Overview — Navan (Nasdaq: NAVN) is a corporate travel and expense platform that combines travel booking, policy controls, and spend management into one workflow for employees and finance teams. The company was founded in 2015 and is headquartered in Palo Alto, California, and it expanded from travel into payments and expense management as a broader “T&E + corporate card” system. Navan’s most recently disclosed annual revenue was about $536.8 million for fiscal 2025 (up from about $402.0 million in fiscal 2024), which frames it as a scaled, still-loss-making software-led operator rather than an early-stage travel-tech app. In the competitive set, the closest “budget lines” investors triangulate against are SAP Concur (via SAP), Amex Global Business Travel (GBTG), and Expensify (EXFY), even though each peer overlaps differently (TMC vs SaaS vs ERP suite). Net-net: Navan is selling cost control + compliance + user experience into a category where CFO pain is permanent and traveler frustration is infinite.

Most Recent Earnings — Navan reported fiscal Q3 2026 results on Monday, December 15, 2025, its first earnings cycle as a public company. Revenue was about $194.9–$195.0 million, up roughly 29% year over year versus about $151.1 million, driven primarily by “usage” revenue (the transaction-linked component) plus a smaller subscription component. Profitability on a GAAP basis worsened sharply, with a GAAP net loss of roughly $225 million (and GAAP loss per share around -$4.58), while non-GAAP profitability improved to positive territory (non-GAAP diluted EPS around +$0.14 versus -$0.31 a year ago). The headline to internalize is that the core engine is still growing fast, but reported earnings are volatile due to financing/non-recurring items and public-company expense structure.

Guidance — Management guided to another quarter of strong growth, and multiple analysts characterized the forward outlook as at least “better than feared,” with commentary pointing to enterprise momentum and continued traction despite the stock’s post-IPO “prove it” phase. The market’s takeaway was less about “can they grow?” and more about “can they grow with cleaner earnings quality and fewer surprises,” which matters disproportionately in a newly public name.

Founding & Evolution — Navan began life as TripActions, built around modernizing corporate travel booking and duty-of-care workflows with a consumer-grade UX. Over time, the platform’s center of gravity shifted from “just booking” to controlling the full spend lifecycle: pre-trip policy, in-trip changes, post-trip expense capture, and reconciliation. The rebrand to Navan signaled that expansion beyond travel into payments/expense wasn’t a side quest—it’s the main game.

Funding & IPO Context — Before listing, the company was valued at roughly $9.2 billion in a 2022 private round, a figure that became the reference point investors used to judge IPO pricing and expectations. In its public-market transition, Navan filed publicly and then moved into a traditional underwritten offering process, positioning itself as a scaled growth business with improving unit economics but still meaningful reported losses. This “late-stage private → public scrutiny” shift is exactly where narrative gets replaced by quarterly math—fast.

Products & How It Makes Money — Navan monetizes through (1) usage-based revenue tied to travel transaction volume and (2) subscription revenue tied to platform access and modules. Product-wise, the platform bundles travel booking, policy controls, approvals, expense automation, and increasingly payment rails (corporate cards / payments workflows) into a single system of record for T&E. The strategic bet is that once you own policy + spend data + traveler behavior, you’re not a “travel app”—you become spend infrastructure.

Customers & Go-To-Market — Navan’s sweet spot is mid-market and enterprise accounts that (a) travel enough to care about leakage, (b) have finance teams tired of policing receipts like it’s a hobby, and (c) want higher adoption than legacy tools typically get. Its enterprise motion is classic: land with travel, expand into expense and payments, then use that footprint to drive higher retention and more durable revenue.

Market Landscape — Navan operates at the intersection of business travel (a massive spend category) and travel & expense management software (a smaller but fast-growing software layer that captures workflow, compliance, and data). The spend layer is cyclical-ish (travel volumes move with macro), while the software layer is secular (finance automation, fraud controls, policy enforcement, and real-time visibility don’t go out of style). That mix creates a business that can grow structurally even when travel demand is uneven—if adoption and expansion are strong.

Market Growth to 2030 — Independent market models commonly peg the global travel & expense management software market in the mid-single-digit billions today, growing to roughly ~$10–$11 billion by 2030, implying a mid-to-high teens CAGR. Meanwhile, global business travel spend is modeled in the low-trillion range today, with forecasts reaching roughly ~$2.7 trillion by 2030 (high-single-digit CAGR). Translation: the “software take-rate” opportunity rises as enterprises modernize workflows, while the underlying spend pool remains enormous.

