Executive Summary:

Grab Holdings Limited is a leading superapp in Southeast Asia, offering a wide range of services including transportation, food delivery, and financial services. It operates as a platform connecting drivers, merchants, and consumers, facilitating seamless transactions and creating value for all stakeholders. As a key player in the region’s digital economy, Grab plays a crucial role in driving economic growth and improving people’s lives through technology-enabled solutions.

Grab Holdings Limited reported revenue surged 17% year-over-year to $664 million.

Stock Overview:

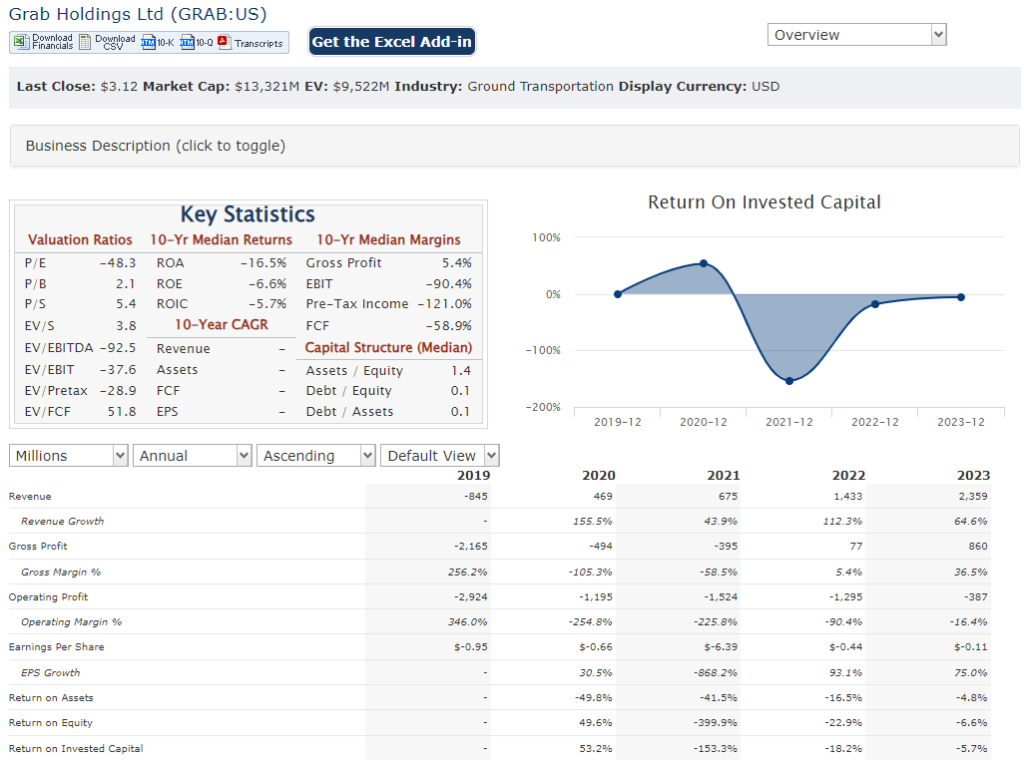

| Ticker | $GRAB | Price | $3.12 | Market Cap | $12.33B |

| 52 Week High | $3.88 | 52 Week Low | $2.90 | Shares outstanding | 3.84B |

Company background:

Grab Holdings Limited is a leading superapp in Southeast Asia, offering a wide range of services that have transformed the way people live and work in the region. Founded in 2012 by Anthony Tan and Tan Hooi Ling, the company started as a taxi-hailing app but has since expanded its offerings to include ride-sharing, food delivery, digital payments, and financial services. Grab has secured substantial funding from investors including SoftBank, Didi Chuxing, and Toyota, fueling its rapid growth and expansion across Southeast Asia.

The company’s core products and services revolve around its superapp platform, which connects drivers, merchants, and consumers. Users can book rides, order food, make payments, and access financial services through a single, convenient app. Grab has become an integral part of daily life for millions of people in the region, contributing to the growth of the digital economy.

Grab’s primary competitors include Gojek, another Southeast Asian superapp, as well as local ride-hailing and food delivery players in specific markets. Despite intense competition, Grab has maintained a strong market position through its focus on innovation, partnerships, and a deep understanding of the local market. Headquartered in Singapore, Grab operates in eight countries across Southeast Asia, serving a population of over 670 million people.

