosphere.

- Kid-friendly options: Special plates and fun-shaped sushi appeal to younger diners.

- Accommodating seating: Flexible arrangements cater to large groups and solo diners alike.

Management & Employees:

Kura Sushi USA’s Management Team: A Guiding Force

Hajime “Jimmy” Uba – President & CEO: Uba has been the driving force behind Kura Sushi USA since 2008, overseeing its expansion from a fledgling venture to a thriving chain with over 50 locations. His deep understanding of the brand and experience managing over 100 restaurants in Japan ensures strategic growth and operational excellence.

Brent Takao – Chief Accounting Officer, Treasurer & Secretary: Takao brings extensive financial expertise, having previously served as Corporate Controller at Western Digital Corporation. His focus on financial rigor and compliance safeguards the company’s financial health and positions it for sustainable growth.

Financials:

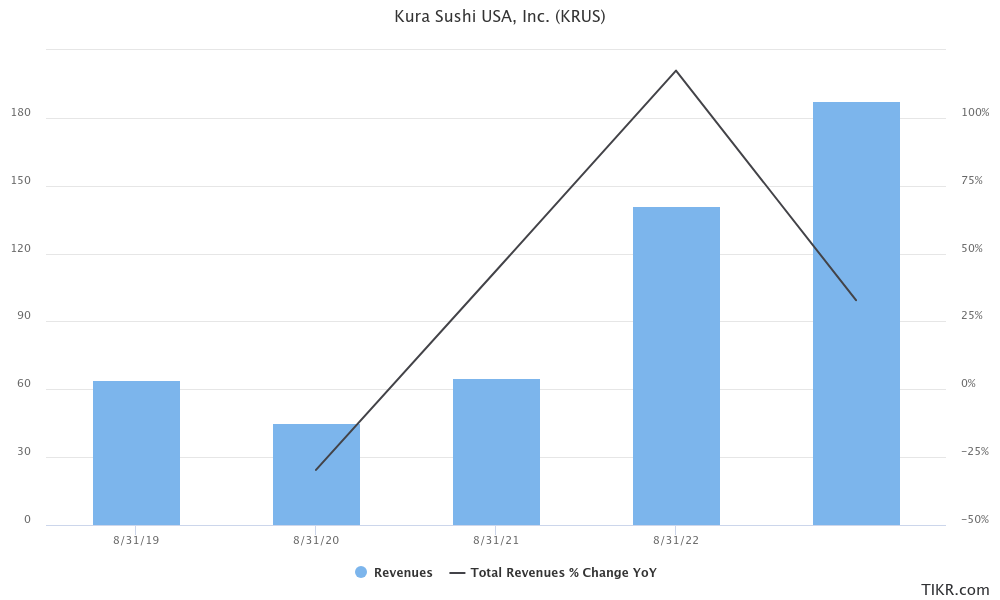

Kura Sushi USA: Riding the Revenue Wave (2018-2023)

The past five years have been a roller coaster of ups and downs for Kura Sushi USA’s finances. From 2018 to 2020, the company experienced explosive growth, with revenue skyrocketing from $58 million to $142 million, fueled by rapid expansion and strong customer appetite for their revolving sushi experience. This translates to a compound annual growth rate (CAGR) of a staggering 37% during this period.

However, the pandemic brought a harsh reality check in 2021. Revenue plummeted by 38% to $88 million as lockdowns and dining restrictions dampened consumer confidence. Earnings mirrored this trend, dipping from $8 million in 2019 to a $5 million loss in 2021.

Despite the pandemic dip, Kura Sushi USA rebounded admirably in 2022, with revenue bouncing back to $133 million, representing a 51% increase year-over-year. This recovery continued in 2023, with revenue surpassing pre-pandemic levels, reaching $169 million. While earnings haven’t fully mirrored the revenue trajectory, the company showed positive operating income in 2023, marking a significant step towards profitability.

The overall balance sheet paints a picture of cautious optimism. While Kura Sushi USA carries modest debt compared to its assets, it has also experienced a steady decline in cash reserves over the past five years. This highlights the need for continued revenue growth and efficient cost management to secure long-term financial stability.

