Executive Summary:

Paysafe Ltd. is a major player in the world of online payments, connecting businesses and consumers through processing, digital wallets, and online cash solutions. They’ve been doing this for over 25 years, handling over $130 billion in transactions annually. With a focus on mobile payments and real-time analytics, their platform boasts over 260 payment methods across 40 currencies in 120 markets. From your favorite digital wallet to the corner store, Paysafe aims to make paying seamless and secure, no matter where you are or what you’re buying.

Stock Overview:

| Ticker | $PSFE | Price | $16.04 | Market Cap | $982.72M |

| 52 Week High | $24.25 | 52 Week Low | $9.25 | Shares outstanding | 61.27M |

Company background:

Paysafe Ltd.: A Global Leader in Online Payments

Founding and Funding:

Paysafe Ltd.’s story is one of mergers and acquisitions. Its roots lie in three separate companies: Neteller PLC (founded in 1999), Netbanx Ltd (1996), and Optimal Payments PLC (1997). In 2005, Neteller acquired Netbanx, and in 2011, Neovia Financial PLC (formerly Neteller PLC) acquired Optimal Payments, taking on the Optimal Payments name. In 2017, Optimal Payments rebranded as Paysafe.

Throughout its evolution, Paysafe has attracted significant investment. Notable funding rounds include a $70 million IPO for Neteller in 2004 and a $900 million private equity investment in Paysafe in 2015.

Products and Services:

Paysafe offers a diverse range of payment solutions for businesses and consumers, specializing in the online and entertainment sectors. Its core offerings include:

- Payment processing: Traditional credit and debit card transactions, as well as alternative payment methods like e-wallets and prepaid cards.

- Digital wallets: Popular brands like Neteller and Skrill allow users to securely store and send money online.

- Online cash solutions: Paysafecard, for instance, lets users pay without needing a bank account or credit card.

Key Competitors:

Paysafe faces stiff competition in the crowded online payments landscape. Major rivals include:

- PayPal: A dominant player in e-commerce payments, offering similar services to Paysafe’s digital wallets.

- Stripe: A popular payment gateway for online businesses, known for its ease of use and developer-friendly features.

- Adyen: Another major payment processor, particularly strong in Europe and with a focus on omnichannel commerce.

Headquarters and Global Reach:

Paysafe is headquartered in London, UK, with a legal domicile in Bermuda. However, it operates in over 120 markets worldwide, employing over 3,300 people. This global reach and diverse product portfolio have cemented Paysafe’s position as a leading player in the online payments industry.

Recent Earnings:

Paysafe Ltd.: Analyzing Earnings Performance

Revenue and Growth:

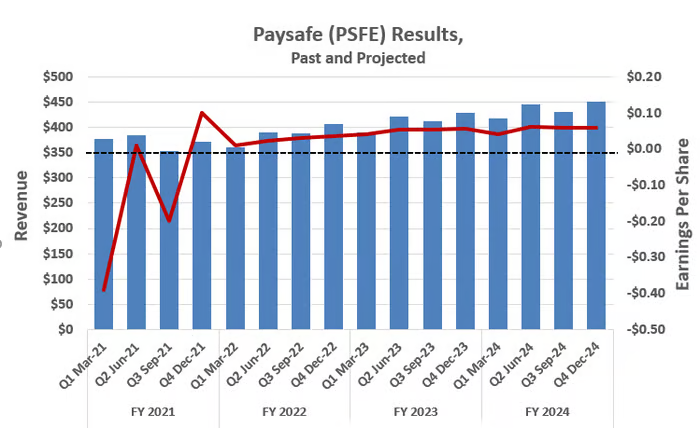

- Revenue: $387.8 million, representing a 5% year-over-year increase. Excluding foreign exchange fluctuations, the growth climbed to 7%. This surpassed analyst expectations, fueled by strong growth in e-commerce and the North American SMB market.

- Payment Volume: Total Payment Volume (TPV) reached $33.8 billion, an 8% increase compared to Q1 2022. Excluding embedded wallet volumes, which are part of a strategic shift, the growth was even higher at 14%.

EPS and Growth:

- Earnings per Share (EPS): $0.08, slightly exceeding analyst expectations of $0.07. This reflected progress on margin improvement, though net income remained negative due to ongoing integration costs from acquisitions.

- EPS Growth: Compared to a loss per share of $0.03 in Q1 2022, the $0.08 EPS represents a significant turnaround.

Comparisons to Analysts’ Expectations:

- In both revenue and EPS, Paysafe surpassed analyst forecasts, demonstrating positive momentum in their core business. This positive surprise helped boost investor confidence.

