Overview

Blackstone Inc. is a leading global alternative asset manager specializing in private equity, real estate, credit, infrastructure, hedge funds and other investment strategies. Founded in 1985, it has grown to manage more than $1 trillion in assets under management (AUM) and serves institutional and individual investors worldwide. Its headquarters are in New York City. Key competitors include firms such as Carlyle Group, KKR & Co., and Apollo Global Management. Leveraging scale across real-asset, credit and private equity platforms, Blackstone seeks to generate investor returns while building strong businesses and asset portfolios. The company’s diversified footprint across multiple asset classes has positioned it as one of the most influential players in the alternative investment landscape.

Most Recent Earnings (Q2 2025) – Performance & Guidance

On July 24, 2025, Blackstone reported its quarterly results for Q2 2025. The company posted adjusted EPS of $1.21, beating analyst consensus of around $1.10 by about $0.11. Revenue was $3.71 billion, rising from $2.796 billion a year ago (up ~32.7 %) and above estimates. Fee-related earnings also beat estimates, supported by growth in private wealth, credit & insurance and infrastructure segments. While the company did not release detailed guidance in the headline press release, it continues to emphasise strong momentum in deployment, fundraising and exiting investments amid robust deal activity. The broad guidance implies continued growth in fee-earning businesses and AUM expansion, though macro, interest-rate and asset-valuation risks remain. Investors will look for upcoming commentary on next-quarter and full-year expectations at the next earnings call.

Founding, History, Products & Headquarters

Blackstone was founded in 1985 by Stephen A. Schwarzman and Peter G. Peterson, both of whom had backgrounds at Lehman Brothers. Originally established as a mergers & acquisitions advisory firm, Blackstone soon expanded into private equity investing, real estate acquisitions and leveraged buy-outs. Over time, the firm broadened into credit markets, infrastructure, hedge funds, secondaries and growth equity. Headquarters remain in New York City. In terms of product offerings, Blackstone manages private equity funds, real estate investment funds, credit funds, infrastructure investments, hedge fund portfolios and insurance-solutions platforms. Its key competitors include, but are not limited to, KKR & Co., The Carlyle Group and Apollo Global Management. As an alternative asset manager, Blackstone is distinguished by its scale, global reach and multi-asset-class platform.

Market & Industry Dynamics

Blackstone operates in the global alternative asset-management industry, encompassing private equity, real estate investment, private credit, infrastructure and hedge funds. This market is driven by institutional demand (pension funds, sovereign wealth funds, endowments) for diversified returns beyond traditional equities and bonds. Growth expectations to 2030 are favourable: as global pension liabilities grow and low-yield environments persist in traditional assets, allocations to alternatives are expected to rise. Some industry estimates suggest mid-single-digit to low double-digit CAGR for alternative assets under management over the remainder of the decade. For instance, the firm reports managing over $1.2 trillion in assets as of June 30, 2025, which underlines the scale and growth potential. Real estate and infrastructure investment are also expected to see structural tailwinds (urbanisation, digital infrastructure, data centres, climate-resilient assets) which benefit Blackstone’s platforms. A recent note highlighted Blackstone’s expansion of data-centre projects in Spain, signalling digital-infrastructure as a growth vector. The long-term growth runway thus looks supportive, though revenue and asset valuation risks (interest rates, inflation, liquidity) remain.

Competitors

Blackstone’s main competitors include KKR, Carlyle and Apollo, each managing sizable alternative-asset portfolios with overlapping product lines (private equity, credit, real estate). KKR emphasises global private equity and credit; Carlyle emphasises diversified private-credit and real-asset solutions; Apollo emphasises opportunistic credit and financial-services investing. These firms all vie for institutional capital, deal flow and asset-management scale. The competitive landscape features pressure on fees, and asset-valuation sensitivity can create differences in return profiles across firms. For Blackstone in particular, its size and breadth provide advantages, but also bring complexity and execution risks versus smaller, more nimble competitors.

Differentiation

Blackstone’s unique differentiation lies in its tremendous scale (over $1 trillion AUM), multi-asset-class platform (private equity, real estate, credit, infrastructure, hedge funds, insurance solutions) and global reach. Its ability to originate, deploy and exit large deals across sectors and geographies gives it a competitive edge. Moreover, its strong track record of raising capital, generating fee-earning businesses and leveraging synergies across operating platforms (for example, creating integrated solutions for institutional investors) positions it well. In addition, Blackstone emphasises building “long-term value” by actively managing its portfolio companies and assets, not just providing passive capital. These attributes help it stand out versus competitors with a narrower focus.

