Executive Summary:

BigCommerce Holdings, $BIGC offers an open Software-as-a-Service (SaaS) platform for building and managing online eCommerce stores. Their services cater to businesses of all sizes, from small startups to established enterprises, across various industries. BigCommerce has sophisticated features and performance, while maintaining ease of use and customization. Renowned brands like Ben & Jerry’s and Vodafone use BigCommerce to power their online storefronts, and the company boasts a global presence with offices in Austin, London, Kyiv, San Francisco, and Sydney.

BigCommerce’s most recent earnings were for the third quarter of 2023, reported on November 8th. While revenue grew 8% year-over-year to $78.0 million, slightly missing analyst expectations of $78.3 million, their performance on the bottom line surprised positively. They posted a non-GAAP net income of $686 thousand, or 1% of revenue, compared to a $11.2 million loss in Q3 2022, exceeding analyst expectations of a $13.4 million loss. This marked a significant improvement and signaled potential progress towards profitability. The earnings report was well-received by investors, pushing the stock price up over 8% that day.

Stock Overview:

| Ticker | $BIGC | Price | $8.48 | Market Cap | $645.24M |

| 52 Week High | $13.39 | 52 Week Low | $6.81 | Shares outstanding | 76.09M |

Company background:

Rising Star in E-commerce

BigCommerce Holdings, Inc. is a leading provider of open SaaS (Software-as-a-Service) ecommerce platforms, empowering businesses of all sizes to build, innovate, and grow their online stores. Founded in 2009 by Brent Eller, Eddie Machaalani, and Evan Cherkezian, the company has attracted over $324.4 million in funding and boasts a global presence with headquarters in Austin, Texas, and additional offices in London, Kyiv, San Francisco, and Sydney.

Products and Services

BigCommerce’s core offering is its namesake platform, a comprehensive ecommerce solution that provides everything businesses need to launch and manage their online stores. This includes features like product management, order processing, marketing tools, SEO optimization, and robust security. The platform is known for its ease of use, scalability, and flexibility, allowing businesses to customize their online storefronts to perfectly match their brand and customer needs.

Beyond the core platform, BigCommerce offers a variety of additional products and services to cater to the diverse needs of its merchants. These include:

- BigCommerce Marketplace: An app store with thousands of third-party integrations for expanding store functionality and features.

- BigCommerce Enterprise: A tailored solution for high-volume businesses with advanced features and dedicated support.

- BigCommerce Payments: A payment processing solution that simplifies accepting payments online.

- BigCommerce Shipping: A shipping management solution that helps businesses streamline their fulfillment process.

Competitive Landscape

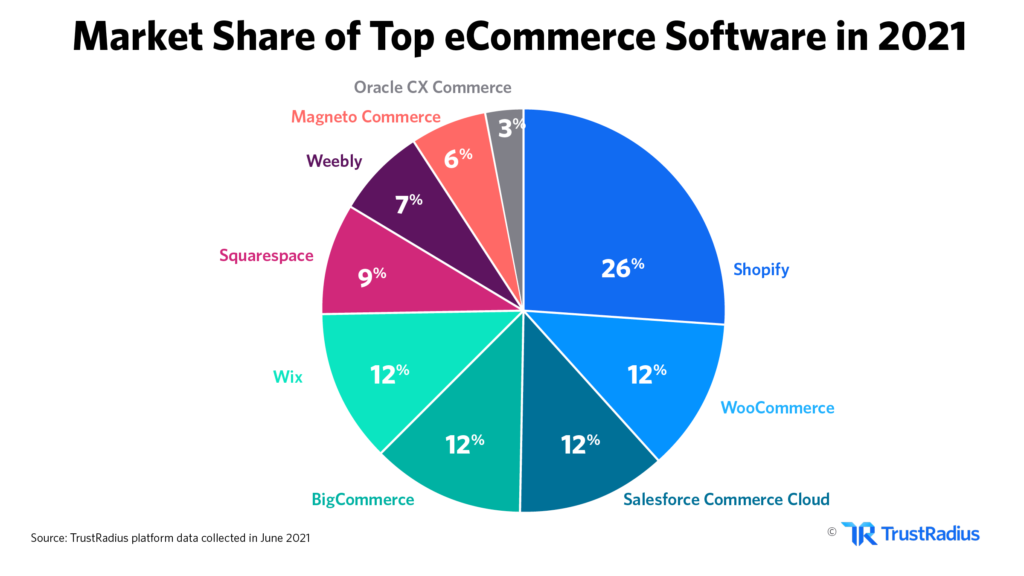

BigCommerce operates in a highly competitive market, with major players like Shopify, Magento, and WooCommerce vying for market share. However, BigCommerce differentiates itself through its focus on:

- Ease of use: The platform is designed to be user-friendly, even for those with no technical experience.

