Executive Summary:

Novavax is a biotechnology company committed to addressing serious infectious diseases globally through the discovery, development, and delivery of innovative vaccines. The company was founded in 1987 and is headquartered in Gaithersburg, Maryland. Novavax focuses on developing life-saving vaccines to fight infectious diseases, using a combination of recombinant protein approach, nanoparticle technology, and its patented Matrix-M adjuvant to enhance the immune response. The company’s pipeline includes vaccines for COVID-19, influenza, and COVID-19 and influenza combined. Novavax is currently commercializing a COVID-19 vaccine, NVX-CoV2373, under the brand names of Nuvaxovid, Covovax, and Novavax COVID-19 Vaccine.

Novavax reported a per-share loss of $1.26 for the third quarter of 2022, which beat forecasts for a loss of $2.22 per share and $115.4 million in sales, according to FactSet. Sales tumbled 75% year over year, but losses narrowed compared to the previous year. For the fourth quarter, analysts expect a per-share gain of 16 cents on an adjusted basis, with losses in the first, second, and third quarters of 2024. Sales are projected to have shrunk down to $1.07 billion for 2023.

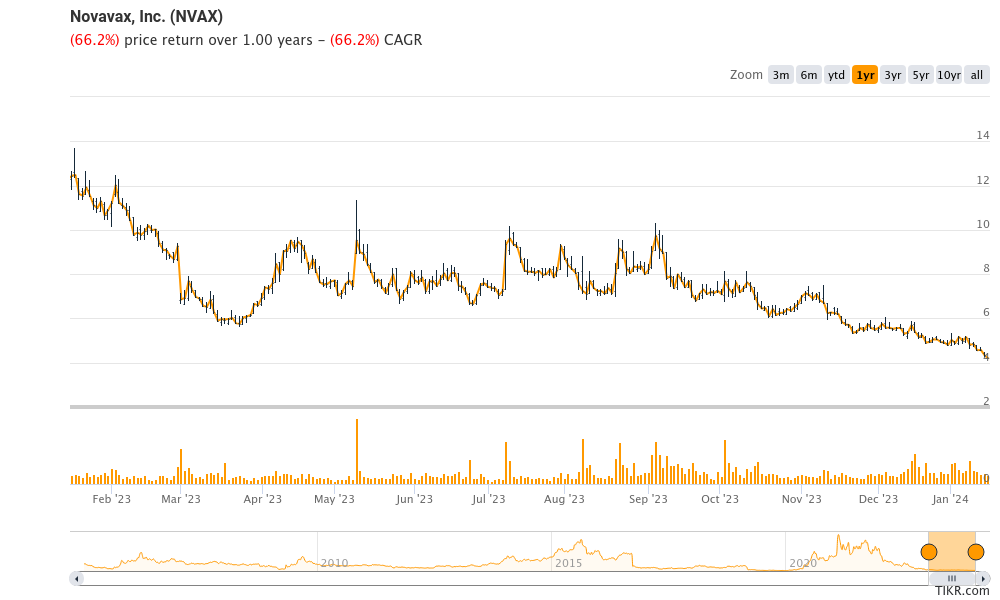

Stock Overview:

| Ticker | $NVAX | Price | $4.04 | Market Cap | $479.91M |

| 52 Week High | $12.65 | 52 Week Low | $4.01 | Shares outstanding | 118.79M |

Company background:

Novavax’s founders include Stanley C. Erck, who has been the President and CEO of the company since 2011. The company has received significant funding over the years to support its vaccine development efforts, including investments from both private and public sources.

Novavax is known for its innovative vaccine products, including NanoFlu, a seasonal influenza vaccine, and NVX-CoV2373, its COVID-19 vaccine. The company’s vaccine platform combines a recombinant protein approach, nanoparticle technology, and its patented Matrix-M adjuvant to enhance the immune response. Novavax’s key competitors in the biotechnology and pharmaceutical industry include other companies involved in vaccine development, such as Pfizer, Moderna, and Johnson & Johnson.

In recent years, Novavax has made significant strides in its vaccine development efforts, particularly with the successful development and commercialization of its COVID-19 vaccine. The company’s COVID-19 vaccine, NVX-CoV2373, has been authorized for emergency use in various countries and is being marketed under different brand names, including Nuvaxovid, Covovax, and Novavax COVID-19 Vaccine.

