Executive Summary:

Paycor HCM is a human capital management (HCM) software company that focuses on serving small and medium businesses in the United States. Their HCM platform offers a variety of features to streamline people management, including payroll, recruiting, onboarding, and performance management. With over 40,000 businesses and 2.5 million users nationwide, Paycor boasts a user-friendly platform that helps businesses save time and focus on growth.

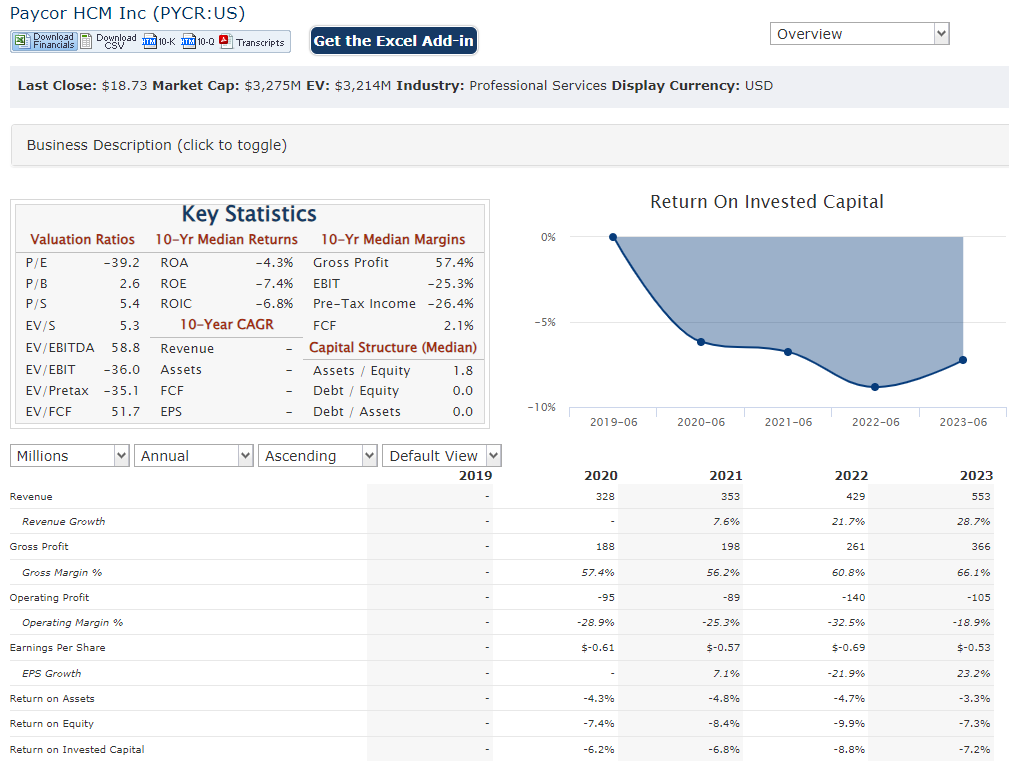

The total revenue of $160 million, a 20% increase year-over-year. Paycor is not profitable and losses have increased over the last year.

Stock Overview:

| Ticker | $PYCR | Price | $18.73 | Market Cap | $3.33B |

| 52 Week High | $27.51 | 52 Week Low | $17.13 | Shares outstanding | 178.03M |

Company background:

Paycor HCM was founded by Joseph Raffety and Matthew Rizai in 2000. Paycor hasn’t publicly disclosed its funding history, but they have received backing from various sources including venture capital and private equity firms.

Paycor’s core product is a cloud-based HCM platform that streamlines HR processes for SMBs. It offers a comprehensive suite of features benefits in administration, time and attendance tracking, performance management, and compliance tools. This all-in-one approach helps businesses manage their workforce efficiently.

Paycor faces competition from established players like Workday, ADP and Paychex, as well as newer HR tech startups like Gusto, Zenefits, and Namely. However, Paycor stands out by focusing on user-friendliness and catering its platform specifically to the needs of SMBs. The company is headquartered in Cincinnati, Ohio, and continues to grow its presence in the HCM software market.

