Executive Summary:

ODDITY Tech Ltd, founded in 2013, operates in the beauty and wellness space but utilizes technology to set themselves apart. Their platform leverages data and machine learning to develop and sell beauty products through their brands like IL MAKIAGE and SpoiledChild. They claim this approach allows for highly targeted solutions and disrupts the traditional beauty market. ODDITY emphasizes user data and feedback in their business model, aiming to provide precise product matches and a superior customer experience.

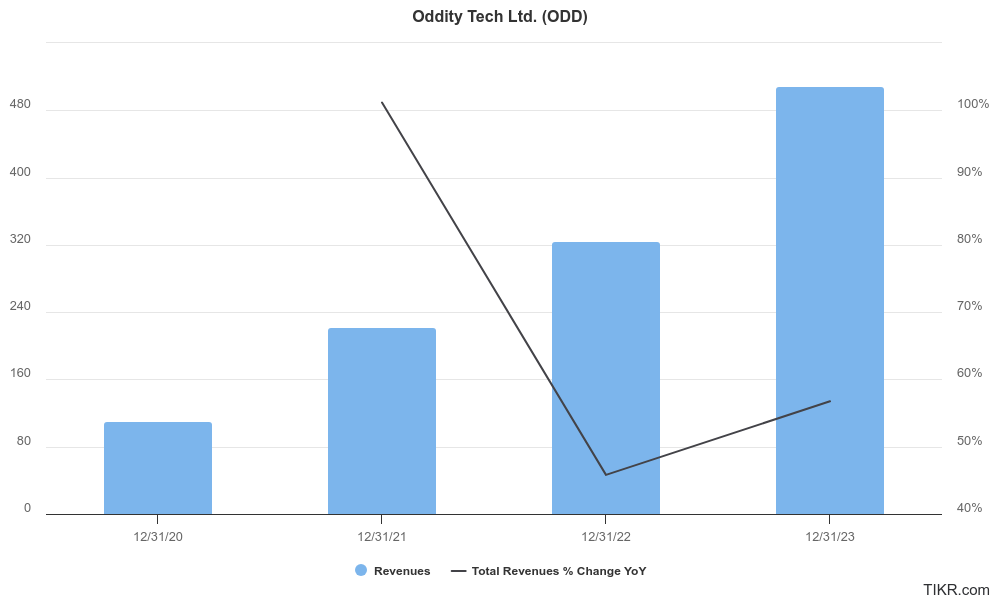

Revenue reached $508.69 million, a significant increase compared to $324.52 million the prior year. This translates to year-over-year growth of over 57%.

EPS was reported at $1.31. Financial guidance for 2024 indicates expectations of EPS between $1.49 and $1.54, showcasing continued profitability.

Stock Overview:

| Ticker | $ODD | Price | $45.00 | Market Cap | $2.56B |

| 52 Week High | $56.00 | 52 Week Low | $24.12 | Shares outstanding | 45.32M |

Company background:

ODDITY Tech Ltd. is an Israeli company that disrupts the beauty and wellness industry by leveraging data and machine learning. They operate a consumer tech platform designed to support a portfolio of brands and services within this vast market.

ODDITY’s approach involves utilizing user data and AI to personalize product recommendations and even develop entirely new formulas for beauty and wellness products.

The company is headquartered in Tel Aviv, Israel, and has received funding from notable investors like Balderton Capital and L Catterton. ODDITY faces competition from established players in the beauty space like E.L.F., Estee Lauder Companies, L’Oreal, Sephora, and Ulta Beauty. Their recent financial performance suggests strong growth, potentially indicating the success of their data-centric model.

Recent Earnings:

- Revenue: ODDITY reported strong revenue growth, reaching $508.69 million for the full year 2023. This signifies a significant increase compared to $324.52 million in the previous year, translating to a year-over-year growth of 57%.

- EPS (Earnings Per Share): ODDITY reported an adjusted diluted EPS of $1.31 for the year.

The Market, Industry, and Competitors:

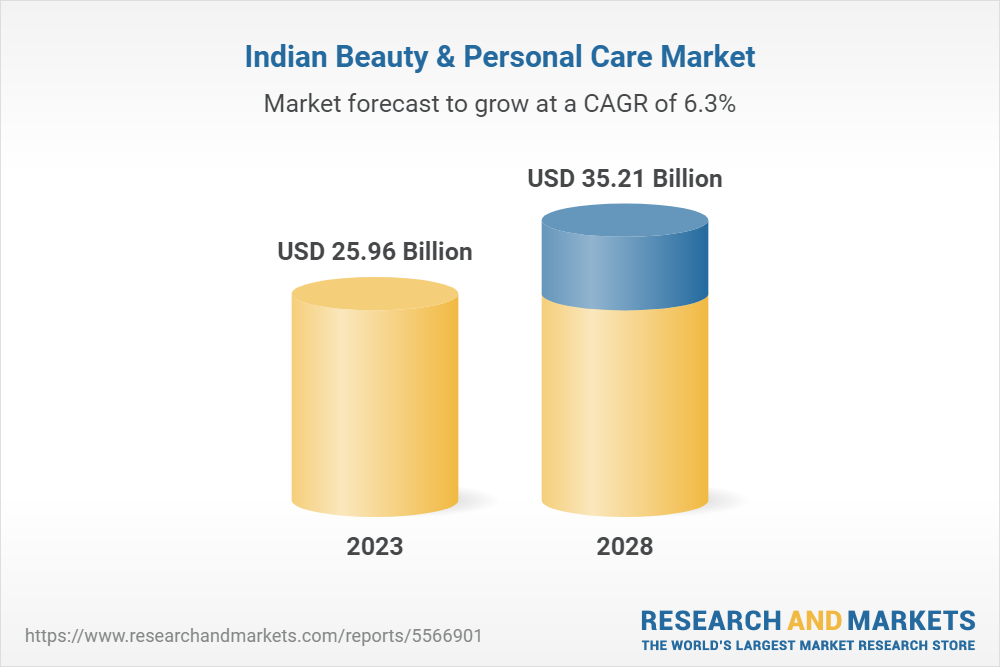

ODDITY Tech Ltd. this global market is projected to reach a value of over $712 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of approximately 5.7%.

This growth is attributed to several factors, including rising disposable income in emerging economies, increasing consumer awareness of personal care and wellness, and the growing influence of social media and digital marketing.

Unique differentiation:

- Beauty giants: Companies like L’Oreal, Estee Lauder Companies, Sephora, and Ulta Beauty possess strong brand recognition, extensive distribution networks, and significant resources for product development and marketing. These factors can make it challenging for ODDITY to gain market share.

- Traditional retailers: Companies like Walmart, Target, and Amazon also offer a wide range of beauty products, often at competitive prices.

New-Age Competitors:

- Direct-to-consumer (D2C) brands: Several new companies are adopting similar data-driven approaches, focusing on online sales and personalized product recommendations. Examples include Glossier, Kylie Cosmetics, and The Ordinary.

- Tech-enabled startups: Companies that leverage technology to create niche product offerings or cater to specific customer segments can also pose a threat.

Data-Driven Personalization:

- Focus on AI and machine learning: ODDITY leverages user data and AI algorithms to personalize product recommendations and even develop entirely new formulas based on customer preferences and needs. This sets them apart from traditional companies that rely on generic marketing strategies.

- Targeted solutions: Their approach aims to address the limitations of “one-size-fits-all” solutions in the beauty market.

Direct-to-Consumer Model:

- Reduced overhead costs: By bypassing traditional retail channels, ODDITY potentially benefits from lower operational costs, allowing them to potentially offer competitive pricing.

- Enhanced customer experience: Direct control over the customer journey allows for tailored communication, promotions, and loyalty programs, fostering stronger brand engagement.

Management & Employees:

- Oran Holtzman: Co-founder, Chief Executive Officer (CEO), and Executive Chairman – Responsible for the company’s overall strategy and direction.

- Shiran Holtzman-Erel: Co-founder and Chief Product Officer (CPO) – Leads product development and innovation initiatives.

- Lindsay Drucker Mann: Chief Financial Officer (CFO) – Oversees financial operations and reporting.

Financials:

Earnings Growth:

- While growth figures weren’t provided, their recent press release indicates confidence in continued profitability, with projected EPS for 2024 ranging from $1.49 to $1.54.

Balance Sheet:

- Oddity reports strong cash flow generation. They reported $85 million in free cash flow for the full year 2023.

Technical Analysis:

After an IPO base (cup below) the shares are range-bound in the weekly and monthly chart. On the daily chart there is a consolidation off the $48 range and as a trade, this stock shows entry close to the $38 range and sell off at the $45 range.

Bull Case:

- Market Growth: The global beauty and wellness market is projected to experience significant growth in the coming years, reaching over $712 billion by 2030.

- Data-Driven Personalization: ODDITY’s unique selling proposition lies in its focus on leveraging AI and machine learning to personalize product recommendations and potentially develop customized formulas. This approach caters to the growing consumer demand for targeted solutions in the beauty space.

- Strong Brand Portfolio: Owning established brands like IL MAKIAGE and SpoiledChild provides a foundation for customer loyalty and brand recognition.

Bear Case:

- Limited Differentiation: While ODDITY emphasizes its data-driven personalization, the long-term effectiveness of this approach compared to traditional marketing strategies or similar tactics employed by competitors remains to be proven.

- Dependence on Technology: ODDITY’s success heavily relies on the accuracy and effectiveness of their AI algorithms and data analysis. Technical glitches, issues with data collection, or an inability to adapt their technology to evolving consumer preferences could significantly impact their business.

- Limited Financial Transparency: While ODDITY reports revenue and EPS figures, a more comprehensive analysis of their financial health, including detailed breakdowns of operational metrics like customer acquisition cost and user base, is not readily available. This lack of transparency can raise concerns for potential investors.