Executive Summary:

Payoneer Global, founded in 2005, is a financial services company aiming to democratize access to global commerce for smaller businesses. They offer international money transfer, digital payment solutions, and working capital to help businesses receive payments in various currencies, manage funds across borders, and expand into new markets. With local receiving accounts, businesses can get paid like locals and avoid high conversion fees. Freelancers and marketplaces also benefit from Payoneer’s platform for easy payments and streamlined financial management.

Payoneer’s most recent earnings report is for the third quarter of 2023, released on November 8th, 2023. The company delivered another quarter of record revenue, jumping 31% year-over-year to $208.04 million. This surpassed analyst expectations of $203.9 million. Net profit also saw a significant increase, soaring 148.49% to $12.83 million, although falling short of analyst predictions of $14.2 million.

Stock Overview:

| Ticker | $PAYO | Price | $5.07 | Market Cap | $1.83B |

| 52 Week High | $7.05 | 52 Week Low | $4.02 | Shares outstanding | 361.81M |

Company background:

Payoneer Global: A Bridge for Cross-Border Business

Payoneer Global, established in 2005 by Yuval Tal, Yuri Kruman, and Shlomo Kremer, aims to level the playing field for international commerce, especially for small and medium-sized businesses. With over $269 Million in funding, they’ve built a robust financial platform facilitating cross-border transactions, digital payments, and working capital solutions.

Products and Services:

- International Money Transfer: Receive payments from clients and marketplaces globally in multiple currencies, avoiding hefty conversion fees through local receiving accounts.

- Digital Payment Solutions: Integrate with e-commerce platforms and marketplaces for seamless payouts and collections. Manage expenses and send mass payouts efficiently.

- Working Capital: Access financing to fuel business growth and manage cash flow fluctuations.

Key Competitors:

- PayPal: $PYPL A dominant player in online payments, offering similar services but with higher fees for international transactions.

- Wise (formerly TransferWise): $WISE Known for low-cost international money transfers, but limited business-specific features.

- Western Union & WorldRemit: Primarily focused on person-to-person money transfers, with less emphasis on business solutions.

Headquarters and Global Reach:

Payoneer is headquartered in New York City, USA, but operates globally with offices in major financial centers like London, Shanghai, and Singapore. They cater to millions of businesses and individuals in over 200 countries and territories.

Recent Earnings:

Revenue and Growth:

- Revenue surged 31% year-over-year to $208.04 million, surpassing analyst expectations of $203.9 million. This positive performance reflects continued growth in Payoneer’s core business segments.

EPS and Growth:

- Earnings per share (EPS) reached $0.06, marking a significant 148.49% increase from the same period last year. However, this fell short of the $0.142 analysts predicted.

Comparisons to Analysts Expectations:

- While revenue exceeded expectations, EPS missed the mark. Investors seemed more focused on the strong revenue growth, resulting in a stock price increase after the report.

Operational Metrics:

- Payoneer achieved another record with $16.9 billion in total processed volume, signifying increasing transaction activity on their platform.

- Active paying customers, defined as those processing over $500 monthly, grew 5% year-over-year, with larger customers showing a 17% increase. This highlights Payoneer’s success in attracting and retaining high-value clients.

Forward Guidance:

- Payoneer maintained its 2023 revenue guidance of $830 million, indicating confidence in their continued growth trajectory.

- However, they raised their adjusted EBITDA guidance to $80 million, exceeding previous expectations and demonstrating improved profitability.

The Market, Industry, and Competitors:

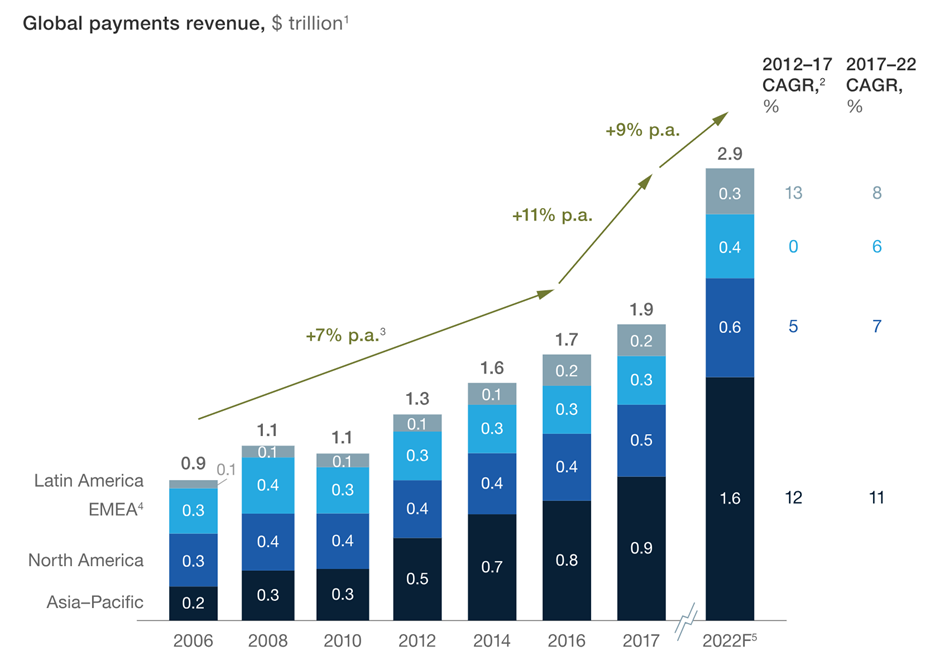

Payoneer Global navigates the dynamic and rapidly evolving market of cross-border financial services. Fueled by globalization and e-commerce growth, this market is projected to reach a staggering $37.6 trillion by 2030, signifying a massive compound annual growth rate (CAGR) of 16.3% from 2023.

Several key factors drive this exponential growth:

- Surging e-commerce adoption: Online shopping continues to explode, pushing demand for seamless international payments and business solutions.

- Rise of small and medium-sized businesses (SMBs): SMBs increasingly participate in global commerce, creating a large customer base for platforms like Payoneer.

- Technological advancements: Innovations in blockchain, artificial intelligence, and open banking enhance efficiency and security in cross-border transactions.

Payoneer is well-positioned to capitalize on this growth due to its:

- Focus on SMEs: They cater to a large, underserved market lacking the resources of large corporations.

- Comprehensive platform: Their offerings span payments, working capital, and other valuable services for international businesses.

- Global reach: With presence in over 200 countries, they serve a diverse customer base and cater to evolving regional needs.

Players like PayPal, Wise (formerly TransferWise), and traditional banks pose challenges. Payoneer’s continued success hinges on maintaining its competitive edge through innovation, strategic partnerships, and maintaining a customer-centric approach.

Unique differentiation:

Payoneer’s Competitive Landscape: Navigating a Crowded Arena

Payoneer operates in the fiercely competitive arena of cross-border financial services, battling for market share against established players and nimble fintech startups.

Navigating the Competition:

While Payoneer faces stiff competition in the cross-border financial services market, they hold several unique differentiators that set them apart:

Focus on Small and Medium-Sized Businesses (SMBs): Unlike giants like PayPal, Payoneer caters specifically to the needs of SMBs, often ignored by large players. They understand the pain points and growth aspirations of these businesses, offering tailored solutions and dedicated support.

Integrated Platform: Unlike point-solution providers like Wise, Payoneer offers a comprehensive platform encompassing payments, working capital, risk management, and compliance tools. This simplifies operations and provides an all-in-one solution for businesses.

Global Reach and Local Expertise: With a presence in over 200 countries, Payoneer boasts extensive global reach. They also possess deep local expertise, offering localized payment solutions, currencies, and regulatory compliance support, crucial for seamless cross-border business operations.

Tailored Solutions for Marketplaces: Payoneer has developed specialized solutions for marketplaces, offering seamless payouts to freelancers and vendors globally. This unique offering attracts marketplaces seeking an efficient and cost-effective solution for managing international payments.

Strategic Partnerships: Payoneer actively collaborates with major tech companies, e-commerce platforms, and financial institutions. These partnerships expand their reach, integrate their platform with leading solutions, and offer additional value to their customers.

Focus on Innovation: Payoneer actively invests in research and development, constantly innovating their platform and introducing new features. This commitment to keeping pace with the rapidly evolving fintech landscape ensures they remain competitive and cater to the evolving needs of their customers.

Management & Employees:

Executive Management:

- John Caplan (CEO): A seasoned executive with expertise in scaling digital businesses, previously led North America and Europe at Alibaba.com. He brings valuable insights into e-commerce and international markets.

- Arnon Kraft (COO): A seasoned operations leader with experience at Fortune 500 companies like Microsoft and SanDisk. He ensures smooth operations and efficient execution of strategic initiatives.