Recent Earnings:

In the third quarter of 2023, Novavax reported a per-share loss of $1.26, surpassing the expected loss of $1.821. The company’s revenue for the quarter was $115.4 million, reflecting a significant decrease compared to the previous year. Despite the decline in sales, Novavax’s earnings per share (EPS) outperformed analysts’ expectations, indicating a positive outcome for the company.

Looking ahead, analysts forecast a robust growth trajectory for Novavax. The company is projected to achieve a 65% annual growth in earnings and a 5.2% annual growth in revenue, with an expected EPS growth rate of 67.6% per annum. While the revenue growth rate is anticipated to be 4.4% per year, the company’s earnings are forecasted to outpace its revenue growth, signaling potential efficiency and cost management measures.

In terms of operational metrics, it is projected to remain unprofitable over the next three years, indicating ongoing investment in growth and development initiatives.

The Market, Industry, and Competitors:

Novavax operates in the biotechnology and pharmaceutical industry, focusing on the development and commercialization of vaccines for various infectious diseases. The company’s market is expected to grow significantly in the coming years, driven by the increasing demand for vaccines and the ongoing efforts to combat global health challenges.

Novavax is forecast to grow its earnings and revenue by 65% and 5.2% per annum, respectively, while its EPS is expected to grow by 67.6% per annum.

Unique differentiation:

The company faces competition from several other companies in the industry, including Adaptive Biotechnologies, Moderna, HOOKIPA Pharma, Vaccitech, AlloVir, Proteus Digital Health, Hemab ApS, Wren Therapeutics, TCR2 Therapeutics, Agenus (AGEN), Kodiak Sciences (KOD), BioCryst Pharmaceuticals (BCRX), Allogene Therapeutics (ALLO), Anavex Life Sciences (AVXL), Adaptive Biotechnologies (ADPT), HilleVax (HLVX), Immatics (IMTX), Autolus Therapeutics (AUTL), and Exscientia (EXAI).

Novavax faces intense competition from established players such as Pfizer, Johnson & Johnson, Moderna, BioNTech, and AstraZeneca in the vaccine market.

The company’s unique differentiation lies in its focus on developing innovative vaccines using a combination of recombinant protein approach, nanoparticle technology, and its patented Matrix-M adjuvant to enhance the immune response. By leveraging these advanced technologies, Novavax aims to create a unique value proposition that makes it less likely for customers to switch to its competitors.

Management & Employees:

The company’s current CEO John C. Jacobs, joined Novavax as president and chief executive officer, and a member of the board of directors, in January 2023. He is a seasoned industry leader who has more than 25 years of commercial, operations, business and leadership experience across multiple therapeutic areas. Previously, Mr. Jacobs served as president and chief executive officer and a member of the board of directors at Harmony Biosciences

Stanley C. Erck, who has been leading the company since 2011 is the past CEO. Other key members of the management team include Filip Dubovsky, EVP and Chief Medical Officer, and Jim Kelly, EVP, CFO & Treasurer.

