Executive Summary:

HashiCorp is an American software company founded in 2012 that helps developers, operators and security professionals manage cloud-based infrastructure. Their tools allow users to set up, secure, run and connect cloud systems. The company offers a freemium model, with a free tier and paid plans with additional features. HashiCorp recently agreed to be acquired by IBM, creating a comprehensive hybrid cloud platform.

Earnings per share (EPS) were positive at $0.05.

Stock Overview:

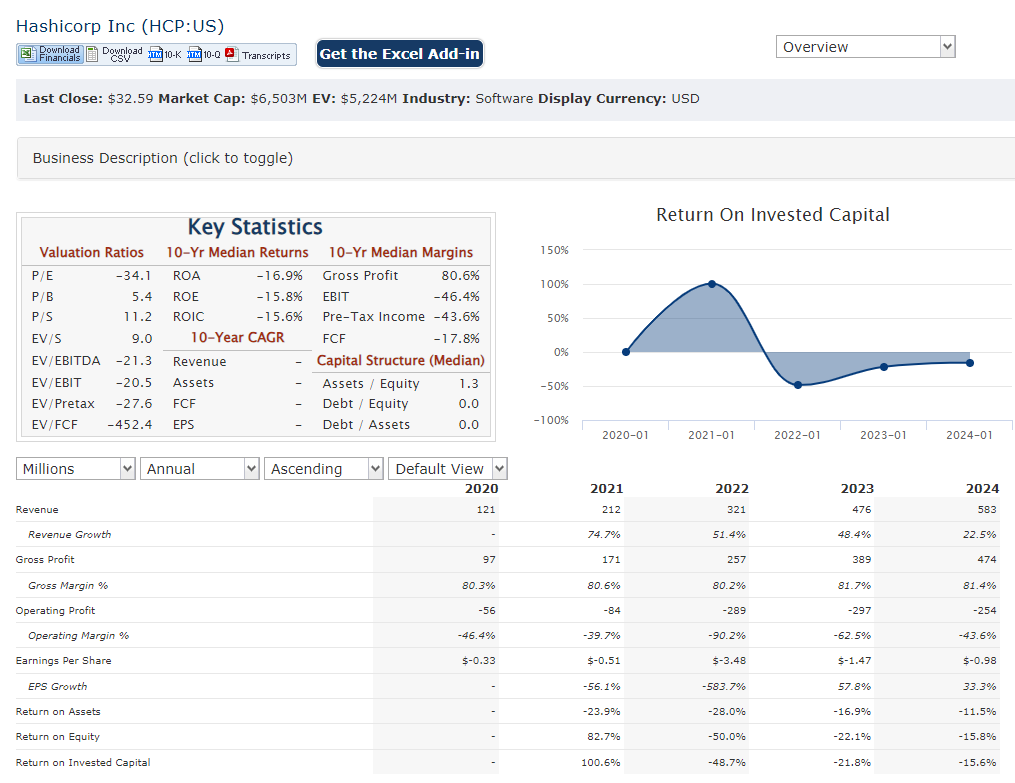

| Ticker | $HCP | Price | $32.48 | Market Cap | $6.51B |

| 52 Week High | $36.39 | 52 Week Low | $18.91 | Shares outstanding | 126.4M |

Company background:

HashiCorp, founded by Mitchell Hashimoto and Armon Dadgar, is a San Francisco-based software company. HashiCorp’s suite of infrastructure automation tools assists users in provisioning, securing, running, and connecting cloud-based systems.

HashiCorp’s flagship products include Terraform, a widely used tool for infrastructure provisioning across various cloud platforms; Vault, which secures secrets and credentials; Consul, a service mesh solution for managing service discovery and communication; and Nomad, a tool for deploying and managing containerized applications. These products address the challenges of managing complex cloud environments, making HashiCorp a key player in the cloud computing industry.

HashiCorp faces competition from major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP), all of which offer their own cloud infrastructure management tools. Additionally, HashiCorp competes with companies like Terraform Labs, which develops tools complementary to HashiCorp’s Terraform, and Red Hat, which offers cloud management solutions. HashiCorp’s focus on open-source development and interoperable tools has solidified its position in the market.

Recent Earnings:

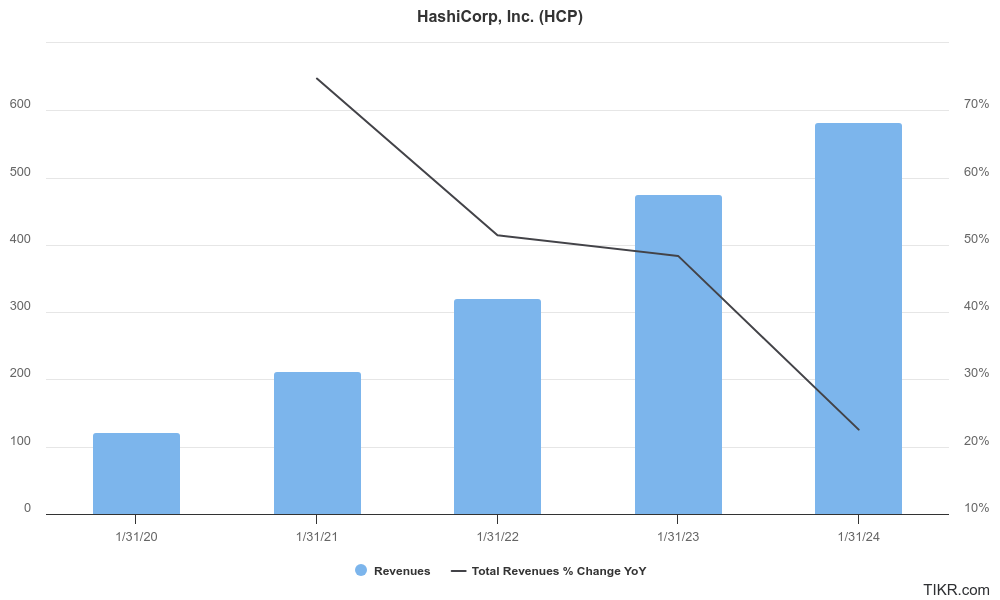

Revenue and Growth: HashiCorp reported a total revenue reaching $583.1 million for the year, representing a year-over-year increase of 23%.

