Company Overview

Remitly Global Inc. is a digital-native international money transfer company focused on immigrants sending money to family and friends across borders, with a product built mobile-first rather than agent-first. Founded in 2011 and headquartered in Seattle, the company operates in more than 170 countries, supporting hundreds of corridors with bank deposits, cash pickup, mobile wallets, and home delivery. Remitly’s value proposition centers on transparent FX pricing, speed options, and trust in high-stakes transactions. In 2024, the company generated roughly $1.1 billion in revenue, growing north of 30% year over year. Its primary public competitors include Wise, Western Union, and MoneyGram, but its real edge is behavioral: immigrants defaulting to an app, not a storefront.

Most Recent Earnings Performance

Subtitle: Profitability inflection meets sustained volume growth

Remitly reported its most recent quarterly earnings in November 2025 for Q3 2025, delivering revenue of approximately $327 million, up about 35% year over year, materially ahead of consensus expectations. EPS came in at roughly breakeven on an adjusted basis, beating analyst estimates that still modeled modest losses, marking another step toward durable GAAP profitability. Active customers exceeded 7.5 million, up over 30% year over year, while send volume crossed $15 billion for the quarter. Management guided Q4 revenue to the $330–340 million range and reiterated full-year revenue growth in the low-to-mid-30% range, signaling confidence despite FX volatility and global macro noise.

Founding and Early History

Subtitle: Built by immigrants, for immigrants

Remitly was founded in 2011 by Matt Oppenheimer, Josh Hug, and Shivaas Gulati, all of whom had personal experience with the friction and opacity of traditional remittance services. The founders identified that legacy players optimized for physical distribution and fees, not user trust or transparency. Early traction came from immigrant corridors like US-India and US-Philippines, where price sensitivity and reliability mattered most. The company deliberately delayed aggressive monetization to build credibility, a choice that later paid off in retention and organic growth.

Funding and IPO Journey

Subtitle: Venture-backed patience before public scale

Before going public in 2021, Remitly raised over $400 million from investors including Accel, DFJ, Stripes, and Bezos Expeditions. The IPO priced the company as a high-growth fintech rather than a payments utility, which initially proved volatile as public markets rotated away from growth. However, Remitly used its balance sheet conservatively, maintaining strong liquidity and avoiding the overextension seen in many consumer fintech peers. That discipline has allowed management to focus on unit economics instead of survival.

Product Portfolio and Capabilities

Subtitle: Speed tiers, trust, and corridor depth

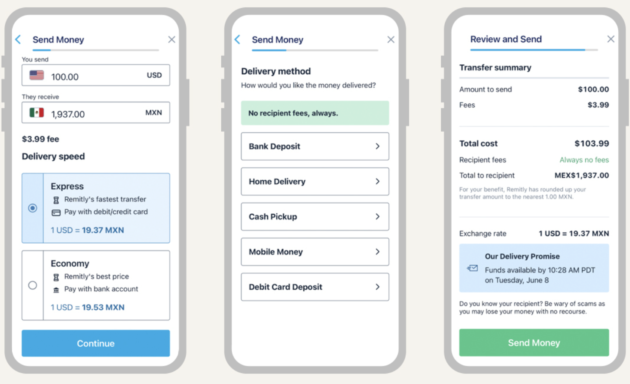

Remitly’s core product is its international money transfer app, which offers multiple speed options—economy, express, and instant—priced transparently with upfront FX disclosure. Unlike many competitors, Remitly invests heavily in corridor-specific compliance, payout methods, and local partnerships, which increases reliability and reduces failed transfers. The company also layers in fraud detection, localized UX, and multilingual support, all of which matter disproportionately in first-generation immigrant use cases. This is not a generic payments app; it is operationally deep by design.

