Executive Summary:

International Game Technology (IGT) is a global leader in gaming, providing a wide range of products and services across various gaming segments. The company operates in over 100 countries and offers solutions for lotteries, gaming machines, sports betting, and digital gaming. IGT is known for its innovative technology, extensive game library, and commitment to responsible gaming.

International Game Technology PLC (IGT) reported its revenue for the quarter was $586 million, a 45% decrease from the third quarter of 2023. Diluted earnings per share from continuing operations were $0.17, compared to $0.38 in the prior-year period. Adjusted diluted earnings per share from continuing operations were $0.46, compared to $0.41 in the prior year.

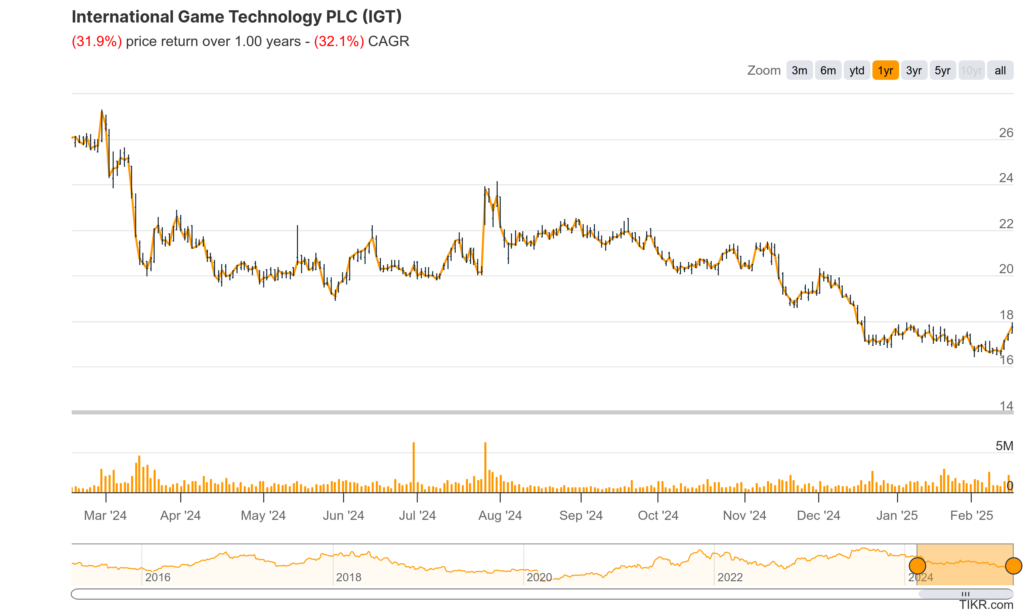

Stock Overview:

| Ticker | $IGT | Price | $17.75 | Market Cap | $3.59B |

| 52 Week High | $27.27 | 52 Week Low | $16.42 | Shares outstanding | 202M |

Company background:

International Game Technology (IGT) is a global gaming giant with a rich history, formed through strategic mergers and acquisitions. The company’s headquarters are in London, UK, its maintain a operational offices in Rome, Italy; Las Vegas, Nevada; and Providence, Rhode Island.

IGT’s primary focus is on providing a comprehensive suite of gaming solutions across various segments. Their offerings include lottery products and services, gaming machines for casinos, sports betting platforms, and digital gaming content. This diverse portfolio caters to a wide range of clients, from government-run lotteries to private casino operators. IGT is known for its innovative technology, extensive game library, and commitment to responsible gaming practices.

Some of its key competitors include Scientific Games, Aristocrat Leisure, and Everi Holdings. These companies offer similar products and services, such as slot machines, lottery systems, and online gaming platforms. IGT differentiates itself through its global reach, diverse product portfolio, and strong relationships with regulators and operators in various jurisdictions.

The company announced a strategic move to spin off its non-lottery businesses and merge them with Everi, while the remaining lottery business would operate under a different name. This restructuring reflects IGT’s focus on its core lottery operations and its commitment to maximizing shareholder value. The company continues to evolve and adapt to the changing landscape of the gaming industry, driven by innovation and strategic partnerships.

Recent Earnings:

International Game Technology PLC (IGT) reported its revenue for the fourth quarter of 2023 was $1.1 billion, a 3% increase compared to the prior-year period. Full-year 2023 consolidated revenue reached $4.3 billion, a 2% increase from the previous year. The growth was 7% net of Italy commercial services sales.

The diluted loss per share for the fourth quarter was $0.04, compared to a loss of $0.32 in the prior year. Adjusted earnings per share increased by 40% to $0.56, versus $0.40 in the prior year. For the full year, diluted income per share was $0.77, compared to $1.35 in the prior year. Adjusted earnings per share for the full year was $2.02, compared to $1.99 in the prior year.

IGT showed a revenue of $586 million, a 44.98% decrease since the same period last year. The earnings per share (EPS) fell -91.3% since last year same period to 0.04 in the Q3 2024. Net income for the quarter was $7 million.

IGT expects revenue between $640 million to $690 million and adjusted EBITDA of $280 million to $300 million, with full-year revenue projected at $4.3 billion – $4.4 billion with an operating margin of 20% – 21%.

The Market, Industry, and Competitors:

International Game Technology PLC (IGT) operates in the global gaming industry, providing a diverse range of products and services. These include lotteries, gaming machines, digital gaming, and sports betting, delivered to regulated public and commercial gaming operators across 100 countries on six continents. IGT’s offerings encompass online and instant lottery systems, iLottery, instant ticket printing, lottery management services, gaming systems, electronic gaming machines, iGaming, and sports betting. The company designs, sells, operates, and leases point-of-sale machines for lottery funds reconciliation, provides online lottery transaction processing systems, produces instant ticket games, and offers related printing services. IGT also provides video lottery terminals, VLT central systems, and VLT games.

