Executive Summary:

Marathon Digital Holdings Inc. is a American company that mines Bitcoin, a cryptocurrency. They focus on using energy efficient technology to create new Bitcoins and keep the Bitcoin network secure. The company was founded in 2010 and is publicly traded under the ticker symbol MARA. They are one of the largest holders of Bitcoin among publicly traded companies in North America and recently acquired two operational Bitcoin mining sites in December 2023.

Stock Overview:

| Ticker | $MARA | Price | $17.95 | Market Cap | $5.07B |

| 52 Week High | $34.09 | 52 Week Low | $7.16 | Shares outstanding | 282.6M |

Company background:

Marathon Digital Holdings Inc. went public in 2021 under the ticker symbol MARA, and is currently one of the largest publicly traded holders of Bitcoin in North America.

Marathon Digital Holdings is currently led by CEO Fred Thiel. The company is headquartered in Las Vegas, Nevada.

As a Bitcoin mining company, Marathon Digital Holdings doesn’t sell physical products in the traditional sense. Their primary function is to validate Bitcoin transactions and add new blocks to the blockchain ledger through a complex computational process. As a reward for this work, they are awarded Bitcoins. The company’s revenue comes from holding and potentially selling these mined Bitcoins.

Marathon Digital Holdings faces competition from other large-scale Bitcoin mining companies like Core Scientific, Riot Blockchain, Hut 8 Mining, and Hive Blockchain Technologies. The success of Marathon Digital Holdings is tied to the overall health of the Bitcoin ecosystem, including the price of Bitcoin and the difficulty of mining new coins.

Recent Earnings:

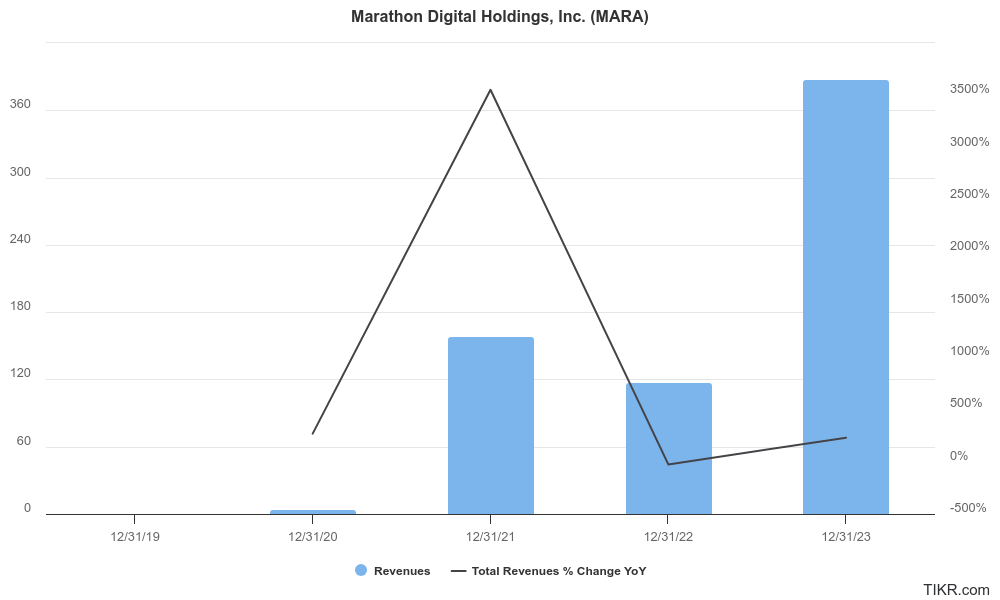

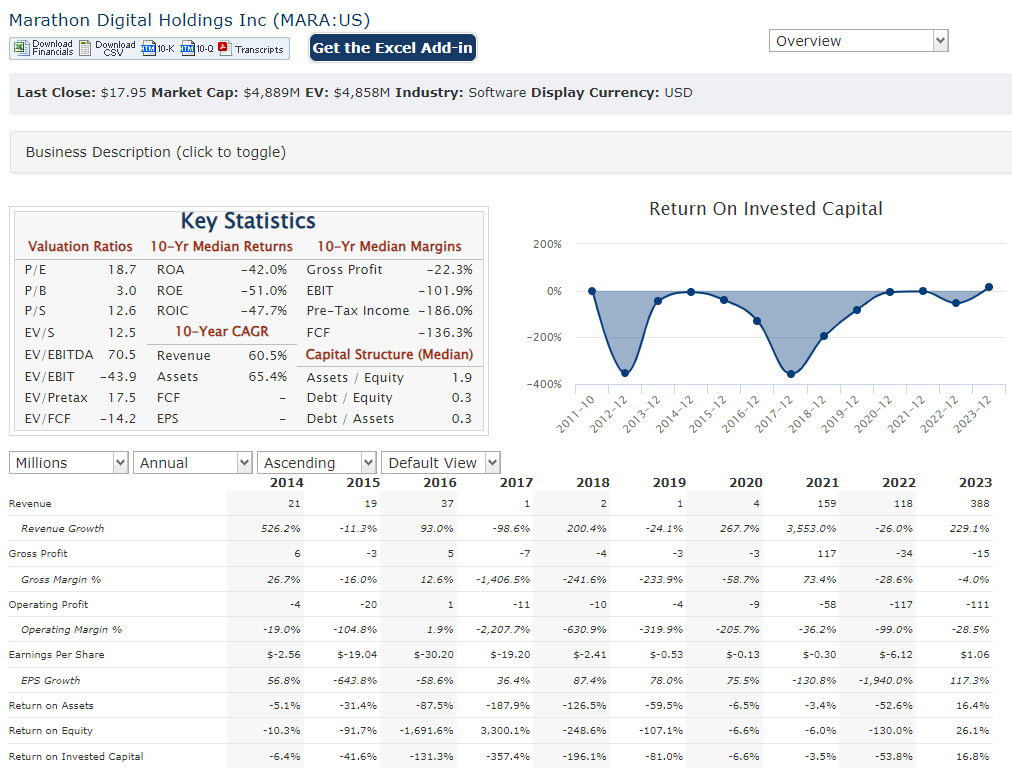

Revenue reached $387.5 million, a significant increase of 229% compared to $117.8 million in 2022. This growth was primarily driven by a 210% increase in Bitcoin production and a 101% rise in average Bitcoin prices throughout the year.

In terms of profitability, Marathon turned things around in 2023. They reported a net income of $261.2 million, or $1.06 earnings per share (EPS). This is a major improvement from a net loss of $694.0 million and negative EPS in 2022.

EPS forecasts downwards estimates were around $0.14 per share, but have been adjusted to $0.07.

The Market, Industry, and Competitors:

Marathon Digital Holdings operates in the Bitcoin mining industry, a relatively young and dynamic market. The profitability of Bitcoin mining companies like Marathon Digital Holdings is significantly impacted by two main factors: the price of Bitcoin and the difficulty of mining new coins.

Predicting the exact growth of the Bitcoin mining industry by 2030 is difficult. Analysts expect significant growth due to factors like increasing adoption of Bitcoin as a mainstream investment and rising institutional investment. Some estimates suggest a Compound Annual Growth Rate (CAGR) of over 50% for the Bitcoin mining market by 2030. This optimistic outlook is based on the belief that Bitcoin will continue to gain traction and its value will rise.

A high-risk industry with factors like regulation and environmental concerns that could impact future growth. For instance, governments around the world could impose stricter regulations on cryptocurrency mining due to its high energy consumption.

Unique differentiation:

- Core Scientific (CORZ): A publicly traded company in the US, Core Scientific is one of the largest Bitcoin miners globally. They boast a strong focus on sustainable mining practices and geographically diverse data centers.

- Riot Blockchain (RIOT): Another American publicly traded company, Riot Blockchain holds a significant Bitcoin position and operates large-scale mining facilities in North America. They prioritize utilizing low-cost, environmentally friendly energy sources.

