Zoom is not just “that pandemic stock” anymore; it’s a $4½–4.8 billion-revenue, $23–24 billion-market-cap collaboration platform trying to grow up in a world dominated by Microsoft and Google. The company, founded in 2011 and headquartered in San Jose, sells a suite of unified communications tools built around Zoom Meetings, Zoom Phone, Zoom Rooms, Zoom Contact Center, Zoom Events/Webinars, Team Chat, and increasingly an AI-first “work platform” layer branded around its AI Companion. It serves roughly hundreds of thousands of enterprise and business customers globally across sectors from tech and education to healthcare and financial services, monetizing primarily via subscription SaaS. For the latest full fiscal year, Zoom generated roughly $4.7 billion in revenue with low-single-digit growth and strong profitability, supported by high gross margins and hefty free cash flow. Its main competitive reference set in investor decks is Microsoft Teams, Google Meet within Google Workspace, and Slack/Salesforce’s broader collaboration cloud.

The most recent numbers on the table are Q3 FY2026 (quarter ended October 31, 2025, reported November 24). Zoom delivered revenue of about $1.23 billion, up 4.4% year over year and roughly $15 million ahead of the top end of its own guidance, with enterprise revenue growing faster than online. Non-GAAP EPS came in at $1.52, up about 10% year over year and comfortably ahead of Street expectations around $1.44, while GAAP EPS spiked to $2.01 thanks to margin expansion and lower expenses. Operating cash flow was about $629 million, up just over 30% year over year, translating into a free-cash-flow margin near 50%, which is elite SaaS territory. For the next quarter, management guided revenue to roughly $1.23–1.24 billion and non-GAAP EPS to about $1.48–1.49, and for the full FY2026 they now expect $4.852–4.857 billion of revenue and $5.95–5.97 in non-GAAP EPS, both raised from prior guidance.

Zoom was founded by Eric Yuan, a former Webex (Cisco) engineering leader who left after years of frustration with video quality and product pace and decided to build a cloud-native, mobile-first video platform from scratch. The company initially bootstrapped with a relatively small team, launched beta in 2012 and GA in early 2013, and quickly differentiated on reliability, ease of use, and low-friction freemium onboarding. Venture funding arrived from firms like Emergence Capital and Sequoia as usage and enterprise traction accelerated, culminating in an IPO in 2019 that valued Zoom at roughly $9 billion pre-COVID. The pandemic then put rocket fuel under the business, driving daily users from tens of millions into the hundreds of millions and forcing the company to scale infrastructure, security, and enterprise features almost in real time.

Product-wise, Zoom has evolved from a “meetings app” into a broader work stack. Core offerings include Zoom Meetings for video, Zoom Phone as a cloud PBX replacement, Zoom Rooms for conference-room hardware and room systems, Team Chat and Mail/Calendar for persistent collaboration, plus Zoom Webinars and Events for large-scale broadcasts and virtual conferences. On top of this sits an increasingly prominent AI layer: AI Companion (now at 3.0) handles meeting summaries, next-step extraction, auto-drafted chat and email, and more, while Virtual Agent and Contact Center target customer-experience and support workflows. The monetization strategy is to keep some AI capabilities bundled in paid plans to reduce churn and upsell heavier-use AI features (e.g., Custom AI Companion) as premium add-ons.

Zoom is headquartered in San Jose, California, with a distributed workforce and R&D presence across North America and Asia. It competes primarily in enterprise and SMB collaboration but its product tentacles now stretch into CCaaS (contact center), UCaaS (unified communications), CX, and event platforms, so it increasingly bumps into Salesforce (via Slack and Service Cloud), Cisco Webex, and niche players like RingCentral and Five9. Historically, the company focused on organic growth rather than big acquisitions, using its cash pile as a buffer and for buybacks; the failed attempt to acquire Five9 in 2021 pushed it to lean harder into building its own phone and contact-center stack. Today, the strategy is “AI-first communications plus CX,” where meetings are just the entry point.

The market Zoom plays in is the global unified communications and collaboration (UCC) + enterprise meetings + cloud calling + CX/CCaaS space, which is comfortably north of $100 billion today if you stack all segments together. Within that, video-conferencing alone is a slower-growth piece as pandemic comps fade, but cloud telephony, CCaaS, AI-driven CX automation, and integrated work platforms are still growing solidly in the low- to mid-teens. Most analysts expect the broader UCC+CXM stack to compound at roughly 10–13% annually through 2030, with AI-infused CX workloads (virtual agents, self-service, summarization) growing faster, sometimes modeled at 15–20%+ CAGR. By 2030, it’s reasonable to frame Zoom’s addressable market as a few hundred billion dollars, provided it can win share beyond pure meetings and deeper into phone, contact center, and AI workflows.

