Executive Summary:

Duolingo is an American educational technology company. Their mission is to make education accessible to everyone by offering a fun and effective way to learn languages through their mobile app. They provide courses in over 40 languages, along with music, math, and even an English proficiency test. Duolingo uses a freemium model, with a free ad-supported tier and a premium ad-free subscription service.

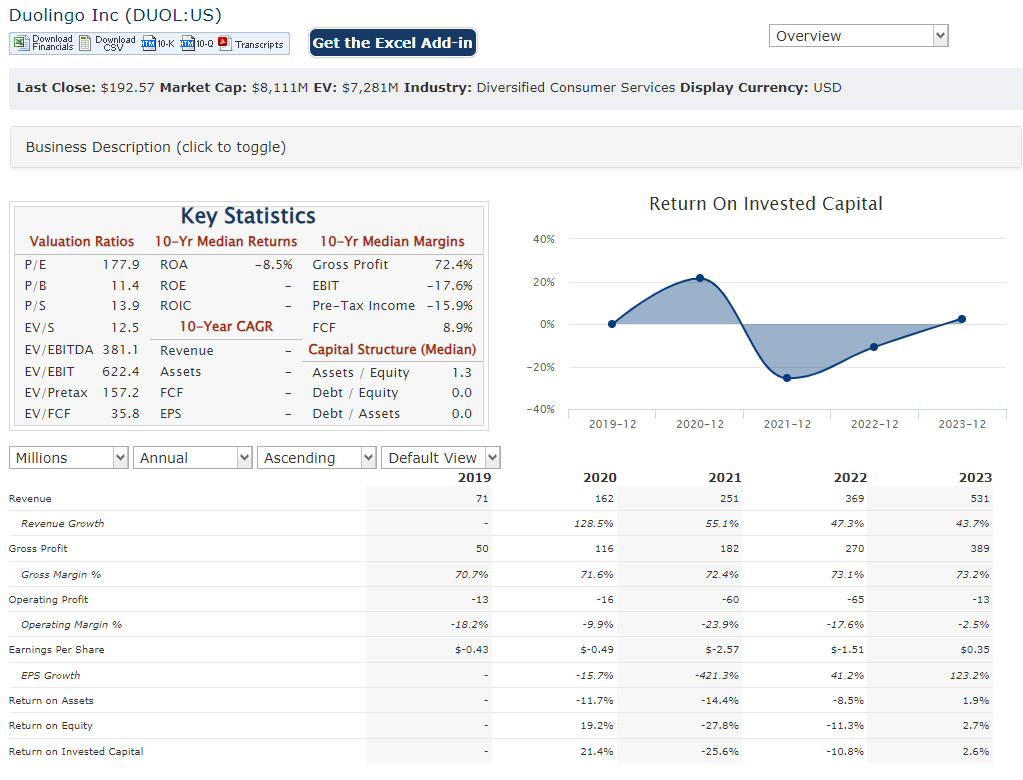

Duolingo expecting earnings per share (EPS) to be around $0.33. Revenue reported $167.6 million for the first quarter of 2024.

Stock Overview:

| Ticker | $DUOL | Price | $192.57 | Market Cap | $8.29B |

| 52 Week High | $251.30 | 52 Week Low | $121.89 | Shares outstanding | 36.98M |

Company background:

Duolingo, the leading mobile language learning platform globally, was founded in 2012 by Luis von Ahn and Severin Hacker, both computer science professors at Carnegie Mellon University. Their vision was to democratize education by creating a fun and accessible way for people to learn languages. The company has attracted significant funding throughout the years from investors including Kleiner Perkins, Union Square Ventures, and Google Capital.

They’ve gamified the learning experience, making it engaging and bite-sized, perfect for fitting into busy schedules. Beyond languages, Duolingo has expanded into other educational areas with its math and music learning apps. They also offer the Duolingo English Test, a convenient and affordable way to certify English proficiency.

Duolingo leverages a freemium business model. The free tier includes ads, while a paid subscription removes ads and offers additional features. This approach has helped them reach a massive user base.

Recent Earnings:

Duolingo reported strong revenue growth of 45% year-over-year, reaching $167.6 million. This positive trend extends to their earnings per share (EPS) which jumped a significant 1050% year-over-year to $0.57.