- Hut 8 Mining (HUT): A Canadian Bitcoin mining company with a presence on both the NASDAQ and Toronto Stock Exchange, Hut 8 is known for its diversified business model that includes Bitcoin mining and high-performance computing solutions.

- Hive Blockchain Technologies (HIVE): This Canadian company listed on the NASDAQ and Toronto Stock Exchange operates geographically dispersed mining facilities in North America powered by green energy sources. They also offer GPU cloud computing services.

- Focus on Energy Efficiency: Marathon emphasizes utilizing energy-efficient mining practices. This could be through hardware choices, innovative cooling solutions like their immersion cooling system, or seeking out renewable energy sources. By keeping operational costs down, they might achieve higher profit margins compared to competitors who rely on less efficient methods.

- Recent Expansion: While other established players have a strong presence, Marathon’s recent acquisition of two operational mining sites in December 2023 signifies a growth spurt.

- Focus on North American Market: While some competitors have geographically dispersed operations, Marathon seems concentrated on the North American market. This could be advantageous if regulations or public sentiment regarding Bitcoin mining become more favorable in that region.

Management & Employees:

- Fred Thiel (Chairman and CEO): While detailed information about prior experience isn’t publicly available, Fred Thiel holds the top leadership positions at Marathon Digital Holdings.

- Salman Khan (Chief Financial Officer): Khan brings expertise in finance and corporate strategy to the table. His background includes leadership roles at Verb Technology Company Inc.

- James Crawford (Chief Operating Officer): Oversees day-to-day operations at Marathon Digital Holdings.

Financials:

Marathon Digital Holdings’ financial performance over the last 5 years paints a picture of a company transitioning from a development stage to a revenue-generating business in the relatively young Bitcoin mining industry.

The company reported significant net losses as they invested in building their infrastructure and hash rate (computing power) for Bitcoin mining. Revenue figures were minimal during this period.

Marathon reported a record revenue of $387.5 million, a staggering 229% increase compared to 2022. This impressive growth was primarily driven by a 210% rise in Bitcoin production and a 101% increase in average Bitcoin prices throughout the year.

The company progressed from a net loss of $694 million in 2022 to a net income of $261.2 million in 2023. This translates to an earnings per share (EPS) jump from negative territory to $1.06.

Technical Analysis:

The stock has formed a bullish cup and handle pattern on the monthly and weekly chart, but is stage 4 decline on the daily chart. There is support at the $17 range where it has bounced before and could be a key pivot point, but the range from $15.7 to $16.2 is another likely support area. The stock is very volatile and very dependent on Bitcoin prices for its revenue. We would wait for a confirmation to the uptrend to buy, but long term MARA is a strong secondary investment opportunity for those that dont want to own $BTCUSD.

Bull Case:

- Rising Bitcoin Price: The most crucial factor is the price of Bitcoin itself. If Bitcoin experiences another bull run, surpassing its historical highs and reaching new levels, it would directly benefit Marathon.

- Increased Institutional Adoption: If Bitcoin gains wider acceptance as an investment asset class by institutions, it could lead to a surge in demand. This increased demand could push the price of Bitcoin even higher, benefiting Marathon as discussed above.

- Growth in Hash Rate: Hash rate refers to the combined computational power of the Bitcoin mining network. Marathon has been actively expanding its operations and hash rate through strategic acquisitions and technological advancements.

Bear Case:

- Falling Bitcoin Price: The most significant risk is a drop in the price of Bitcoin. If Bitcoin undergoes a sustained bear market, the value of Marathon’s Bitcoin holdings would decrease, leading to lower revenue and potentially losses.

- Regulation and Environmental Concerns: Government regulations aimed at curbing Bitcoin mining due to its high energy consumption could significantly impact Marathon’s operations. Additionally, growing public concern about the environmental impact of Bitcoin mining could lead to stricter regulations or even bans, hindering the industry’s growth and potentially harming Marathon’s stock price.

- Dependence on Limited Revenue Streams: Unlike some competitors that have diversified business models, Marathon is primarily reliant on revenue generated from mining and selling Bitcoin.