Overview

Vimeo, Inc. (NASDAQ: VMEO) is a software-as-a-service (SaaS) provider offering a comprehensive video platform that enables businesses, creators, and brands to create, host, edit, manage and distribute high-quality videos. The company was founded in 2004 and is headquartered in New York City. In 2024, Vimeo generated approximately US $417 million in revenue (essentially flat versus the prior year). Key competitors include Brightcove Inc., Kaltura Inc. and Wistia, LLC.

Recent Earnings

On May 5, 2025, Vimeo reported results for the quarter ended March 2025: revenue of US $103.03 million, representing a year-over-year decline of 1.8%. The company reported EPS of –US $0.02, which missed the consensus estimate of US $0.03. The modest revenue beat of the $102.93 million estimate was offset by the EPS shortfall. For the quarter ended June 2025 (reported August 4) Vimeo delivered EPS of US $0.04, above expectation, though revenue of US $104.7 million was essentially flat year-over-year. Vimeo raised its adjusted EBITDA guidance for the full year to approximately US $35 million (up from US $25-30 million), signalling cost discipline and margin focus.

Company Background & Business Model

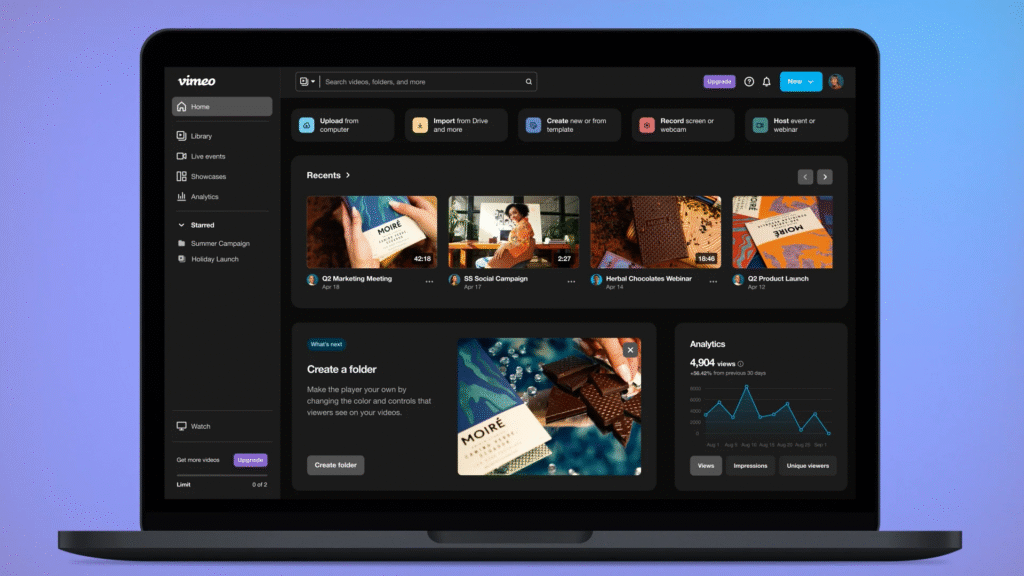

Vimeo was founded in 2004 by filmmakers who sought a higher-quality video hosting and sharing service, initially as a creative community. The company evolved into a business-oriented video software platform. Vimeo’s headquarters is in New York City. Over time Vimeo secured financing and eventually went public via a spin-off from IAC Inc. in May 2021. Vimeo’s platform offers video creation and editing tools, hosting, streaming, analytics, enterprise video solutions, and more recently AI-enabled capabilities such as transcription, translation and collaboration features. Its offerings target both self-serve creators/small businesses and enterprise customers (via “Vimeo Enterprise”). Key competitors include Brightcove, Kaltura and Wistia, as well as broader video or streaming platform providers. Vimeo is differentiated by its all-in-one video experience platform combining creation, hosting, analytics and enterprise video management in one SaaS offering.

Market & Growth Opportunities

Vimeo operates in the broader enterprise video software, streaming and video-as-a-service market. This market encompasses video hosting/streaming, corporate communications video, marketing video, creator monetization platforms, and live/ondemand video services. Analysts estimate that the enterprise video software market will grow substantially through 2030, with annual growth rates in the high single digits to low double digits across segments (for example, video marketing platforms, streaming video tools, creator monetization). Vimeo’s ability to address both creator and enterprise segments positions it to capture growth as organizations increasingly embed video into workflows, communications, marketing and training. The integration of artificial intelligence (AI) tools—such as automatic transcription, translation, video segmentation and collaboration features—offers an incremental growth lever. At the same time, high competition and pressure to differentiate and monetize creator services remain.

