Progressive Corporation is a U.S.-based insurance holding company that primarily operates in personal auto insurance, along with select commercial auto and property-casualty lines. It differentiates itself by blending direct sales (online/phone) with an independent agency network. Over the decades it has leaned heavily on data, pricing segmentation, and technology (e.g. usage-based insurance) to compete. It also offers bundled and ancillary insurance products (home, RVs, motorcycles, etc.). The company is headquartered in Mayfield Village, Ohio.

2. Most Recent Earnings

In its Q2 2025 results (for period ended June 30, 2025), Progressive reported net premiums written of $20.08 billion, and a net income of $3.18 billion, or EPS of $5.40 per share, up from $2.48 a year ago. The EPS of $5.40 represented a ~23.9% surprise above the consensus forecast of $4.36. Meanwhile, revenue (premiums) came in slightly below analyst expectations (a ~1.95% revenue shortfall) even though growth remained healthy. The combined ratio (a measure of underwriting performance) improved to about 86.2%, down from ~91.9% in the prior year quarter.

As for guidance, while Progressive does not always give full forward numeric guidance due to the variability in insurance cycles, management has reiterated its goal of maintaining a combined ratio near the low to mid-90s (or better) and continuing disciplined underwriting and growth in policies in force. Analysts’ models generally expect modest growth in premium volume and stable underwriting margins.

3. History, Founding, Products & Competitive Position

Progressive was founded on March 10, 1937 by Joseph M. Lewis and Jack Green (both lawyers) as Progressive Mutual Insurance Company in Ohio, with a focus initially on automobile insurance. In the 1950s and 1960s it began to specialize in nonstandard drivers (higher risk segments) and pioneered more flexible, segmented pricing approaches. In 1971 it went public, and over time grew its direct (online/phone) and independent agent channels.

Progressive offers a broad suite of products: primarily personal auto, commercial auto, motorcycles, boats, RVs, trailers, and other specialty vehicle lines. It also offers property (homeowners, flood, condo) insurance and bundling opportunities, typically in partnership or via affiliated carriers. On the claims and servicing side, Progressive emphasizes fast, technology-enabled claims processing and digital engagement.

Key competitors include the large diversified property & casualty insurers such as State Farm, Allstate, Geico (a unit of Berkshire Hathaway), Liberty Mutual, and Travelers, among others. In the niche of auto insurance, its primary competitive set is State Farm and GEICO.

The company is headquartered in Mayfield Village, Ohio.

4. Market & Industry Analysis

Progressive operates in the U.S. property & casualty (P&C) insurance market, with a strong emphasis on personal auto insurance. In the U.S., auto and property insurance is highly commoditized but regulated state by state. Premium rates must often be approved, and underwriting discipline is critical.

The auto insurance market over the next decade is expected to be shaped by several trends: increasing vehicle repair and parts costs, more frequent severe weather events, potential impacts of autonomous vehicles, telematics/usage-based pricing, and regulatory pressures. Some industry projections suggest that P&C insurance markets may grow at a mid-single-digit CAGR, though profitability (underwriting margins) will remain cyclical. I don’t currently see a well-cited 2030 total market forecast specifically, but the underlying tailwinds (vehicle growth, increased vehicle values, regulatory inflation) support a steady expansion.

In the auto insurance sector, usage-based insurance and telematics are expected to grow faster, enabling insurers to better price risk and attract low-mileage or safe-driving customers. Progressive has been an earlier mover in that area (e.g. their “Snapshot” program) which gives it some runway to capture benefit from that shift.

Weather and climate risk is a significant challenge, especially for bundled home and auto insurers, as catastrophic losses have grown in frequency and magnitude. Insurers increasingly must price for that risk or shift exposure.

5. Competition

Progressive’s main competitors in auto and P&C insurance are:

- State Farm: the largest personal auto insurer in the U.S., with broad scale, brand strength, and a large agent network.

- GEICO (part of Berkshire Hathaway): strong in direct channels, competitive pricing, and scale in auto lines.

- Allstate, Liberty Mutual, and Travelers also compete across multi-line P&C, homeowner, and commercial lines.

These players all have deep capital bases, actuarial sophistication, and distribution networks. The competitive pressure is high on pricing, customer acquisition cost, claims cost control, and technology differentiation.