- Openness and flexibility: BigCommerce offers an open API and a wide range of third-party integrations, allowing businesses to customize their stores to meet their specific needs.

- Scalability: The platform can accommodate businesses of all sizes, from small startups to large enterprises.

With the e-commerce market expected to continue its strong growth trajectory, BigCommerce is well-positioned to capitalize on this trend. The company’s focus on ease of use, flexibility, and scalability makes its platform a compelling choice for businesses of all sizes looking to establish or expand their online presence. With continued innovation and strategic partnerships, BigCommerce is poised to be a major player in the e-commerce landscape for years to come.

Recent Earnings:

BigCommerce’s Q3 2023 Earnings: Mixed Results with Signs of Progress

BigCommerce’s most recent earnings report for Q3 2023, released on November 8th, 2023, presented a mixed picture. While the company met or exceeded expectations in certain areas, others fell short.

Revenue and Growth: Total revenue reached $78.0 million, representing an 8% year-over-year increase, slightly missing analyst estimates of $78.3 million. This marks a steady pace of growth but suggests some room for improvement in top-line performance.

Earnings per Share (EPS) and Growth: Non-GAAP EPS was a bright spot, coming in at $0.01. This translates to a non-GAAP net income of $686 thousand, a significant improvement from the $11.2 million loss in Q3 2022. This exceeded analyst expectations of a $13.4 million loss and signaled potential progress towards profitability.

Analyst Expectations: Overall, the earnings report yielded a mixed reaction from analysts. While the revenue miss was a slight disappointment, the positive surprise on EPS and the continued focus on cost management were viewed favorably.

Operational Metrics: Looking beyond financials, some key operational metrics were encouraging. Total annual revenue run-rate (ARR) climbed 9% year-over-year to $332.2 million, suggesting a healthy backlog of future revenue. Additionally, ARR from Enterprise Accounts grew 11% year-over-year, showcasing continued traction in the higher-value segment.

Forward Guidance: Management provided cautious guidance for Q4 2023, suggesting revenue in the range of $77 million to $78 million. This indicates a continued focus on profitability rather than aggressive top-line growth.

BigCommerce’s Q3 2023 earnings offered a mixed bag. While revenue growth remained steady, the beat on EPS and continued progress towards profitability were encouraging. The cautious guidance for Q4 reflects a focus on long-term stability and cost optimization.

The Market, Industry, and Competitors:

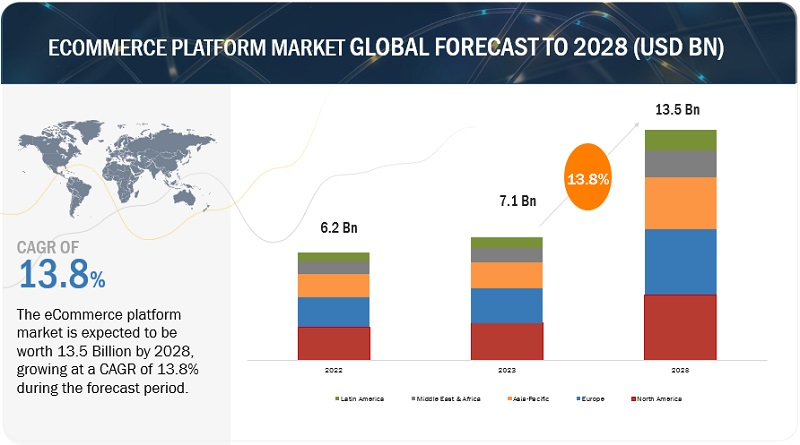

BigCommerce operates in the booming global e-commerce market, which is expected to reach a staggering $8 trillion by 2030, fueled by increasing internet penetration, mobile payments, and changing consumer preferences. This translates to a compound annual growth rate (CAGR) of over 14% through the decade, offering immense potential for BigCommerce.

The e-commerce space is further segmented into B2C (business-to-consumer) and B2B (business-to-business) domains. While B2C dominates the current landscape, B2B e-commerce is projected to witness an even faster CAGR of around 17%, due to factors like digitalization of supply chains and increasing B2B marketplace adoption. BigCommerce caters to both segments, positioning itself to capture growth across the board.