Competitive Landscape and Key Rivals

Subtitle: Digital insurgent versus legacy incumbents

Remitly competes most directly with Wise on the digital side and Western Union and MoneyGram on the legacy side. Wise is stronger in Europe and among higher-income users focused on FX efficiency, while Remitly dominates immigrant corridors where cash pickup and speed matter more than basis points. Western Union and MoneyGram still control physical distribution but are structurally disadvantaged by higher fixed costs and weaker mobile engagement. New entrants exist, but corridor density and regulatory muscle make this a scale game with high barriers to entry.

Market Opportunity

Subtitle: An $800B+ market still mid-digit digital penetration

The global remittance market exceeds $800 billion annually and is expected to surpass $1 trillion by 2030, driven by migration, urbanization, and wage arbitrage. Digital penetration remains below 25% globally, leaving a long runway for app-based platforms. Industry forecasts point to a 7–9% CAGR through 2030, with digital providers growing materially faster than the overall market. Remitly’s focus on emerging market corridors positions it squarely in the fastest-growing segments.

Structural Tailwinds

Subtitle: Smartphones, trust, and regulatory normalization

Smartphone adoption among immigrant populations continues to rise, while regulators increasingly standardize digital KYC and cross-border compliance frameworks. At the same time, younger senders are abandoning storefronts entirely, accelerating share shift toward mobile platforms. FX volatility, counterintuitively, often benefits transparent providers like Remitly because users see pricing clearly rather than being surprised at pickup. These structural forces favor scale digital players with brand trust.

Unique Differentiation

Subtitle: Trust at scale in high-stress financial moments

Remitly’s moat is not just price; it is reliability under stress. When money is sent for rent, medical bills, or emergencies, failure is catastrophic. The company’s investment in corridor depth, fraud prevention, and customer support creates switching costs that are emotional as much as financial. This is why marketing efficiency improves as cohorts mature—trust compounds.

Management Team Overview

Subtitle: Founder-led with operational discipline

Matt Oppenheimer serves as CEO and remains deeply involved in product and regulatory strategy, providing continuity from startup to scale. CFO Joe Flanagan brings public-company rigor, with a focus on unit economics and margin expansion rather than vanity growth. The broader leadership team blends fintech, payments, and international operations experience, which is critical in a compliance-heavy business.

Financial Performance (Five-Year View)

Subtitle: Growth first, now margins catching up

Over the last five years, Remitly has compounded revenue at roughly 40% annually, scaling from sub-$300 million to over $1 billion in annual revenue. Gross margins have steadily expanded into the mid-40% range as scale efficiencies and better FX optimization kicked in. Operating losses have narrowed each year, with 2025 marking the transition toward sustained profitability. The balance sheet remains clean, with ample cash and no existential leverage risk.

Unit Economics and Balance Sheet Health

Subtitle: Marketing leverage finally showing up

Customer acquisition costs have declined on a cohort basis as brand awareness improves, while lifetime value has increased due to repeat usage and higher send frequency. Contribution margin per customer is now solidly positive, enabling the company to self-fund growth. Cash on hand comfortably exceeds near-term needs, giving management flexibility without dilution.

Bull Case for RELY

Subtitle: A digital remittance compounder hiding in plain sight

The bull case rests on Remitly becoming the default global remittance app as digital penetration accelerates, driving multi-year 25–30% revenue growth with expanding margins. Continued share gains from legacy incumbents could produce operating leverage faster than the market expects. If Remitly evolves into a broader immigrant financial platform, upside optionality increases materially.

Bear Case for RELY

Subtitle: Execution risk in a margin-sensitive business

The bear case centers on FX volatility, regulatory friction, or rising compliance costs compressing margins. Competition from Wise or aggressive pricing from incumbents could slow growth in key corridors. Any trust-eroding outage or fraud incident would disproportionately damage the brand.

The stock is still in a long term neutral consolidation phase stage 3 (neutral) on the monthly chart and on a stage 4 decline on the daily chart. The near term outlook is a move lower to the $10.4 range where it could reverse.