Archer Aviation Inc. (NYSE: ACHR) is a California-based aerospace company developing electric vertical takeoff and landing (eVTOL) aircraft for urban air mobility. Their flagship model, the Midnight, is designed for short-haul flights, offering a sustainable alternative to traditional ground transportation. Archer aims to revolutionize urban commuting by providing efficient, low-noise, and zero-emission air taxi services. The company has secured significant partnerships, including a $1 billion order from United Airlines and a manufacturing alliance with Stellantis. Archer is also exploring defense applications through a collaboration with Anduril Industries.

Archer Aviation Inc. $ACHR, founded in 2018 and headquartered in Santa Clara, California, is a leading developer of electric vertical takeoff and landing (eVTOL) aircraft, aiming to revolutionize urban air mobility. In 2024, the company reported annual revenues of approximately $0.5 million, reflecting its pre-revenue stage as it focuses on aircraft development and certification. Archer’s primary competitors include Joby Aviation, Lilium, and Vertical Aerospace.

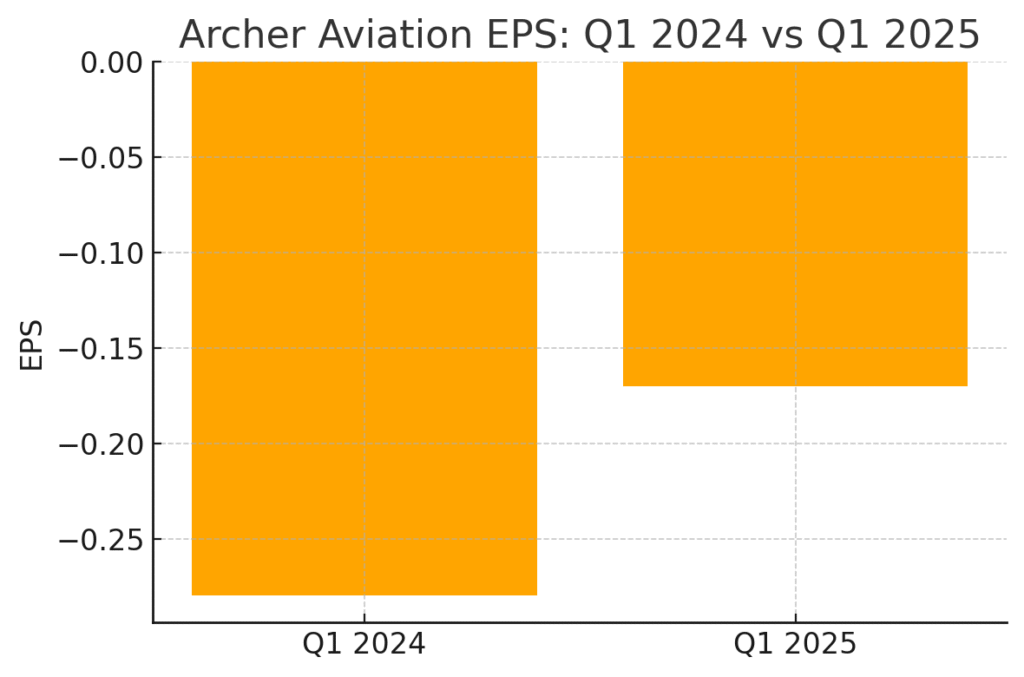

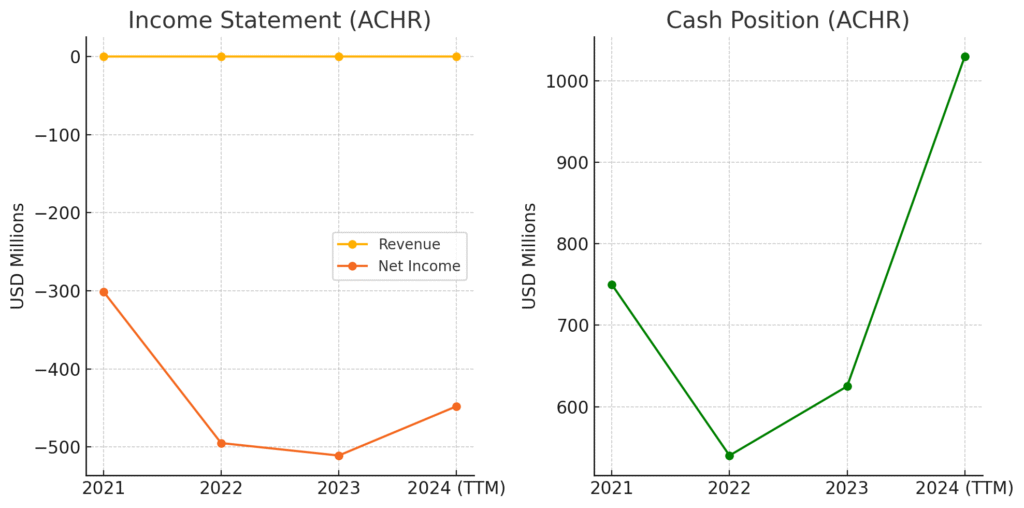

In Q1 2025, Archer reported a net loss of $93.4 million, an improvement from the $116.5 million loss in Q1 2024. The company’s adjusted EBITDA loss was $109 million, within the guided range of $95–$110 million. Earnings per share (EPS) came in at -$0.17, beating analyst expectations of -$0.28. Archer ended the quarter with a strong cash position of $1.03 billion, bolstered by a $301.8 million direct equity offering.

Archer’s revenue streams are currently limited, given its developmental stage. However, the company has made significant strides in establishing partnerships and securing contracts that promise future revenue. Notably, Archer has agreements with major entities like Abu Dhabi Aviation and Ethiopian Airlines for its “Launch Edition” program. The company also highlighted a partnership with Palantir Technologies Inc. to build AI for the future of next-generation aviation technologies.

For Q2 2025, Archer anticipates an adjusted EBITDA loss between $100 million and $120 million. The company plans to deliver its first Midnight aircraft to the UAE in the coming months, with planned deployment slated for later this year.Archer also aims to produce two aircraft per month by the end of 2025 and is preparing for piloted flights imminently.

Following the earnings release, Archer’s stock experienced a 5.29% increase in after-hours trading, reaching $9.56. This positive reaction reflects investor confidence in the company’s strategic direction and financial health.

CEO Adam Goldstein emphasized the significance of 2025 as a pivotal year, stating, “2025 is an inflection point for the company and for the industry.” He reiterated the company’s commitment to bringing the Midnight aircraft to market safely and efficiently.