Analysts foresee BigCommerce benefitting significantly from this explosive market expansion. Factors like their user-friendly platform, focus on enterprise-level solutions, and strong partnerships with payment gateways and tech giants like Google and Amazon are expected to propel their growth. While competition from established players like Shopify and Magento remains fierce, BigCommerce’s unique offerings and aggressive growth plans promise continued success in the years to come.

BigCommerce operates in a rapidly growing market with strong tailwinds from changing consumer behavior and technological advancements. With a focus on scalability, flexibility, and strategic partnerships, BigCommerce is well-positioned to ride the e-commerce wave and contribute to the sector’s projected CAGR of over 14% by 2030.

Unique differentiation:

BigCommerce: Navigating a Crowded E-commerce Arena

BigCommerce may be a rising star, but the e-commerce platform landscape is teeming with rivals vying for market share. Here’s a glimpse into some major competitors:

Shopify: The reigning king of the e-commerce world, Shopify boasts a user-friendly platform, extensive app marketplace, and robust marketing tools. While BigCommerce focuses on scalability and flexibility, Shopify excels in ease of use and brand building, making it a popular choice for startups and small businesses.

Magento (now Adobe Commerce): A behemoth with enterprise-grade features and customization options, Magento (now Adobe Commerce) caters to high-volume businesses and complex needs. While powerful, its complexity can be daunting for less tech-savvy users, giving BigCommerce an edge in ease of use for mid-sized companies.

WooCommerce: This free, open-source plugin for WordPress powers over 40% of online stores globally. Its affordability and integration with the vast WordPress ecosystem make it a favorite for tech-savvy businesses. However, its lack of built-in features and reliance on third-party integrations can create scalability challenges, an area where BigCommerce shines.

Emerging Players: Beyond the established players, a new wave of innovative companies like VTEX and Scalefast are shaking things up. VTEX offers powerful headless commerce solutions, while Scalefast provides all-in-one DTC (direct-to-consumer) platform solutions. These new contenders add further complexity to the competitive landscape, pushing BigCommerce to constantly innovate and refine its offerings.

BigCommerce faces a diverse and dynamic competitive landscape. Its success hinges on balancing user-friendliness and scalability, while leveraging its strengths in open APIs, flexibility, and enterprise-level solutions.

Openness and flexibility: BigCommerce boasts an open API and a vast app marketplace, offering merchants unparalleled flexibility to customize their stores and integrate with the tools they need. This contrasts with some competitors like Shopify, where customization options can be more limited.

2. Focus on mid-sized businesses: BigCommerce strikes a balance between Shopify’s ease of use for startups and Magento’s robust features for large enterprises. It caters to the growing segment of mid-sized businesses looking for a platform that is both powerful and scalable.

3. Emphasis on headless commerce: BigCommerce offers strong headless commerce capabilities, separating the front-end user experience from the back-end data management. This gives developers greater control over creating unique and engaging online stores, particularly for B2B and enterprise-level businesses.

4. Strong developer community: BigCommerce fosters a vibrant developer community with extensive documentation, tutorials, and support resources. This empowers developers to build custom functionality and extensions, further enhancing the platform’s flexibility and appeal.

5. Commitment to innovation: BigCommerce actively invests in research and development, constantly bringing new features and functionalities to the platform. This focus on keeping ahead of the curve helps attract and retain merchants in a rapidly evolving market.

6. Value proposition: While cost isn’t the only factor, BigCommerce offers competitive pricing compared to some of its rivals, particularly for high-volume merchants. This combined with its strong feature set and open platform makes it a compelling value proposition for many businesses.

Management & Employees:

BigCommerce Holdings Management Team:

- Brent Bellm, Chief Executive Officer: A retail and e-commerce veteran with 20+ years of experience, Brent has steered BigCommerce towards significant growth and profitability. His previous roles at HomeAway and PayPal showcase his expertise in scaling digital businesses.

- Daniel Lentz, Chief Financial Officer: Daniel brings over two decades of finance and operational leadership from industry giants like Dell, Procter & Gamble, and RetailMeNot. He plays a crucial role in optimizing BigCommerce’s financial performance and driving strategic investments.

- Steven Chung, President: Steven oversees BigCommerce’s Sales, Marketing, and Services organizations, spearheading customer acquisition, engagement, and success. His extensive experience in technology and B2B sales strengthens BigCommerce’s market reach.

