Executive Summary:

Axcelis Technologies is a major player in the global semiconductor industry. They design, manufacture and service equipment critical for chip production, specifically ion implantation systems and curing systems. It was founded in 1995 and is headquartered in Massachusetts, USA.

Analysts have a consensus EPS forecast of $1.26, which would be lower than the $1.43 EPS they reported for Q1 2023.

Stock Overview:

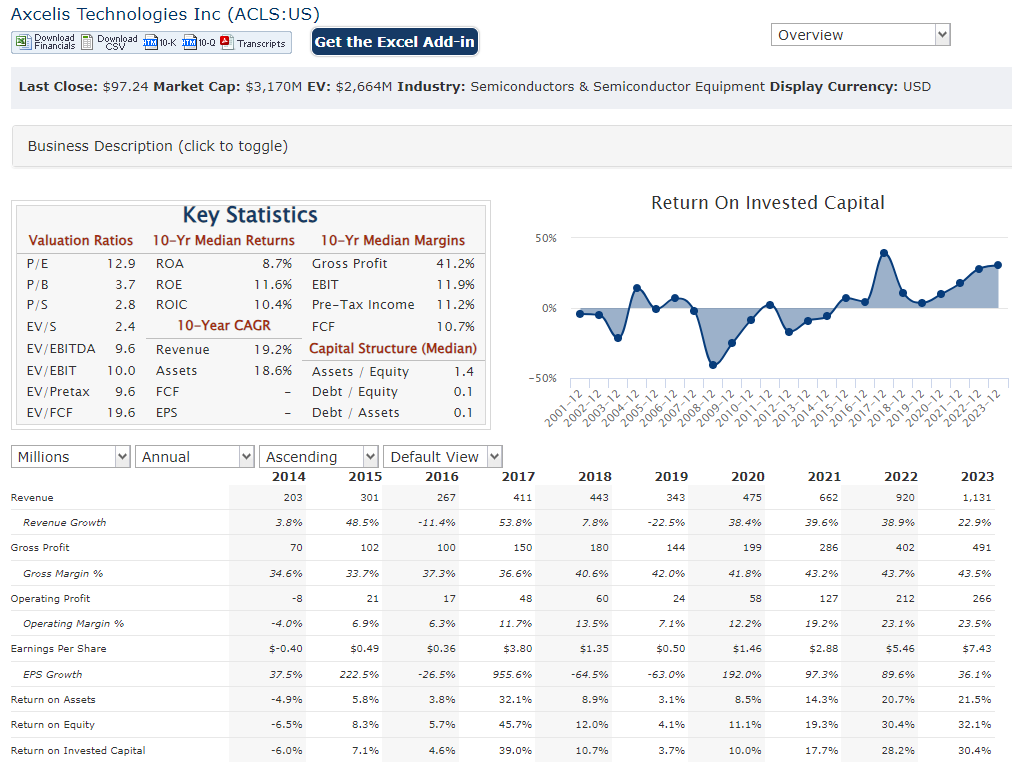

| Ticker | $ACLS | Price | $97.24 | Market Cap | $3.17B |

| 52 Week High | $201.00 | 52 Week Low | $93.77 | Shares outstanding | 32.63M |

Company background:

Axcelis Technologies, their core products are ion implantation systems and curing systems, both playing a vital role in the fabrication of semiconductor chips.

Axcelis faces competition from several established companies in the semiconductor equipment market. Some of their key competitors include Applied Materials, ASML Holding NV, and Tokyo Electron Limited. This competitive landscape pushes Axcelis to continuously invest in research and development to maintain its position at the forefront of technology.