Competitive Landscape

Vimeo competes with established enterprise video platform providers such as Brightcove and Kaltura, as well as creator-oriented platforms like Wistia and broader streaming video infrastructure providers. Each competitor offers a subset of capabilities (hosting, streaming, analytics, monetization, live video) and Vimeo’s challenge is to maintain a differentiated offering while scaling revenue and improving margins. Some competitors may focus more narrowly on enterprise, others on creator monetization or video marketing; Vimeo’s all-in-one value proposition must avoid being commoditized.

Differentiation & Unique Value Proposition

Vimeo’s unique differentiation stems from its unified platform that spans the full video lifecycle: creation/editing tools, hosting and streaming infrastructure, analytics and enterprise video management, all delivered via SaaS. Many competitors offer fragments of this stack (e.g., hosting plus streaming, or editing plus collaboration, or analytics) but Vimeo attempts to integrate them under one roof. Moreover, its focus on serving both creators and enterprises gives it dual market exposure—self-serve SaaS plus enterprise contracts. The company’s recent emphasis on AI-enabled features (e.g., transcription, translation, video intelligence) may further strengthen its moat in video workflows. Finally, Vimeo’s brand as a trusted, ad-free high-quality video platform may appeal to professional users and enterprises that want video without the distraction of consumer-social ads.

Management Team

The chief executive officer is Philip Moyer (appointed in April 2024). He brings experience in scaling SaaS businesses and has signalled a strategic shift toward AI, enterprise growth, and margin improvement. The chief financial officer is Gillian Munson, responsible for financial operations, guiding the company’s adjusted EBITDA improvement and cost discipline efforts. Another key leader is Rose Frawley, appointed Chief People Officer in July 2025, who leads global talent strategy and culture in support of Vimeo’s growth agenda. Together, this management team is driving Vimeo’s transition from growth-at-all-costs to sustainable profitability and margin expansion.

Financial Performance (Last 5 Years)

Over the last five years, Vimeo’s revenue grew from approximately US $196 million in 2019 to US $417 million in 2024, representing a compound annual growth rate (CAGR) of roughly 15-16%. However, revenue growth has recently plateaued: for example, revenue was roughly US $433 million in 2022, then US $417 million in 2023/2024, indicating stagnation and even slight decline. On the earnings side, Vimeo has shifted toward profitability, but margins remain thin and variable. While showing improvement in operating margin over the past years, achieving consistent earnings growth remains a challenge given competitive pressure and investment needs. On the balance sheet, Vimeo carries typical SaaS-company infrastructure and continues to invest in growth, but the company’s focus now is on improving adjusted EBITDA (for example the raised guidance of ~US $35 million full-year). The combination of flat revenue growth with margin improvement indicates Vimeo is at an inflection point where cost discipline and scaling enterprise contracts will determine its financial trajectory.

Bull Case

• Vimeo successfully leverages its integrated video platform and AI enhancements to win enterprise contracts and expand average revenue per user (ARPU).

• The shift to enterprise and creator monetization, combined with margin-improvement initiatives (e.g., raised EBITDA guidance) could lead to sustainable profitability and renewed revenue growth.

• As video becomes increasingly embedded in workflows (corporate communications, training, marketing, creator monetization), Vimeo’s broad platform positioning may capture incremental growth and expand its addressable market.

Bear Case

• Vimeo’s recent revenue stagnation raises concerns about growth momentum; if revenue fails to accelerate, valuation pressure may persist.

• Intense competition from many video-platform and streaming infrastructure providers could push pricing pressure, margin compression, or customer churn.

• Execution risk remains—if Vimeo fails to scale enterprise segments, monetize creators effectively, or integrate AI features meaningfully, the narrative could falter.

Analyst sentiment toward Vimeo is cautious. According to consensus, the average rating is “Hold” with a 12-month price target around US $6.81 (implying downside from current levels). Some analysts pointed to the raised EBITDA guidance as positive, but flagged the flat revenue growth as a concern. After the Q2 2025 earnings beat on EPS and raised guidance, the stock jumped in aftermarket trading, reflecting a short-term positive reaction, though longer-term skepticism remains due to growth dynamics.

The stock is in a consolidation stage 1 on the monthly and weekly charts, with a range of $3 – $7.8. On the daily chart it is consolidation stage 1 that’s higher in the $7.5 – $7.9 range. We would not be buyers yet, but expect the stock to be acquired by another company.