Financials:

Strong Financial Outlook

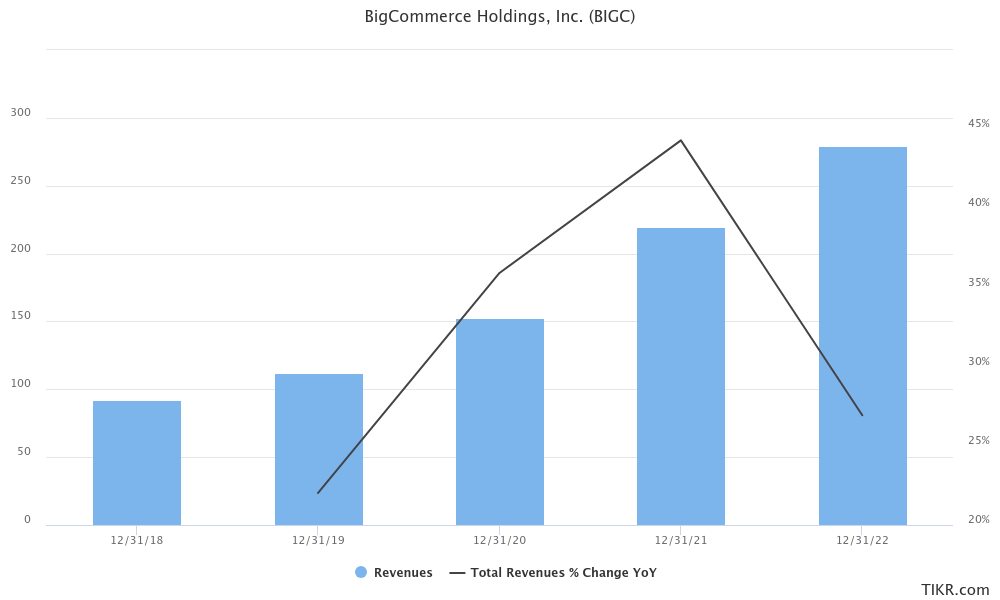

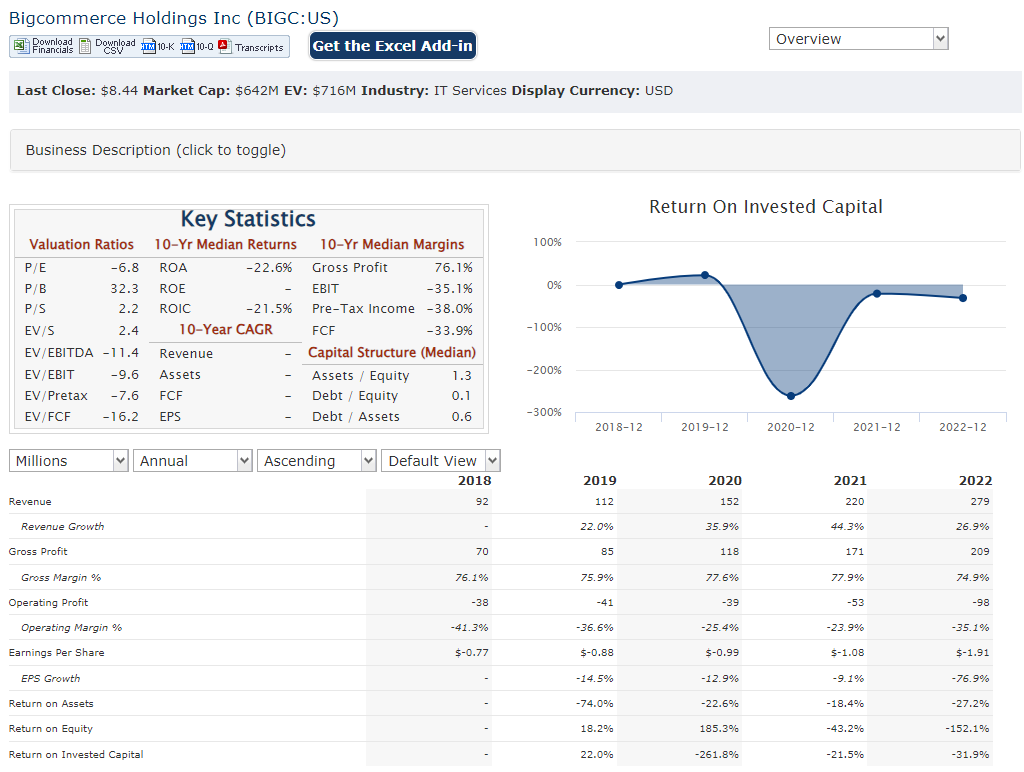

BigCommerce has enjoyed a period of consistent and impressive financial growth over the past five years (2019-2023). Revenue has been on a steady upward trajectory, climbing from $84.6 million in 2019 to $219.9 million in 2021, marking a Compound Annual Growth Rate (CAGR) of 44%. This momentum continued in 2022, with revenue reaching $268.7 million, representing a 22% year-over-year increase. While 2023’s full-year results are not yet available, the company’s most recent Q3 report showed stable revenue growth of 8% compared to the same period in 2022.

