Executive Summary:

Five9 Inc. is a cloud software company that provides contact center solutions for businesses in the United States and internationally. Their cloud platform acts as a central hub for customer interactions, enabling businesses to manage both inbound and outbound calls from a single system. Five9 focuses on transforming traditional call centers into customer engagement centers by using features like artificial intelligence and offering a customizable platform.

They achieved record revenue of $137.9 million, reflecting a 45% increase compared to the same period last year. The company did not meet EPS expectations, reporting a loss of -$0.13 per share compared to the analyst consensus of -$0.26 per share.

Stock Overview:

| Ticker | $FIVN | Price | $50.04 | Market Cap | $3.69B |

| 52 Week High | $92.40 | 52 Week Low | $49.52 | Shares outstanding | 73.87M |

Company background:

Five9, Inc. is a leading provider of cloud contact center software, established in 2001. The company was founded by Rowan Trollope and Izhak Cohen, with a vision to revolutionize the way businesses handle customer interactions. Five9’s cloud-based platform offers scalability and flexibility, allowing companies to easily adjust their agent capacity based on demand.

Five9’s core product is its Intelligent Cloud Contact Center which integrates various features to enhance the customer experience. This includes omnichannel support for calls, emails, chat, and social media, along with artificial intelligence (AI) powered tools for agent productivity and automated tasks.

Five9 has carved a niche for itself with its focus on ease of use, scalability, and a robust open platform that allows for integrations with various third-party applications. The company is headquartered in San Ramon, California, and has a global presence with operations across North America and other regions.

Recent Earnings:

Revenue and Growth: Five9 reported strong revenue of $137.9 million, reflecting a significant 45% year-over-year growth.

EPS and Analyst Expectations: Five9 reported a loss of -$0.13 per share. This underperformed analyst predictions of -$0.26 per share.

The Market, Industry, and Competitors:

Five9 operates in the Cloud Contact Center Software (CCaaS) market a Compound Annual Growth Rate (CAGR) of approximately 14.20% by 2030. The increasing adoption of cloud-based solutions, the rising demand for omnichannel customer service, and the growing importance of artificial intelligence (AI) for enhancing agent productivity and customer experience.

Their focus on innovation, scalability, and a user-friendly platform positions them well to capitalize on the expanding market. As companies continue to prioritize exceptional customer service and leverage cloud technologies, Five9 is poised to benefit from this industry tailwind.

Unique differentiation:

Industry Leaders: Genesys Cloud CX and NICE CXone are major competitors with comprehensive cloud contact center solutions. Genesys stands out for its ability to handle very large, global contact centers with tens of thousands of agents.

Focus on Specific Areas: Talkdesk is known for its ease of use and rapid deployment, making it attractive for businesses seeking a user-friendly solution. CloudTalk caters to small and medium businesses with a cost-effective option that provides core contact center features.

Considering Alternatives: Depending on specific needs, some businesses might look beyond CCaaS entirely. For instance, 3CX offers an on-premise option for companies preferring to host their contact center software themselves.

Ease of Use and Scalability: Five9 prides itself on a user-friendly platform that simplifies deployment and agent adoption. This is particularly attractive for businesses seeking a solution that can be implemented quickly and without extensive IT resources. Five9’s cloud-based architecture allows companies to easily scale their contact center capacity up or down as needed, making it suitable for businesses of all sizes.

Open Platform and Integrations: Five9 offers a robust open platform that integrates seamlessly with various third-party applications. This flexibility empowers businesses to tailor their contact center to their specific needs and workflows. By integrating CRM systems, marketing automation tools, or business intelligence software, companies can create a more unified customer experience and streamline operations.

Focus on Innovation: Five9 consistently invests in research and development, pushing the boundaries of CCaaS technology. They incorporate features like artificial intelligence (AI) for tasks like call routing, sentiment analysis, and automated chatbots.

Management & Employees:

- Mike Burkland (CEO & Chairman): Leads the overall direction and strategy of Five9.

- Dan Burkland (President): Oversees day-to-day operations and execution.

- Jonathan Rosenberg (CTO): Drives the technological innovation behind Five9’s platform.

Financials:

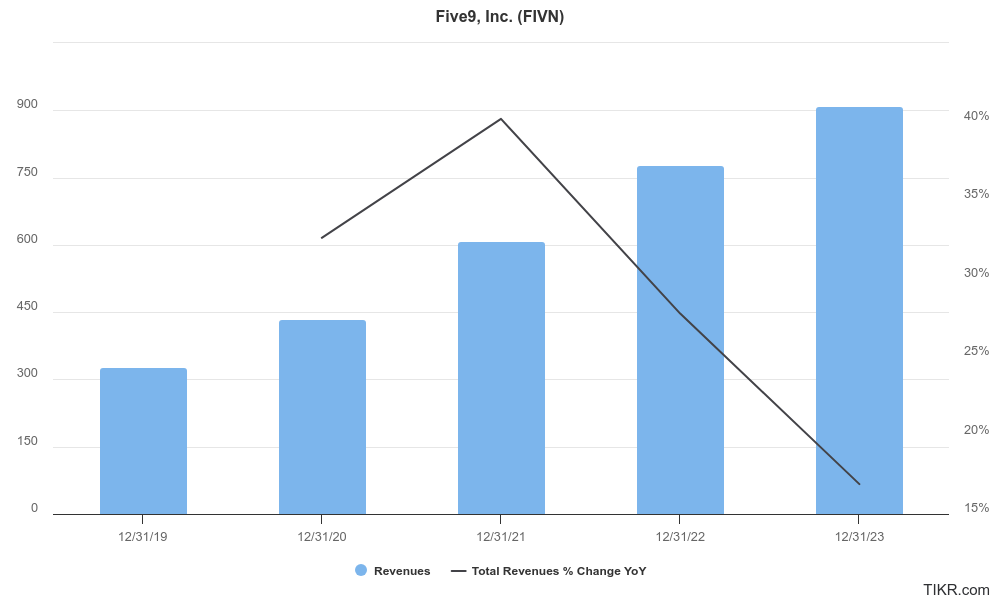

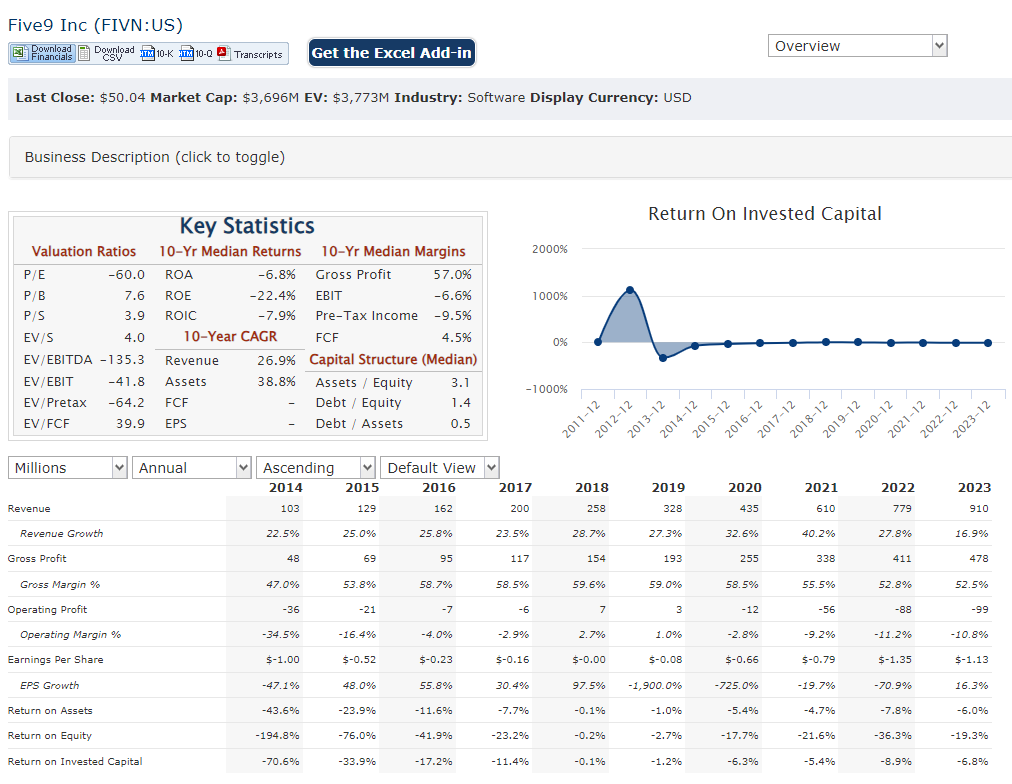

Five9 has their annual revenue has grown at a Compound Annual Growth Rate (CAGR) exceeding 15%. This impressive trajectory reflects the increasing demand for cloud-based contact center solutions.

Five9 remains unprofitable. The company has reported net losses in recent years, though the losses may be narrowing as they invest heavily in research and development to fuel future growth.

This could include expanding their data center infrastructure, developing new features for their platform, or pursuing strategic acquisitions. It’s difficult to assess the overall health of their balance sheet in terms of debt levels or cash reserves.

Technical Analysis:

Shares are in a stage 1 consolidation after a long stage 4 (markdown) phase on the monthly chart. On the weekly chart as well, there is a base being built, but no reversal yet. On the daily chart, a stage 4 markdown is seen, which indicates more near term weakness. We would avoid the stock until a reversal is confirmed.

Bull Case:

Market Growth Tailwind: The Cloud Contact Center Software (CCaaS) market is experiencing significant growth, projected to reach a CAGR of around 14.20% by 2030. This surge is fueled by factors like cloud adoption, omnichannel customer service demands, and the rise of AI in the contact center space.

Potential Acquisition Target: The CCaaS market is consolidating, with larger players acquiring smaller ones. Five9’s strong market position and technological advancements could make them an attractive acquisition target for a bigger tech company seeking to expand its cloud offerings.

Bear Case:

Focus on Revenue Growth Over Profitability: While Five9 boasts impressive revenue growth, they haven’t yet achieved profitability. Continued losses could raise concerns about the long-term sustainability of the business model. Investors might be wary of a stock price that relies solely on future growth projections without a clear path to profitability.

Customer Acquisition Costs and Churn: Acquiring new customers in the CCaaS space can be expensive. If Five9 struggles to retain existing customers due to competition or product limitations, it could negatively impact their financials and growth trajectory.