Positive Signs: HashiCorp boasts a healthy trailing four-quarter average Net Dollar Retention Rate of 115%, indicating that existing customers are increasing their spending.

The Market, Industry, and Competitors:

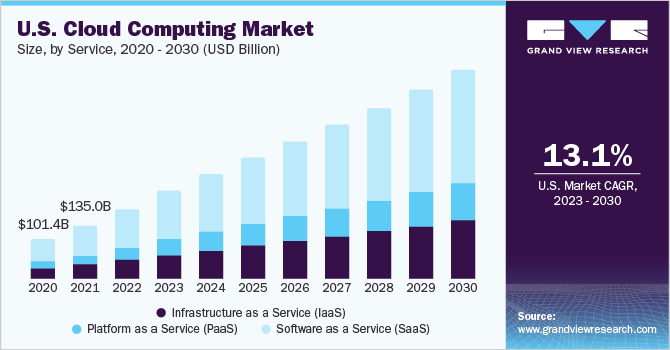

HashiCorp caters to the rising adoption of cloud computing and the necessity for tools that manage complex cloud environments. Analysts anticipate this market to experience robust growth by 2030, with a Compound Annual Growth Rate (CAGR) reaching the high teens (between 15-19%). This trajectory is fueled by businesses increasingly migrating towards cloud-based solutions and the ongoing demand for efficient cloud infrastructure management.

Unique differentiation:

- Major cloud providers: Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) all offer their own cloud infrastructure management tools. These tools are naturally integrated with their respective cloud platforms, potentially offering a smoother experience for users already heavily invested in that specific cloud ecosystem.

- Focused open-source competitors: Terraform Labs, the company behind HashiCorp’s flagship product Terraform’s core functionality, is a notable example. They develop complementary tools that extend Terraform’s capabilities.

- Broader enterprise software players: Companies like VMware and Microsoft provide a wider range of enterprise software solutions, sometimes including cloud infrastructure management functionalities as part of a larger suite. While their feature sets might not directly mirror HashiCorp’s offerings, they can be competitors for a portion of a customer’s budget.

HashiCorp stands out for its focus on open-source development and interoperable tools. This strategy fosters a strong developer community and allows for integration with various cloud platforms, giving them an edge in attracting users who value flexibility and vendor neutrality.

Open-Source Focus and Interoperability: HashiCorp embraces open-source development for its core products. This fosters a vibrant developer community that contributes to and extends the functionality of their tools. Furthermore, HashiCorp’s tools are designed to be interoperable, meaning they can work seamlessly across different cloud platforms.

Suite of Products for Different Needs: HashiCorp doesn’t just offer a single point solution. They provide a comprehensive suite of tools catering to various aspects of cloud infrastructure management. This bundled approach can be attractive to companies seeking a one-stop shop for their cloud infrastructure automation requirements.

Management & Employees:

Dave McJannet (Chief Executive Officer): Leads the overall strategy and direction of the company.

Armon Dadgar (Co-Founder and Chief Technology Officer): A technical mastermind who plays a key role in product development and innovation.

Marc Holmes (Chief Marketing and Business Operations Officer): Spearheads marketing initiatives and business development.

Financials:

HashiCorp total revenue reached $583.1 million, reflecting a significant 22.54% increase year-over-year. This consistent growth trajectory translates to a Compound Annual Growth Rate (CAGR) in the high teens over the past five years.

Earnings per share (EPS) have seen some improvement, the company is still in the investment phase, prioritizing growth over immediate profitability.

HashiCorp’s strong revenue growth suggests a healthy business model with a loyal customer base, as evidenced by their high Net Dollar Retention Rate.

Bull Case:

Riding the Cloud Wave: The cloud infrastructure automation market is booming, driven by the ever-increasing adoption of cloud computing. Analysts predict this market will experience a CAGR in the high teens (15-19%) by 2030. HashiCorp’s suite of products directly addresses the challenges of managing complex cloud environments, positioning them to benefit significantly from this growth.

Recent Acquisition by IBM: The recent acquisition by IBM is a major bullish signal. It validates the value proposition of HashiCorp’s technology and creates a powerful combined entity with a comprehensive hybrid cloud platform. This could lead to significant cross-selling opportunities and increased market penetration for HashiCorp’s products.

Bear Case:

Integration Challenges with IBM: The recent acquisition by IBM might not be as smooth as anticipated. Integrating two large companies with potentially overlapping functionalities can be complex and time-consuming. Delays or unforeseen challenges during integration could hinder growth and impact HashiCorp’s stock price.

Open Source Risks: While open-source development has its advantages, it also carries risks. HashiCorp relies heavily on open-source technologies, which means they face potential security vulnerabilities and may struggle to differentiate themselves if competitors adopt similar open-source approaches.

Net Dollar Retention Rate Decline: While still positive, HashiCorp’s Net Dollar Retention Rate has shown a slight decline in recent quarters. This could indicate a slowdown in customer spending or potential churn, which would negatively impact future revenue growth.