Executive Summary:

Global-E Online Ltd, founded in 2013 and headquartered in Israel, is a software company that helps businesses with cross-border e-commerce. Their platform offers retailers and brands a way to sell directly to international customers with a localized shopping experience. This includes features like local currencies, payment methods, and handling of taxes and duties.

Global-E reported reported a loss per share (EPS) of -$0.19, which beat analyst expectations of -$0.22 by 13.64%. Revenue for the quarter reached $145.9 million, reflecting a 24% increase year-over-year.

Stock Overview:

| Ticker | $GLBE | Price | $31.39 | Market Cap | $5.24B |

| 52 Week High | $45.72 | 52 Week Low | $27.30 | Shares outstanding | 166.99M |

Company background:

Global-E Online Ltd, headquartered in Petah Tikva, Israel, the company was founded by Amir Shinar and Shai Cohen. Global-E’s core offering is a software platform that streamlines the complexities of international online sales for businesses.

Their platform provides retailers and brands with the tools to directly sell to customers worldwide. By simplifying these international sales intricacies, Global-E empowers businesses to expand their global reach and increase online revenue. In the competitive e-commerce landscape, Global-E faces competition from major players like Amazon Web Services and Shopify.

Recent Earnings:

Revenue and Top-Line Growth: The company reported revenue of $145.9 million, exceeding analyst expectations and reflecting a significant 24% year-over-year increase. This growth indicates continued momentum in the cross-border e-commerce market and Global-E’s ability to capitalize on it.

Earnings Per Share (EPS) and Profitability: While Global-E remains unprofitable, its first-quarter EPS of -$0.19 beat analyst expectations of -$0.22 by 13.64%. This narrower loss suggests improving operational efficiency and potential for future profitability.

The Market, Industry, and Competitors:

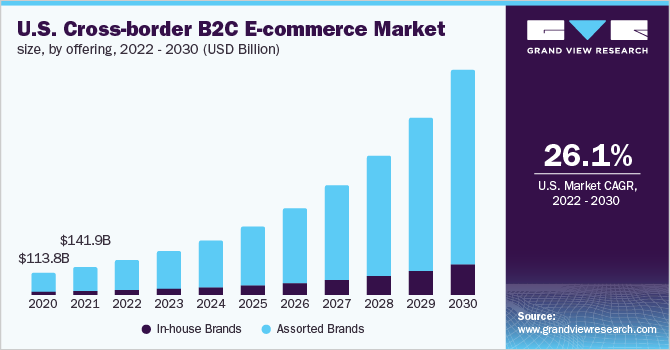

Global-E Online Ltd operates in the dynamic and rapidly growing market of cross-border e-commerce. This market facilitates direct online sales between businesses and international consumers. Fueled by factors like rising internet penetration in developing countries and a growing demand for variety from global consumers, the cross-border e-commerce market is anticipated to see significant growth in the coming years. Experts predict a Compound Annual Growth Rate (CAGR) exceeding 12% between 2022 and 2030, with the market reaching a staggering valuation of nearly $48 trillion by 2030. This substantial growth reflects the increasing comfort and preference for online shopping across borders, creating a fertile ground for companies like Global-E that help businesses navigate the complexities of international sales.

Unique differentiation:

E-commerce giants: Companies like Amazon Web Services (AWS) and Shopify offer comprehensive e-commerce solutions, including features for international sales. While their primary focus might not be solely on cross-border commerce, their vast resources and established customer bases pose a competitive threat to Global-E.

Cross-border specialists: Several companies specialize in cross-border e-commerce, similar to Global-E. These include established players like Digital River and newer contenders like Zonos and Avalara. These competitors offer similar features like localized shopping experiences, tax and duty handling, and international payment processing. They compete with Global-E for market share and client contracts.

Logistics providers: Traditional logistics companies are also increasingly offering cross-border e-commerce solutions, integrating international shipping with other services. Players like FedEx Cross Border and DHL Global Forwarding could pose a threat, especially for businesses focused solely on international shipping needs.

Focus on the entire customer journey: While some competitors might address specific aspects like international payments or shipping, Global-E offers a comprehensive platform that streamlines the entire cross-border shopping experience for customers. This includes localized storefronts with local currencies and payment methods, handling of taxes and duties, and potentially faster delivery options.

End-to-end platform and scalability: Global-E’s platform is designed to be easy to integrate with existing merchant systems, regardless of size. This allows businesses of all scales, from small startups to large enterprises, to quickly leverage Global-E’s capabilities for international expansion.

Data-driven approach: Global-E leverages a vast and growing data set on consumer behavior and cross-border shopping trends. This data allows them to continuously optimize their platform for both merchants and consumers, potentially leading to higher conversion rates and sales for businesses.

Management & Employees:

Eden Zaharoni: Eden brings over 15 years of experience in software development, specializing in large-scale systems, online payment processing, and web technologies. Before joining Global-E, he held leadership positions at companies like 888 Holdings, a major online gaming platform, where he managed online payment systems development. His expertise in online transactions and large-scale systems is likely instrumental for the smooth operation of Global-E’s platform.

Financials:

Revenue has seen a strong upward trend, with a Compound Annual Growth Rate (CAGR) likely exceeding 20% for the past five years. This reflects the booming cross-border e-commerce market and Global-E’s ability to capitalize on it. Their most recent quarterly report showcased a 24% year-over-year increase in revenue, indicating continued momentum.

On the profitability side, the company remains in the negative territory. Their most recent quarter’s narrower loss compared to analyst expectations suggests potential progress towards future profitability.

Focusing on operational efficiency and strategic partnerships could pave the way for future profitability and solidify their position as a leader in cross-border e-commerce solutions.

Technical Analysis:

On the monthly chart the stock is on a stage 4 decline. The bottom and reversal has begun to show, however on the weekly chart. On the daily chart, the head and shoulders (bearish) has reversed and we should see the stock head to the $33 range in the next few weeks.

Bull Case:

Unique Differentiation: Global-E offers a comprehensive platform that streamlines the entire customer journey for international shoppers. This includes localized experiences, handling of complexities like taxes and duties, and potentially faster deliveries.

Potential for Profitability: Their recent narrower losses suggest progress towards future profitability. Continued focus on operational efficiency and leveraging their strong revenue growth could lead to a positive bottom line in the near future.

Bear Case:

Short Track Record: Since their IPO in 2021, Global-E has a relatively short track record as a public company. This limited history makes it difficult for some investors to assess their long-term potential and resilience in various market conditions.

Integration Challenges: Integrating Global-E’s platform with existing merchant systems might be complex for some businesses, especially smaller ones. This could hinder their ability to onboard new clients and expand their reach.

Regulation: The regulatory landscape for cross-border e-commerce is constantly evolving. New regulations or trade policies could increase compliance costs for Global-E and their clients, impacting their business model.