Their paid subscribers grew by a substantial 54% year-over-year, reaching 7.4 million. Daily active users (DAUs) and monthly active users (MAUs) also showed significant increases of 54% and 35% respectively, compared to the prior year quarter.

The Market, Industry, and Competitors:

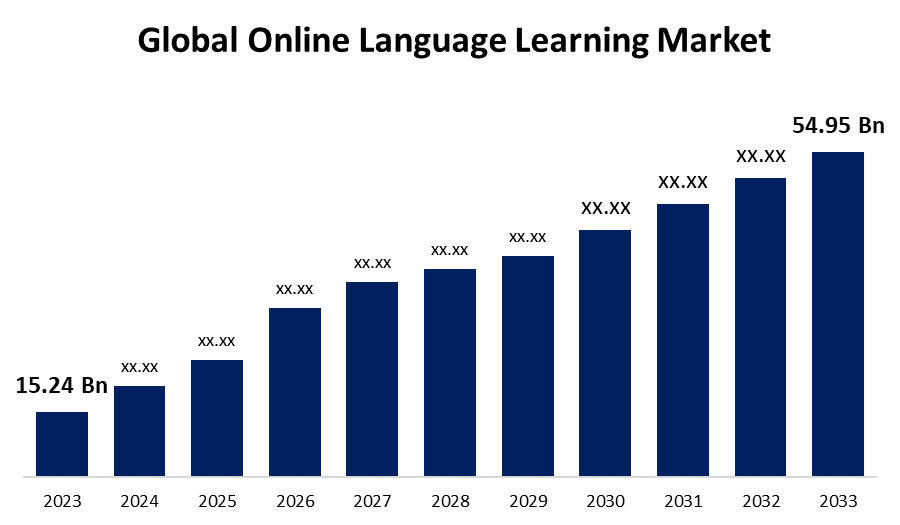

The global online language learning market is a thriving industry projected to reach a value of $29.5 billion by 2030, according to a report by Research and Markets. This translates to a Compound Annual Growth Rate (CAGR) of 12.1% from 2023 to 2030. This growth is fueled by several factors, including rising internet penetration globally, a growing demand for international communication and travel, and increasing urbanization.

Duolingo is a major player in this expanding market, boasting a strong brand reputation and a freemium business model that attracts a wide range of users. Their focus on user acquisition, engagement, and expanding their product offerings beyond languages will be key factors in their future success.

Unique differentiation:

Subscription-based competitors: These companies, like Babbel, Busuu, and Rosetta Stone, offer in-depth language courses with a focus on structured learning paths and conversation practice. They often cater to users willing to pay a premium for a more comprehensive learning experience. While lacking the gamified approach of Duolingo, they might appeal to learners seeking a more traditional classroom-style environment.

Freemium competitors: These platforms, including Memrise and Lingvist, share a similar freemium model with Duolingo. They offer a combination of free and paid features, with the free tiers often limiting access to advanced lessons or functionalities. Memrise utilizes flashcards and spaced repetition for memorization, while Lingvist focuses on gamified elements and a focus on scientifically-backed learning techniques. The competition in this space is fierce, with each platform vying to stand out through unique features, specific language strengths, and personalized learning styles.

Freemium with a focus on accessibility: Duolingo’s freemium model with a robust free tier makes language learning accessible to a wider audience compared to subscription-based competitors who require upfront payment. This low barrier to entry attracts a massive user base and fosters a casual learning environment.

Gamification and bite-sized lessons: Duolingo’s gamified approach makes language learning engaging and manageable. Bite-sized lessons fit seamlessly into busy schedules, allowing users to learn on the go. This gamified aspect sets it apart from competitors who might offer more traditional, structured learning styles.

Focus on mobile: Duolingo’s emphasis on its mobile app caters perfectly to the mobile-first generation. Users can access lessons and practice exercises anywhere, anytime. This mobile-centric design might give them an edge over competitors who may offer desktop-based learning experiences as well.

Course variety beyond languages: While languages are their core offering, Duolingo has expanded into other educational areas with math and music learning apps. This diversification allows users to explore various learning interests on the same platform, potentially increasing user engagement.