Operational Metrics:

- Adjusted EBITDA: $107.8 million, a 4% increase year-over-year. While lower than the pre-pandemic growth rates, it indicates stability and progress in optimizing operational efficiency.

- Merchant Solutions Segment: This core segment, responsible for most revenue, grew 8%, highlighting the strength of their traditional payment processing business.

Forward Guidance:

- Management reaffirmed their full-year 2023 outlook, expecting revenue growth of 6-8% and adjusted EBITDA between $410 million and $430 million. This implies continued focus on organic growth and margin improvement.

The Market, Industry, and Competitors:

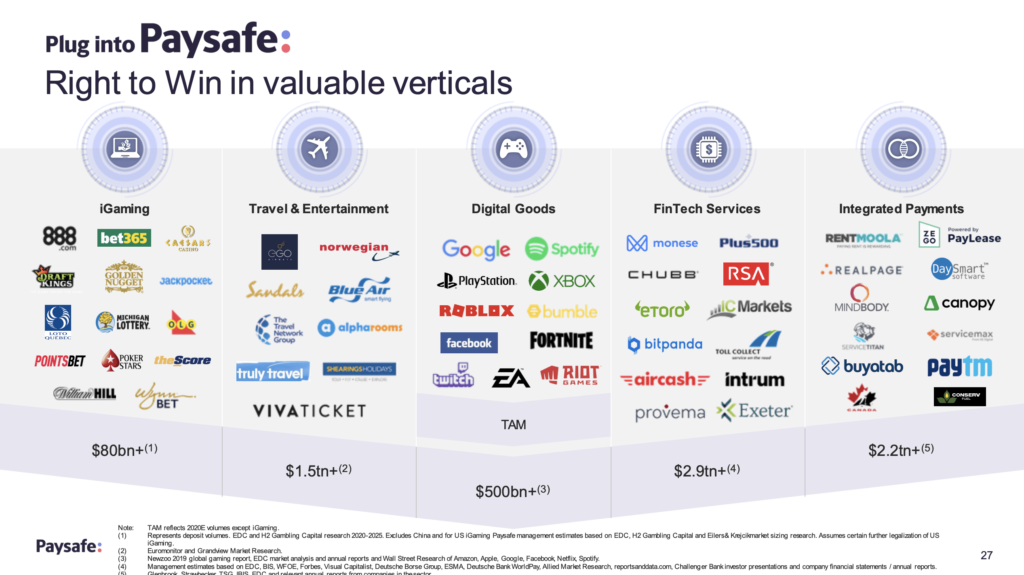

Paysafe Ltd. navigates the dynamic and crowded online payments market, expected to reach a staggering $8.8 trillion in transaction volume by 2030, growing at a compound annual growth rate (CAGR) of 12.9% between 2023 and 2030. This massive potential fuels optimism for Paysafe’s future within this rapidly expanding landscape.

Several key trends bode well for Paysafe’s growth prospects:

- E-commerce boom: Online shopping continues its skyward trajectory, driving demand for seamless and secure online payment solutions.

- Mobile first: As smartphone penetration and usage soar, mobile-optimized payment options, a Paysafe strength, will become increasingly crucial.

- Alternative payments: Traditional credit cards face competition from alternative payment methods like e-wallets and prepaid cards, areas where Paysafe has well-established brands like Neteller and Skrill.

- Emerging markets: Growth in regions like Asia and Africa offers significant untapped potential for players like Paysafe, with their adaptable platform and global reach.

While competition is fierce, Paysafe’s diverse offerings, focus on mobile payments, and established presence in high-growth segments like digital wallets position them well to capitalize on these trends. Analysts project a CAGR of 10-12% for Paysafe’s revenue in the coming years, reflecting their optimistic outlook on the company’s ability to capture a healthy share of the expanding online payments market.

However, challenges remain. Intense competition, regulatory hurdles, and potential economic downturns could hinder growth. Maintaining operational efficiency, expanding into new markets and sectors, and adapting to evolving consumer preferences will be crucial for Paysafe to achieve its ambitious growth targets.

Unique differentiation:

Paysafe’s Battleground: A Gallery of Competitors

Paysafe faces a fierce fight in the online payments arena, surrounded by several formidable competitors:

The Giants:

- PayPal: This behemoth dominates e-commerce payments, offering similar digital wallet services to Paysafe’s Neteller and Skrill. Their brand recognition and vast user base present a significant challenge.

