Starbucks is the world’s largest specialty coffee retailer, operating and licensing over 38,000 stores globally across North America, China, and international markets. Founded in 1971 and headquartered in Seattle, Washington, the company generates roughly $36–37 billion in annual revenue and serves as a bellwether for global consumer discretionary spending. Starbucks’ core business spans company-operated stores, licensed stores, consumer packaged goods, and digital loyalty engagement. The brand’s scale, pricing power, and loyalty ecosystem differentiate it from regional café chains. Its top competitors include McDonald’s (McCafé), Dunkin’, and Luckin Coffee.

Founding, History, and Evolution

Starbucks was founded in 1971 by Jerry Baldwin, Zev Siegl, and Gordon Bowker as a single store selling coffee beans and equipment. The company’s transformation into a global café brand began after Howard Schultz joined in the 1980s, introducing the Italian espresso bar concept. Starbucks went public in 1992, using aggressive store expansion and brand storytelling to scale internationally. Over decades, the company expanded into food, digital ordering, and loyalty programs, making Starbucks one of the most recognizable consumer brands globally.

Products and Revenue Streams

Starbucks’ core products include handcrafted beverages, brewed coffee, teas, food items, and ready-to-drink offerings. Revenue is split between company-operated stores, licensed stores, and channel development, which includes packaged beverages sold through grocery and convenience channels. Digital ordering, mobile payments, and the Starbucks Rewards ecosystem have become central to customer retention and frequency. Premiumization through cold beverages and customization remains a major revenue driver.

Geographic Footprint and Headquarters

The company’s largest market remains North America, accounting for the majority of revenue and operating income. China is Starbucks’ second-largest market and a long-term growth engine, though performance there has been volatile due to competition and macro conditions. Starbucks operates in over 80 countries, with a mix of company-owned and licensed models. Corporate headquarters remain in Seattle, anchoring global strategy and brand management.

Market Overview and Industry Dynamics

Starbucks operates within the global coffee and quick-service restaurant (QSR) market, valued at over $500 billionannually. The market is driven by urbanization, premium beverage demand, and convenience-led consumption patterns. By 2030, the global coffee market is expected to grow at a CAGR of 4–5%, with cold beverages and ready-to-drink formats outpacing traditional hot coffee. Consumer sensitivity to price and convenience continues to shape competitive dynamics.

Growth Outlook Through 2030

Long-term growth is expected to be led by international expansion, digital engagement, and product innovation. Starbucks’ ability to drive traffic recovery in mature markets while scaling profitably in emerging ones will determine its growth trajectory. Management continues to target mid-single-digit revenue growth annually through store expansion and same-store sales improvement. Margin normalization remains a key swing factor for valuation.

Competitive Landscape

Starbucks faces competition from McDonald’s McCafé, Dunkin’, and Luckin Coffee, as well as regional boutique café chains. McDonald’s competes on price and convenience, while Dunkin’ emphasizes speed and value. Luckin Coffee represents a structurally different model in China, leveraging aggressive pricing and digital-first ordering. Despite competition, Starbucks maintains superior brand equity and loyalty engagement.

Differentiation and Competitive Advantage

Starbucks’ key differentiation lies in its brand strength, global scale, and digital loyalty ecosystem. The Starbucks Rewards program drives repeat visits and data-driven personalization. Premium beverage innovation, particularly in cold drinks, allows for pricing power even in inflationary environments. Few competitors can match Starbucks’ global footprint combined with operational consistency.

Management Team Overview

The company is led by Brian Niccol (CEO), tasked with accelerating operational execution and brand relevance. Rachel Ruggeri (CFO) oversees financial discipline, capital allocation, and margin recovery initiatives. The leadership team is focused on balancing growth investments with profitability improvement over the medium term.

Financial Performance – Last Five Years

Over the past five years, Starbucks has delivered steady revenue growth, recovering strongly from pandemic disruptions. Revenue has grown at a low-to-mid single-digit CAGR, driven by store expansion and pricing actions. Earnings growth has been more volatile due to labor cost inflation, supply chain pressures, and strategic investments. Operating margins peaked pre-pandemic and have since compressed, with management targeting gradual normalization.