Management & Employees:

Luis von Ahn (Co-founder, Chief Executive Officer & Board Chairman): A computer science Ph.D., Luis brings his technical background and focus on gamified learning to lead Duolingo’s mission.

Severin Hacker (Co-founder & Chief Technology Officer): Severin, also a computer scientist by training, is responsible for the technological backbone of Duolingo’s platform.

Financials:

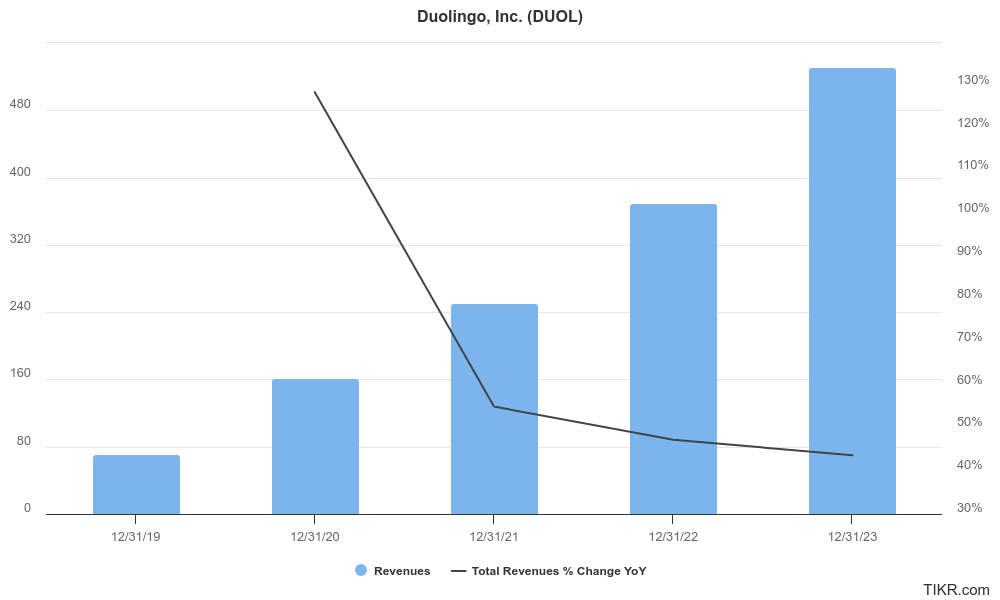

Duolingo’s Compound Annual Growth Rate (CAGR) likely exceeding industry expectations. Duolingo reported a 45% year-over-year increase in revenue compared to the same period in 2023.

Earnings growth has also been impressive. This shift from losses to profitability is a major milestone for Duolingo. With increasing revenue and a shift towards profitability, their assets have likely grown as well. This could include investments in marketing and product development to fuel further user acquisition and engagement.

Technical Analysis:

A reversal after a stage 4 decline on the monthly and daily chart with a retest of the $190s levels indicates a strong case to buy on the monthly and weekly charts. On the daily chart, the range is still in a stage 4 bearish decline, so a move back to the $185 range is likely, but this should be a good buy to earnings on Aug 7th.

Bull Case:

Engaging Learning Experience: Duolingo’s gamified approach with bite-sized lessons makes language learning fun and manageable. This sets them apart from competitors offering a more traditional classroom style, attracting a mobile-first generation with busy schedules.

Product Diversification: While languages are their core offering, Duolingo has expanded into math and music learning, potentially increasing user engagement and attracting new demographics interested in a broader range of educational content on the same platform.

Bear Case:

Limited Monetization Potential: Duolingo’s freemium model, while effective for user acquisition, may limit their ability to significantly increase revenue from existing users. Converting free users to paying subscribers remains a challenge.

Focus on Casual Learners: Duolingo’s gamified approach caters well to casual learners but might not be suitable for users seeking a more rigorous learning experience for professional or academic purposes. This could limit their ability to attract a wider range of learners.

Dependence on Mobile Platform: Duolingo’s focus on mobile learning could restrict their reach to users who prefer desktop interfaces or integrated learning experiences with other devices.