Executive Summary:

Gartner Inc. is a leading global research and advisory company specializing in information technology. They provide valuable insights and advice to organizations worldwide, helping them make informed decisions about their technology strategies. Gartner’s services include comprehensive research reports, analyst briefings, conferences, and consulting services.

Gartner Inc. reported earnings per share (EPS) of $5.32. Revenue for the quarter reached $1.5 billion. Its revenue grew by 5.4% year-over-year, driven by strong growth in its contract value, which increased by 7.3%.

Stock Overview:

| Ticker | $IT | Price | $514.41 | Market Cap | $39.68B |

| 52 Week High | $559.00 | 52 Week Low | $411.15 | Shares outstanding | 77.13M |

Company background:

Gartner Inc., a prominent global research and advisory company, was founded in 1979 by Gideon Gartner. The company’s journey began with a focus on providing insightful analysis and advice to organizations seeking to leverage technology. Gartner has grown significantly, expanding its offerings and solidifying its position as a trusted advisor to businesses worldwide.

Its products and services cater to a wide range of clients, including CIOs, IT leaders, and business executives. Key offerings include research reports, analyst briefings, conferences, and consulting services. These offerings provide valuable insights into emerging technologies, industry trends, and best practices, enabling clients to make informed decisions and drive innovation.

Forrester Research, IDC, and McKinsey & Company are among the key competitors that offer similar services and insights. Gartner’s strong brand reputation, extensive research capabilities, and global reach have allowed it to maintain a leading position in the industry.

It is headquartered in Stamford, Connecticut, United States. The company has offices in numerous countries, enabling it to serve clients worldwide.

Recent Earnings:

Gartner Inc. reported its third quarter, the revenue for the quarter reached $1.5 billion, representing a 5.4% year-over-year increase. It fell slightly short of analysts’ expectations of $1.58 billion.

The company reported earnings per share (EPS) of $5.32, surpassing analysts’ estimates of $3.23. This substantial beat can be attributed to effective cost management and operational efficiencies.

The company’s contract value grew by 7.3% year-over-year on a foreign exchange-neutral basis, indicating strong demand for its research and advisory services. The company expects revenue to be in the range of $1.6 billion to $1.7 billion, with adjusted EPS projected to be between $3.10 and $3.30. It also reflects the company’s awareness of potential economic uncertainties and their potential impact on client spending.

The Market, Industry, and Competitors:

Gartner Inc. operates primarily in the technology research and advisory market, focusing on providing insights, advice, and tools for businesses and IT leaders. The company specializes in areas such as data analytics, artificial intelligence (AI), digital transformation, and emerging technologies. Gartner’s research helps organizations navigate complex technology landscapes, enabling them to make informed decisions regarding technology investments and strategies. The market for technology consulting and research is expected to grow, driven by the increasing demand for digital transformation and AI solutions across various industries.

The global digital transformation market is projected to reach approximately USD 4.6 trillion, growing at a compound annual growth rate (CAGR) of 27.6% from 2024 to 2030. Similarly, the artificial intelligence market is anticipated to grow at an impressive CAGR of 36.6%, reaching an estimated value of USD 196.63 billion by 2030. This growth is fueled by advancements in AI technologies, increased adoption across sectors such as healthcare, finance, and retail, as well as significant investments in research and development. As organizations increasingly rely on data-driven decision-making and automation, Gartner’s role as a leading advisor in these domains positions it well to benefit from this burgeoning market landscape.

Unique differentiation:

Gartner faces competition from several well-established players in the technology research and advisory market. Forrester Research, a prominent competitor, offers comprehensive research and advisory services, focusing on technology trends, market dynamics, and customer experience. Another key competitor is International Data Corporation (IDC), which provides market intelligence and consulting services across various technology industries.

Additionally, consulting firms such as McKinsey & Company, Bain & Company, and Boston Consulting Group offer technology consulting services, often incorporating research and advisory components. These firms leverage their deep industry expertise and strategic consulting capabilities to provide valuable insights to clients. Emerging players and niche consultancies are also vying for market share, offering specialized expertise and innovative approaches.

1. Extensive Research and Analysis:

- Gartner’s analysts conduct in-depth research, leveraging a vast network of industry experts, clients, and vendors.