Recent Earnings:

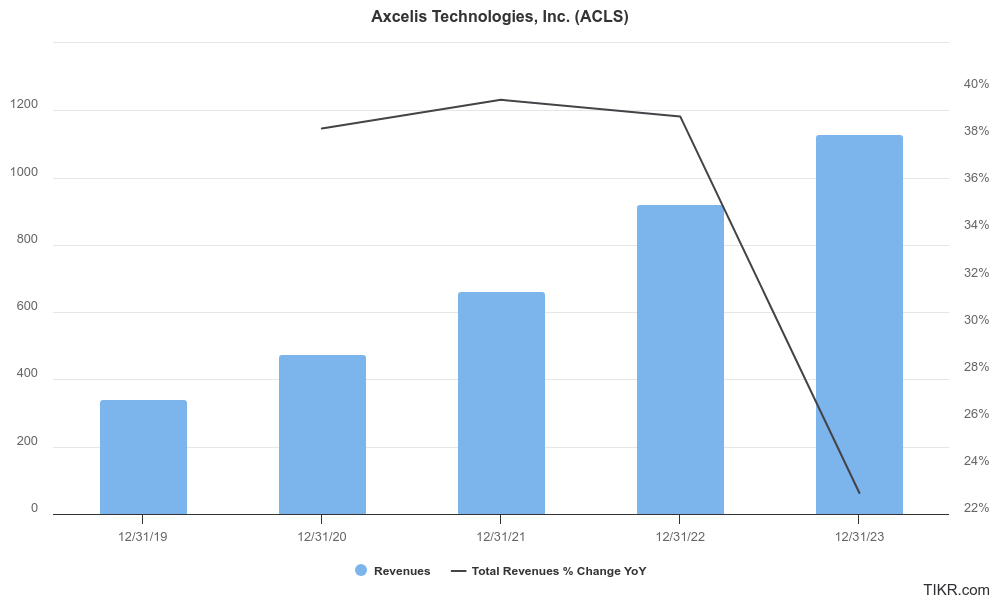

Axcelis revenue reached a record high of $1.13 billion, reflecting a significant 23% increase compared to 2022. This growth indicates a positive trend in the global semiconductor industry, where Axcelis plays a key role. In line with the revenue growth, their net income also saw a healthy increase of 35% year-over-year, reaching $246.3 million. This translates to earnings per share (EPS) of $7.43, exceeding analyst expectations at the time.

Their current forecast is $1.26, which is lower compared to the $1.43 EPS reported for Q1 2023.

The Market, Industry, and Competitors:

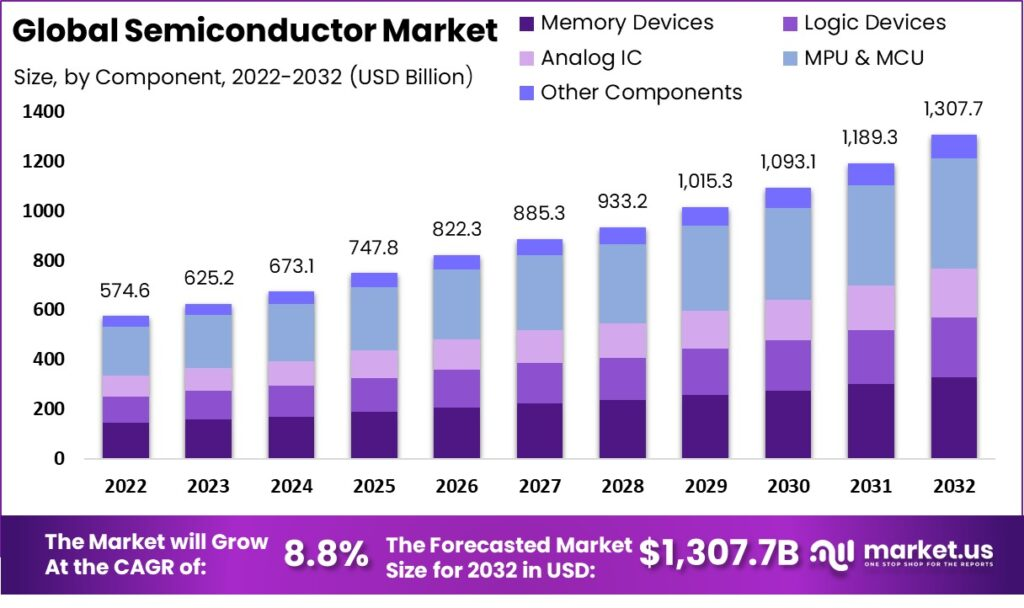

Axcelis Technologies operates in the dynamic and ever-growing semiconductor industry. This industry is a major driver of technological advancements and is crucial for the production of electronic devices, including smartphones, computers, and countless others. Factors like the increasing demand for these devices, the rise of 5G technology, and the Internet of Things (IoT) are expected to propel the industry forward in the coming years. Analysts predict a Compound Annual Growth Rate (CAGR) in the range of 10% to 15% for the semiconductor industry by 2030.