Balance Sheet and Capital Allocation

Starbucks maintains a strong balance sheet with consistent free cash flow generation. The company prioritizes dividends and share repurchases, returning significant capital to shareholders annually. Debt levels remain manageable relative to cash flows, supporting ongoing investment and shareholder returns. Capital expenditures focus on store remodels, digital infrastructure, and international expansion.

Bull Case for Starbucks

The bull case centers on sustained traffic recovery in North America, margin expansion as investments mature, and long-term growth from international markets. Starbucks’ pricing power and loyalty ecosystem support resilient cash flows even in a softer macro environment. Successful execution of the turnaround could drive multiple expansion.

Bear Case for Starbucks

The bear case hinges on persistent margin pressure from labor and commodity costs, intensifying competition in China, and consumer trade-down risk in a prolonged economic slowdown. Failure to fully restore transaction growth could cap earnings leverage. Valuation leaves limited room for execution missteps.

Analyst Reaction to Earnings

Following the earnings release, analysts were broadly constructive, highlighting improving traffic trends but expressing caution on near-term margins. Several firms reiterated Hold to Buy ratings, with modest price target adjustments reflecting the EPS miss offset by better-than-expected comps. The consensus view frames Starbucks as a 2026 recovery story rather than a near-term earnings compounder.

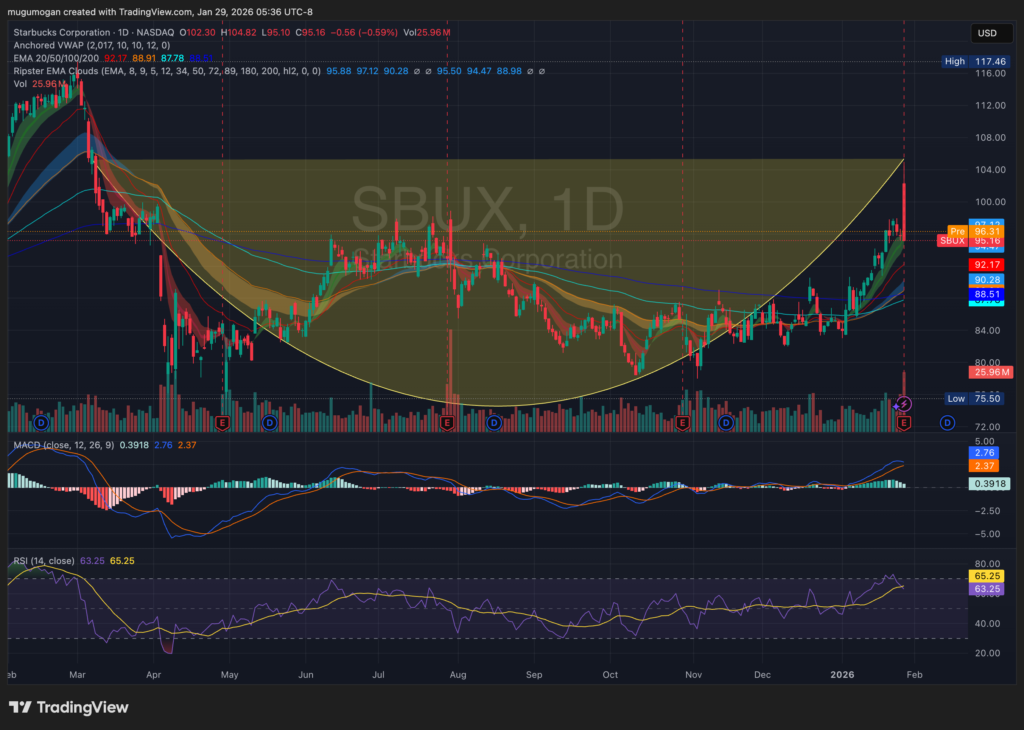

The stock is in a stage 4 decline markdown on the monthly and weekly charts, but is forming a strong bullish stage 2 cup and handle pattern on the daily chart. The move to $90 – 94 would be a good reversal for the stock to head back over $100