Company Overview

DLocal Limited (NASDAQ: DLO) is a Uruguayan fintech company specializing in cross-border payment solutions for global merchants targeting emerging markets. Founded in 2016 and headquartered in Montevideo, Uruguay, the company provides a platform that enables businesses to accept payments, send payouts, and settle funds across various countries with a single integration. DLocal’s services are tailored to address the complexities of local payment methods, regulations, and currencies in regions such as Latin America, Africa, and Asia. The company’s focus on emerging markets positions it uniquely to capitalize on the growing demand for digital payment solutions in these areas. As of 2025, DLocal operates in over 20 countries and continues to expand its global footprint.

Recent Earnings Performance

In the first quarter of 2025, DLocal reported revenue of $216.8 million, surpassing analyst expectations of $205.92 million. The company achieved an earnings per share (EPS) of $0.15, exceeding the consensus estimate of $0.12. This performance reflects a significant increase from the EPS of $0.06 reported in the same quarter of the previous year. The company’s net income for the quarter was $46.7 million, marking a 163% year-over-year growth. Looking ahead, analysts project revenue of $227.42 million and an EPS of $0.13 for the next quarter, with full-year expectations set at $952.81 million in revenue and an EPS of $0.55.

Founding and Business Model

DLocal was co-founded in 2016 by Sergio Fogel and Andrés Bzurovski in Montevideo, Uruguay. The company’s mission is to bridge the gap between global merchants and emerging markets by simplifying cross-border payments. DLocal’s platform offers a unified API that allows businesses to accept payments, issue payouts, and manage funds across multiple countries without the need for separate integrations. This approach addresses the challenges of dealing with diverse payment methods, regulatory environments, and currencies in emerging markets. The company’s services are particularly valuable for e-commerce, travel, and digital services companies seeking to expand their reach in these regions.

Market Opportunity and Growth

The global cross-border payments market is experiencing rapid growth, driven by the increasing demand for digital payment solutions in emerging markets. Industry forecasts predict that the retail cross-border payments market will reach $65 trillion by 2030. This growth presents a significant opportunity for companies like DLocal that specialize in facilitating payments in these regions. The company’s focus on emerging markets positions it to benefit from the ongoing digital transformation and increased internet penetration in these areas. By providing localized payment solutions, DLocal is well-equipped to capture a substantial share of this expanding market.

Competitive Landscape

DLocal operates in a competitive landscape that includes both global and regional players. Key competitors include Payoneer, PagSeguro, Sezzle, Western Union, and Evertec. These companies offer various payment solutions, ranging from digital wallets to money transfer services. However, DLocal differentiates itself by focusing exclusively on emerging markets and providing a unified platform that simplifies cross-border transactions for global merchants. This specialization allows DLocal to offer tailored solutions that address the unique challenges of operating in these regions.

Unique Differentiation

DLocal’s unique value proposition lies in its ability to provide a single integration for global merchants to access multiple emerging markets. Unlike competitors that may require separate integrations for each country, DLocal’s platform simplifies the process by offering a unified API. This approach reduces complexity and accelerates time-to-market for businesses expanding into new regions. Additionally, DLocal’s deep understanding of local payment methods, regulatory requirements, and consumer behaviors enables it to offer customized solutions that resonate with local markets. This localized expertise is a significant competitive advantage in the fragmented and complex landscape of emerging market payments.

Management Team

DLocal’s leadership team comprises experienced professionals with a strong background in finance and technology. Pedro Arnt serves as the Chief Executive Officer, bringing extensive experience in financial management and strategic planning.Sergio Fogel, one of the company’s co-founders, holds the position of President and Chief Strategy Officer, leveraging his entrepreneurial background to drive the company’s strategic initiatives. Carlos Menendez serves as the Chief Operating Officer, overseeing the company’s global operations and ensuring the effective delivery of services across markets.

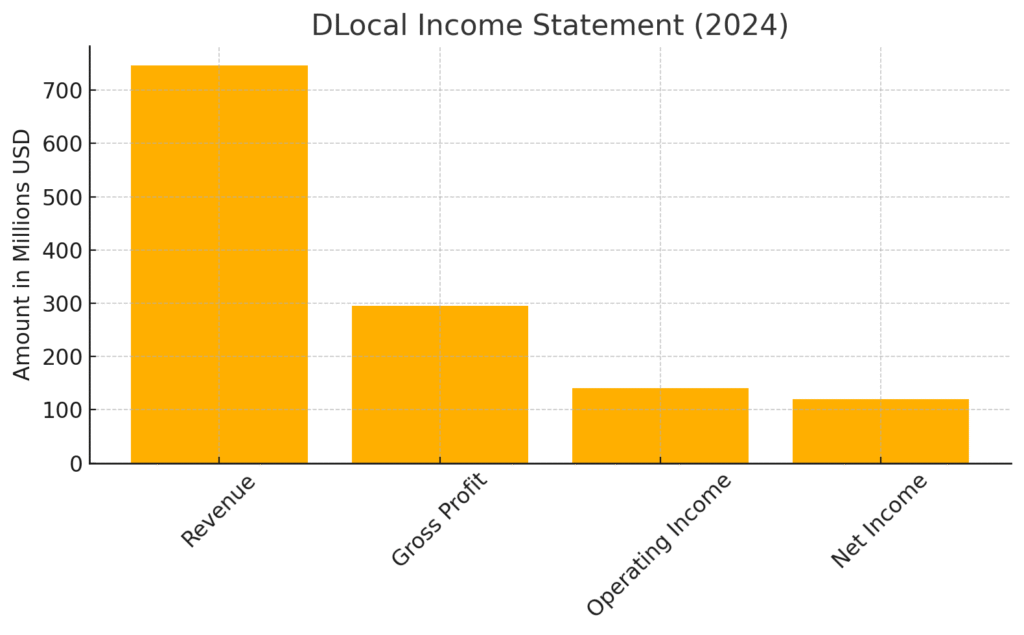

Financial Performance Overview

Over the past five years, DLocal has demonstrated robust financial growth. The company’s revenue increased from $104.14 million in 2020 to $745.97 million in 2024, representing a compound annual growth rate (CAGR) of approximately 63%. This growth is attributed to the company’s successful expansion into new markets and the increasing adoption of digital payment solutions in emerging economies. DLocal’s net income also showed significant improvement, reflecting the company’s ability to scale its operations efficiently while maintaining profitability. The company’s balance sheet remains strong, with substantial cash reserves and manageable debt levels, providing the financial flexibility to invest in future growth opportunities.

Bull Case for DLocal Stock

- Strong growth potential in the rapidly expanding cross-border payments market, particularly in emerging economies.

- Unique value proposition with a unified platform that simplifies cross-border transactions for global merchants.

- Robust financial performance with consistent revenue and net income growth, supported by a strong balance sheet.

Bear Case for DLocal Stock

- Exposure to regulatory risks and economic volatility in emerging markets, which could impact operations and profitability.

- Intensifying competition from both global and regional payment service providers, potentially leading to margin pressures.

- Dependence on a limited number of large clients, which could pose concentration risks if key clients reduce their business with DLocal.

The stock is in a consolidation phase stage 1 (neutral) on the weekly chart and likely to move higher because of earnings to the $14 mark.