Executive Summary:

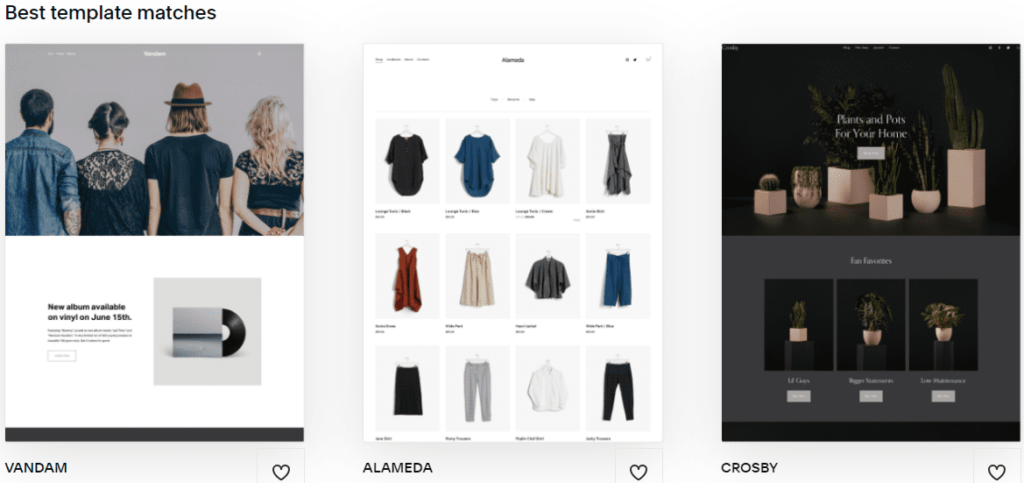

Squarespace provides website building and hosting services. They cater to entrepreneurs and small businesses with an all-in-one platform for building online stores, scheduling appointments, and managing a social media presence. Squarespace offers pre-built website templates and drag-and-drop editing tools, making it easy for users to create professional-looking websites without any coding knowledge.

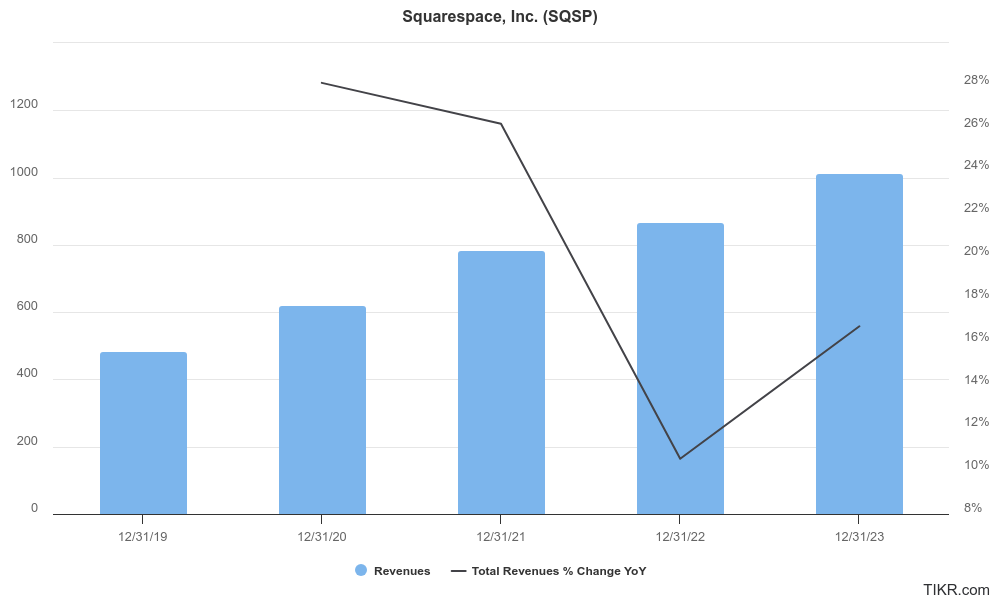

Squarespace’s reported total revenue of $270.7 million, an 18% year-over-year increase. Earnings Per Share (EPS) is forecasted at $0.03 compared to $0.16 last year.

Stock Overview:

| Ticker | $SQSP | Price | $35.75 | Market Cap | $4.91B |

| 52 Week High | $37.89 | 52 Week Low | $25.60 | Shares outstanding | 89.57M |

Company background:

Squarespace, founded in 2004 by Anthony Casalena, is a New York City-based company that empowers individuals and businesses to establish a strong online presence. Casalena envisioned a platform that would democratize web design, making it accessible to those without coding expertise. Squarespace offers a subscription-based model for its software as a service (SaaS) website building and hosting tools.

This allows users to create professional-looking websites for various purposes, from showcasing portfolios to running online stores.

Squarespace faces competition from other website building platforms like Godaddy, WordPress, Wix, and Webflow.com. While WordPress offers more customization options, Squarespace is known for its user-friendly approach. The company, now a publicly traded entity on the New York Stock Exchange under the ticker symbol SQSP, continues to innovate and expand its offerings, aiming to be the go-to platform for building and managing a successful online presence.

Recent Earnings:

EPS and Growth: Squarespace’s EPS for Q4 2023 is expected to be $0.03, which is significantly lower compared to $0.16 reported in the same quarter of the previous year. This represents a decline of over 80%.

Forward Guidance: Squarespace provided positive forward guidance for the full year of 2024. They anticipate overall revenue to land between $274 million and $277 million in the first quarter, representing a year-over-year growth of 16% to 17%. They project their non-GAAP unlevered free cash flow to be between $83 million and $86 million for the first quarter.

