Executive Summary:

Applied Optoelectronics Inc. (AOI) NASDAQ: AAOI is a leading designer and manufacturer of fiber optic networking products. They primarily serve the cable television broadband, fiber-to-the-home, and internet data center markets. AOI excels at creating a diverse range of optical communication products, their process beginning with the meticulous development of lasers and laser components. These foundational elements are crafted to facilitate various levels of integration, allowing AOI to construct everything from individual components and subassemblies to complete turn-key equipment.

- AOI is a publicly traded company on the NASDAQ exchange under the ticker symbol AAOI

- They are headquartered in Sugar Land, Texas, and have manufacturing facilities in Taiwan and China.

- AOI has over 2,000 employees worldwide.

- They are a leading supplier of optical transceivers and RF equipment solutions.

Applied Optoelectronics’ most recent earnings were for the third quarter of 2023, announced on November 9th. They reported revenue of $62.5 million, representing a 10% increase compared to the same quarter in 2022 and a 25% jump from the second quarter of 2023. This surpassed analyst expectations of $59.2 million. However, the company still posted a net loss of $9.0 million, or $0.27 per share, which remained wider than the predicted $0.24 loss per share.

Stock Overview:

| Ticker | $AAOI | Price | $16.40 | Market Cap | $582.8M |

| 52 Week High | $24.08 | 52 Week Low | $1.60 | Shares outstanding | $35.54M |

Applied Optoelectronics: Weaving the Future of Fiber Optics

A Pioneering Vision: Applied Optoelectronics Inc. (AOI) is a name synonymous with innovation in the field of fiber optic networking. Founded in 1999 by Dr. Yi-Qun Li and Dr. Xiao-Wei Li, two visionary minds with a deep understanding of lasers and their potential, AOI has carved its niche as a leading designer and manufacturer of fiber optic components and equipment. Headquartered in Sugar Land, Texas, the company operates with a global footprint, employing over 2,000 individuals across facilities in Taiwan and China.

Building the Building Blocks: AOI’s strength lies in its meticulous focus on the core – lasers and their components. By mastering the art of creating these foundational elements, the company empowers itself to craft a diverse range of optical communication solutions. From individual components like transceivers and modules to subassemblies and complete turn-key equipment, AOI caters to the ever-growing needs of the data-hungry world.

Products Powering Progress: The tapestry woven by AOI’s products stretches across various applications. Cable television broadband, fiber-to-the-home (FTTH) networks, and the lifeblood of the digital age – internet data centers – all rely on AOI’s solutions to transmit data at breakneck speeds and phenomenal bandwidths. Their optical transceivers, the workhorses of data transmission, are a testament to their dedication to quality and performance.

Facing the Giants: The road to fiber optic supremacy is paved with competition. Tech giants like Acacia Communications, Finisar Corporation, Lumentum Holdings Inc., Mellanox Technologies Ltd., and Oclaro Inc. are all vying for a slice of the pie. However, AOI’s commitment to innovation and its vertically integrated manufacturing process, allowing for greater control over quality and cost, set it apart in this high-stakes game.

A Future Illuminated: As the demand for faster, more reliable data transmission continues to surge, AOI stands poised to capitalize on its expertise. With a relentless focus on research and development, the company is constantly pushing the boundaries of what’s possible in the realm of fiber optics. Whether it’s exploring next-generation laser technologies or delving into the world of silicon photonics, AOI is weaving the future of a hyper-connected world, one fiber at a time.

Recent Earnings:

Applied Optoelectronics: Q3 2023 Earnings Shine a Light on Growth, But Profitability Remains Elusive

Revenue on the Rise: Applied Optoelectronics’ third quarter of 2023 was marked by positive revenue growth, a welcome sign amidst continued profitability challenges. The company reported $62.5 million in revenue, a 10% increase compared to the same quarter in 2022 and a 25% jump from Q2 2023. This surpassed analyst expectations of $59.2 million, indicating strong operational performance despite broader market uncertainties.

EPS: Improvement, but Still in Negative Territory: Despite encouraging revenue growth, AOI’s bottom line remained in the red. The company posted a net loss of $9.0 million, or $0.27 per share. While this represents a narrowing of the loss compared to previous quarters, it still fell short of the predicted $0.24 loss per share from analysts.

