Company Overview

Abercrombie & Fitch Co. (NYSE: ANF) is a U.S.-based specialty retailer that designs and sells casual apparel and accessories through its brands: Abercrombie & Fitch, abercrombie kids, Hollister, and Gilly Hicks. Founded in 1892, the company has evolved from an elite sporting goods outfitter to a modern lifestyle brand targeting young adults and teens. Headquartered in New Albany, Ohio, Abercrombie operates a global network of physical stores and a growing e-commerce platform. Under CEO Fran Horowitz, the company has undergone a significant brand transformation, focusing on inclusivity, digital innovation, and customer-centric design. This repositioning has revitalized its image and financial performance.

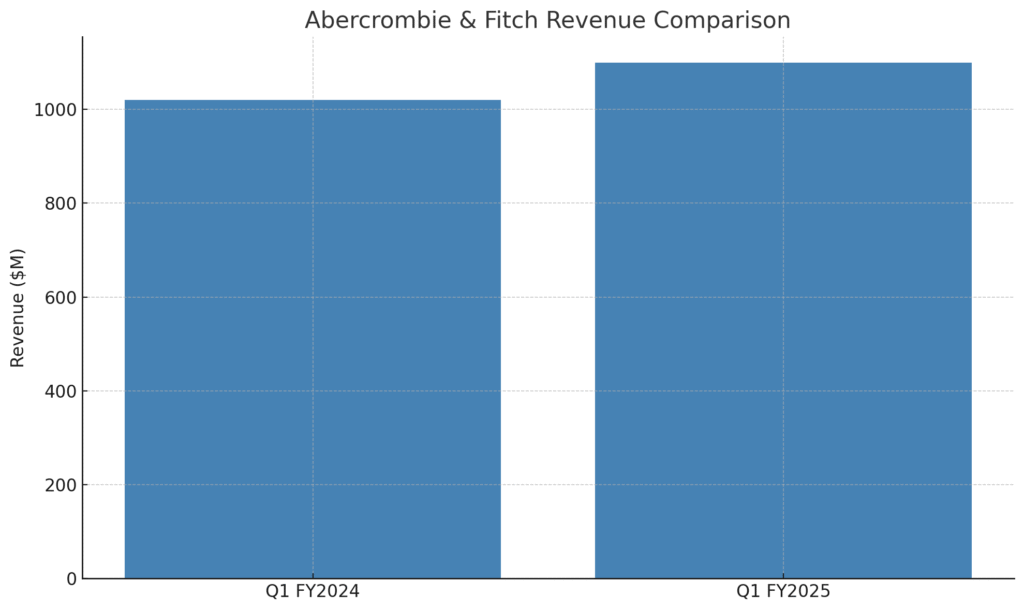

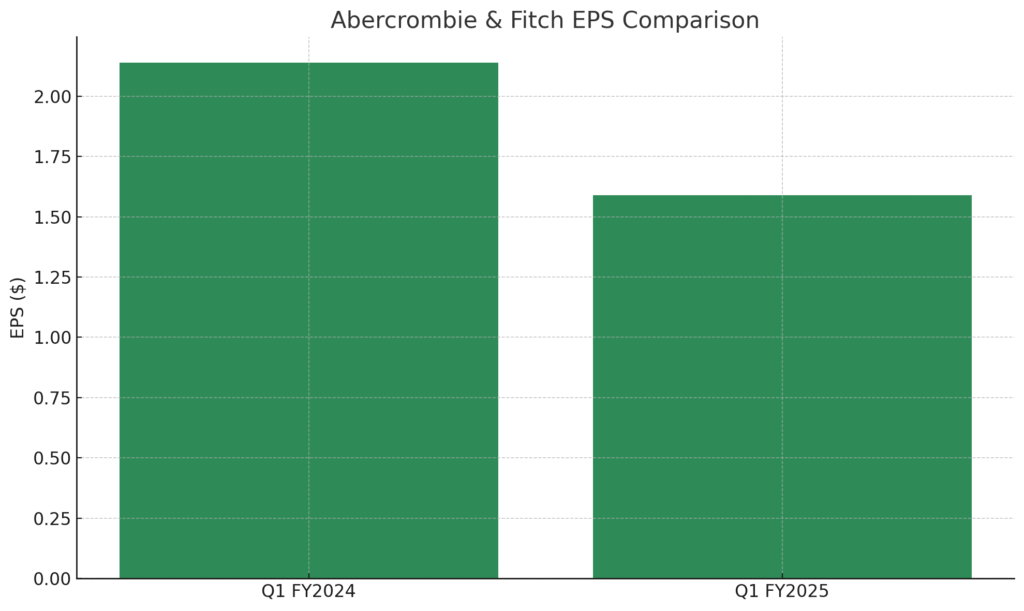

Q1 2025 Earnings Summary

In Q1 FY2025, Abercrombie & Fitch reported earnings per share (EPS) of $1.59, surpassing analyst expectations of $1.33. Revenue reached $1.1 billion, marking an 8% increase year-over-year, though slightly below the consensus estimate of $1.08 billion. The company provided guidance for Q2 FY2025 with an EPS range of $2.10 to $2.30, compared to the consensus estimate of $2.47. For the full fiscal year 2025, Abercrombie anticipates EPS between $9.50 and $10.50, aligning closely with analyst expectations of $10.28. The company also projects net sales growth of 3% to 6% and an operating margin between 12.5% and 13.5% .

Founding, Products, and Headquarters

Abercrombie & Fitch was established in 1892 by David Abercrombie as an upscale sporting goods store in Manhattan, New York. Ezra Fitch joined as a partner in 1900, leading to the company’s rebranding as Abercrombie & Fitch in 1904 . Over the years, the company transitioned from selling outdoor gear to focusing on casual apparel. Today, its product offerings include clothing, personal care items, footwear, and accessories. The company’s headquarters are located in New Albany, Ohio .

Market Landscape and Growth Expectations

Abercrombie & Fitch operates in the global apparel retail market, which is experiencing steady growth driven by factors such as increasing disposable income, fashion consciousness, and the rise of e-commerce. The company’s strategic focus on digital transformation and expanding its online presence positions it well to capitalize on these trends. Additionally, its efforts to diversify product lines and appeal to a broader demographic are expected to contribute to sustained growth.