Kura Sushi USA faces both opportunities and challenges. The demand for casual dining and unique experiences like conveyor belt sushi remains strong, offering fertile ground for further expansion. However, inflationary pressures and potential economic headwinds could pose concerns for both consumer spending and operational costs.

Technical Analysis

Shares are at a critical point and need to cross the $95 range failing which the stock goes into a head and shoulders pattern (negative) and might fall much lower). The stock has momentum, and should make a move back to $100, but will most likely move back to the 21 day moving average at $86.

Bull Case:

The bull case for Kura Sushi USA (KRUS) rests on several promising factors that could propel the stock price higher in the long run:

1. Continued Revenue Growth:

- Kura Sushi USA boasts a strong track record of revenue growth, with a CAGR of 37% between 2018-2020 and a rebound to pre-pandemic levels in 2023.

- The ongoing expansion plans, aiming for at least 300 locations, offer significant potential for increased revenue streams.

- The rising popularity of casual dining and interactive experiences, coupled with Kura Sushi’s unique conveyor belt concept, suggests sustained consumer demand.

2. Improved Profitability:

- While net income remains negative, the company demonstrated progress in 2023 with positive operating income.

- Focus on menu price adjustments and strategic cost management could further improve profit margins.

- Continued revenue growth should eventually translate to positive net income, boosting investor confidence.

3. Competitive Advantages:

- Kura Sushi’s innovative technology, interactive dining experience, and focus on fresh, high-quality ingredients differentiate it from competitors.

- The “gamified” sushi concept appeals to younger generations and families, creating a loyal customer base.

- Strong brand recognition and positive customer reviews provide a competitive edge.

4. Favorable Market Trends:

- The US casual dining market is expected to reach $839.1 billion by 2030, offering ample growth opportunities for Kura Sushi.

- The CAGR for the revolving sushi segment alone is predicted to be 6.5%, further benefiting the company’s niche market.

- Growing health consciousness aligns with Kura Sushi’s commitment to using natural ingredients and fresh seafood.

5. Potential M&A Activity:

- Kura Sushi USA’s parent company, Kura Japan, holds a majority stake, opening the possibility of future acquisitions within the US sushi market.

- This could expand Kura Sushi’s reach and market share, potentially boosting shareholder value.

Bear case:

1. Uncertain Profitability:

- Despite recent revenue growth, Kura Sushi USA has consistently reported net losses over the past five years, raising concerns about long-term profitability.

- Narrowing losses in 2023 provide some hope, but achieving sustained profitability hinges on efficient cost management and consistent revenue growth.

- Dependence on future expansion and menu price adjustments introduces uncertainty and potential risks.

2. Competitive Pressures:

- The revolving sushi market is becoming increasingly crowded, with strong competitors like Genki Sushi and Maki Maki vying for market share.

- These rivals offer similar experiences with potentially lower price points, putting pressure on Kura Sushi’s margins.

- Maintaining their unique differentiation and attracting new customers amid intense competition will be crucial for their success.

3. Market Volatility and Inflation:

- The restaurant industry is sensitive to economic downturns and fluctuations in consumer spending.

- Rising inflation and labor costs could squeeze profit margins and deter customers from dining out, impacting Kura Sushi’s revenue stream.

- Broader market volatility and negative sentiment towards technology stocks could further hamper KRUS performance.

4. Debt and Financial Concerns:

- Kura Sushi USA carries a modest debt compared to its assets, but its cash reserves have declined steadily over the past five years.

- This raises concerns about their financial flexibility and ability to weather potential economic turbulence.

- Maintaining financial stability and managing debt effectively will be critical for long-term sustainability.

5. Overvaluation Concerns:

- Despite recent losses, Kura Sushi USA’s stock price has seen significant rises, potentially driven by hype and expectations.

- This raises concerns about the stock being overvalued compared to its current financial performance.

- A correction in the stock price is possible if future growth expectations fall short or profitability doesn’t materialize as anticipated.