Drilling down, enterprise collaboration suites (Microsoft 365, Google Workspace, Zoom, Slack/Salesforce) are expected to keep taking budget from legacy PBX, on-prem email/groupware, and point tools. For Zoom specifically, the real growth vector is attaching Zoom Phone and Contact Center into existing meetings accounts and then layering AI features on top, effectively turning a $15–20 per seat meetings customer into a $30–40+ per seat UCaaS/CX customer over time. In the bullish 2030 scenario, Zoom grows mid- to high-single digits organically on revenue while expanding margins via AI and automation; in a more pessimistic scenario, it stagnates low-single digits as Microsoft and Google continue to use bundling to choke off standalone collaboration platforms.

On competitors, Microsoft Teams is the primary elephant in the room: Microsoft’s Productivity and Business Processes segment (where Teams lives) did roughly $75–80 billion of cloud-productivity revenue in 2024 alone, with Teams effectively bundled into almost every enterprise Office 365 license at marginal cost. Google Meet within Google Workspace is the second big suite-integrated competitor, riding on top of Gmail, Docs, and Drive; Alphabet’s total revenue in 2024 was about $350 billion, with search and cloud funding aggressive price-competitive moves in workspace. Slack, now part of Salesforce, plays more in persistent messaging and workflow automation but overlaps Zoom in meetings and collaboration, sitting inside a $38 billion-revenue CRM and cloud platform. Cisco Webex remains relevant, especially in large enterprises and regulated industries, while RingCentral, Five9, and others compete more directly with Zoom Phone and Contact Center than with Meetings.

The competitive problem for Zoom is that its three biggest rivals all use broader suites and balance sheets as weapons. Microsoft and Google can treat video/chat as features rather than profit centers, pricing them aggressively inside bundles, while Salesforce can package Slack and Service Cloud together for CX and sales teams. That means Zoom has to win on product quality, reliability, AI, integration, and speed rather than on price. In some niches — higher-education, small business, and mid-market enterprises that are less tightly locked into Microsoft 365 — Zoom still has brand strength and user preference, but in large enterprises the default question is often “why not just use Teams?”

Zoom’s main differentiation is focus plus execution in real-time communications: it built a single-purpose, cloud-native video platform first and only later broadened out, so meeting reliability, low-latency performance, and simplicity remain strong relative points versus more bloated suites. The company is also pushing harder than most peers on bundling AI directly into the core experience rather than hiding it behind separate SKUs, which helps user adoption; meeting summaries, auto-generated action items, and AI-drafted responses are increasingly “just there” for paying users. In CX, Zoom’s Virtual Agent and Contact Center products let it tie meetings, calling, and customer interactions together on one stack, which is attractive for mid-market companies trying to consolidate vendors. Finally, Zoom remains far smaller than its big-tech rivals, so incremental wins in phone, CX, and AI can move the growth needle in a way that’s almost invisible inside Microsoft’s or Alphabet’s P&L.

On the management side, Eric Yuan is still the face and driving force of the company as founder-CEO; he’s highly technical, obsessed with customer feedback, and has already steered the firm through hypergrowth, a massive security/privacy backlash in 2020, and a post-pandemic normalization. Supporting him on the technology front is Xuedong Huang as CTO, bringing deep AI and speech-recognition expertise to the product roadmap and the AI Companion stack. The broader exec bench includes leaders across product, go-to-market, and finance who have experience at large-cap tech (Cisco, Microsoft, Google), giving Zoom a reasonably seasoned C-suite relative to its size.

Financially, Zoom’s last five fiscal years show the classic COVID spike and then a long landing. Revenue went from about $2.65 billion in FY2021 to $4.10 billion in FY2022, $4.39 billion in FY2023, $4.53 billion in FY2024, and roughly $4.67 billion in FY2025, implying a five-year revenue CAGR in the mid-teens but a very modest 3% compound growth over the last three years as the pandemic tailwind faded. That trajectory is why the market no longer treats Zoom as a hypergrowth stock; it’s now a profitable, steady mid-single-digit grower unless the AI/CX bets change the slope.

