Carvana Co. is a U.S.-based e-commerce platform that enables customers to buy and sell used cars online, and offers vehicle delivery and pick-up services. The company was founded in 2012 and is headquartered in Tempe, Arizona. It reported substantial revenue growth in recent years driven by rising used-car demand and its verticalised business model. Carvana competes chiefly with traditional used-car dealers and online platforms such as CarMax, Inc., Vroom, Inc. and others in the automotive retail space. The business has been through a turnaround phase and is now benefiting from cost-controls, operational leverage and technology–enabled logistics.

Recent Earnings (Q3 2025)

In its most recent quarter (ended September 30 , 2025), Carvana reported revenue of approximately $5.65 billion, representing a year-over-year increase of roughly 54.5%. Analysts had expected about $5.08 billion. Net income came in at about $263 million, up from about $148 million a year earlier. Despite the strong top-line beat, investor reaction was muted because of margin pressure concerns and other broader risks. For the next quarter (Q4) Carvana guided to selling at least 150,000 vehicles and maintained full-year adjusted EBITDA of $2.0 billion to $2.2 billion.

(Note: full detailed guidance for the year was not explicitly broken out beyond that range.)

Company Background, Founding, Funding & Products

Carvana was founded in 2012 by Ernest Garcia III, Ryan Keeton and Ben Huston. The company emerged out of the used-car retailer/financing business run by the Garcia family and the affiliate DriveTime Automotive Group, Inc., which provided initial backing. Carvana went public in April 2017. Its product offering is a fully online used-car buying and selling experience: users browse inventory, obtain financing, and get vehicles delivered (or pick up from Carvana’s automated vending-machines) rather than visiting traditional dealerships. The firm also operates wholesale vehicle sales (selling used cars into auctions or to other dealers) and provides vehicle financing (via captive or third-party lenders). Its headquarters is in Tempe, Arizona and it has expanded across the U.S., including large metro markets and “car vending machine” showrooms for brand awareness. Key competitors include CarMax, Vroom, and traditional used-car dealerships. Over time, Carvana has integrated logistics, inspection, reconditioning, delivery/dropship, and online retail into one business model to differentiate.

Market & Industry Overview

Carvana operates primarily in the U.S. used-car retail market, which is large and fragmented. With millions of used-car transactions annually, the opportunity is significant. Carvana has been estimated to capture ~25.7% of the online-used-car dealer industry revenue in the U.S. according to IBISWorld. The growth expectations to 2030 for the online used-car market are favourable given secular shifts to digital commerce, consumer preference for no-haggle pricing and home delivery, and the value proposition of online platforms. The compound annual growth rate (CAGR) for online used-car retail is expected to be notably higher than traditional dealership growth, although precise market forecasts vary depending on macro-economic factors (interest rates, credit availability, used-car supply). The used-car market overall will face cyclical challenges tied to vehicle supply, credit conditions, and consumer demand but the shift to online remains a key secular tailwind.

Competitors

Carvana’s major competitors include CarMax, which has a large network of physical stores plus online operations, and Vroom, which is a pure online used-car platform. Traditional local used-car dealerships also compete, especially in non-urban markets or for low-price/credit-challenged segments. Each competitor has different strengths—CarMax benefits from physical footprint and brand recognition, Vroom is more digitally pure but smaller scale, and many local dealers have deep local market knowledge. The competition thus ranges from large multi-channel players to nimble digital disruptors.

Unique Differentiation

Carvana differentiates through its end-to-end digital platform combined with logistics and delivery capabilities (including “car vending machine” pickup experiences). Its vertically integrated model allows it to control inventory buying, reconditioning, inspection, financing and delivery under one roof. The one-stop digital buying/selling experience (often home delivery, 7-day return window) appeals to consumers seeking convenience and transparency compared to a traditional dealership. Moreover, its focus on operational efficiencies and cost savings (versus bricks-and-mortar footprint) gives it a potential cost advantage. These factors provide Carvana a differentiated value proposition among online used-car retailers.