Competitors — SAP Concur remains the legacy heavyweight embedded in enterprise finance stacks, especially where SAP is already the ERP backbone; it wins on installed base and integration gravity. Amex GBT (GBTG) is more of a travel management company + services/agency model with tech enablement, often winning where managed travel programs and supplier economics dominate. Expensify is narrower and more expense-centric, historically stronger in SMB/mid-market expense workflows, but it lacks the “travel-first + integrated payments” narrative that Navan is pushing.

Differentiation — Navan’s clearest differentiation is the single-platform approach that aims to drive higher user adoption (traveler happiness) while giving finance teams policy enforcement and real-time spend visibility (CFO happiness). That sounds fluffy until you remember the buyer is finance and the end-user is employees—winning both sides is what reduces leakage and increases attach. The other differentiator is structural: blending travel, expense, and payments increases data exhaust and workflow lock-in, which can raise switching costs versus point solutions.

Management Snapshot — Ariel Cohen (co-founder, CEO) and Ilan Twig (co-founder, President) are the two key figures associated with building the platform from the TripActions era into the Navan multi-product suite. For public investors, the finance leadership bench matters disproportionately right now because earnings volatility and the optics of CFO transitions can dominate the narrative even when revenue execution is solid. In other words: execution is necessary; credibility is mandatory.

Financial Performance (Last ~5 Years of What’s Disclosed) — As a recently public company, Navan’s cleanest, most comparable financial disclosure is concentrated in the last few fiscal years and recent interim periods. The key disclosed trajectory is strong top-line growth: fiscal 2025 revenue of about $536.8 million versus fiscal 2024 revenue of about $402.0 million, plus continued growth into fiscal 2026 based on the first-half run-rate disclosed in its IPO materials. Losses have been large and noisy: fiscal 2025 net loss around $181 million versus fiscal 2024 net loss around $332 million, and then a much wider GAAP loss in the most recent quarter that included notable non-operating items. The balance-sheet and earnings-quality discussion is therefore less about “is there demand?” and more about “how fast does GAAP profitability converge as scale increases and one-time items fade?”

Bull Case —

- Revenue durability improves if Navan keeps converting travel volume into higher-margin subscription attach and payments monetization, making growth less dependent on pure transaction volumes.

- If enterprise momentum is real, operating leverage can show up fast because workflow software tends to scale better than services-heavy travel models.

- A mid-to-high teens CAGR category plus share gains can compound into “rule-of-40-ish” outcomes later, even if the next few quarters are messy.

Bear Case —

- GAAP losses and earnings volatility persist long enough to keep the stock in the penalty box, especially if investors interpret surprises (like CFO transitions) as a process/control risk rather than a one-off event.

- Competitive pressure from SAP Concur’s installed base and TMC incumbents could force pricing or incentive spend that delays margin expansion.

- If macro weakens and corporate travel budgets get cut, usage-based revenue can slow quickly, and the multiple compresses before profitability arrives.

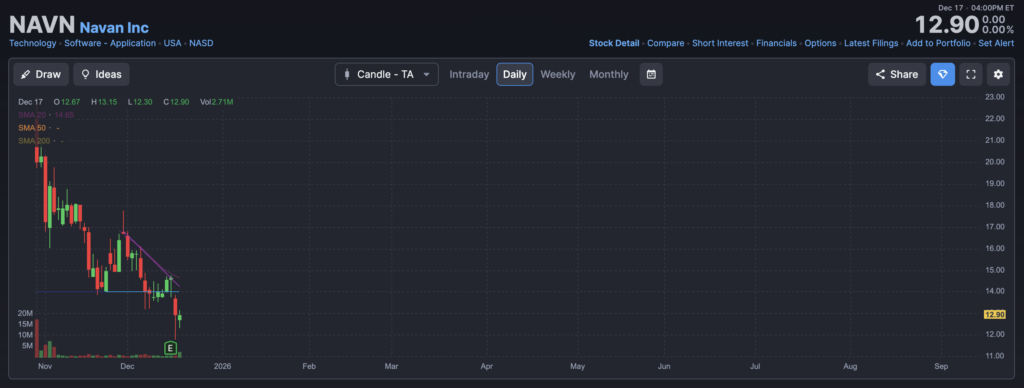

The stock is a recent IPO and not yet at the point where we should take a position. The shorter timeframe charts are all in stage 4 bearish markdown.