Competitive Landscape

The apparel retail industry is highly competitive, with Abercrombie & Fitch facing competition from both traditional retailers and fast-fashion brands. Key competitors include American Eagle Outfitters, H&M, Forever 21, Gap, Tommy Hilfiger, J.Crew, Urban Outfitters, Zara, and Uniqlo . These companies compete on various factors such as price, fashion trends, brand loyalty, and digital engagement.

Differentiation Strategy

Abercrombie & Fitch differentiates itself through a combination of brand repositioning, product innovation, and customer engagement. The company has shifted from its previous exclusive image to a more inclusive and diverse brand identity. This transformation includes expanding size ranges, modernizing store designs, and enhancing digital capabilities. Additionally, the launch of specialized collections, such as “The Wedding Shop,” demonstrates the company’s commitment to meeting evolving customer needs and preferences .

Management Team Overview

- Fran Horowitz, CEO since 2017, has been instrumental in the company’s turnaround, focusing on brand revitalization and customer-centric strategies.

- Scott Lipesky, Executive Vice President and Chief Operating Officer, previously served as CFO and brings extensive experience in financial management and operational efficiency.

- Robert Ball, appointed CFO in November 2024, has a strong background in corporate finance and investor relations, contributing to the company’s financial stability and strategic planning .

Financial Performance Overview

Over the past five years, Abercrombie & Fitch has demonstrated significant financial improvement. The company’s revenue grew from $3.6 billion in FY2020 to $4.9 billion in FY2025, reflecting a compound annual growth rate (CAGR) of approximately 6.4% . Earnings have also seen substantial growth, with a five-year CAGR of 50.8%, indicating strong profitability and effective cost management . The company’s balance sheet remains robust, with strong liquidity and ongoing investments in digital infrastructure and store modernization.

Bull Case for ANF Stock

- Strong Brand Revitalization: Successful rebranding efforts have attracted a broader customer base and enhanced brand loyalty.