6. Differentiation and Moat

Progressive’s differentiation stems from:

- Its hybrid distribution model combining direct (online, phone) and independent agents, giving flexibility in reaching diverse customer segments

- Deep data and pricing/risk segmentation capabilities, including its early adoption of usage-based insurance (Snapshot) to tailor premiums more closely to actual driving behavior

- Strong brand and customer acquisition efficiency

- Underwriting discipline and a focus on the combined ratio (i.e. controlling losses + expense) rather than pure growth

- Ability to cross-sell ancillary and bundled products

These elements together form a moated position in auto insurance, as competing solely on scale or price is difficult when underwriting losses and claims volatility are large risk factors.

7. Management Team

- Tricia Griffith – President & CEO. She has led Progressive since 2016 and has been with the company in various roles over many years. Under her leadership, the company has grown premiums, expanded technology initiatives, and maintained strong underwriting discipline.

- Lawton W. Fitt – Chairperson of the Board. (Chair of Progressive’s board)

- Other senior executives include the CFO, COO, and heads of underwriting/claims, though publicly available profiles often emphasize Griffith as the key leader.

8. Financial Performance (Last 5 Years)

Over the past five years, Progressive has achieved solid growth in premium volume, underwriting profitability, and net income. Its revenue (premium) growth has been supported by both volume growth (policies in force) and rate increases. Its insistence on maintaining combined ratio discipline has helped ensure that growth translates into earnings rather than loss-making scale.

Earnings growth has been volatile due to insurance cycles, cat losses, and claims inflation, but net income has grown at a healthy rate overall. The company’s return on equity and capital deployment (shareholders’ equity) have also trended positively, with capital cushions allowing it to absorb occasional volatility.

On the balance sheet, Progressive holds significant invested assets (reserves invested in fixed income and securities) to back its insurance liabilities. It maintains prudent reserves for claims outstanding and reinsurance arrangements to manage tail risk. Capital adequacy is generally well regarded in the industry.

One risk is that rising claims, inflation in auto parts/labor, and increasing severity of losses could erode margin if not offset by rate increases. But Progressive’s model is structured to respond in those scenarios with discipline.

9. Bull Case

- Progressive can continue to gain share in auto insurance, especially among low-risk, usage-based customers, improving yields

- Strong combined ratio control gives it buffer versus peers during adverse loss cycles

- Its hybrid distribution and tech capabilities may allow capturing more of the telematics/usage-based segment profitably

10. Bear Case

- Claims inflation and catastrophic events could outpace rate increases, hurting margin

- Regulatory constraints on premium rate increases in some states may impede sufficient pricing flexibility

- Increased competition or disintermediation (e.g. insurtechs) may erode margins or customer acquisition

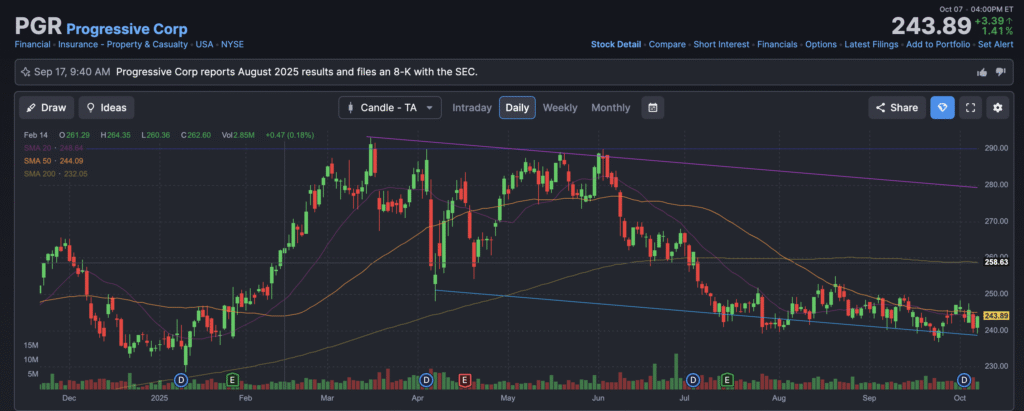

The stock is in a stage 4 markdown bearish on the monthly chart, but range bound stage 1 on the weekly chart with $232 – $292 being the range. The daily chart is in stage 1 as well and shows a range of $238 – $252. This should resolve over the next quarter earnings to the upside.