1. Company Overview

Palo Alto Networks is a leading global cybersecurity company headquartered in Santa Clara, California. It offers an integrated suite of security products spanning network firewalls, cloud security, endpoint protection, identity and access management, and threat intelligence. Its mission centers on empowering organisations to adopt “cyber-transformation” by simplifying and strengthening security in the digital era. The business serves more than 70,000 organisations worldwide and is widely regarded as a trusted security partner across enterprise and public-sector customers. Over time the company has evolved from firewall hardware into multi-cloud, SaaS-centric security platforms and is positioning itself for the “AI-era” of threats.

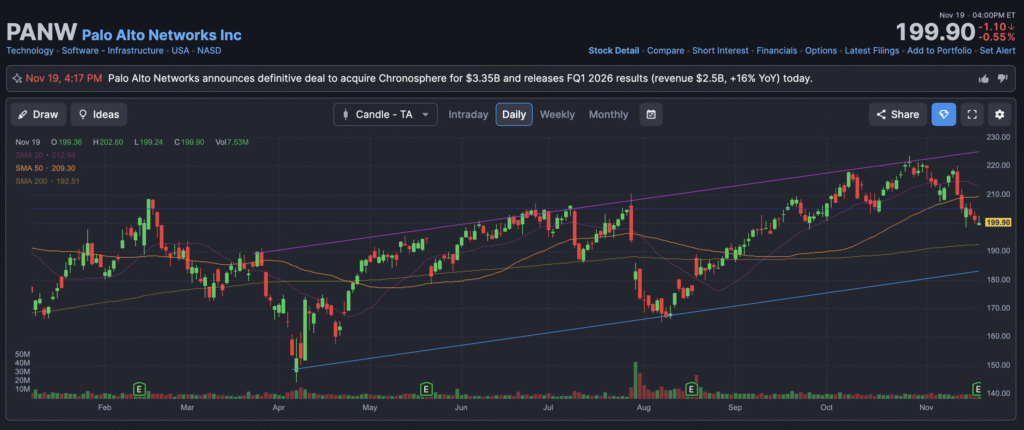

2. Most Recent Earnings (Fiscal Q1 2026)

In the quarter ended October 31 2025, Palo Alto Networks reported total revenue of approximately US$2.5 billion, up ~16% year-over-year. GAAP net income was about US$334 million (EPS US$0.47), compared with US$351 million (EPS US$0.49) a year prior. On a non-GAAP basis, net income was US$662 million or US$0.93 per diluted share, versus US$545 million or US$0.78 per share a year earlier. The company guided for Q2 2026 revenue in the US$2.57 billion to US$2.59 billion range (growth ~14-15%) and full-year FY 2026 revenue in the US$10.50-10.54 billion band (growth ~14%). Next-Generation Security ARR (annual recurring revenue) is guided at US$7.0-7.1 billion for FY 2026 (growth ~26-27%). Analysts noted the results broadly met expectations — revenue beat slightly (~US$2.47 billion vs ~US$2.46 billion expected) but the stock still showed modest reaction.

3. Founding, Products & Competitive Landscape

Palo Alto Networks was founded in 2005 by Nir Zuk (a former engineer at Check Point and NetScreen) in California. The company went public in 2012. Over time it expanded via product innovation and acquisitions into a full-stack security platform company. It is headquartered in Santa Clara, California. Key product offerings include: the next-generation firewall line, Prisma Cloud (cloud workload security), Cortex (XDR, XSIAM, SOC automation) and SASE/SD-WAN security. The company’s major competitors include Fortinet, Inc., Check Point Software Technologies Ltd., CrowdStrike Holdings, Inc., Zscaler, Inc. and Cisco Systems, Inc. (in certain segments) — all vying for enterprise security spend. Headquarters remains in Santa Clara, serving customers globally.

4. Market & Growth Opportunity

Palo Alto Networks operates in the cybersecurity market, including network security, cloud security, identity & access management, endpoint detection & response and threat intelligence services. Analysts expect robust growth in these segments due to rising cyber-threats, ransomware, nation-state attacks, cloud migration, zero-trust adoption and now AI-driven risk. The broader global cybersecurity market is projected to grow at a CAGR of roughly 10-15% through 2030 (depending on segment). For example, the transition to cloud-native workloads, SASE and identity-centric security raises the total addressable market (TAM) significantly. Palo Alto itself has stated a target Next-Gen Security ARR of US$20 billion by ~2030 (per some analyst notes) which would imply very strong long-term growth. The move into AI-security, observability, identity and horizontal platformisation further expands the scope. The growth runway remains favourable given enterprises shifting from fragmented point solutions to integrated platforms.

5. Competitor Landscape (Detailed)

Major competitors:

- Fortinet: strong firewall & network security franchise, high volume based business model.