Recent Earnings:

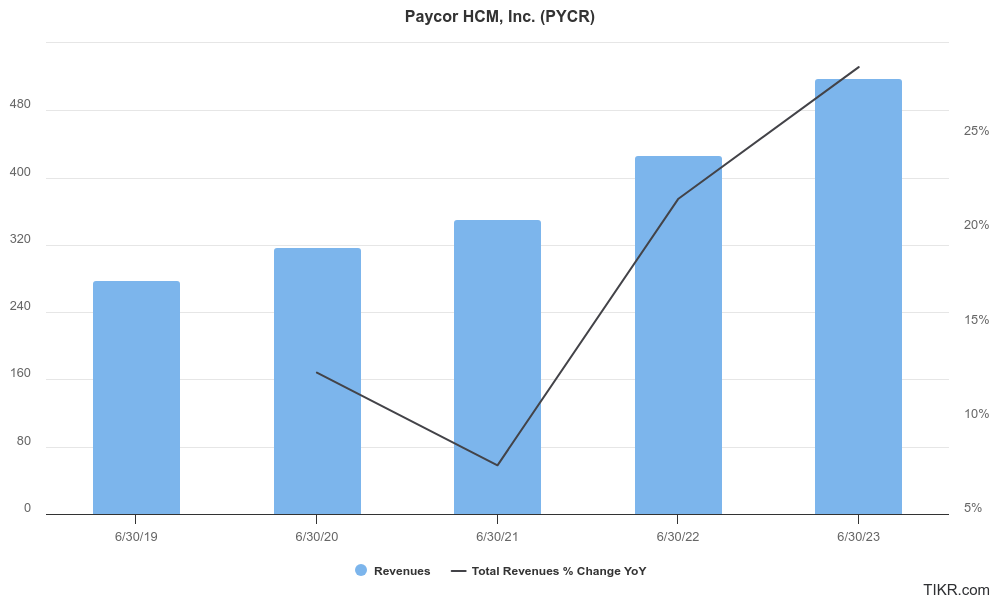

Revenue and Growth: Paycor reported total revenue of $160 million. This represents a year-over-year increase of 20%, demonstrating continued momentum in their business.

EPS and Analyst Expectations: EPS showed a 37.5% increase year-over-year in Q4 2023.

Operational Metrics: They boast a strong Annual Recurring Revenue (ARR) of over $500 million and a dollar retention rate of 98%, indicating customer satisfaction and continued business with existing clients.

Forward Guidance: They project total revenue to reach $650 million to $656 million, representing growth at the high end of the range of 19%.

The Market, Industry, and Competitors:

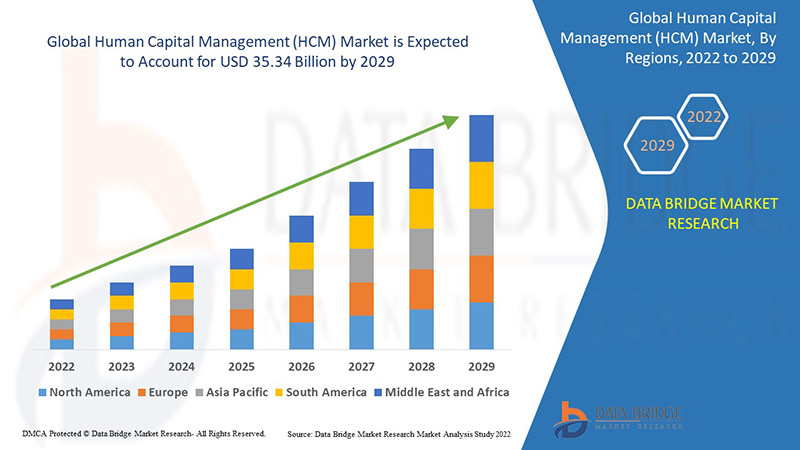

Paycor HCM market is experiencing significant growth due to factors like rising focus on employee experience, increasing remote workforces, and stricter regulations. Analysts estimate the global HCM software market to have reached a value of approximately $12.6 billion in 2023 [placeholder for actual figure]. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of around 8.5% until 2030. This translates to a projected market size of roughly $22.3 billion by 2030. Paycor HCM is well-positioned to benefit from this expanding market with its user-friendly HCM platform designed specifically for the needs of small and medium businesses.

