Executive Summary:

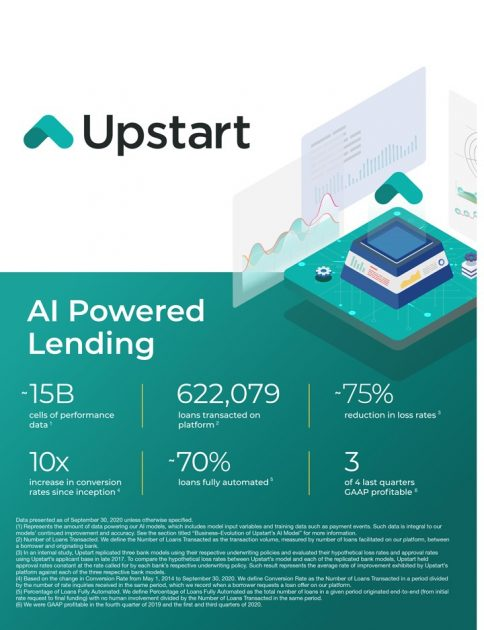

Upstart Holdings Inc. uses artificial intelligence (AI) to power its lending platform. They partner with banks and credit unions to offer loan products like personal loans and auto refinancing. Upstart’s AI considers more than just traditional credit scores to assess creditworthiness, including a borrower’s education and employment history. This allows them to approve more borrowers for loans at potentially lower rates. The company was founded in 2012 and is headquartered in San Mateo, California.

The reported an adjusted net loss per share of $0.56. Revenue of $140 million came in slightly above forecasts. This represents a 4% decrease year-over-year. The company attributed the decline to a decrease in loan volume.

Stock Overview:

| Ticker | $UPST | Price | $26.52 | Market Cap | $2.29B |

| 52 Week High | $72.58 | 52 Week Low | $11.93 | Shares outstanding | 86.43M |

Company background:

Upstart Holdings Inc. was Founded by Dave Girouard (ex Google) and Paul Gu, the company leverages AI to assess creditworthiness and offer a wider range of loan approvals, potentially at lower rates, for borrowers.

Upstart’s platform goes beyond traditional credit scores by considering factors like education and employment history. Their loan products include personal loans, auto refinancing loans, and even small-dollar relief loans.

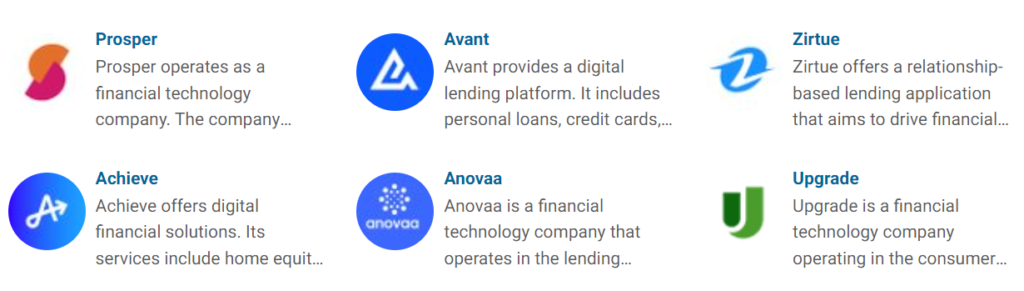

Upstart faces competition from several established players in the fintech industry, including LendingClub, Kabbage, and Avant. Despite the competition, Upstart has been successful in fundraising, having secured over $1.6 billion in funding throughout its existence.

Recent Earnings:

- Revenue and Growth: Upstart reported revenue of $140 million, falling short of analyst expectations of $142 million.

- EPS and Growth: The EPS reflects a year-over-year decline compared to adjusted net loss per share of $0.47 in Q4 2022.

- Operational Metrics: Upstart reported a conversion rate of 11.6% for loan requests in Q4 2023, which is an improvement from 10.5% in the same period of the prior year.

- Forward Guidance: Upstart projected revenue of $150 million for the next quarter, indicating their anticipation of a rebound in growth.