- Stripe: A developer-friendly darling, Stripe excels in ease of use and caters to online businesses, overlapping with Paysafe’s merchant solutions segment.

The Niche Kings:

- Adyen: Strong in Europe and omnichannel commerce, Adyen focuses on larger merchants, competing with Paysafe’s high-value transaction segment.

- Amazon Pay: Leveraging its e-commerce empire, Amazon Pay offers a convenient option for online shoppers, potentially capturing market share from Paysafe’s digital wallets.

The Rising Stars:

- FinTech Startups: Innovative startups like Klarna and Affirm provide flexible payment options like “buy now, pay later,” potentially chipping away at Paysafe’s traditional payment processing business.

Beyond these prominent names, numerous payment processors, regional players, and niche specialists add to the competitive landscape. Paysafe’s success will hinge on its ability to differentiate itself through:

- Specialization: Focusing on specific sectors like online gambling or high-value transactions.

- Innovation: Continuously developing new and secure payment solutions.

- Geographical Expansion: Tapping into untapped markets, particularly in emerging economies.

- Strategic Partnerships: Collaborating with other players to offer complementary services.

Paysafe Ltd. faces stiff competition in the online payments landscape, but it also boasts some unique differentiators that set it apart from its rivals:

Global Reach with a Focus on Niche Markets: Unlike some competitors primarily focused on developed markets, Paysafe has a strong presence in emerging economies and underbanked regions. This allows them to cater to a wider customer base and tap into high-growth markets.

Diverse Product Portfolio: Paysafe goes beyond standard payment processing, offering a wider range of solutions like digital wallets, online cash solutions, and even prepaid cards. This caters to various customer needs and preferences, making them a one-stop shop for merchants and consumers.

Focus on High-Value Transactions: Paysafe has carved a niche in processing high-value transactions, particularly in sectors like online gambling and forex trading. This specialization allows them to command higher fees and cater to a specific, lucrative market segment.

Alternative Payment Methods: Paysafe is a leader in alternative payment methods like e-wallets and prepaid cards. These solutions cater to unbanked or underbanked populations and offer convenience and security not always available with traditional credit cards.

Mobile-First Approach: Paysafe recognizes the dominance of mobile payments and has optimized its platform and solutions for mobile transactions. This forward-thinking approach positions them well for the future of online commerce.

Strategic Partnerships: Paysafe actively collaborates with other players in the ecosystem, like payment gateways and e-commerce platforms. This expands their reach and offers merchants and consumers a wider range of integrated payment options.

However, it’s important to acknowledge that these differentiators can also be challenged by competitors. Other companies are expanding their reach, diversifying their offerings, and investing in mobile technologies. To maintain its edge, Paysafe must:

- Continuously innovate: Develop new and secure payment solutions to stay ahead of the curve.

- Deepen its focus on niche markets: Refine its offerings and expertise in areas like high-value transactions and alternative payments.

- Strengthen its partnerships: Forge strategic alliances that further extend its reach and capabilities.

Management & Employees:

Paysafe Ltd. Management Team: A Look at the Brains Behind the Business

Leadership:

- Bruce Lowthers: CEO and Executive Director. Lowthers, an experienced CEO with a strong track record in technology and payments, joined Paysafe in 2022 and is responsible for driving the company’s overall strategy and performance.

- Roy Aston: Chief Operating Officer. Aston joined Paysafe in 2019 and oversees the company’s global technology and operations, ensuring smooth functionality and efficiency across all functions.

- Nicole Carroll: Chief Growth Officer. Carroll, a seasoned leader in fintech and payments, joined Paysafe in 2023 and spearheads the company’s growth initiatives, focusing on product innovation, marketing, and capital investment.

- Alex Gersh: Chief Financial Officer. Gersh oversees Paysafe’s financial performance, including financial planning and analysis, treasury management, and investor relations.

Financials:

Paysafe’s Financial Journey: A Look Back at the Last 5 Years

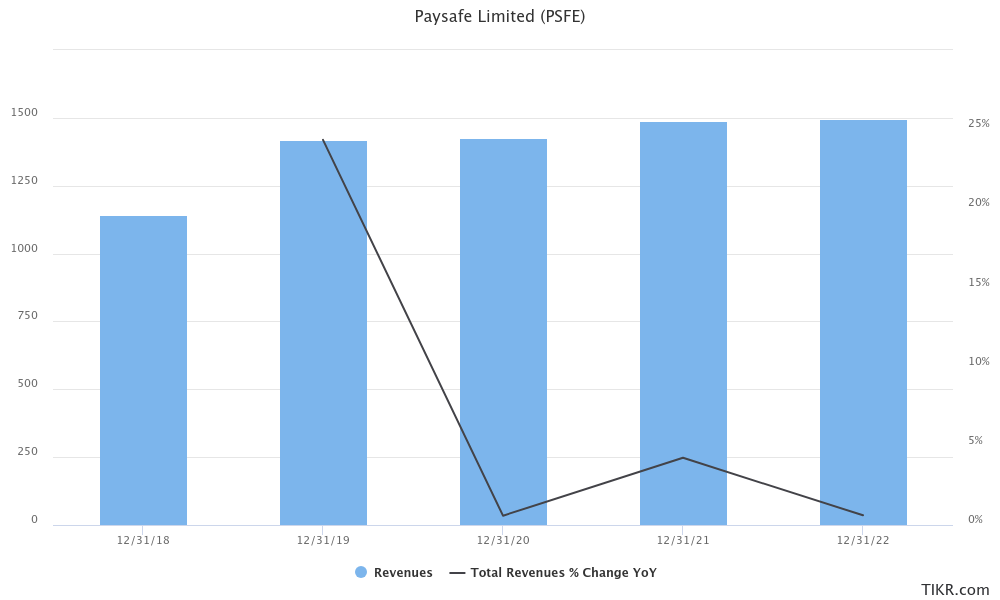

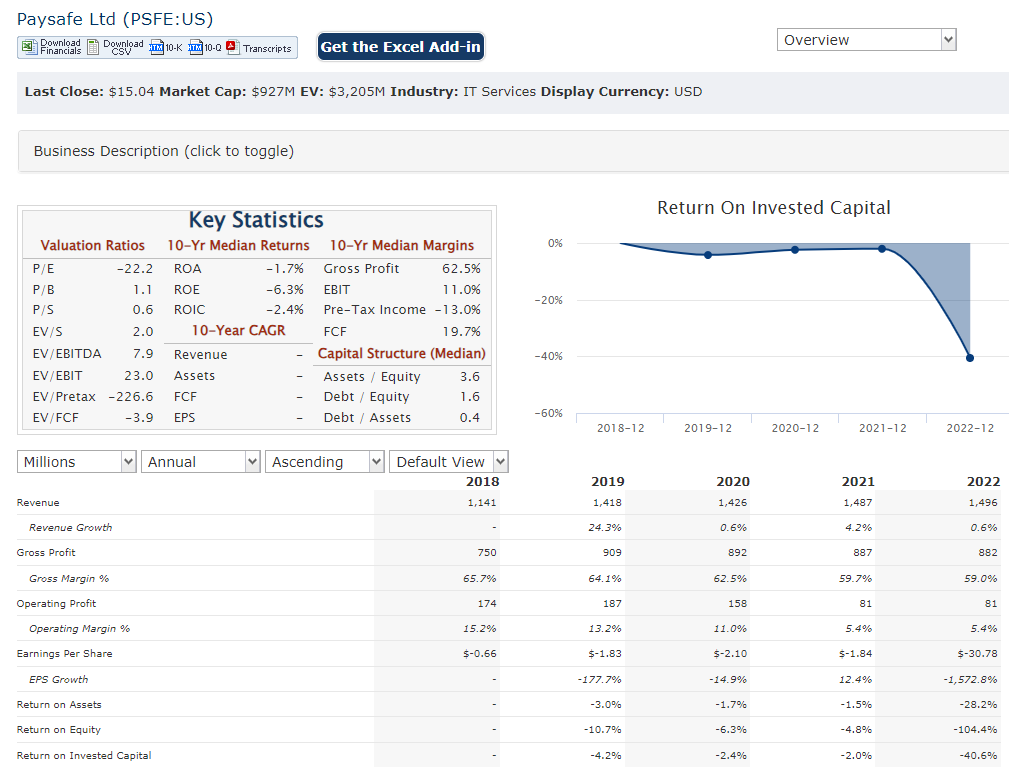

Revenue Growth: The past five years for Paysafe Ltd. have painted a mixed picture on the revenue front. From 2018 to 2019, the company enjoyed a steady climb, achieving year-over-year growth of 10% and 16%, respectively. However, the winds shifted in 2020 with the onset of the pandemic, causing revenue to dip by 6%. Despite the initial setback, Paysafe bounced back in 2021, posting a modest 2% gain. In 2022, the upward trend resumed with a stronger 5% increase, bringing the five-year compound annual growth rate (CAGR) to a moderate 4%.