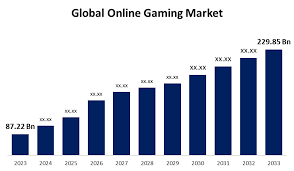

The global gaming market is experiencing a transformative shift with the increasing adoption of cloud gaming and subscription-based models. The gaming market size is expected to reach USD 535.3 billion by 2033, reflecting a compound annual growth rate (CAGR) of 8.3%. This growth is fueled by advancements in 5G technology, which enhances latency reduction and ensures seamless gameplay experiences. Emerging trends in the gaming market include the integration of artificial intelligence in game development, the rise of cross-platform gaming, and the increasing popularity of VR and AR gaming. IGT reported a market capitalization of $3.34 billion in February 2025.

Unique differentiation:

The gaming industry is a competitive landscape, and International Game Technology (IGT) faces challenges from several established players. Among its key competitors is Scientific Games, a major provider of lottery systems, gaming machines, and digital content. Scientific Games offers a comprehensive portfolio of products and services, similar to IGT, and competes in various segments of the gaming market. Another significant competitor is Aristocrat Leisure, a leading manufacturer of gaming machines and provider of digital gaming solutions. Aristocrat is known for its popular slot machine titles and strong presence in the casino gaming sector.

IGT also faces competition from other companies specializing in specific areas of the gaming market. For instance, Everi Holdings focuses on providing financial technology solutions and gaming equipment to casinos, while Konami Gaming is a prominent supplier of slot machines and casino management systems. The competitive landscape is further diversified by the presence of smaller companies and new entrants that are constantly innovating and seeking to capture market share. This dynamic environment necessitates that IGT continues to invest in research and development, enhance its product offerings, and maintain strong customer relationships to remain competitive.

Comprehensive Portfolio: IGT offers a truly comprehensive range of gaming solutions, spanning lotteries, gaming machines, sports betting, and digital gaming. This diverse portfolio allows them to cater to a wide range of clients and provides a competitive edge by offering a one-stop shop for various gaming needs.

Commitment to Responsible Gaming: IGT places a strong emphasis on responsible gaming practices and incorporates responsible gaming features into its products and services. This commitment to responsible gaming helps build trust with customers and regulators.

Management & Employees:

- Marco Sala: Executive Chair of the Board and Executive Director. Mr. Sala has been with IGT and its predecessors for many years, holding various leadership positions. He has extensive experience in the gaming industry and is responsible for overseeing the strategic direction of the company.

- Vincent L. Sadusky: Chief Executive Officer and Executive Director. Mr. Sadusky has served on the Board since the formation of the company and has a strong background in finance and corporate governance. He provides leadership and strategic direction to IGT.

- Nick Khin: President, Global Gaming. Mr. Khin leads IGT’s global gaming business, which includes gaming machines and interactive solutions. He has extensive experience in the gaming industry and is responsible for driving innovation and growth in this segment.

Financials:

International Game Technology PLC (IGT) has reported consolidated revenue of $4.3 billion, a 2% increase from the prior year, or 7% net of Italy’s commercial services sales. Record operating income was $1.0 billion, up 9% from $922 million in the prior-year period, and record Adjusted EBITDA was $1.8 billion, up 7% from $1.7 billion in the prior-year period. Diluted income per share was $0.77, versus $1.35 in the prior year, while adjusted earnings per share were $2.02 compared to $1.99.

In Q3 2024, IGT’s revenue was $587 million. The company reported a net income of $43 million, with a diluted loss per share from continuing operations of $0.39. Adjusted diluted loss per share from continuing operations was $0.02. The Q3 results also include a $38 million restructuring charge related to optimizing administrative and operating activities.

Analyzing IGT’s Q3 2024 performance compared to the same period last year reveals a revenue decrease of 44.98% to $586 million. Net profit fell by 92.55% to $7 million. The earning per share (EPS) fell by 91.3% to $0.04.

Revenue was $1.86 billion compared to $1.85 billion in the prior year. Diluted earnings per share from continuing operations were $0.17, compared to $0.38 in the prior-year period, and adjusted diluted earnings per share from continuing operations were $0.46 compared to $0.41. The company’s total liquidity stood at $1.9 billion as of September 30, 2024, including $0.5 billion in unrestricted cash and $1.4 billion in additional borrowing capacity.

Technical Analysis:

The stock is in a stage 4 decline (bearish) on the monthly and weekly charts, but a reversal is forming on the daily chart with resistance in the $18.7 zone, which it should get to. The momentum looks strong enough to carry it over that hurdle however. The next stop should be in the $19.X zone.

Bull Case:

Strategic Focus on Lottery Business: IGT’s recent strategic move to spin off its gaming and digital businesses underscores its commitment to the high-margin lottery segment. This focus allows the company to concentrate resources and expertise on its core strength, potentially leading to improved profitability and shareholder returns.

Growth Opportunities in Emerging Markets: IGT has a strong presence in both developed and emerging markets, providing opportunities for expansion. As gambling regulations evolve and new markets open up, IGT’s global reach positions it to capitalize on these growth prospects.

Bear Case:

Dependence on Lottery Business: While IGT’s lottery dominance is a strength, it also creates a dependence on this segment. Any downturn in lottery spending, increased competition, or unfavorable regulatory changes could significantly impact IGT’s revenue and profitability. The spin-off of the gaming and digital businesses, while focusing the company, also increases this reliance.

Regulatory Risks: The gaming industry is heavily regulated, and IGT operates in numerous jurisdictions with varying and sometimes unpredictable regulatory environments. Changes in regulations, tax laws, or licensing agreements could negatively impact IGT’s operations and financial performance.