The Market, Industry, and Competitors:

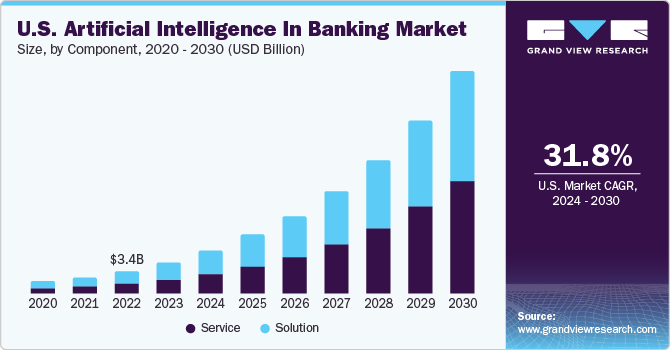

This market is expected to experience significant growth in the coming years, driven by factors like increasing adoption of AI in financial services and a growing demand for alternative lending options. Analysts predict a Compound Annual Growth Rate (CAGR) of approximately 25.99% between 2024 and 2030 for this market. This translates to a potential market size of $1 trillion by 2030, compared to an estimated current market size of $250 billion. The rise of AI-powered lending offers numerous benefits, including faster loan approvals, more flexible loan terms, and potentially lower interest rates for borrowers with limited credit history. This makes Upstart well-positioned to capitalize on this expanding market.

Unique differentiation:

Upstart Holdings Inc. faces competition from a diverse group of players in the fintech lending landscape:

- Traditional lenders: Established banks and credit unions remain significant competitors.Upstart aims to differentiate itself by providing faster approvals and potentially more favorable rates through its AI-powered approach.

- Fintech lenders: Upstart faces competition from other online lending platforms like LendingClub, Kabbage, and Avant. These companies cater to similar borrower demographics and offer comparable loan products. The competitive edge often lies in factors like interest rates, loan terms, and user experience.

- Specialty lenders: There are also niche players focusing on specific borrower segments or loan types. Upstart competes with these players by offering a wider range of loan products while leveraging AI to potentially approve borrowers who might be rejected elsewhere.

Upstart has a two-pronged approach that sets it apart from competitors in the lending market:

- AI-powered credit assessment: Upstart goes beyond traditional credit scores by utilizing artificial intelligence (AI) to analyze a wider range of data points when evaluating borrowers. This includes factors like education, employment history, and even alternative data sources. This allows Upstart to potentially approve borrowers who might be rejected by traditional lenders or competitors relying solely on credit scores.

- Focus on accessibility and affordability: Upstart focus on financial inclusion makes Upstart appealing to a broader pool of borrowers compared to competitors who might have stricter lending criteria.

Management & Employees:

- David Girouard (Co-Founder and CEO): Girouard spearheads Upstart’s vision and strategy. He brings prior experience as a senior executive at Google.

- Paul Gu (Co-Founder): Gu’s expertise lies in product development and data science. He plays a crucial role in shaping Upstart’s AI-powered lending platform.

- Anna Counselman (Co-Founder and Senior VP of Business Operations): Counselman oversees Upstart’s internal operations and ensures smooth business functionality.

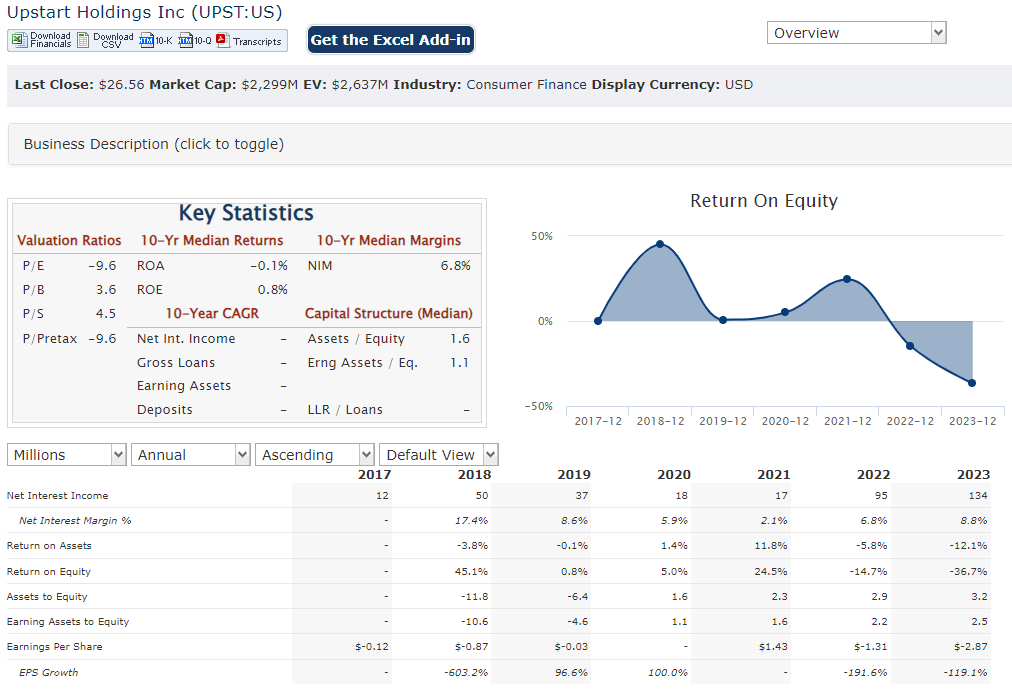

Financials:

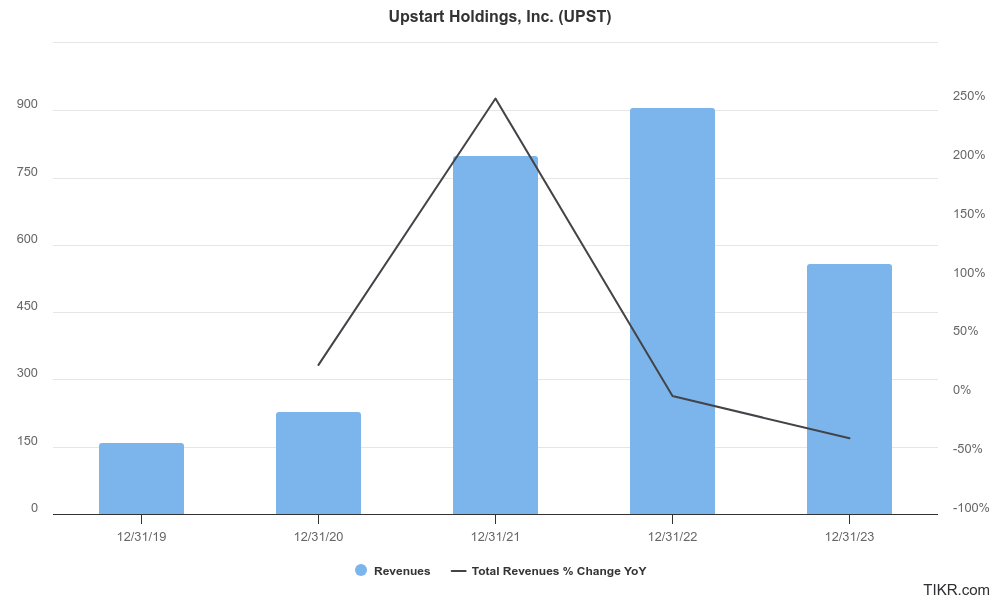

Upstart Holdings Inc. as witnessed a remarkable surge, with revenue increasing by over 600%. This translates to a Compound Annual Growth Rate (CAGR) exceeding 200% during that period. However, 2022 and 2023 saw a shift in this trend. Revenue growth slowed down considerably, and even dipped slightly in 2023 compared to 2022.

While Upstart has yet to achieve profitability, their focus has primarily been on revenue growth and market share acquisition. Despite increasing revenue in the early years, the company has consistently reported net losses.

In terms of their balance sheet, Upstart has likely seen an increase in assets over the past five years due to their revenue growth. This could include cash reserves, investments, and loans receivable. Liabilities would also likely have grown as the company expanded, potentially through debt financing or accounts payable.

Technical Analysis:

On the monthly and weekly chart the stock is still in a base-building (accumulation) phase – stage 1 – which means they are range bound. On the daily chart it is still on a stage 4 markdown (bearish). There is support in the $22.X range and resistance in the $26 and $33 range. We expect shares to move slightly up to next earnings, but if the small bull flag on the daily chart materializes, we expect shares to get to $35.

Bull Case:

- With lower interest rates expected in 2024, the market for personal and other loans should see an increase, which will result in revenue growth.

- Large addressable market: The consumer lending market in the US alone is massive, estimated to be in the trillions of dollars. Upstart is currently focused on personal loans, auto loans, and small-dollar relief loans, but they have the potential to expand into other loan products in the future.

- Strong financial performance (historically): The explosive growth rates witnessed in the early years demonstrate the potential of Upstart’s business model. Analysts believe with economic recovery and continued refinement of their AI model, Upstart can return to a high-growth trajectory.

- Recovery from recent stumbles: Upstart’s recent stock price decline is partly attributed to broader economic factors. Bulls believe the company can overcome these challenges and their stock price can rebound as the market recovers and Upstart demonstrates continued progress.

Bear Case:

- Economic dependence: Upstart’s business model relies heavily on a healthy economy. During economic downturns, loan defaults could rise significantly, hurting Upstart’s revenue and profitability.

- Profitability concerns: Despite early revenue growth, Upstart has yet to achieve consistent profitability. Bears might be skeptical about the company’s ability to turn a profit in the long run, especially if economic conditions worsen or competition intensifies.

- Reliance on lending partners: Upstart originates loans through partnerships with banks and credit unions. If these partnerships falter, Upstart’s loan volume and revenue could suffer.