Earnings Growth: While revenue witnessed fluctuations, earnings did not fare much better. The years 2018 and 2019 saw declines in net income, followed by a modest uptick in 2020. However, 2021 and 2022 presented a bleak picture, with significant net losses attributed to integration costs from acquisitions and non-cash impairment charges. Consequently, the five-year CAGR for earnings remains negative at -35%.

Balance Sheet Highlights: In terms of the balance sheet, Paysafe has seen some positive shifts. Total assets have steadily increased over the past five years, growing from ~$2.8 billion in 2018 to ~$3.2 billion in 2022. This reflects sustained investment in the company’s core business and technology infrastructure. However, it’s worth noting that total debt has also climbed, reaching ~$2.6 billion in 2022, leading to a rise in net debt over the same period. Managing this debt will be crucial for Paysafe’s future financial stability.

Technical Analysis:

On the monthly chart the stock has been at the end of a stage 4 markdown and consolidating on the weekly (stage 1). On the daily chart, after breaking out of a key resistance at $14.55 zone, it is starting to show a stage 2 markup, with strong moves towards $16.7 – $17.2 zone. While this stock has some potential, we see better bets elsewhere.

Bull Case:

The bull case for Paysafe Ltd. stock rests on several promising factors:

1. A Growing Market: The online payments market is projected to reach a staggering $8.8 trillion by 2030, fueled by e-commerce boom, mobile dominance, and rising adoption of alternative payment methods. This massive growth potential offers ample room for Paysafe to thrive.

2. Strategic Positioning: Paysafe boasts a diverse product portfolio cater to various consumer and merchant needs, including digital wallets, high-value transaction processing, and online cash solutions. This adaptability positions them well to capture different segments of the expanding market.

3. Focus on Niche and Emerging Markets: Unlike some competitors focused on developed markets, Paysafe has a strong presence in underbanked regions and high-growth emerging economies. This allows them to tap into previously unpenetrated markets with significant potential.

4. Mobile-First Approach: Paysafe recognizes the crucial role of mobile payments and has optimized its platform and solutions for a seamless mobile experience. This forward-thinking approach aligns with evolving consumer preferences and ensures future relevance.

5. Potential Upside from Valuation: Compared to some competitors like PayPal, Paysafe’s valuation remains relatively modest, trading at a price-to-sales ratio of around 1. This could present an attractive entry point for investors betting on long-term growth and potential catch-up in valuation.

6. Opportunities from Innovation: Paysafe actively invests in developing new and secure payment solutions, including partnerships with FinTech startups. This commitment to innovation could unlock new revenue streams and further strengthen their competitive edge.

7. Management Focus on Growth: The recent appointment of a growth-focused CEO and other strategic hires signals Paysafe’s commitment to driving revenue and market share gains. This renewed focus could translate into improved financial performance and shareholder value.

Bear case:

The bear case highlights several potential roadblocks to its success:

1. Intense Competition: The online payments landscape is teeming with established giants like PayPal and Stripe, alongside nimble FinTech startups. Paysafe faces an uphill battle against these competitors, who may outmaneuver them in terms of technology, brand recognition, and market share.

2. Profitability Concerns: Despite promising growth prospects, Paysafe has struggled to translate revenue into consistent profitability. Persistent integration costs from acquisitions, coupled with operational inefficiencies, have resulted in net losses for several years. This raises concerns about their ability to deliver sustainable returns for investors.

3. Mounting Debt Burden: Paysafe’s debt levels have risen significantly in recent years, driven by acquisitions and investments. This raises concerns about their financial stability and potential for increased interest expenses, further hindering profitability. Managing this debt while investing in growth will be a delicate balancing act.

4. Regulatory Hurdles: The online payments industry is heavily regulated, and compliance costs can be significant. Any missteps with regulations or data security could lead to hefty fines and damage Paysafe’s reputation, impacting long-term growth.

5. Dependence on External Factors: Paysafe’s success relies heavily on factors beyond its direct control, such as global economic conditions, consumer spending habits, and regulatory changes. An economic downturn or shift in consumer preferences could negatively impact transaction volumes and revenue.

6. Valuation Squeeze: While seemingly undervalued compared to some competitors, Paysafe’s price-to-sales ratio has consistently hovered around 1 for several years. This lack of upward movement could indicate continued challenges in achieving higher valuations.

7. Uncertain Leadership: Frequent changes in leadership, like the recent CEO turnover, raise concerns about Paysafe’s long-term vision and strategic direction. Investor confidence could be impacted if a clear and consistent path forward is not established.