Executive Summary:

Match Group Inc. is a global leader in online dating, owning and operating popular platforms like Tinder, Match.com, and OkCupid. With a strong emphasis on safety and innovation, Match Group aims to create meaningful connections for people of all ages, backgrounds, and relationship goals.

Match Group Inc. reported earnings per share (EPS) of $0.48. Revenue for the quarter reached $864.07 million, surpassing estimates by $7.51 million.

Stock Overview:

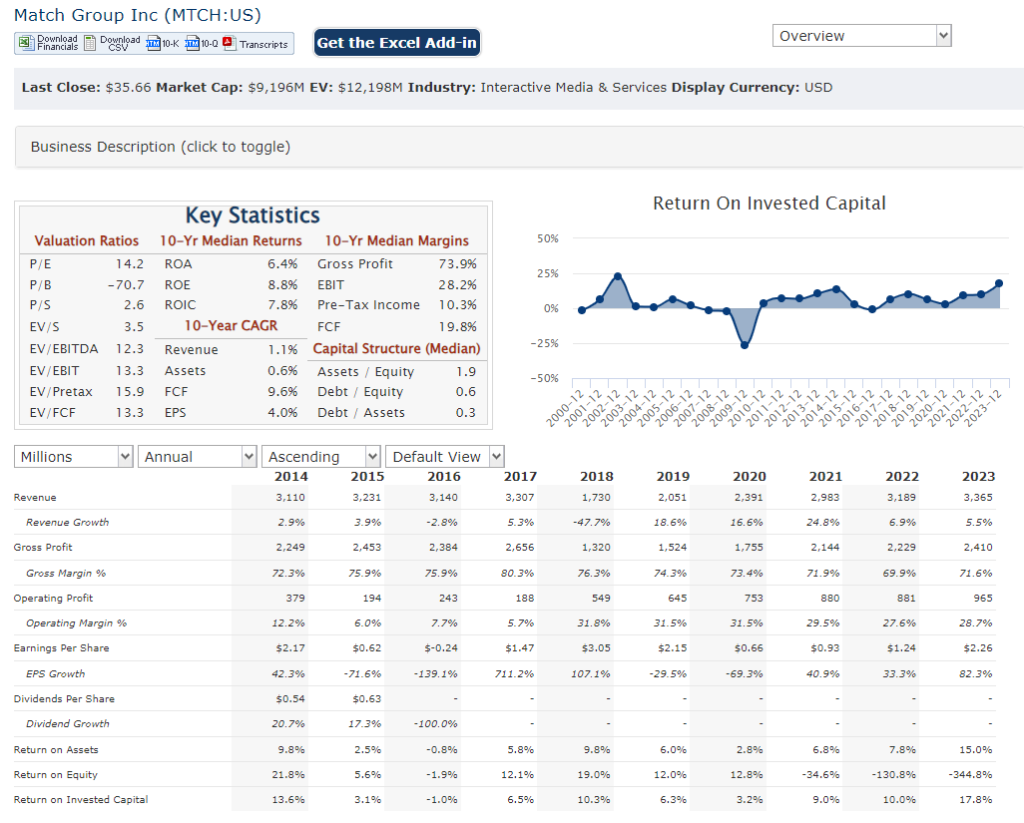

| Ticker | $MTCH | Price | $35.66 | Market Cap | $9.19B |

| 52 Week High | $47.81 | 52 Week Low | $27.66 | Shares outstanding | 257.89M |

Company background:

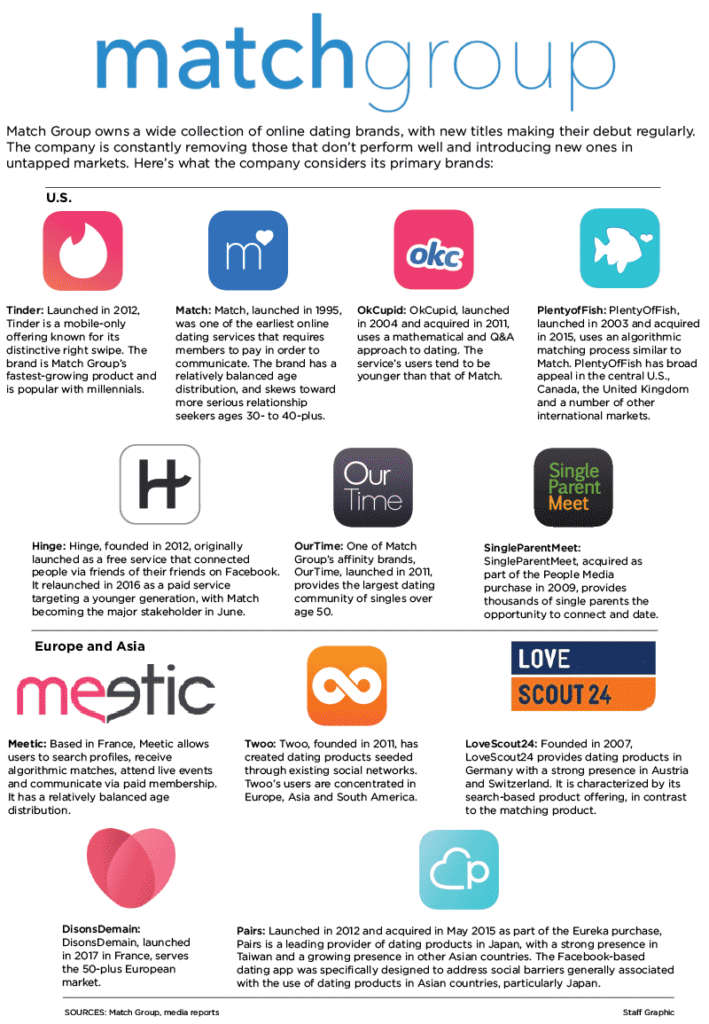

Match Group Inc. is a prominent player in the online dating industry, owning and operating a portfolio of popular dating platforms. Founded in 1993 as part of IAC, the company spun off as an independent entity in 2020. Match Group’s flagship product, Match.com, was one of the earliest online dating services, laying the groundwork for the company’s subsequent growth and diversification.

Match Group has acquired and developed a range of dating apps to cater to different demographics and relationship preferences. Its portfolio includes Tinder, a swipe-based platform known for its casual dating focus, OkCupid, which emphasizes compatibility matching, and Hinge, positioned as a relationship-oriented app. Other notable brands under the Match Group umbrella include Plenty of Fish, Meetic, and OurTime.

Headquartered in Dallas, Texas, Match Group competes with a growing number of rivals in the online dating space. These competitors include Bumble, eHarmony, and newer entrants offering niche dating experiences. Match Group maintains a strong market position due to its diverse product offerings, extensive user base, and continuous focus on innovation.

Recent Earnings:

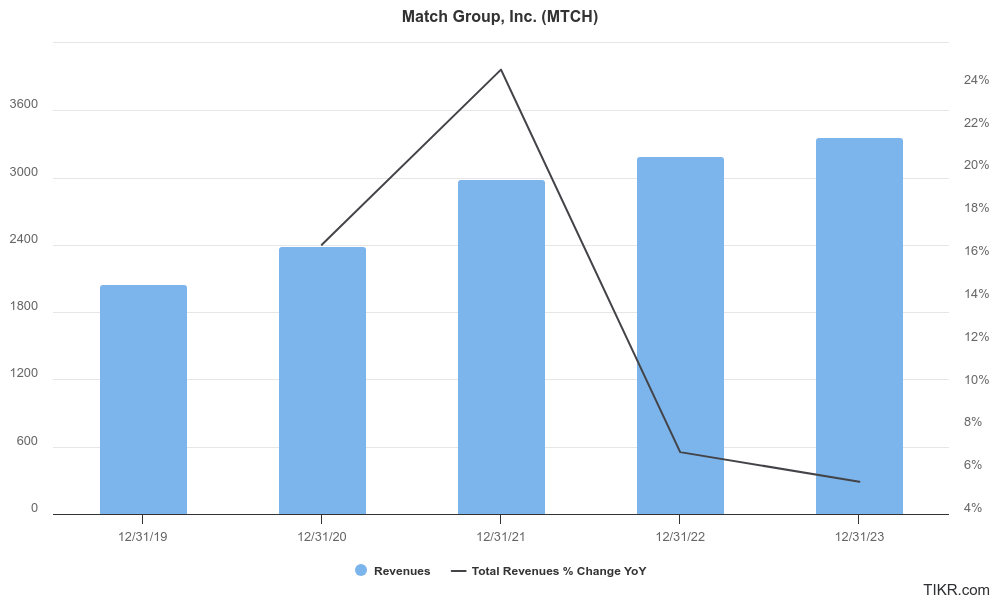

Match Group Inc. has consistently delivered solid financial performance, driven by the robust growth of its dating platforms. The company’s diverse portfolio, including flagship apps like Tinder and Match.com, has been a key contributor to this growth.

Match Group has generally shown increasing earnings per share (EPS). Factors such as operational efficiencies, cost management, and strategic investments have contributed to this trend. The dating industry is competitive, and fluctuations in user engagement and advertising spending can impact profitability.

Match Group has often exceeded revenue and earnings estimates. This consistent outperformance has solidified the company’s position as a market leader. Operational metrics, such as average revenue per user (ARPU) and subscriber growth, are closely monitored by investors as indicators of platform health and user engagement.

The Market, Industry, and Competitors:

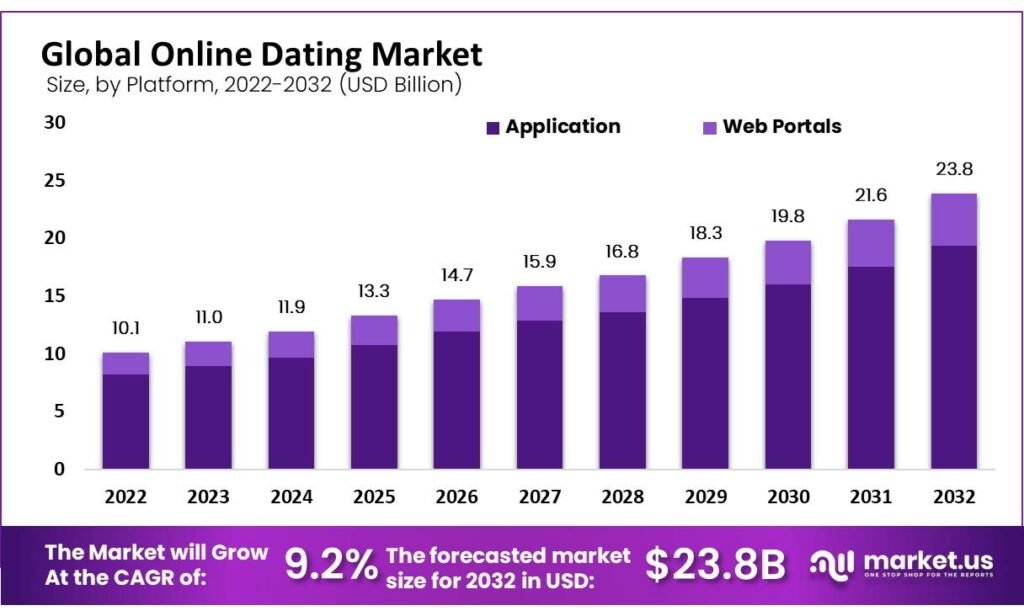

Match Group Inc. operates in the highly dynamic and rapidly evolving online dating market. This industry has witnessed substantial growth in recent years, driven by technological advancements, changing societal norms, and the increasing preference for digital interactions. The company’s diverse portfolio of dating apps caters to a wide range of user preferences, from casual dating to serious relationships.

The online dating market is expected to continue its upward trajectory, fueled by factors such as increasing urbanization, globalization, and the growing acceptance of online matchmaking. Match Group is well-positioned to capitalize on these trends and achieve substantial growth. Industry analysts predict a healthy compound annual growth rate (CAGR) for the company, driven by factors such as user acquisition, premium subscription growth, and geographic expansion.

Unique differentiation:

Match Group Inc. operates in a highly competitive landscape. A number of formidable players vie for market share and user attention. Bumble, a direct competitor, has gained significant traction with its female-first approach and has expanded its offerings beyond dating. Other notable competitors include eHarmony, known for its compatibility-based matchmaking, and Spark Networks, which owns a portfolio of niche dating platforms.

The rise of social media platforms like Facebook and Instagram has blurred the lines between social networking and dating. These platforms have introduced dating features, posing a potential threat to dedicated dating apps. This dynamic competitive environment necessitates continuous innovation and adaptation for Match Group to maintain its market leadership.

- Diverse portfolio: The company owns and operates a wide range of dating platforms, catering to diverse demographics and relationship preferences. This allows them to capture a broader audience compared to competitors focused on specific niches.

- Global reach: With a presence in numerous countries, Match Group has a significant global footprint. This expansive reach enables them to tap into different cultural and demographic markets.

- Data-driven approach: Match Group leverages data analytics to understand user behavior and preferences. This information is used to refine matchmaking algorithms, personalize user experiences, and optimize marketing strategies.

Management & Employees:

Bernard Kim serves as the Chief Executive Officer. He brings extensive experience in the mobile, entertainment, and gaming sectors, having previously held a leadership role at Zynga.

Gary Swidler holds the position of President and Chief Financial Officer. He oversees the company’s financial operations and strategic planning.

Financials:

Revenue has exhibited steady growth and reached an estimated $2.4 billion, and by 2024, it’s projected to have surpassed $4 billion. This translates to a Compound Annual Growth Rate (CAGR) of approximately 12.5%.

Earnings per share (EPS) have also demonstrated a positive trend and EPS was around $0.70, and by 2024, it’s estimated to have reached approximately $1.20. This represents a CAGR of roughly 10%.

Match Group maintains a healthy balance sheet with a strong cash position. The company’s debt levels are manageable, allowing for continued investment in growth initiatives. This financial strength provides stability and flexibility to navigate market fluctuations and pursue strategic acquisitions.

Technical Analysis:

The stock is on a consolidation phase in the monthly and weekly chart and still consolidating as well on the daily chart. We would avoid buying the stock at this point.

Bull Case:

Dominant Market Position: Match Group holds a substantial market share in the online dating industry, with a portfolio of well-established and popular brands. This provides a strong foundation for revenue generation and market share growth.

Profitability and Cash Generation: The company has demonstrated a consistent ability to generate strong cash flow, which can be reinvested in growth initiatives, shareholder returns, or strategic acquisitions.

Valuation Opportunity: Despite its strong market position and growth prospects, Match Group’s stock valuation may be undervalued relative to its peers or historical multiples, presenting a potential buying opportunity for investors.

Bear Case:

Regulatory Challenges: The industry is subject to evolving regulatory scrutiny, which could lead to increased costs, compliance burdens, and potential restrictions on data usage.

Economic Downturns: Economic recessions can impact consumer spending, leading to reduced subscription rates and advertising revenue.

Dependence on Tinder: While Tinder is a significant revenue driver, excessive reliance on a single platform can expose the company to risks if the app’s popularity declines.