- Digital Transformation: Investments in e-commerce and digital marketing have expanded the company’s reach and sales channels.

- Product Diversification: Introduction of new product lines and collections caters to diverse customer needs and occasions.

Bear Case for ANF Stock

- Intense Competition: The apparel retail market is saturated, with numerous competitors vying for market share.

- Economic Sensitivity: Consumer spending on apparel is discretionary and can be impacted by economic downturns.

- Supply Chain Challenges: Global supply chain disruptions could affect inventory management and product availability.

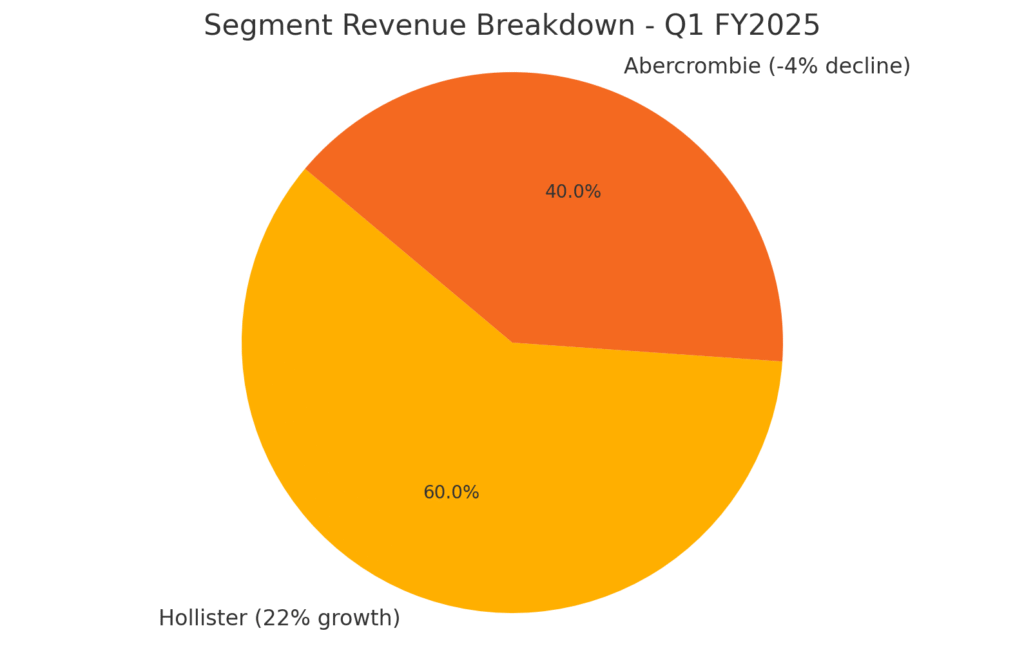

Segment-wise, the Hollister brand experienced a robust 22% year-over-year sales growth, achieving its best-ever first-quarter performance. In contrast, the Abercrombie brand saw a 4% decline in sales. Geographically, the company reported sales growth across all regions: EMEA (Europe, Middle East, and Africa) up 12%, Americas up 7%, and APAC (Asia-Pacific) up 5%.

For FY2025, Abercrombie & Fitch updated its guidance, projecting net sales growth between 3% and 6%, an increase from the previous 3% to 5% range. However, the company lowered its EPS forecast to a range of $9.50 to $10.50 from the earlier $10.40 to $11.40, citing anticipated tariff expenses of approximately $50 million. Operating margin is expected to be between 12.5% and 13.5%.

Following the earnings release, Abercrombie & Fitch’s stock surged over 25% in premarket trading, reflecting investor optimism about the company’s performance and outlook. The strong demand, particularly for the Hollister brand, and the company’s strategic initiatives contributed to the positive market reaction.

CEO Fran Horowitz highlighted the company’s achievement of record first-quarter net sales, attributing the success to broad-based growth across regions and the exceptional performance of the Hollister brand. She acknowledged the challenges posed by tariffs but expressed confidence in the company’s ability to navigate the evolving retail landscape.

The stock is reversing on the monthly chart after a deep sell off stage 4, and is likely to head to the $116 range, but the earnings and guidance suggests a move lower to the $85 range is likely post the earnings euphoria.