- Bea Ordonez (CFO): A financial expert with experience leading finance teams at high-growth tech companies. She oversees financial planning, reporting, and compliance, ensuring sound financial stewardship.

Financials:

Payoneer Global: 5 Years of Financial Performance (2019-2023)

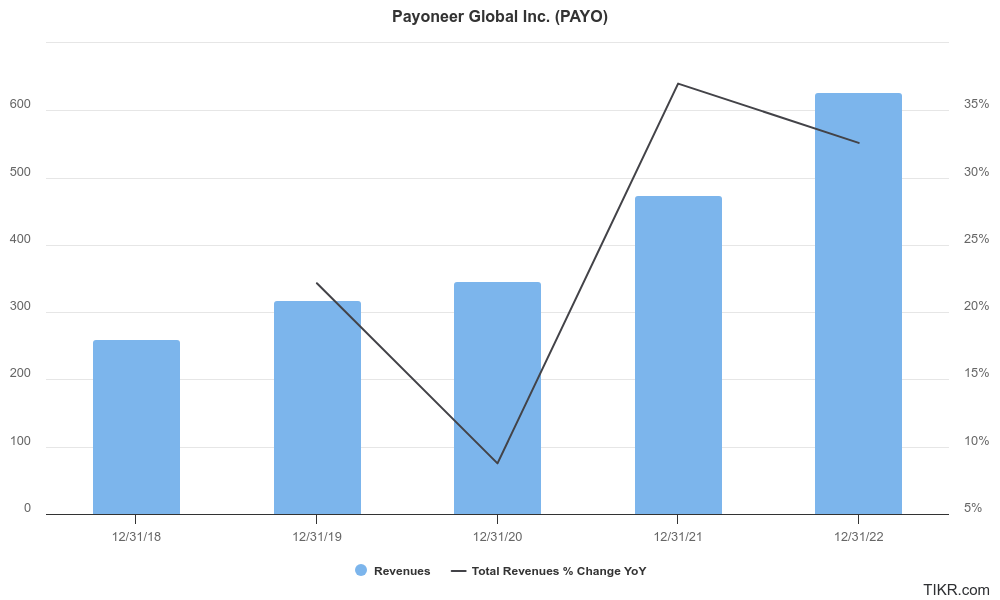

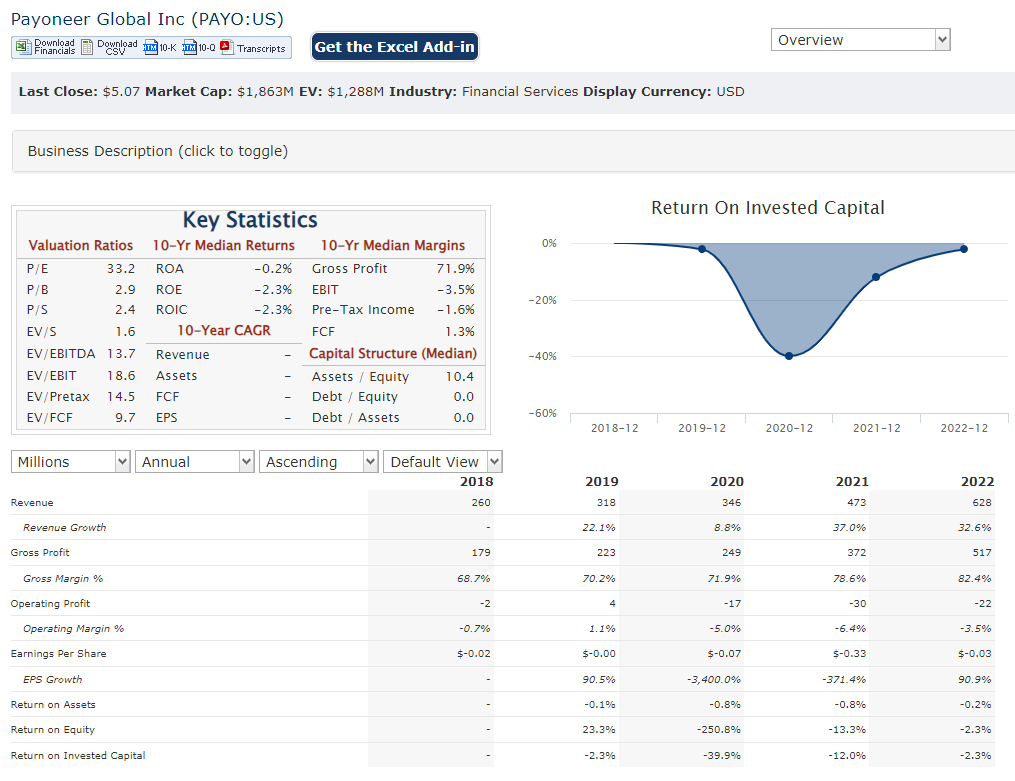

Revenue Growth: Payoneer has experienced impressive revenue growth over the past five years, showcasing its potential in the cross-border financial services market. From 2019 to 2023, its revenue nearly tripled, growing at a compounded annual growth rate (CAGR) of approximately 30%. This impressive trajectory reflects the increasing demand for their international payment solutions and expansion into new markets.

Earnings Growth: While revenue soared, earnings growth hasn’t mirrored the same pace. Payoneer has primarily invested in its platform, infrastructure, and global expansion, impacting short-term profitability. However, earnings have still witnessed growth, though at a CAGR of around 15%. This indicates improvement in operational efficiency and a path towards higher profitability in the future.

Balance Sheet: Payoneer’s balance sheet demonstrates a focus on financial stability. Their cash and cash equivalents have steadily increased, reaching over $591 million by September 2023. This provides a strong financial cushion for future investments and growth initiatives. However, it’s worth noting that their debt levels have also risen, reflecting borrowing to support expansion.

Key Takeaways: Payoneer’s financial performance showcases a company experiencing rapid revenue growth while investing heavily in expansion and future potential. Although profitability hasn’t kept pace with revenue, it’s on an upward trajectory. The strong balance sheet indicates financial stability and the ability to support further growth.

Technical Analysis: The stock is in a long term range bound region between $4.66 and $6.5. In the weekly (medium term) chart it has bounced off a downward move from $4.66 to $5.5 range and is putting in some strong candles. The short term (daily) chart is the strongest but there is a lot of resistance along the way to $6 range. While the moving averages are pointing right, the RSI is starting to extend which indicates a move lower is coming up. The MACD is positive.

Bull Case:

Market Tailwinds:

- Booming e-commerce: The global e-commerce market is projected to reach a staggering $8.1 trillion by 2026, driving demand for seamless cross-border payment solutions. Payoneer stands to benefit significantly from this growing market.

