AST SpaceMobile is a U.S.-based satellite communications company headquartered in Midland, Texas. The firm is building what it asserts will be the first global cellular-broadband network in space, designed to allow standard, unmodified mobile phones to connect directly to satellites. It markets this capability to mobile network operators (MNOs), governments, and uses its own constellation of satellites (its BlueWalker and BlueBird satellite series) as the backbone. AST SpaceMobile is publicly traded under the ticker ASTS and operates in the broader space communications / direct-to-device connectivity segment, which is increasingly gaining interest. While it remains pre-profit, the company carries ambitious growth expectations and has drawn both enthusiasm and skepticism.

2. Most Recent Earnings

In Q3 2025, AST SpaceMobile reported revenue of approximately US$14.74 million, achieving a tremendous year-over-year increase of ~1,236%. However, the company recorded an EPS of −US$0.45 (i.e., a loss of 45 cents per share), which missed consensus expectations of around −US$0.18. Analyst sentiment is cautious: the consensus rating is “Reduce” with an average price target near US$45.27. Guidance for the upcoming quarter/year is more muted and focused on execution of its satellite launches and partnerships (rather than near-term profit). The stock drop following the miss underscores the market’s emphasis on execution risk rather than simply top-line growth.

3. Company Background, Founders, Funding & Key Products

AST SpaceMobile began as AST & Science, founded in 2017 by Abel Avellan (who remains CEO and Chairman). The company’s mission is to eliminate connectivity gaps by providing space-based broadband directly to mobile devices. The company raised significant venture and strategic funding: for example, a Series B round in 2020 reportedly raised US$110 million, led by firms including Vodafone and Rakuten. Through a SPAC merger in 2021, AST SpaceMobile became publicly traded.

In terms of products and technology:

- The BlueWalker 3 satellite is a prototype large phased-array satellite that was successfully deployed and used to demonstrate satellite-to-smartphone connectivity with unmodified handsets.

- The BlueBird commercial satellites (Block 1, Block 2) are the operational constellation pieces intended to deliver the live service. The company plans production and launches of many satellites monthly once scaled.

Key competitors include SpaceX’s Starlink (including its direct-to-cell ambitions), ViaSat, Iridium Communications and other satellite broadband and LEO-constellation players. Headquarters are in Midland, Texas (United States).

4. Market & Growth Expectations

AST SpaceMobile is operating in the satellite-to-cellular connectivity market — a niche within the broader space communications and telecom sectors. The core value proposition is enabling mobile network coverage where terrestrial infrastructure is unavailable or impractical (remote areas, maritime, disaster zones, etc.). Growth drivers: increasing demand for global connectivity, rising smartphone penetration in emerging markets, and MNO interest in plugging the “last mile” of coverage.

Forecasts suggest that the market for direct-to-smartphone satellite services could exceed US$10 billion by the early 2030s. Growth rates (CAGR) are less well-publicised, but given the infancy of the business, high double-digit expansion is assumed until commercial scale is achieved. In the near term, the ramp-up of AST’s satellite constellation, securing spectrum/licensing, and partnering with MNOs are key inflection points. For 2030 and beyond, if scale and regulatory hurdles are cleared, the serviceable addressable market (SAM) could be in the multi-billions annually.

5. Competitors Overview

Major competitors for AST SpaceMobile include Starlink (via SpaceX) which recently acquired a large tranche of spectrum (US$17 billion from EchoStar) to support direct-to-cellphone or direct-to-user services. Iridium Communications offers satellite voice/data services globally. Viasat and other traditional satellite broadband providers also compete, especially in niche enterprise/government segments. The level of competition is becoming more intense, particularly around spectrum access, launch/constellation scaling, regulatory licensing, and handset compatibility.

6. Unique Differentiation

AST SpaceMobile’s key differentiator: the claim to provide direct connectivity from satellite to unmodified, standard mobile smartphones (rather than forcing special handsets or terminals). Their focus on partnering with major telecom operators (e.g., AT&T, Verizon, Vodafone) for integration into standard mobile networks gives them a potential edge in commercialization. Additionally, AST holds a significant patent/IP portfolio for direct-to-device satellite connectivity. If they can execute the satellite launches and secure spectrum/licensing globally, that gives a barrier to entry against smaller players.

7. Management Team (Key Members)

- Abel Avellan — Founder, Chairman & CEO. He has a background in satellite communications (previously founded Emerging Markets Communications) and leads AST’s strategic vision.

- Andrew Martin Johnson — CFO and Chief Legal Officer. He handles the financial and regulatory/legal aspects of the company.