- Their research covers a wide range of technology domains, providing a holistic view of the market landscape.

- The company’s research methodologies are rigorous and data-driven, ensuring the accuracy and reliability of its insights.

2. Client-Centric Approach:

- Gartner prioritizes building strong relationships with its clients, understanding their unique challenges and aspirations.

- The company offers personalized advisory services, tailored to the specific needs of each client.

- Gartner’s analysts are readily accessible to clients, providing timely advice and support.

Management & Employees:

Eugene A. Hall: Chairman of the Board and Chief Executive Officer

Alwyn Dawkins: Executive Vice President, Global Business Sales

Valentin T. Sribar: Executive Vice President, Research and Advisory

Kenneth Allard: Executive Vice President, Digital Markets

William James Wartinbee: Executive Vice President, Global Sales Strategy and Operations

Thomas Sang Kim: Executive Vice President, General Counsel and Secretary

Financials:

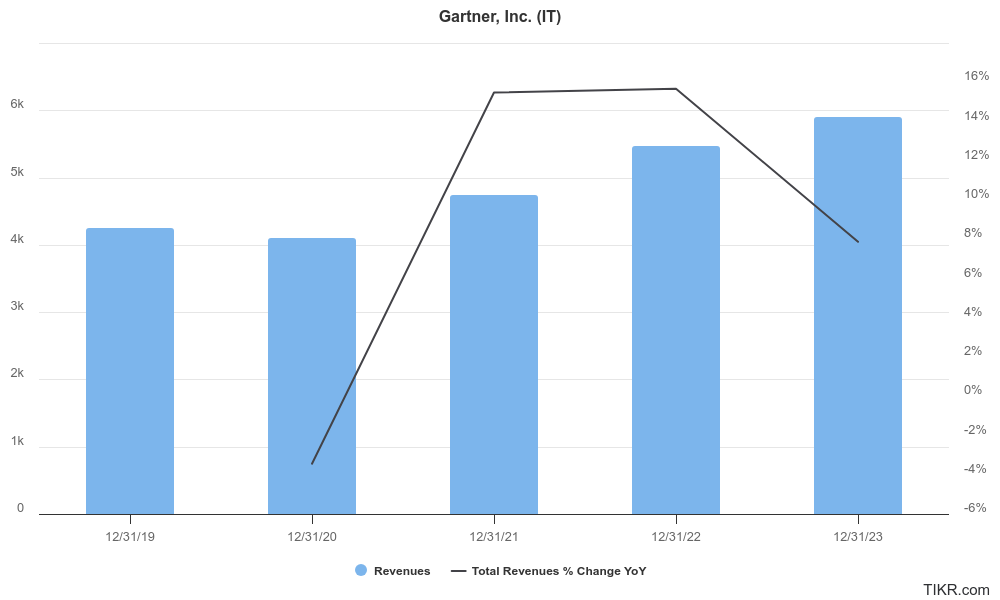

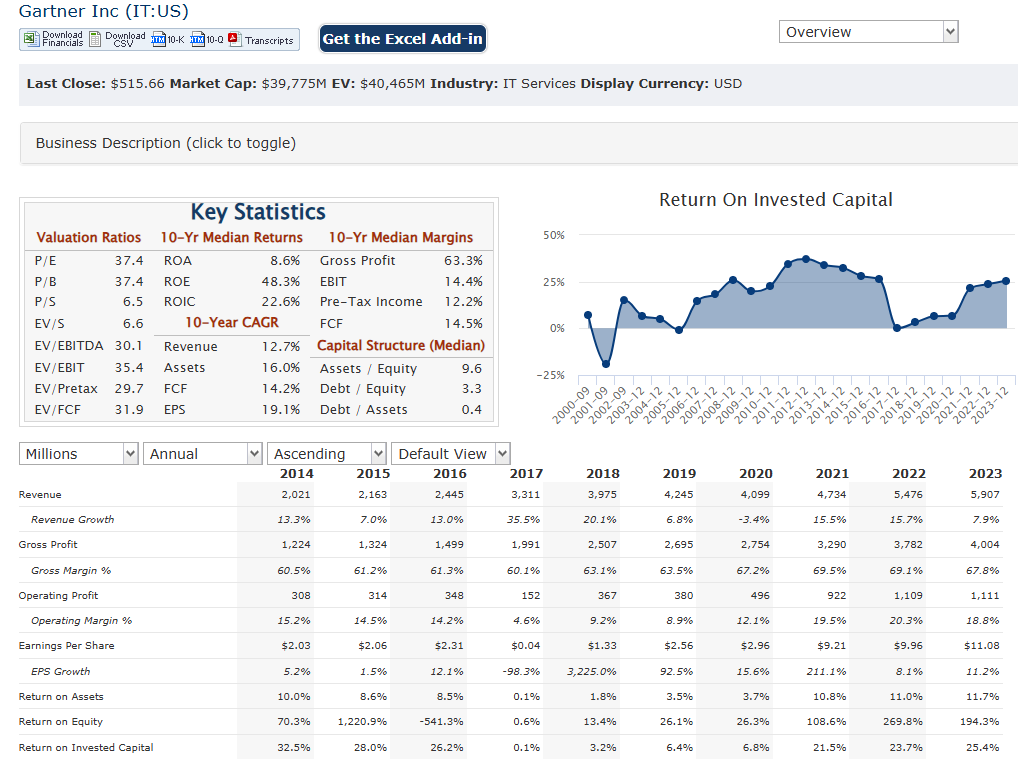

Gartner Inc. has reported revenue increased from approximately $4.7 billion to $6.1 billion, reflecting a compound annual growth rate (CAGR) of about 9.4%. This growth trajectory is indicative of Gartner’s strong market position in the technology research and advisory sector, where demand for insights and strategic guidance has surged as organizations increasingly prioritize digital transformation and data-driven decision-making.

Gartner achieved an average annual earnings growth rate of 26.7% during the same period. The company’s earnings per share (EPS) rose significantly, from around $5.32 in 2019 to approximately $11.08 in 2023, marking a CAGR of about 35%. This remarkable growth in earnings has outpaced the broader IT industry, which saw average earnings growth of only 6.4% annually, highlighting Gartner’s effective business strategies and operational efficiencies.

Gartner has maintained a strong financial position, evidenced by a return on equity (ROE) of nearly 99.9% and net profit margins of 17.3% as of September 2024. The company has also demonstrated solid cash flow generation, with operating cash flow reaching approximately $1.2 billion in 2023, up by 5% from the previous year. As organizations continue to seek expert guidance in navigating technological advancements, Gartner is poised to capitalize on these opportunities.