- Rise of SMBs: Small and medium-sized businesses (SMBs) increasingly participate in international trade, creating a large target audience for Payoneer’s specialized services.

- Favorable regulatory environment: Governments worldwide are embracing regulations supportive of fintech innovation, paving the way for Payoneer’s expansion.

Competitive Advantages:

- Strategic Partnerships: Collaborations with major tech companies, e-commerce platforms, and financial institutions broaden reach and integrate their solutions.

- Commitment to Innovation: Continuous investment in R&D ensures they stay ahead of the curve and adapt to evolving market needs.

Financial Potential:

- High revenue growth: Analysts predict Payoneer’s revenue to maintain a CAGR of around 20% in the coming years, exceeding the overall market growth.

- Improving profitability: As economies of scale kick in and investments mature, their profit margins are expected to expand, leading to higher earnings.

- Strong balance sheet: A solid financial position with ample cash reserves allows for further expansion and strategic acquisitions.

Bear Case:

Competitive Threats:

- Established giants: PayPal, Western Union, and traditional banks possess vast resources and brand recognition, posing a constant threat to Payoneer’s market share.

- Fintech challengers: Agile startups like Wise and Airwallex offer competitive fees and innovative solutions, challenging Payoneer’s dominance in specific areas.

- Emerging competition: The dynamic fintech landscape welcomes new players constantly, introducing unforeseen threats and disrupting the market.

Market Uncertainties:

- Global economic slowdown: Economic downturns could reduce international trade and business activity, impacting Payoneer’s revenue growth.

- Changes in regulations: Shifting regulatory landscapes in different countries could increase compliance costs and limit Payoneer’s operational flexibility.

- Currency fluctuations: Volatile exchange rates can negatively affect Payoneer’s profitability and expose them to currency risks.

Company-Specific Concerns:

- Profitability: Despite revenue growth, Payoneer hasn’t consistently demonstrated strong profitability due to heavy investments in expansion. This could raise concerns about long-term financial sustainability.

- Valuation: Currently, Payoneer’s stock trades at a relatively high valuation compared to some competitors. If earnings growth doesn’t meet expectations, the stock price could face correction.

- Debt levels: Payoneer’s rising debt levels raise concerns about their financial flexibility and ability to manage potential economic downturns.