Management Team

Ernest Garcia III serves as Chairman and Chief Executive Officer. He is the son of Ernest Garcia II (long-time used-car/finance entrepreneur) and played a leading role in founding and scaling Carvana. Under his leadership the company has pivoted from rapid expansion to a more disciplined growth and profitability strategy. Another key executive is Dan Gill (evangelised within Carvana’s investor communications as a senior leader, though his formal title varies). A third leader is Mark W. Jenkins who has served as Chief Financial Officer (or previously Chief Accounting Officer) and guides Carvana’s financial strategy, including restructuring efforts and cost controls. Together the management team has been focused on stabilising the business, improving margins, reducing debt/leverage, and driving vehicle unit growth sustainably.

Financial Performance (Last Five Years)

Over the past five years, Carvana has shown volatile but overall strong revenue growth, with annual top-line expansion often exceeding 30-40%. For instance, in its Q2 2025 results the company reported revenue of about $4.84 billion, up roughly 42% year-over-year. Earnings were previously negative in earlier years but the firm achieved positive EPS in recent quarters (e.g., EPS of $1.28 in Q2 2025). This indicates a transition from growth mode to profitability mode. The revenue-CAGR over the last five years likely lies in the high-20s to low-30s percentage range, though exact full-year numbers vary by reporting period and macro conditions. On the earnings front, growth from negative earnings to positive EPS reflects a strong turn-around—however, comparability is more challenging since earlier years included losses and restructuring charges. On the balance sheet, Carvana has focused on reducing leverage, improving cash flows and tightening working capital (inventory turnover, vehicle purchasing discipline). The company’s shift to operational efficiency and cost management is reflected in margin improvement and positive net income running in recent quarters. As such, investors are watching whether the business can sustain positive earnings growth and maintain strong free cash flow while continuing vehicle unit growth.

Bull Case

• The secular shift to online used-car purchases gives Carvana a large runway for growth.

• A vertically integrated digital model with logistics/delivery infrastructure provides cost advantages and consumer convenience.

• Continued improvement in margins, combined with vehicle unit growth, could unlock significant earnings expansion and free-cash-flow generation.

Bear Case

• The used-car market is cyclical, sensitive to interest rates, credit availability, and vehicle supply; a downturn could impair demand or margins.

• Competitive pressures from larger multi-channel dealers (with scale) or digital pure-plays may erode Carvana’s pricing or margin benefits.

• Execution risk remains given past regulatory/legal issues, inventory/credit risks, and the need to sustain profitability rather than merely growth.

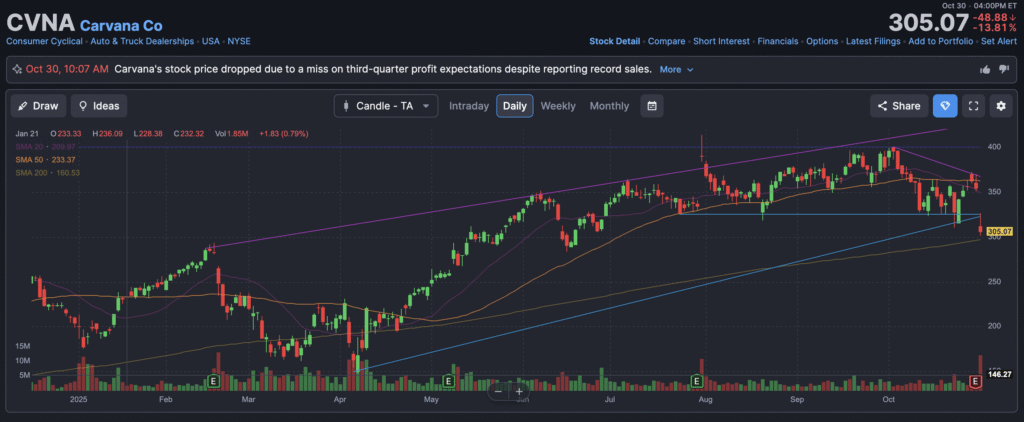

The stock is in a stage 3 consolidation on the monthly chart and starting consolidation on the weekly chart in stage 3 as well. The daily chart is in a stage 4 markdown with support at the $265 – $283 range where it could reverse.