Operational Metrics Suggest Momentum: Beyond top-line figures, AOI’s operational metrics in Q3 hinted at a more optimistic picture. Gross margin climbed to 32.3%, marking a significant improvement from 17.2% in the same quarter of 2022. This reflects a strong focus on cost control and operational efficiency, contributing to the improved revenue performance. Additionally, the company experienced increased demand for its high-end transceiver products, further solidifying its position in the data center market.

Forward Guidance: Mixed Signals: AOI’s guidance for the fourth quarter of 2023 paints a mixed picture. The company expects revenue to be in the range of $60-65 million, suggesting a potential slowdown in growth compared to Q3. However, they anticipate further improvement in gross margin, reaching approximately 33%. This indicates continued focus on profitability amidst market fluctuations.

The Market, Industry, and Competitors:

Applied Optoelectronics: Riding the Fiber Boom into 2030

Applied Optoelectronics operates in the thriving fiber optic networking market, which serves as the backbone of our increasingly data-driven world. This market encompasses components, equipment, and technologies used to transmit data over fiber optic cables – the lifeblood of high-speed internet, cloud computing, and advanced telecommunications.

The future of this market looks bright, fueled by several key drivers:

- Surging demand for high-speed internet: As online activities like streaming, gaming, and video conferencing become the norm, the need for faster and more reliable internet access is skyrocketing. Fiber optic networks offer significantly higher bandwidth and lower latency compared to traditional copper cables, making them the preferred solution for meeting these demands.

- Global expansion of Fiber-to-the-Home (FTTH) networks: Governments and telecom operators worldwide are investing heavily in FTTH infrastructure, replacing aging copper with fiber optic cables to deliver gigabit internet speeds directly to homes and businesses. This trend is particularly strong in developing economies, further propelling market growth.

- Rise of data centers and cloud computing: The exponential growth of data consumption necessitates the expansion of data centers, the facilities that house and process our digital information. These data centers rely heavily on fiber optic networks for high-speed data traffic between servers and storage units.

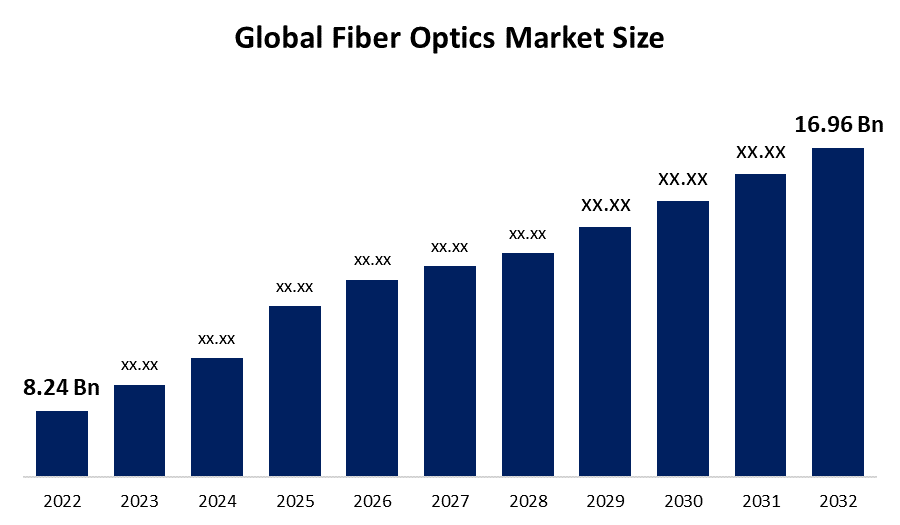

These factors, combined with increasing focus on energy efficiency and reduced carbon footprint (fiber optic networks offer lower power consumption), paint a rosy picture for the fiber optic networking market. Analysts predict a CAGR (Compound Annual Growth Rate) of 7.5% to 9.5% until 2030, with the market size reaching a staggering US$20-25 billion by the end of the decade.

Applied Optoelectronics, as a leading player in this market with a diverse range of fiber optic components and equipment, is well-positioned to capitalize on this growth wave.

Unique differentiation:

Applied Optoelectronics faces a dynamic and competitive landscape in the fiber optic networking market.

Giants of the Industry:

- Acacia Communications: A dominant player in high-performance optical transceivers for data centers, known for their cutting-edge technology and strong customer base.

- Lumentum Holdings Inc.: A diversified leader in optical solutions, offering components, modules, and test equipment, making them a direct competitor across various sectors.