Unique differentiation:

- Applied Materials (AMAT): A behemoth in the industry, Applied Materials offers a vast portfolio of equipment used throughout the chipmaking process. Their financial muscle and broader range of products make them a formidable competitor for Axcelis.

- ASML Holding NV (ASML): Another industry leader, ASML specializes in photolithography equipment, a critical stage in chip production. While their focus differs slightly from Axcelis’s core ion implantation and curing systems, they compete for market share in the overall chip manufacturing ecosystem.

- Tokyo Electron Limited (TEL): A Japanese multinational, TEL offers a variety of chipmaking equipment that overlaps with Axcelis’s product line.

- Focus on a Specific Niche: Unlike some competitors like Applied Materials with a broader product portfolio, Axcelis seems to concentrate on ion implantation and curing systems.

- Innovation for Performance: Axcelis emphasizes its commitment to innovation, which likely translates to developing cutting-edge technology for their core products. This focus on performance could give them an edge in etching sharper features or achieving better uniformity during chip production, making their systems more desirable.

- Client-Centric Approach: Information suggests that Axcelis prioritizes exceeding client expectations in performance. This client focus could involve superior customer service, customization options, or ensuring their systems integrate well with existing equipment in a client’s fabrication facility.

Management & Employees:

- Russell J. Low, Ph.D.: Currently serving as both President and CEO, Dr. Low leads the overall direction and strategy for the company.

- Kevin J. Brewer: As EVP and Chief Financial Officer (CFO), Mr. Brewer handles Axcelis’s financial operations and reporting.

Financials:

Axcelis Technologies has demonstrated impressive financial growth. Their revenue has seen a steady upward trajectory, culminating in a record high of $1.13 billion for the full year 2023. This represents a Compound Annual Growth Rate (CAGR) estimated to be in the double digits, reflecting the increasing demand for their chip-making equipment.

Earnings growth has mirrored the revenue trend. Axcelis has consistently reported year-over-year increases in net income, with 2023 showing a significant 35% jump compared to 2022.

The consistent revenue and earnings growth suggest they’re likely profitable and have the ability to invest in research and development, keeping their technology competitive. Achieving record revenue in 2023 implies they have sufficient assets, like inventory and equipment, to meet customer demand.

Technical Analysis:

The stock is in a stage 4 decline in the monthly, weekly and daily charts. There is support in the $85 – $90 range. We would not be buyers in the stock now.

Bull Case:

- Soaring Chip Demand: The global demand for semiconductors is expected to surge due to factors like the proliferation of 5G technology, the Internet of Things (IoT), and the ever-increasing processing power needed in various devices. This rising demand translates to a need for more chip fabrication plants and equipment, benefiting Axcelis.

- Focus on Niche Expertise: Unlike some competitors with a broader product portfolio, Axcelis concentrates on perfecting ion implantation and curing systems. This focus allows them to potentially become leaders in this specific, but crucial, stage of chip production.

- Innovation for Performance: Their emphasis on cutting-edge technology could give them an edge in etching sharper features or achieving better uniformity during chipmaking. This translates to potentially superior systems sought after by chip manufacturers.

Bear Case:

- Economic Downturn: A broader economic downturn could dampen demand for electronic devices, leading to a ripple effect that reduces demand for chip fabrication equipment, impacting Axcelis’s sales.

- Rapid Technological Change: The semiconductor industry is characterized by rapid advancements. If Axcelis fails to keep pace with innovation, their technology could become obsolete, making their equipment less attractive to chipmakers.

- Customer Concentration: If Axcelis relies heavily on a small number of customers for a large portion of their revenue, a shift in those customers’ spending patterns or buying decisions could significantly impact Axcelis’s financial performance.