Technical Analysis:

The stock is in a stage 2 markup (Bullish) on the monthly chart and stage 2 as well on the weekly chart. The daily chart is showing consolidation stage 3 (neutral) with a support zone in the $500 to $520 range, at which point it should reverse and head back to $550 range.

Bull Case:

Recurring Revenue Model:

- Gartner’s subscription-based business model generates predictable and recurring revenue streams.

- This model provides stability and reduces reliance on volatile cyclical markets.

Growth Opportunities:

- The increasing complexity of technology and the growing need for expert advice drive demand for Gartner’s services.

- The company can capitalize on emerging technologies like AI, IoT, and cloud computing, expanding its market reach and revenue potential.

- International expansion offers significant growth opportunities, particularly in emerging markets.

Strong Financial Performance:

- Gartner has consistently delivered solid financial performance, characterized by revenue growth and profitability.

- The company’s focus on cost management and operational efficiency enhances its financial strength.

- A healthy balance sheet and robust cash flow position provide financial flexibility for future investments and acquisitions.

Bear Case:

Economic Uncertainty:

- Economic downturns or industry-specific challenges can impact client spending, leading to reduced demand for Gartner’s services.

- A slowdown in technology adoption or budget cuts can negatively affect the company’s revenue growth.

Technological Disruption:

- Rapid technological advancements and changing client preferences can disrupt Gartner’s business model.

- The company must continuously adapt to emerging trends and invest in new technologies to remain competitive.

Talent Acquisition and Retention:

- Attracting and retaining top talent is essential for maintaining a competitive edge.

- The industry’s high demand for skilled professionals can lead to increased competition for talent and higher labor costs.