- Check Point Software: heritage network security vendor with global footprint.

- CrowdStrike: endpoint-centric, cloud-native security model, expanding into other security domains.

- Zscaler: cloud security & SASE specialist.These competitors each have strengths in specific niches; Palo Alto competes with them by offering a broader platform across network, cloud, identity and operations. The competitive environment is intense and pricing, innovation and go-to-market execution matter.

6. Unique Differentiation

Palo Alto Networks’ key differentiation is its platform orientation — rather than providing point solutions, it aims to deliver a unified security architecture spanning network, cloud, identity, operations and AI-era threats. This allows customers to manage security at scale with fewer vendors, streamlining operations, reducing integration cost and improving threat visibility. Furthermore, the company emphasises its “Next-Generation Security ARR” growth, high recurring revenue model and strong momentum in advanced segments (SASE, Cortex, etc). The integration of threat-intel (Unit 42) and strong partner ecosystem gives it credibility. In short: unified platform + recurring revenue + deep investment in R&D and strategic acquisitions.

7. Management Team

- Nikesh Arora — Chairman & Chief Executive Officer. A former Google/SoftBank executive, Arora joined Palo Alto Networks in 2018 and has led its transformation into a broader cybersecurity platform business.

- Dipak Golechha — Chief Financial Officer. In the Q1 2026 release he highlighted the company’s operating efficiency and free-cash-flow margin targets.

- Lee Klarich — Chief Product Officer (and stepping into CTO / product leadership roles). He oversees the product roadmap across network, cloud, identity, operations and AI offerings. (Note: founding CTO Nir Zuk stepped down from board in recent years)

8. Financial Performance – Last Five Years

Over the last five years, Palo Alto Networks has achieved robust revenue growth. For example, FY 2025 revenue was approximately US$9.2 billion, up ~15% year-over-year. CAGR over the five-year period (rough estimate) is in the mid-teens (≈14–17%) given earlier years’ growth rates. On the profitability side, the company has improved non-GAAP earnings significantly. For Q1 2026, non-GAAP EPS rose to US$0.93 from US$0.78 a year prior (~19% growth) indicating decent earnings leverage. The balance sheet remains strong: the company carries significant recurring revenue, growing remaining performance obligations (RPO) and Next-Gen Security ARR (US$5.9 billion figure for Q1) which indicate strong forward revenue visibility. Free-cash-flow margins are improving; guidance for FY 2026 projects adjusted free-cash-flow margin of 38–39%. On the debt side, Palo Alto has managed leverage prudently and uses acquisitions strategically (e.g., CyberArk, Chronosphere) though large M&A deals increase risk. The financial fundamentals—growth, recurring revenue, margin improvement—support the valuation, albeit market expectations are high.

9. Bull Case

- Platform consolidation: customers shifting away from point-security to integrated platforms favour Palo Alto’s broad offering.

- Strong growth runway: with rising cyber-threats, cloud migration and new domains (AI & identity) demand remains high.

- Recurring revenue & margin improvement: high-visibility ARR, improving cash-flow margins and disciplined execution create leverage for upside.

10. Bear Case

- High valuation: with elevated expectations built in, any miss could trigger downside.

- Competitive pressure: many well-capitalised players in cybersecurity may erode margins or lock in customers before Palo Alto.

- M&A and integration risk: large recent acquisitions (e.g., CyberArk for ~US$25 billion) increase execution and financial risk if synergies don’t materialise.

11. Analyst Reactions

Analyst firm Cantor Fitzgerald reiterated an “Overweight” rating on PANW with a US$250 price target, pointing to the company’s strong performance in platform consolidation and its raised long-term Next-Gen Security ARR target. Some other brokerage houses increased their targets (e.g., to ~US$248) following the Q1 results. The sentiment remains broadly positive, though some investors caution the high valuation and integration of recent acquisitions.

12. Valuation Table (Peer Comparison)

Here is a simplified comparison table of Palo Alto Networks and three of its competitors:

| Company | Annual Revenue (FY latest) | Revenue Growth Rate | Net Income | Market Capitalisation |

|---|---|---|---|---|

| Palo Alto Networks (PANW) | ≈ US$9.22 billion (FY 2025) | ~15% year-over-year | ~US$1.13 billion | ~US$135 billion |

| Fortinet, Inc. (FTNT) | Approximate revenue not precisely given for full year, 2025 TTM shows ~₹566 billion (~US$6.8 billion) | ~14%+ growth (Q3 2025: revenue US$1.72 billion, +14% YoY) | ~US$1.94 billion net income for twelve months ended June 30 2025 | ~US$59 billion |

| CrowdStrike Holdings, Inc. (CRWD) | ≈ US$3.95 billion (FY 2025) | ~20-25% growth | Net income: approximately a loss of US$19.3 million | ~US$130 billion |