Recent Earnings:

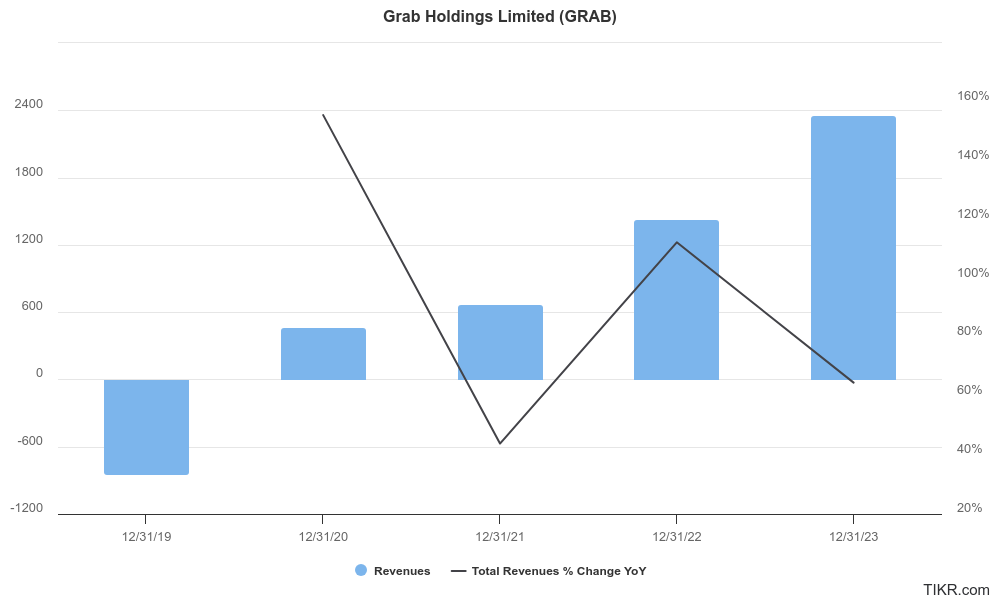

Grab Holdings Limited demonstrating continued growth and improved profitability. Revenue surged 24% year-over-year to $653 million, exceeding analyst expectations. This positive trajectory was fueled by strong performance across all segments, particularly in the On-Demand sector, which saw GMV growth of 18% year-over-year.

They reflects Grab’s ongoing focus on cost management and operational efficiency. The company’s ability to drive growth while simultaneously improving profitability is a testament to its strong execution.

Grab has raised its full-year Adjusted EBITDA guidance to $250-$270 million, indicating confidence in its growth trajectory. The company remains committed to expanding its user base, increasing engagement, and driving further penetration in the Southeast Asian market.

The Market, Industry, and Competitors:

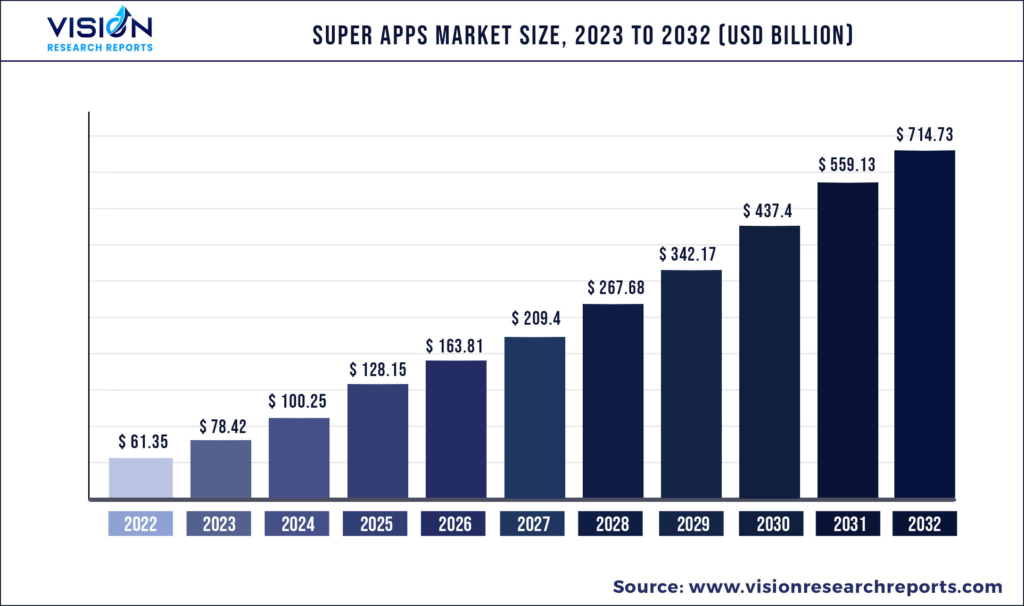

Grab Holdings Limited operates in the highly dynamic and rapidly growing Southeast Asian market. This region is characterized by a burgeoning middle class, increasing smartphone penetration, and a growing appetite for digital services. As a leading superapp, Grab is well-positioned to capitalize on these trends by providing a comprehensive suite of services that cater to the diverse needs of consumers and businesses.