Management Team

Stephen A. Schwarzman is the Chairman, Chief Executive Officer and Co-Founder of Blackstone. He has led the firm since its founding and drives major strategic decisions. Joe Baratta serves as Global Head of Private Equity at Blackstone, overseeing the private-equity platform. Jonathan Gray is President and Chief Operating Officer, and also serves as Global Head of Real Estate. Together, these leaders constitute a core executive team influencing Blackstone’s investment strategy and operations across business units. Their experience, long tenure and alignment with the firm’s culture and goals add to investor confidence.

Financial Performance (Last Five Years)

Over the past five years, Blackstone has exhibited robust revenue growth driven by fundraising, increased deployment, management and performance fees, and exit activity. Although specific annual figures are not all publicly summarised here, the Q2 2025 revenue of $3.71 billion represents a ~32.7 % year-over-year rise from $2.796 billion a year earlier. Earnings growth has similarly accelerated — for quarter Q2 2024 to Q2 2025, GAAP EPS rose from $0.58 to $0.98, while adjusted EPS was $1.21 (versus consensus ~$1.10). On the balance sheet side, Blackstone benefits from significant capital commitments, diversified portfolio holdings and recurring fee streams; its size and asset base provide both scale advantages and risk exposure to asset valuation and liquidity cycles. The firm’s AUM as of June 30, 2025 stood at approx. $1.211 trillion. The compound annual growth rate (CAGR) in revenue and earnings over the past several years appears to be in the high-single to low-double-digit range, bolstered by favourable industry trends and Blackstone’s deployment strength. Looking ahead, maintaining strong growth will depend on continued fundraising, investment exits, fee generation and asset-valuation gains.

Bull Case

- Blackstone’s enormous scale and diversified asset-class exposure position it to capture growth in alternative investing, real estate, infrastructure and credit as institutional demand rises.

- The firm’s strong deal-making capability and global presence allow it to take advantage of value-creation opportunities, especially in structurally-driven sectors (e.g., digital infrastructure, data centres).

- Its recurring fee-earning businesses (management fees, performance fees, platform services) create steady cash flow, which supports dividends and reinvestment.

Bear Case

- The alternative asset industry is highly sensitive to interest rates, asset valuations, liquidity and exit timing; a prolonged high interest-rate environment or valuation decline could impair returns and growth.

- Blackstone’s large size, complexity and broad exposure may lead to slower decision-making, higher overhead and more difficulty in generating outsized returns compared to smaller, more nimble competitors.

- If fundraising weakens or competition for deals intensifies, Blackstone may face margin pressure on fees or fewer value-creation opportunities, which could weigh on growth and profitability.

Analyst Reactions

Following the Q2 2025 earnings beat (adjusted EPS of $1.21 vs ~$1.10 consensus; revenue of $3.71 billion vs ~$2.79 billion) analysts responded positively. Some upgraded their outlooks on Blackstone’s ability to drive growth in credit, infrastructure and real-assets segments. Price-target revisions were upward in part driven by the stronger than expected fee-earning performance and robust AUM growth. That said, some analysts remain cautious and have flagged the macro/valuation risks inherent in the alternatives space. A mixture of upgrades and reaffirmations reflects the consensus that Blackstone is in a favourable position, yet not without exposure to cyclical risks.

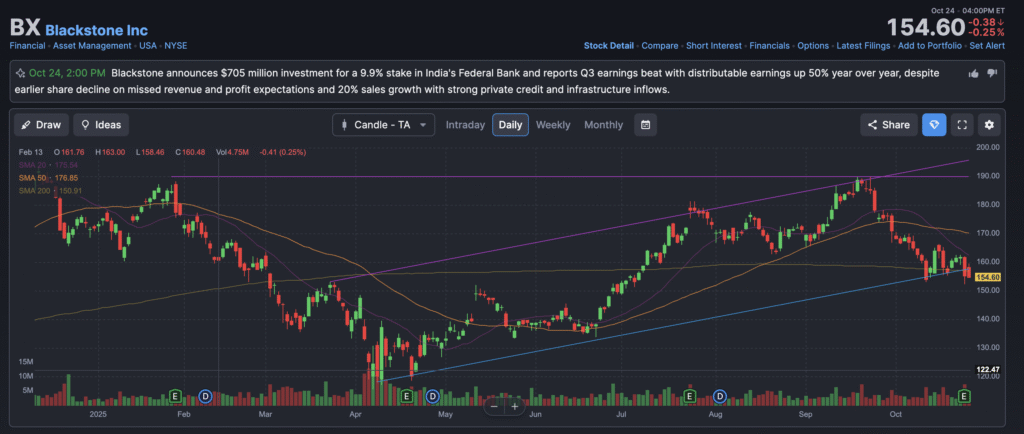

The stock is in a stage 4 markdown bearish on the monthly and weekly charts, with broken cup and handle, with support in the $149 – $152 zone, but could head even lower to the $140 – $145 area before a reversal.

Good stock to own but wait for a reversal, would be my recommendation.