Executive Summary:

Atlanta Braves Holdings, Inc. owns and operates the Atlanta Braves Major League Baseball Club. Its business extends beyond just the baseball team, encompassing the operation of Truist Park, the team’s stadium. The company is also involved in the mixed-use real estate development known as The Battery Atlanta, which includes retail, office, hotel, and entertainment spaces.

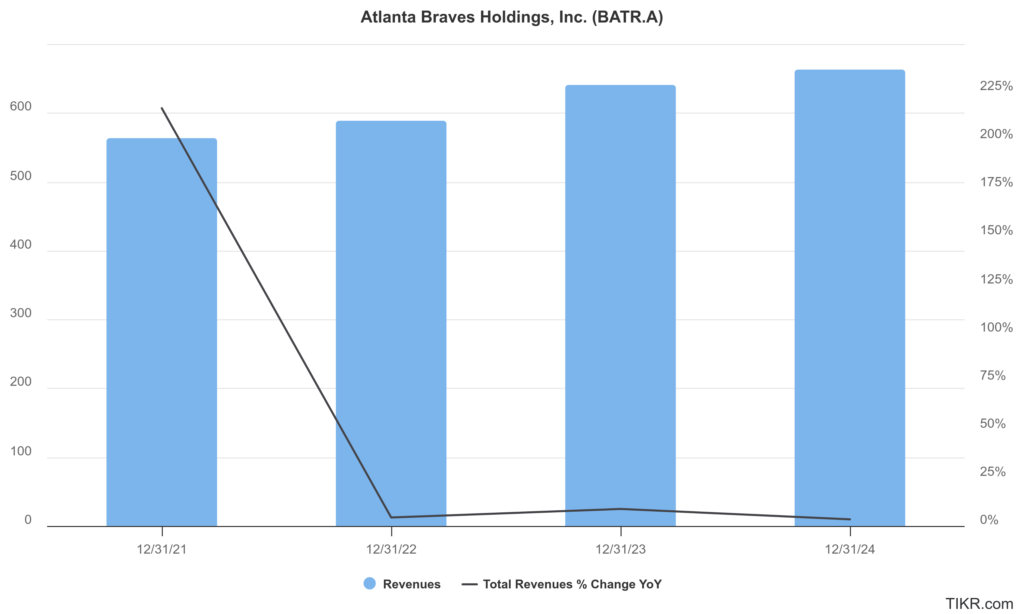

Atlanta Braves Holdings, Inc. released its total revenue, reaching $663 million in the fourth quarter, showing growth from $641 million in the prior year. This revenue increase was driven by a 2% rise in baseball revenue, reaching $595 million, and a 14% growth in mixed-use development revenue, which hit $67 million.

Stock Overview:

| Ticker | $BATRA | Price | $44.06 | Market Cap | $2.51B |

| 52 Week High | $46.65 | 52 Week Low | $38.90 | Shares outstanding | 10.32M |

Company background:

Atlanta Braves Holdings, Inc. is a company centered around the Atlanta Braves Major League Baseball Club. It encompasses the broader business operations tied to the team and its associated real estate. Atlanta Braves Holdings, Inc. owns Braves Holdings, LLC, which is the entity that owns the Atlanta Braves and the assets related to Truist Park.

Key aspects of the company include its ownership and operation of Truist Park, the Atlanta Braves’ stadium, and the development and management of The Battery Atlanta. This mixed-use development surrounding the stadium features retail, office, hotel, and entertainment spaces, creating a multifaceted revenue stream. The company’s business model combines professional sports with real estate development. The company was separated as a tracking stock from Liberty Media Corporation, and became its own entity in 2022. The headquarters of Atlanta Braves Holdings, Inc. is located in Atlanta, Georgia.

Atlanta Braves Holdings, Inc. operates within the professional sports and entertainment industry. Its key competitors include other Major League Baseball teams and the companies that own them, as well as those involved in the broader entertainment and real estate development sectors. For the Battery Atlanta mixed-use development, competitors are other mixed-use real estate developments.