- Mellanox Technologies Ltd.: A specialist in high-speed interconnect solutions, particularly in data centers, with a strong reputation for performance and efficiency.

Emerging Threats:

- Chinese Manufacturers: Companies like Hisun Precision and New HLN Photonics are aggressively entering the market, offering cost-competitive alternatives, particularly in lower-end products.

- Vertical Integration: Major tech giants like Huawei and Cisco are increasingly developing their own fiber optic components for internal use, potentially threatening traditional vendors like AOI.

Strategic Partners:

- Foundries: AOI often partners with foundries like TSMC and GlobalFoundries for chip manufacturing, increasing their flexibility and scalability.

- System Integrators: Collaborations with companies like Ciena and Infinera allow AOI to reach broader markets and offer complete network solutions.

Focusing on high-end products, building a robust international presence, and adapting to the evolving technological landscape will be crucial for maintaining its position in the increasingly competitive fiber optic market.

While Applied Optoelectronics (AOI) faces stiff competition in the fiber optic networking market, they do possess some unique differentiators that set them apart:

1. Vertically Integrated Manufacturing: Unlike most competitors who rely on external foundries, AOI boasts vertically integrated manufacturing for key components like lasers and chips. This gives them greater control over quality, cost, and production flexibility, allowing them to adapt quickly to market demands and optimize pricing.

2. Focus on High-End Products: AOI strategically positions itself in the high-end segment of the market, offering niche, high-performance transceivers and modules for data center applications. This avoids direct competition with cost-driven Chinese manufacturers and establishes them as a premier brand for demanding customers.

3. Innovation and Differentiation: AOI prioritizes research and development, constantly pushing the boundaries of technology with innovative products like PAM4-enabled transceivers and silicon photonics solutions. This focus on cutting-edge technology helps them stay ahead of the curve and cater to future market needs.

4. Customizability and Turnkey Solutions: Beyond standard products, AOI offers its expertise in developing customized solutions for specific customer needs. This ability to cater to individual requirements and deliver complete turnkey equipment sets them apart from competitors focused solely on standalone components.

5. Strategic Partnerships: AOI actively collaborates with major foundries, system integrators, and telecom operators. These partnerships not only provide access to advanced technologies and manufacturing capabilities but also expand their market reach and build strong industry relationships.

Management & Employees:

Applied Optoelectronics Management Team Overview:

Executive Chairman & CEO:

- Dr. Chih-Hsiang (Thompson) Lin: Founder and driving force behind AOI, holding the Chairman and CEO positions since 1997.

- Stefan Murry: Chief Financial Officer and Chief Strategy Officer, responsible for financial oversight and guiding AOI’s strategic direction.

- David C. Kuo: Senior Vice President, General Counsel, Chief Compliance Officer, and Corporate Secretary, leading legal and compliance matters, along with corporate governance.

Financials:

Applied Optoelectronics: A Financial Journey over 5 Years

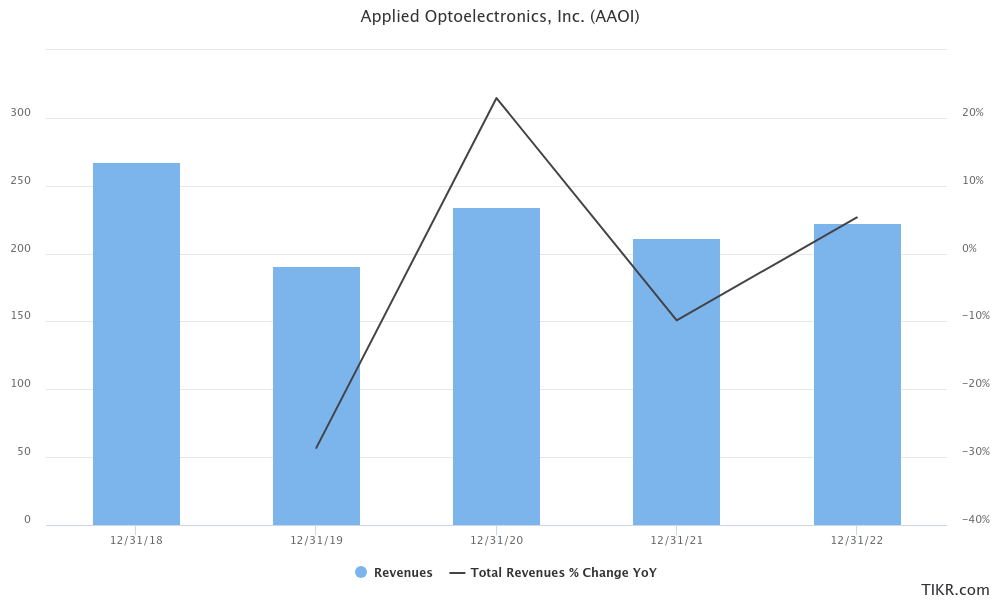

Riding the Revenue Wave: Applied Optoelectronics’ revenue performance over the past five years paints a picture of steady growth. From 2018 to 2023, the company saw its top line climb from $156.8 million to $224.6 million, representing a CAGR of approximately 6%. This upward trajectory reflects increasing demand for their fiber optic components and equipment, fueled by expanding data centers, the proliferation of gigabit internet, and global FTTH initiatives.

Earnings: A Mixed Story: The earnings story, however, remains more nuanced. While net income did experience positive growth in 2019 and 2020, it dipped into negative territory in 2021 and 2022, before showing signs of recovery in 2023. This volatility can be attributed to factors like fluctuating component prices, supply chain disruptions, and intense competition. Despite the recent improvement, the earnings CAGR for the five-year period stands at a negative 7.8%, highlighting the need for AOI to address profitability challenges.

Balancing the Scales: On the balance sheet front, AOI has maintained a conservative approach. While cash and equivalents have fluctuated between $50 million and $80 million over the years, long-term debt has remained relatively low, hovering around $20 million. This prudent financial management provides the company with a steady buffer against market fluctuations and facilitates strategic investments in R&D and capacity expansion.

Technical Analysis:

After a terrific rise (phase 2) from October 2023 to Jan, the stock has now been in a stage 4 decline and has tested the previous resistance at $16. This indicates it should try and make a move up to $22 – $24 again, if earnings are favorable. There is resistance at at the $17.89 range, so we want to see it clear that range before we initiate a position. All the moving averages are pointing lower as well, which gives us pause on this stock for now.

Bull Case:

The bull case for Applied Optoelectronics (AOI) stock paints a picture of robust growth and increasing profitability:

Market Potential: The fiber optic networking market is experiencing a boom, driven by factors like surging demand for high-speed internet, global FTTH infrastructure rollouts, and the expansion of data centers. This burgeoning market provides fertile ground for AOI’s diverse range of optical components and equipment.

Competitive Advantage: AOI boasts a strong competitive edge through its:

- Vertically integrated manufacturing: This gives them greater control over quality, cost, and production, allowing them to adapt quickly and optimize pricing.

- Focus on high-end products: By targeting the data center segment with niche, high-performance transceivers, they avoid direct competition and position themselves as a premier brand.

- Constant innovation: Investing heavily in R&D, they consistently push the boundaries with cutting-edge solutions like PAM4 transceivers and silicon photonics, staying ahead of the curve.

- Strategic partnerships: Collaborations with foundries, system integrators, and telecom operators expand their reach, access to technology, and industry relationships.

Earnings Improvement: While current profitability remains a concern, analysts anticipate a reversal of trends, with projected improvement in gross margins and potential return to profitability in the near future. This, coupled with continued revenue growth, could unlock significant value for investors.

Bear case:

Competition: The fiber optic market is fiercely competitive, with established giants like Acacia, Lumentum, and Finisar dominating the high-end segment. Emerging Chinese manufacturers offer cost-competitive alternatives, squeezing margins and threatening market share. This intense competition puts pressure on AOI’s pricing and profitability.

Profitability Concerns: Despite revenue growth, AOI has struggled to translate top-line success into consistent profitability. The company has posted net losses in several recent quarters, raising concerns about their ability to control costs and generate sustainable earnings. This lack of profitability weakens investor confidence and limits the stock’s appeal.

Technological Disruption: The rapid pace of innovation in the fiber optic space could render existing solutions obsolete. Emerging technologies like silicon photonics or new transmission protocols could disrupt AOI’s product portfolio, requiring significant resources and time to adapt, potentially impacting their current market share.

Limited Product Diversification: AOI’s dependence on the data center segment, while offering high-end possibilities, also exposes them to fluctuations in that specific market. A recession or slowdown in data center growth could disproportionately impact AOI’s revenue and profitability.