Executive Summary:

Marqeta is a financial services company founded in 2010 that provides a modern credit, payment & debit card issuing platform. Their platform allows businesses to create custom and innovative payment card solutions. Essentially, they empower businesses to build and integrate debit, credit, and prepaid card programs into their existing infrastructure. Marqeta boasts a flexible and scalable cloud-based system with open APIs that streamlines the process for businesses. With headquarters in Oakland, California, Marqeta is a public company serving a global clientele.

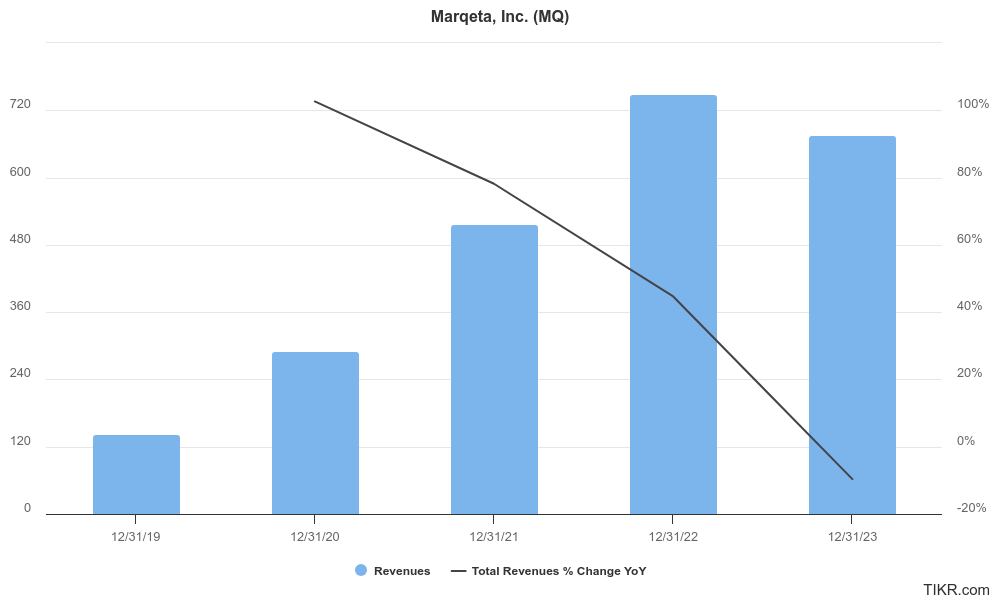

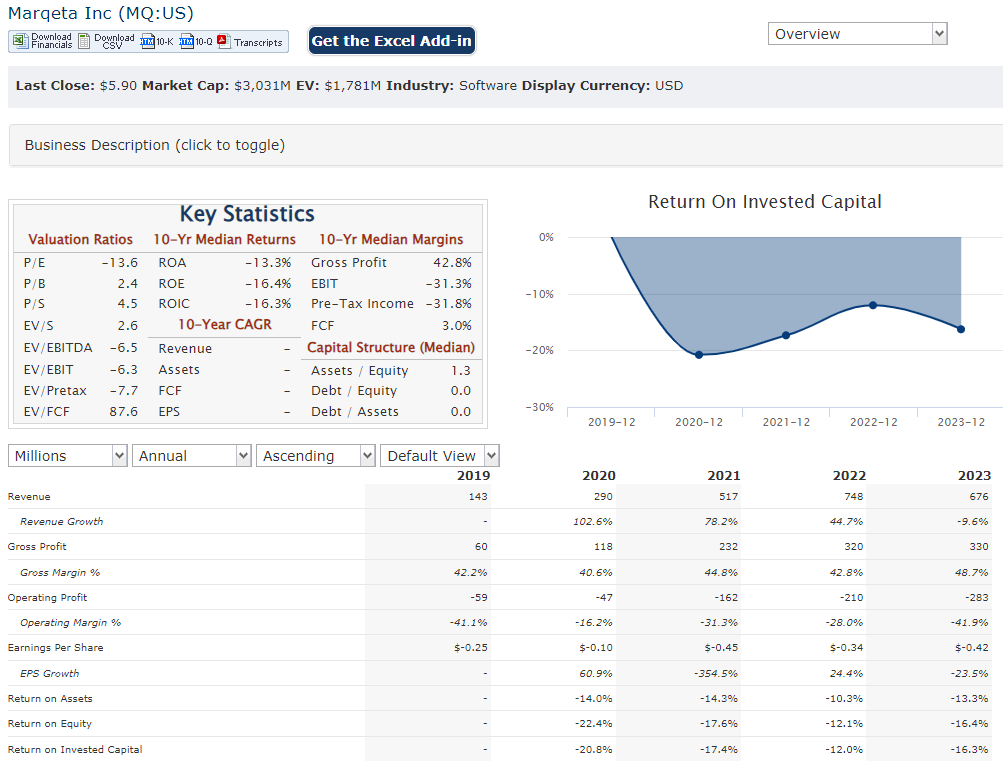

Revenue for Q4 lower at $119 million, reflecting a change in revenue presentation. The annual total processing volume (TPV) grew 34% year-over-year to $222 billion, generating $676 million in total revenue for the year.