Recent Earnings:

Atlanta Braves Holdings, Inc. reported total revenue of $663 million in the fourth quarter. This represents an increase from $641 million in the same period of the previous year. Baseball revenue saw a 2% annual increase, reaching $595 million, driven by factors like new sponsorship deals and contractual rate increases. The Battery Atlanta, demonstrated substantial growth, with revenue rising by 14% to $67 million. This segment’s growth is a key driver for the company.

The mixed-use development segment’s Adjusted OIBDA showed a 15% increase, indicating strong operational performance. Factors such as reduced attendance at regular season home games impacted certain revenue streams. The company’s strategic focus remains on maximizing revenue from both its baseball operations and the development of The Battery Atlanta. The company also focuses on media partnerships and maintaining a competitive roster. The management has emphasized that they are focused on maintaining strong liquidity, and growing their international brand.

The Market, Industry, and Competitors:

Atlanta Braves Holdings Inc. operates primarily in the entertainment and real estate sectors, with its core business centered around owning and managing the Atlanta Braves Major League Baseball team. The company also oversees Truist Park, the Braves’ stadium, and The Battery Atlanta, a mixed-use development that includes retail, office spaces, hotels, and entertainment venues. This diversified approach allows the company to generate revenue from baseball operations and real estate and hospitality activities. Atlanta Braves Holdings is categorized under the Communication Services sector and Entertainment industry, and it has a market capitalization of approximately $3.87 billion as of early 2025.

The company is projected to achieve an aggressive annual growth rate of 74% to reach profitability by 2024, driven by investments in infrastructure and operational efficiency. This optimistic forecast depends on maintaining strong performance across both baseball and real estate segments. Challenges such as high debt levels—currently over twice its equity—pose risks that could impact long-term growth expectations if not addressed effectively.

While the entertainment sector generally offers robust growth opportunities due to increasing consumer demand for live events and experiences, the company’s reliance on mixed-use developments adds complexity to its financial outlook. If successful in navigating these challenges, Atlanta Braves Holdings could emerge as a profitable and diversified player in both sports management and real estate development by the end of the decade.

Unique differentiation:

Atlanta Braves Holdings, Inc. faces competition across two primary sectors: professional sports, specifically Major League Baseball (MLB), and the mixed-use real estate development market. In the MLB arena, the company’s direct competitors are the other 29 MLB franchises. These teams vie for fan attention, ticket sales, media viewership, and sponsorship dollars. Each team operates as a distinct business entity, with varying ownership structures, stadium experiences, and market demographics. Competition within MLB is intense, as teams strive to build competitive rosters, enhance stadium experiences, and maximize revenue streams. The success of each team is heavily influenced by on-field performance, which directly impacts attendance and fan engagement.

Atlanta Braves Holdings, Inc. competes in the mixed-use real estate development sector through its operation of The Battery Atlanta. The company’s competitors are other developers and operators of similar mixed-use projects. These developments often combine retail, dining, entertainment, residential, and office spaces, aiming to create vibrant, integrated destinations. Competitors in this space include companies specializing in urban development, entertainment venue management, and retail property operations. The success of The Battery Atlanta hinges on its ability to attract and retain tenants, create compelling consumer experiences, and maintain a competitive edge in the regional real estate market. The company also competes with other entertainment venues, for consumer spending, in the greater Atlanta region.

- Integrated Sports and Entertainment Destination: Unlike most MLB franchises that primarily focus on baseball operations, Atlanta Braves Holdings, Inc. has successfully developed and integrated The Battery Atlanta, a mixed-use development surrounding Truist Park. This creates a year-round entertainment destination, extending the company’s revenue streams beyond the baseball season. This integration allows the company to capture value from various sources, including retail, dining, entertainment, and hospitality, in addition to traditional sports revenue. This diversified approach enhances the company’s financial stability and reduces its reliance on seasonal baseball operations.