The Southeast Asian digital economy driven by factors such as e-commerce, mobile payments, and on-demand services. Grab, with its strong market position and diversified business model, is poised to be a key beneficiary of this growth. CAGR projections can fluctuate based on various economic and market conditions, it’s reasonable to anticipate that Grab’s growth rate will remain robust as it continues to expand its services and user base across the region.

Unique differentiation:

Grab Holdings Limited operates in a highly competitive market, facing stiff competition from both regional and global players. Its primary rival is Gojek, another Southeast Asian superapp offering similar services. Both companies are engaged in a fierce battle for market share across various segments, including ride-hailing, food delivery, and digital payments.

Grab also competes with global giants like Uber, which has a significant presence in some Southeast Asian markets. For instance, in Indonesia, Grab competes with local ride-hailing services like Blue Bird Group. The competitive landscape is further intensified by the emergence of new entrants and the rapid evolution of technology, forcing Grab to continuously innovate and adapt to stay ahead.

Deep local knowledge: With its focus on Southeast Asia, Grab has a deep understanding of local cultures, preferences, and market dynamics, enabling it to tailor its services accordingly.

Diversified business model: Grab’s superapp approach, offering a wide range of services beyond transportation, provides it with multiple revenue streams and reduces reliance on any single business line.

Financial services integration: Grab’s foray into financial services, including payments, lending, and insurance, positions it as a one-stop shop for consumers, enhancing customer stickiness.

Management & Employees:

Anthony Tan: As the CEO, Co-Founder, and Chairman, Tan oversees the overall strategy and direction of Grab.

Alex Hungate: Serving as the Chief Operating Officer, Hungate is responsible for the day-to-day operations of the company.

Suthen Thomas Paradatheth: As the Chief Technology Officer, Paradatheth leads Grab’s technology initiatives and drives innovation.

Financials:

Grab Holdings Limited services and increasing adoption of digital platforms in Southeast Asia. Revenue has exhibited a strong upward trajectory, with a Compound Annual Growth Rate (CAGR). This growth can be attributed to factors such as the expansion of its user base, increased transaction volume, and diversification into new business segments like food delivery and financial services.

Grab has achieved significant revenue growth, it has operated in a highly competitive market characterized by intense competition and heavy investments in technology and infrastructure. The company has reported net losses in recent years as it prioritizes growth and market share over profitability.

Grab’s balance sheet has generally maintained a solid financial position, supported by substantial funding rounds and strategic partnerships. The company has invested heavily in technology, operations, and expansion initiatives, which has impacted its cash flow.

Technical Analysis:

The stock is consolidating (stage 1) on the monthly and weekly chart, but the bottom seems to be in the $3 level and the stock is reversing off its lows. $2.9 would be the current stop loss and the should head to the $3.92 mark in the short term.

Bull Case:

Dominant Market Position: Grab enjoys a strong market position in Southeast Asia, a region experiencing rapid economic growth and increasing digital adoption. As a superapp, it offers a wide range of services, from ride-hailing and food delivery to financial services, providing a sticky platform for users.

Cost Reduction and Profitability: Grab has shown progress in reducing costs and improving profitability, which is crucial for investor confidence. Continued efficiency gains can lead to improved financial performance.

Valuation Upside: Compared to global tech peers, Grab’s valuation may be relatively low, offering potential upside as the company matures and delivers on its growth plans.

Bear Case:

Regulatory Risks: The ride-hailing and on-demand delivery industries are subject to evolving regulations. Changes in labor laws, taxation, or licensing requirements could impact Grab’s operations and profitability.

Economic Downturns: Economic downturns can negatively impact consumer spending, reducing demand for ride-hailing and food delivery services. This could lead to lower revenue and profitability for Grab.

Dependence on Drivers: Grab’s business model relies heavily on a large pool of drivers. Shortages or labor disputes could disrupt operations and impact service quality.