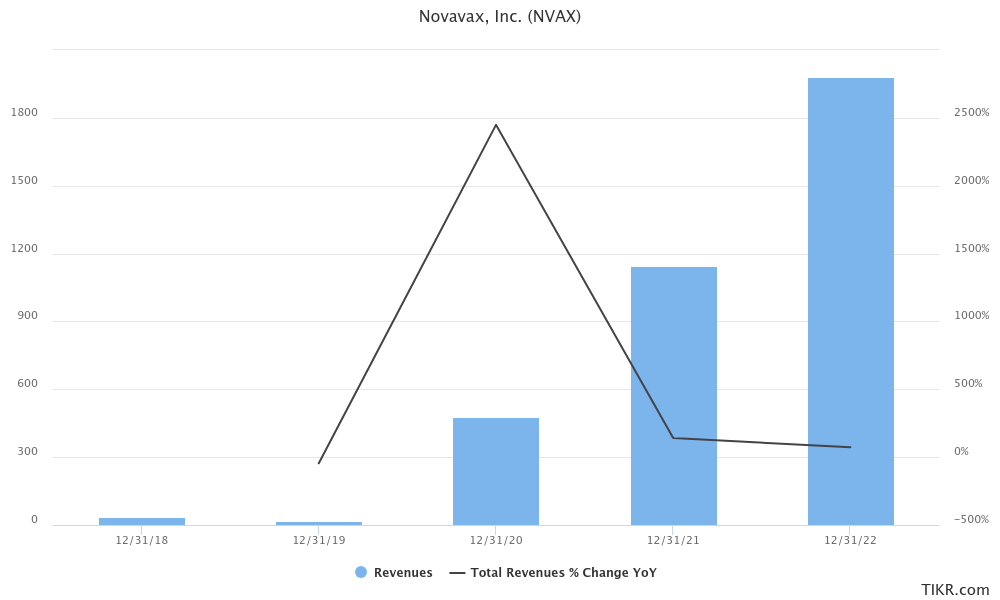

Financials:

Novavax’s financial performance over the last five years has been characterized by significant fluctuations. The company’s revenue growth rate has been volatile, with a compound annual growth rate (CAGR) of 20.5% over the last five years. However, the company’s revenue has decreased significantly in recent years, with a revenue of $1.05 billion in the last twelve months.

Novavax’s earnings growth rate has also been volatile, with a CAGR of -38.5% over the last five years. The company has reported net losses in each of the last five years, with a net loss of $548.92 million in the last twelve months.

In terms of the balance sheet, Novavax’s cash and cash equivalents have decreased from $1.5 billion as of December 31, 2021, to $1.3 billion as of December 31, 2022. The company has also raised $250 million in concurrent equity and convertible securities offerings in December 2022.

Technical Analysis:

Novovax is still in a markdown (Stage 4) decline phase and has not show any signs of consolidation or accumulation (stage 1) yet. A lot depends on the settlement offering due by end of Feb.

Wait for confirmation before buying

Bull Case:

Potential for continued COVID-19 vaccine demand: While the initial pandemic boom for vaccines is subsiding, Novavax still sees opportunity. Their protein-based vaccine offers advantages like long-term stability and less cold chain dependence, potentially appealing to underserved regions and individuals hesitant about mRNA vaccines.

2. Updated vaccines and pipeline potential: Novavax is developing an updated COVID-19 vaccine targeting Omicron and other variants, expected this fall. Their pipeline also includes a combined COVID-flu vaccine showcasing strong phase 2 data, potentially becoming a major product in the coming years.

3. Competitive advantage with protein-based technology: Novavax is the only major player offering a protein-based vaccine. This established technology might resonate with individuals preferring a more traditional platform than mRNA vaccines.

4. Attractive valuation: After significant drops in the past year, Novavax stock could be considered undervalued by some investors, presenting a potential buying opportunity.

Bear case:

1. Missed the initial COVID-19 boom: Novavax’s vaccine arrived significantly later than competitors like Pfizer and Moderna, losing access to the peak pandemic demand. This significantly impacts their potential revenue and market share.

2. Limited current demand and sales: With most individuals already vaccinated, current demand for Novavax’s vaccine is limited. Even among hesitant individuals, other protein-based options are available, further decreasing their market share potential.

3. Competitive landscape and pressure: Pfizer, Moderna, and other established players dominate the vaccine market, making it challenging for Novavax to gain significant traction. Competition on price and access will be fierce.

4. Pipeline progress and execution risk: Novavax’s future success hinges heavily on their pipeline, including the combined COVID-flu vaccine and potential malaria vaccine. However, these projects are still under development and face the risk of failure or delays, impacting future profitability.

5. Financial struggles and uncertainty: Novavax has been struggling financially with declining sales and potential profitability concerns. This raises questions about their ability to sustain operations and invest in research & development.

6. Uncertain future of pandemic and vaccine demand: The future of COVID-19 and its impact on vaccine demand are uncertain. If the pandemic becomes less severe or transitions to seasonal vaccination, Novavax’s long-term prospects could be negatively affected.

7. Valuation concerns: Although some see Novavax as undervalued, others argue the current price still reflects significant uncertainty and future risks.