Founded in 2018 by Adam Goldstein and Brett Adcock, Archer Aviation is headquartered in Santa Clara, California. The company has raised approximately $2 billion in funding from investors such as Stellantis, United Airlines, BlackRock, and Wellington Management. Archer’s primary product, the Midnight eVTOL aircraft, is designed for urban air mobility, offering a range of up to 100 miles and a top speed of 150 mph. Key competitors include Joby Aviation, Wisk Aero, and Lilium.

Archer operates in the emerging eVTOL market, which is projected to grow significantly in the coming years. Estimates suggest the market could reach $30 billion by 2030, with a compound annual growth rate (CAGR) of approximately 12.6%. This growth is driven by increasing urbanization, advancements in battery technology, and a global push toward sustainable transportation solutions.

Competitors in the eVTOL space include Joby Aviation, which focuses on longer-range aircraft; Wisk Aero, backed by Boeing, emphasizing autonomous flight; and Lilium, which utilizes a unique ducted-fan design for regional travel. Archer differentiates itself with its focus on urban air mobility, strategic partnerships, and a design optimized for short, frequent flights.

Archer’s unique differentiation lies in its strategic collaborations and targeted market approach. The partnership with Stellantis provides manufacturing expertise, while the alliance with United Airlines offers a ready customer base. Archer’s focus on urban air mobility, combined with its emphasis on safety, noise reduction, and sustainability, positions it distinctively in the eVTOL market.

The management team is led by CEO Adam Goldstein, who co-founded Archer and brings a background in entrepreneurship and technology. The team includes experienced professionals from the aerospace and automotive industries, contributing to Archer’s innovative approach to urban air mobility.

Financially, Archer has not yet generated revenue, as it is in the pre-commercialization phase. The company reported a net loss of approximately $447.8 million in the trailing twelve months. Archer’s substantial cash reserves, bolstered by recent funding rounds, provide a runway to continue development and certification efforts. The company’s focus remains on achieving FAA certification and initiating commercial operations.

Bull Case:

- Strategic partnerships with industry leaders like Stellantis and United Airlines provide manufacturing capabilities and a customer base.

- Strong financial backing with over $2 billion in funding supports ongoing development and certification efforts.

- Positioning in the growing urban air mobility market offers significant long-term growth potential.

Bear Case:

- Lack of current revenue generation and ongoing losses may pressure financial sustainability.

- Regulatory hurdles and the complexity of achieving FAA certification could delay commercial launch.

- Intense competition in the eVTOL space may impact market share and profitability.