The Market, Industry, and Competitors:

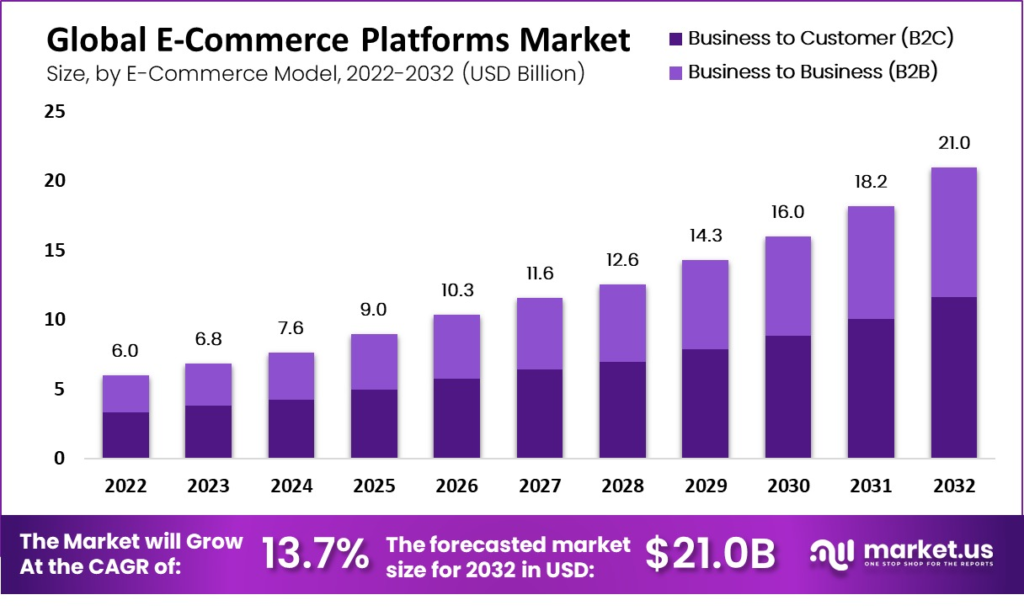

Squarespace operates in the website building and hosting market. Squarespace is well-positioned to benefit from this trend with its user-friendly platform and all-in-one solutions.

While Squarespace analyst estimates suggest a Compound Annual Growth Rate (CAGR) in the range of 10-15% for the website building and hosting market over the next decade. This translates to a potential market size of several hundred billion dollars by 2030. This positive outlook is fueled by the increasing adoption of cloud-based solutions and the growing importance of online presence for businesses of all sizes.

Unique differentiation:

Wix.com: A strong overall competitor, Wix offers a similar user-friendly interface with drag-and-drop editing functions and a vast collection of templates. Wix might appeal to users seeking more creative freedom and a wider range of app integrations.

Shopify: Stands out for its robust e-commerce capabilities. If your primary focus is on building an online store, Shopify offers a comprehensive suite of features for product management, inventory control, and secure payment processing.

WordPress.com: A powerful platform offering a high degree of customization. With its open-source nature, WordPress attracts users seeking complete control over their website’s design and functionality.

All-in-One Solution: Squarespace offers a comprehensive suite of features beyond just website building. Appointment scheduling, marketing tools, and social media management are all integrated into the platform, providing a one-stop shop for entrepreneurs and small businesses to manage their online presence.

Design Aesthetics: Squarespace is known for its focus on clean, modern design templates. This caters to users who prioritize a sleek and professional look for their website without needing extensive design expertise.

Management & Employees:

Chief Marketing Officer (CMO): Kinjil Mathur leads Squarespace’s marketing efforts, driving brand awareness and customer acquisition.

Chief Technology Officer (CTO): John Colton oversees the technological infrastructure and development of Squarespace’s platform, ensuring its stability and scalability.

Chief Creative Officer (CCO): David Lee leads the creative direction for Squarespace, shaping the visual identity of their platform and templates.

Financials:

Squarespace has exhibited consistent revenue growth, solidifying its position in the website building market. Their revenue trajectory suggests a healthy increase in customer base and potentially growing adoption of premium features. Reports indicate year-over-year growth in the range of 15-20% throughout this timeframe. This translates to a Compound Annual Growth Rate (CAGR) estimated to be around 17-18%.

They may have prioritized reinvesting profits back into the business to fuel product development and marketing initiatives. This strategy can be common for fast-growing tech companies. Squarespace might have increased customer deposits or outstanding loans to finance these initiatives.

Technical Analysis:

The stock has built a good base on the monthly chart. On the weekly chart a bull flag is visible and the stock looks like a good bull flag on the daily chart as well. A move down to $33.3 would be a good entry with a stop loss at $31.72 (200 day MA) for a move after earnings to over $37

Bull Case:

Product Expansion: Squarespace continues to expand its product offerings beyond website building, integrating features like appointment scheduling, marketing tools, and social media management. This creates a more valuable proposition for customers and potentially increases their average revenue per user (ARPU).

Mobile-First Approach: Squarespace prioritizes a mobile-first approach, which is crucial in today’s mobile-centric world. This focus on mobile optimization can ensure their platform remains relevant and user-friendly for the evolving needs of customers.

Potential Acquisitions: Squarespace might strategically acquire complementary businesses to expand its offerings and reach new customer segments. This could further strengthen their position in the market.

Bear Case:

E-commerce Limitations: Squarespace offers e-commerce capabilities, but they might not be as robust as dedicated platforms like Shopify. This could be a disadvantage for businesses with complex e-commerce needs.

Subscription Model Dependence: Squarespace relies heavily on its subscription model. If economic downturns lead to customer churn or a shift towards free alternatives, their revenue stream could be negatively impacted.