Stock Overview:

| Ticker | $MQ | Price | $5.90 | Market Cap | $3.03B |

| 52 Week High | $7.36 | 52 Week Low | $3.74 | Shares outstanding | 461.56M |

Company background:

Marqeta is founded by Jason Gardner, It is a financial technology company. Their mission is to empower businesses to create innovative payment solutions by simplifying the complexities of card issuing. Marqeta’s core product is a cloud-based platform with open APIs that allows businesses to easily design, launch all through a single integration. This flexibility has made them a popular choice for companies in various sectors including on-demand delivery, expense management, retail, and digital banking.

Marqeta faces competition from established financial technology players like Fiserv and Global Payments, who offer similar card issuing services. They also compete with fellow fintech startups like Galileo Financial Technologies who provide similar cloud-based card issuing platforms.

Recent Earnings:

A bright spot for Marqeta was their Total Processing Volume (TPV), a key metric in the payments industry. Their annual TPV reached $222 billion, reflecting a healthy 34% increase compared to 2022. They achieved a positive Adjusted EBITDA income of $3 million for Q4 2023. Marqeta success in exceeding $1 billion in single-day TPV.

The Market, Industry, and Competitors:

Marqeta operates in the modern card-issuing platform market, a rapidly growing segment of the financial technology industry. This market caters to businesses that need to create and manage custom debit, credit, and prepaid card programs. The increasing demand for flexible payment solutions and the rise of embedded finance are driving the market’s growth. Embedded finance refers to the integration of financial services within non-financial apps and platforms.

Analysts predict the modern card-issuing platform market to reach a staggering value of $28 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 11%. This significant growth is fueled by the factors mentioned above, along with the increasing adoption of cloud-based solutions and the growing popularity of contactless payments.

Marqeta is a key player in this market, known for its user-friendly cloud-based platform and open architecture. Their focus on innovation and scalability positions them well to capitalize on the projected growth in the modern card-issuing platform market.

Unique differentiation:

Marqeta faces competition on two fronts: established financial technology players and nimble fintech startups.

Established Players: Companies like Fiserv and Global Payments are well-known names in the financial services industry, offering a range of financial products including card-issuing services. These giants have a strong foothold in the market and boast a large existing client base. While their card-issuing solutions might be well-established, they may not offer the same level of agility and innovation as Marqeta’s cloud-based platform.

Fintech Startups: Marqeta also competes with fellow fintech startups like SoFi Galileo Financial Technologies. These startups, similar to Marqeta, provide cloud-based card-issuing platforms. They are known for their flexibility and cutting-edge features, making them attractive to businesses seeking modern solutions.

Scalability with Open Architecture: Marqeta’s cloud-based platform is built for scalability, handling high transaction volumes efficiently. Additionally, their open APIs provide seamless integration with existing systems, minimizing development time and streamlining operations for businesses. This combination allows businesses to grow their card programs without worrying about infrastructure limitations.

- Focus on Innovation: Marqeta positions itself as a leader in innovation within the card-issuing space. They continuously develop new features and functionalities to cater to the evolving needs of businesses, especially in areas like embedded finance and credit card issuing.

Management & Employees:

- Executive Chairman: Jason Gardner (Founder) – Jason provides strategic direction and serves as a liaison between the board and management.

- Chief Executive Officer (CEO): Simon Khalaf – Simon leads the company’s overall strategy, development, and product delivery.

- Chief Financial Officer (CFO): Tripp Faix – Tripp is responsible for Marqeta’s financial health, including accounting, reporting, and financial planning.

Financials:

Marqeta has experienced significant growth over the past five years, solidifying its position in the modern card-issuing platform market:

Revenue Growth: Marqeta’s revenue has reports indicate a 45% growth in 2022 and an estimated 34% growth in total processing volume (TPV) for 2023 compared to 2022. This translates to a Compound Annual Growth Rate (CAGR) likely exceeding 30% for the past five years.

Earnings Growth: Marqeta is still a young company and has focused on growth and market share over profitability.

Balance Sheet: Marqeta’s balance sheet reflects a company in a high-growth phase. They likely have a significant amount of cash and cash equivalents to fuel ongoing operations and product development.

Technical Analysis:

The stock is in stage 1 accumulation on the monthly and weekly chart, which indicates not much movement ahead. On the daily chart there is a head and shoulders pattern (bearish) which means the stock should head lower to find support in the $5.1 to $5.69 zone. We are not buyers of this stock at this point. The fundamentals are poor as well as the technical setup is awful.

Bull Case:

- Strong Product Offering: Marqeta’s cloud-based platform is known for its ease of use, scalability, and open architecture. These features make it attractive to businesses of all sizes, giving them a competitive edge in launching and managing innovative card programs.

- Large Addressable Market: The total addressable market for Marqeta’s solutions is vast, encompassing various industries like on-demand delivery, expense management, retail, and digital banking. This broad market allows for significant potential customer acquisition.

- Potential for Profitability: While Marqeta hasn’t consistently reported positive EPS, their recent achievement of positive Adjusted EBITDA suggests progress towards profitability.

Bear Case:

- High Valuation: Marqeta’s stock price might be inflated due to the hype surrounding the modern card-issuing platform market.

- Regulatory Landscape: The financial technology industry is subject to evolving regulations. Changes in regulations could increase compliance costs or limit Marqeta’s ability to operate in certain markets.

- Limited Track Record: Marqeta is a relatively young company. Their long-term ability to maintain growth and achieve sustained profitability remains to be seen.