Earnings, however, look much better than the growth narrative suggests. Net income in 2024 was about $1 billion, and while 2021–2023 saw volatility as the company ramped hiring and security spend, recent years show a return to expanding operating margins, with non-GAAP operating margin above 25% and Q3 FY2026 non-GAAP operating margin over 40%. Cash generation is strong: free-cash-flow margins around 40–50% put Zoom in the same profitability league as much larger cloud players, and the balance sheet carries billions in cash and equivalents with no net debt. Capital allocation has shifted toward buybacks; the board recently added another $1 billion to the repurchase authorization, signaling that management sees the stock as undervalued and doesn’t have an immediate M&A binge in mind.

Zoom’s five-year revenue CAGR (from FY2021 to FY2025) is roughly 15%, but the more relevant recent three-year CAGR is closer to 3–4%; earnings CAGR is stronger given margin expansion, but again off a lumpy COVID base. The investment question now is whether the company can re-accelerate into high-single-digit or low-double-digit revenue growth by 2030 via AI-driven upsell and CX/phone penetration while maintaining these very high cash margins. If yes, Zoom screens as a cash-rich, under-appreciated mid-cap compounder; if not, it risks being valued like a slowly growing utility-style SaaS asset with good margins but little narrative juice.

Bull case for ZM (up to 3 points)

• AI Companion, Zoom Phone, and Contact Center drive steady ARPU expansion and push revenue growth back toward high-single-digits while margins remain 30–40%+ on a non-GAAP basis, turning Zoom into a cash compounder.

• Hybrid work, CX automation, and vendor consolidation keep favoring unified platforms; Zoom wins mid-market share as an easier, more focused alternative to sprawling Microsoft and Google stacks.

• Strong balance sheet and high free cash flow enable aggressive buybacks at reasonable multiples, boosting per-share metrics even if top-line growth stays modest.

Bear case for ZM (up to 3 points)

• Microsoft and Google keep undercutting Zoom via bundling, causing meeting-seat churn and limiting Zoom’s ability to upsell phone/CX, capping long-term revenue growth at low-single digits.

• AI features become commoditized across collaboration tools, eroding Zoom’s differentiation and making it hard to justify premium pricing or incremental AI monetization.

• Any macro slowdown or IT budget tightening hits mid-market and SMB customers hardest, raising churn and pressuring what is still a concentrated, collaboration-heavy revenue base.

Analyst reaction to the latest Q3 FY2026 print was broadly constructive but not euphoric. The Street acknowledged the clean beat on both revenue and EPS, the strong cash-flow print, and the full-year guidance raise as clear positives, with several brokers nudging price targets higher by mid-single-digits and reiterating neutral/outperform-type ratings rather than making wholesale upgrades. Commentary focused heavily on AI monetization — analysts want to see concrete revenue attribution from AI Companion and CX products, not just adoption metrics — and on whether enterprise expansion can sustainably offset slower online business. A few more cautious voices flagged that 4–5% revenue growth is still not “growth stock” territory and that valuation re-rating will require either faster top-line growth or an even more shareholder-friendly capital-return program.

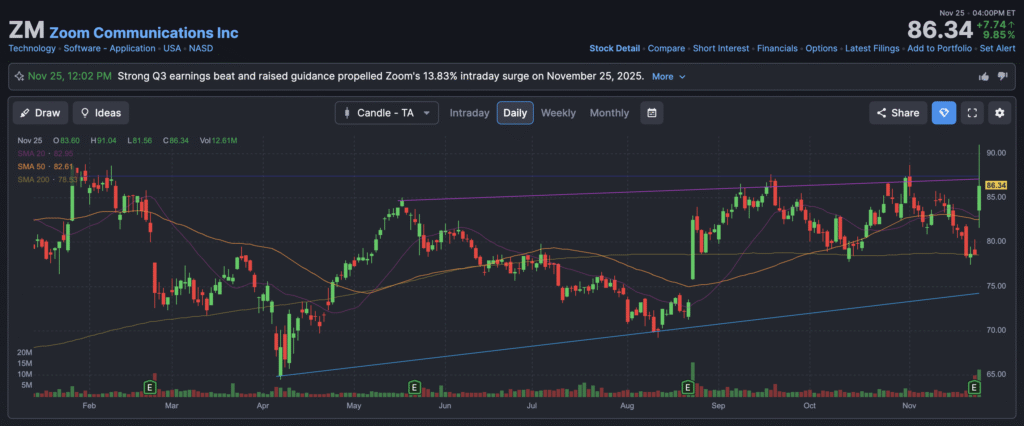

The stock is in a stage 1 consolidation on all 3 timeframes. We are not going to be interested in a position.