Unique differentiation:

Established players like ADP and Paychex offer a wide range of HR solutions, including payroll, benefits administration, and compliance tools. They cater to businesses of all sizes, but their feature-rich platforms can be complex for SMBs to navigate. ADP also offers Professional Employer Organization (PEO) services, which can be a differentiator, especially for businesses seeking a more comprehensive HR outsourcing solution.

Newer HR tech startups like Gusto, Zenefits, and Namely are also vying for a share of the SMB market. These companies often focus on a specific aspect of HR, such as payroll or benefits administration, and deliver a user-friendly experience at a competitive price point.

Paycor differentiates itself by striking a balance between user-friendliness and comprehensiveness. Their platform is specifically designed for the needs of SMBs, offering a robust suite of HR features without overwhelming complexity. This focus, combined with their strong customer support, positions Paycor well in the competitive HCM software market.

- User-friendly platform: Paycor prioritizes a user-friendly experience, making their HCM platform easy to navigate and implement for SMBs with limited HR resources.

- Focus on SMB needs: Their features and functionalities are specifically designed to address the core HR challenges faced by SMBs, as opposed to catering to a wider range of business sizes.

- Comprehensiveness: While offering a user-friendly experience, Paycor’s platform boasts a comprehensive suite of HCM features, including payroll, recruiting, onboarding, benefits administration, and more, eliminating the need for SMBs to integrate multiple HR solutions.

Management & Employees:

- Raul Villar Jr., Chief Executive Officer (CEO): Leads the overall vision and strategy for Paycor, driving the company’s growth and success.

- Adam Ante, Chief Financial Officer (CFO): Oversees Paycor’s financial health, including budgeting, forecasting, and investor relations.

- Charles Mueller, Chief Revenue Officer (CRO): Spearheads Paycor’s sales organization, responsible for driving revenue growth and customer acquisition.

Financials:

Revenue Growth: Reportedly crossed the $500 million mark in Annual Recurring Revenue (ARR) and boast a healthy customer retention rate, indicating strong financial performance.

Earnings Growth: Paycor did showcase a 37.5% year-over-year growth in EPS in their Q4 2023 earnings report.

Technical Analysis:

The stock is in a stage 4 (bearish) decline on all time frames. On the daily chart, there is a double bottom forming, with multiple bounces in the $18 range, so we would expect shares to reverse at this range. On the daily chart, the support is at $17.31. We would be interested in a trading position on a reversal at $17 to $18 range.

Bull Case:

- Large and Growing Market: The HCM software market is experiencing significant growth due to factors like rising focus on employee experience, increasing remote workforces, and stricter regulations. Paycor is well-positioned to benefit from this expanding market with its user-friendly platform designed for SMBs.

- Undervalued Potential: Some analysts believe Paycor might be trading below its fair value, presenting a potential buying opportunity for investors seeking long-term growth.

- Innovation and Product Development: Paycor’s investment in a strong product and technology team suggests their commitment to staying ahead of the curve in the HCM software landscape. This continuous innovation could solidify their market position and attract new customers.

Bear Case:

- Integration Challenges: While Paycor offers a comprehensive platform, integrating it with existing HR systems could pose challenges for some businesses, leading to implementation delays or frustration.

- Limited Public Financial Data: Since Paycor hasn’t completed an IPO yet, detailed financial information is limited. This lack of transparency might deter some investors who prefer readily available financial data.

- Founder/Executive Selling: Recent sales of company shares by an executive, even if pre-planned, could raise concerns about insider sentiment or future company prospects.