- Enhanced Fan Experience: The Battery Atlanta enhances the overall fan experience by providing a vibrant and engaging environment before, during, and after games. This creates a more immersive and memorable experience for attendees, fostering stronger fan loyalty. This comprehensive approach to fan engagement sets the company apart from competitors that primarily focus on the in-stadium experience.

Management & Employees:

Derek Schiller: As the President and CEO of the Atlanta Braves, he oversees the team’s business operations, including ticket sales, marketing, and corporate partnerships. He plays a significant role in the strategic direction of both the baseball club and The Battery Atlanta.

Mike Plant: Serving as the President and CEO of Braves Development Company, he is responsible for the development and management of The Battery Atlanta. His expertise in real estate and development is crucial to the success of this mixed-use project.

John Malone: The Chairman of Liberty Media, which has a controlling interest in Atlanta Braves Holdings, he plays a strategic role in the overall direction of the company. His experience in media and entertainment is invaluable.

Financials:

Atlanta Braves Holdings Inc. has reported revenues of approximately $178 million, which increased substantially to about $568 million in 2021, reflecting a year-over-year growth of over 200%. This growth trajectory continued with revenues reaching approximately $588 million in 2022 and further increasing to around $640 million in 2023. For 2024, the company anticipates revenues of approximately $662 million. The compound annual growth rate (CAGR) for revenue is estimated at around 52%, showcasing a robust expansion driven by increased attendance and enhanced monetization strategies at Truist Park and The Battery Atlanta.

The company reported a net income of approximately -$78 million in 2020, which improved to a loss of about -$11 million in 2021. Net losses persisted, with figures reaching -$35 million in 2022 and -$125 million in 2023. This trend highlights ongoing operational and financial pressures, particularly related to high costs associated with maintaining the stadium and managing player salaries.

Atlanta Braves Holdings has total assets were approximately $1.57 billion, which increased to about $1.64 billion by the end of 2023. The total liabilities have also risen significantly from around $1.29 billion in 2020 to approximately $1.51 billion in 2023. The current ratio has shown some improvement but still indicates potential liquidity risks.

Atlanta Braves Holdings Inc. has demonstrated strong revenue growth with a CAGR of approximately 52%, but its profitability remains a critical concern as evidenced by ongoing net losses and rising liabilities.

Technical Analysis:

The stocks is on a stage 4 decline on the monthly and weekly chart, but consolidating on stage 1 on the daily chart. The near term move is to the support lower at $42.X, but it should recover back to the $46 range post that.

Bull Case:

The Battery Atlanta’s Continued Growth: The mixed-use development surrounding Truist Park is a major driver of the bull case. Its ability to generate consistent revenue from retail, dining, entertainment, and hospitality provides a stable foundation for the company. Further development and optimization of The Battery Atlanta, including attracting new tenants and enhancing the overall consumer experience, could lead to increased revenue and profitability.

Strong Baseball Performance: A consistently competitive Atlanta Braves team drives fan engagement, ticket sales, and media viewership. The team’s on-field success directly translates to increased revenue for the company. The upcoming MLB all-star game hosted at Truist park is expected to be a major catalyst for revenue growth.

Bear Case:

Reliance on Baseball Performance: While The Battery Atlanta provides diversification, the company’s core business remains tied to the Atlanta Braves’ performance. A decline in the team’s on-field success could lead to reduced attendance, lower media viewership, and decreased merchandise sales. The inherent unpredictability of professional sports poses a risk to the company’s revenue stream.

Real Estate Market Risks: The Battery Atlanta’s success is dependent on the health of the local real estate market. Fluctuations in retail, office, and hospitality demand could affect occupancy rates and rental income. Increased competition from other mixed-use developments in the Atlanta region could also pose a challenge.

Media Rights Uncertainty: While media rights are a significant revenue source, changes in the media landscape, such as declining cable viewership or shifts in streaming platform strategies, could impact future deals. The future value of MLB media rights is not guaranteed, and any decline could negatively affect the company’s revenue.