- Dr. Huiwen Yao — CTO. Responsible for the technical architecture of AST’s satellite network, phased-array deployment and direct-to-device innovations.

8. Financial Performance (Last 5 Years)

AST SpaceMobile is pre-profit and so revenue growth, while large percentage-wise, is from a small base. For example, Q3 2025 revenue was US$14.74 m (~1,236% growth year-over-year). Despite top-line growth, the company remains in a deep loss position (EPS −0.45 in that quarter). Because the business is nascent, calculating meaningful five-year CAGRs is difficult and may be misleading given the small base and lumpy satellite launch spend.

The balance sheet shows some positives: as one note indicated, AST has a current ratio of ~9.56 and quick ratio of ~9.48 (indicating strong short-term liquidity) and debt-to-equity around 0.43. However, the cash burn from manufacturing/launching satellites, spectrum acquisition, and regulatory work remains substantial. The key financial story: transition from R&D and deployment phase into revenue-generating operations with scale. If the transition is delayed, the losses will continue and valuation will remain speculative.

9. Bull Case

- Rapidly growing global demand for connectivity and willing MNOs: AST could tap billions of underserved mobile subscribers globally.

- “First mover” direct-to-smartphone satellite model with major telecom partners (Vodafone, AT&T, Verizon) increases commercialization potential.

- If the constellation and licensing go according to plan, AST can scale and convert its large growth potential into real revenue and eventually profitability.

10. Bear Case

- Execution risk is high: satellite manufacturing, launch schedules, regulatory approvals, and spectrum/licensing could experience delays or cost overruns.

- Strong competition (Starlink + other players) and spectrum dynamics may erode AST’s potential edge and margins.

- Very early-stage business: revenues remain very small, losses significant — if market expectations aren’t met, valuation could collapse.

11. Top Analyst Reactions to Earnings

Recent earnings triggered downgrades:

- UBS Group cut the rating from “Buy” to “Hold” and lowered the price target from ~US$62 to US$43.

- Barclays downgraded from “Overweight” to “Underweight,” with a price objective of US$60. Overall, coverage is mixed: ~3 Buy, ~4 Hold, ~4 Sell. Average target ~US$45.27.

12. Valuation Comparison (vs. Top 3 Competitors)

| Company | Revenue (most recent year) | Revenue Growth Rate | Net Income (most recent year) | Market Capitalization* |

|---|---|---|---|---|

| AST SpaceMobile (ASTS) | ~$14.7 m (Q3 2025) | ~1,236% YoY (quarter)† | Significant loss (−US$0.45 EPS) | ~$20.3 b (as of Nov 2025) |

| SpaceX (Starlink) | Not standard public data | High growth expected | Not public | > US$100 b (private estimate) |

| Iridium Communications | ~$2.4 b (FY 2024)‡ | Mid single-digit growth | Positive net income | ~$6–7 b |

| ViaSat | ~$2.5 b (FY 2024)‡ | Low single-digit growth | Positive net income | ~$5–6 b |

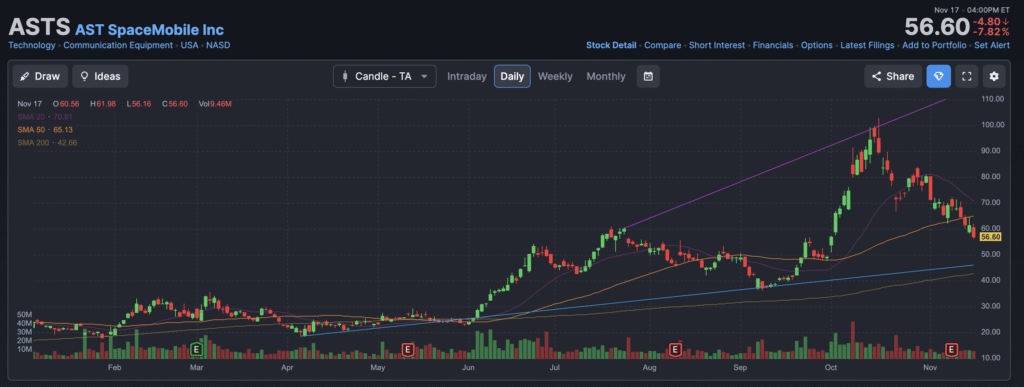

The stock is consolidating stage 3 neutral on the monthly, chart, in a stage 4 bearish markdown on the weekly chart and the daily chart is in stage 4 markdown as well (bearish). We see some support in the $54, $47 and $36 range, where it could reverse, but until then we are not interested.