Earnings have also kept pace with revenue, although not with the same consistent strength. The company transitioned from a net loss of $48.5 million in 2019 to a net income of $3.2 million in 2021, reflecting a remarkable turnaround. However, 2022 saw a dip back into the red with a net loss of $14.1 million, primarily due to increased investments in growth initiatives. Nonetheless, the overall trend suggests BigCommerce is steadily progressing towards profitability, with a five-year CAGR for earnings of -18%.

The balance sheet paints a picture of solid financial health. Cash and equivalents at the end of 2022 stood at $321.4 million, providing a strong financial cushion for future investments and potential acquisitions. Long-term debt remains minimal, further bolstering the company’s financial stability.

Technical Analysis:

The stock has been range bound between $7 to $13 in the weekly and is still building a base. However on the daily chart, it is a much tighter range between $8 and $10. It needs a strong earnings catalyst to push it over $10.

Bull Case:

The bull case for BigCommerce Holdings stock rests on several strong pillars:

1. Powerful tailwinds in the e-commerce market: The global e-commerce market is expected to reach a staggering $8 trillion by 2030, with a CAGR of over 14%. This explosive growth creates a vast opportunity for e-commerce platform providers like BigCommerce.

2. Strong product-market fit and unique differentiators: BigCommerce’s open API, focus on mid-sized businesses, headless commerce capabilities, and developer-friendly platform provide substantial advantages over competitors like Shopify and Magento. This allows for greater customization, scalability, and integration with third-party tools, appealing to diverse merchant needs.

3. Progress towards profitability: While BigCommerce is not yet consistently profitable, it has made significant strides in recent years. The company has shown positive EPS in several quarters, including Q3 2023, and continues to optimize its operational expenses. This progress towards profitability could unlock significant stock price appreciation.

4. Strategic acquisitions and partnerships: BigCommerce’s acquisition of Feedonomics strengthens its product data management capabilities and expands its offerings for larger merchants. Additionally, partnerships with payment gateways like PayPal and tech giants like Google and Amazon add value and attract new customers.

5. Undervalued compared to peers: Some analysts argue that BigCommerce is currently undervalued compared to its competitors, with a lower price-to-sales (P/S) ratio. This presents a potential opportunity for investors seeking undervalued growth stocks in the booming e-commerce sector.

Bear case:

The bear case for BigCommerce Holdings paints a more cautious picture of the company’s future, highlighting potential challenges that could dampen its growth and stock price:

1. Intense competition: BigCommerce operates in a crowded e-commerce platform market, facing established players like Shopify and Magento, as well as rising challengers like VTEX and Scalefast. Maintaining its market share and attracting new customers in this competitive landscape will be crucial to its success.

2. Uncertain path to profitability: While BigCommerce has made progress towards profitability, it is not yet consistently profitable and remains susceptible to fluctuations in revenue and expenses. Additionally, its focus on investing in growth may further delay the timeline for consistent profitability, dampening investor sentiment.

3. Challenges scaling the platform: While BigCommerce caters to mid-sized businesses, scaling its platform effectively to serve larger enterprise clients with complex needs may pose challenges. This could limit its potential market reach and revenue growth.

4. Overvaluation concerns: Some analysts argue that BigCommerce’s current stock price may be inflated compared to its peers, particularly if its growth slows or profitability remains elusive. This potential overvaluation could lead to a correction in the stock price, impacting investors.

Think you should spend time looking at the balance sheet and CB and credit. Calculate the NAV of the company with negative margins and shrinking customer base. How is headless a MOAT exactly in commoditized space? Why doesn’t c-suite buy stock instead of selling RSUs quarterly since IPO. Has any sell side analyst correctly call the correction since the IPO? Asking for a friend

Good point Joe. I am not a fan of the stock. It has lousy growth, poor net margins and limited potential in a fairly competitive space.

PYPL will acquire by end of year $18-$22… almost same exact story as cldr in 2018-2019