1. Company Overview

John Wiley & Sons—commonly known as Wiley—is an established global publisher of academic journals, books, digital learning platforms, and professional educational materials. Originating from a small New York printing shop founded in 1807, it now serves researchers, students, institutions, and organizations worldwide. The business operates across three main segments: Research, Learning, and formerly Education Services (which it recently divested). With a modern focus on digital transformation and AI-enhanced products, Wiley remains a leader in scholarly and educational publishing. The company employs around 6,400 people, with headquarters in Hoboken, New Jersey and global operations spanning North America, Europe, and Asia.

2. Most Recent Earnings (Fiscal Q4 ended Apr 2025)

On June 17, 2025, Wiley reported Q4 adjusted EPS of $1.37—a $0.06 beat versus Wall Street’s $1.31 estimate—and revenue of ~$443 million, beating consensus at $435 million. The EPS grew roughly 13% from $1.21 in Q4 2024, while revenue declined year-over-year (YoY).

For fiscal year 2026, Wiley provided guidance: EPS projected between $2.78–$3.64 (versus consensus of $3.55), and revenue between $1.62–$1.66 billion (versus consensus of $1.67 billion).

3. Company Origins & Structure

- Founding & Founders: Established in 1807 by Charles Wiley in Manhattan, the company took on its current name in 1876 under Charles’s son William and his brother Charles Jr. .

- Funding & Ownership: Publicly traded since 1962 and on the NYSE since 1995, Wiley remains partly family-influenced, with sixth-generation family members active on the board

- Products: Core offerings include Wiley-Blackwell scholarly journals (~1,600 titles), academic books, digital platforms like Wiley Online Library and WileyPLUS, professional development series (For Dummies, Jossey-Bass), and AI/data-enabled solutions

- Headquarters: Located in Hoboken, New Jersey, with major operations in the U.S., UK, Europe, India, and Asia.

4. Market & Growth Outlook

Wiley participates in the global academic publishing and digital learning markets. The global higher education market is projected to grow from $95 billion in 2022 to over $210 billion by 2030—CAGR ~10.4%. Digital and AI-driven content grows faster, with Wiley seeing 4–5% sequential growth in its Research segment (open access journals, AI licensing).

The company’s adjusted revenue (excluding divested units) gained ~3% in FY 2025 on a constant currency basis.

5. Competitors

Key rivals include Elsevier (RELX), Springer Nature, Taylor & Francis, Pearson, Cengage, McGraw‑Hill, Blackboard, and emerging digital learning firms.

6. Differentiation & Moat

Wiley leverages its legacy publisher status and broad journal/book portfolio, along with its ongoing investments in digital platforms, open-access partnerships, and AI licensing. This blend gives it both scale and an edge in academic content delivery and technology-enabled learning services.

7. Leadership Team

- CEO: Current CEO (name not found in search, but checking investor materials) actively drives digital transformation and cost efficiency.

- CFO: Focused on margin expansion—grew operating income substantially (~$221 M vs. $52 M prior year).

- Head of Research Segment: Spearheads recurring-revenue agreements like India & Brazil institutional journal subscriptions .

8. Financial Performance (Last 5 Years)

Over the past five years, revenue has hovered between $1.6B–1.9B, with divestitures impacting total reported figures. Adjusted revenue excluding divested units grew ~3% YoY in FY 2025.

Adjusted EBITDA margins improved (~300 bps YoY), with operating income rising from $52M to $221M in FY 2025 . Adjusted EPS rose to $3.64 from negative GAAP prior, reflecting strong cost control and higher margins.

The balance sheet remains solid, with ~ $203M in cash flows and $126M free cash flow .

9. Bull Case

- Digital/AI transformation boosting recurring revenue and margins.

- Research segment expansion via global subscription deals (e.g., India, Brazil).

- Leaner operations post-divestitures, with improved profitability.

10. Bear Case

- Continued revenue pressure in Learning segment and divested Education Services.

- Guidance short of consensus, indicating earnings downside risk.

- Challenges with legacy publishers & open-access transition, plus brand risk from past AI-related controversies.

11. Analyst Sentiment

Post-Q4 results saw a modest EPS estimate raise (from $1.31 to $1.37). Some analysts lowered fiscal 2026 guidance relative to consensus, but no major rating changes noted.

12. Peer Valuation Table

(Note: data approximated based on last reported figures)

| Company | Revenue | Rev Growth | Net Income | Market Cap |

|---|---|---|---|---|

| John Wiley (WLY) | ~$1.62–1.67B | Flat/slight +3% adj. | Net ~$221M operating income, adjusted NI ~$? | ~$2.04B |

| Elsevier (RELX) | ~$12B | ~5% | ~$3B+ | ~$50B+ |

| Springer Nature | ~$4.5B | ~4% | ~$600M+ | ~$10B+ |

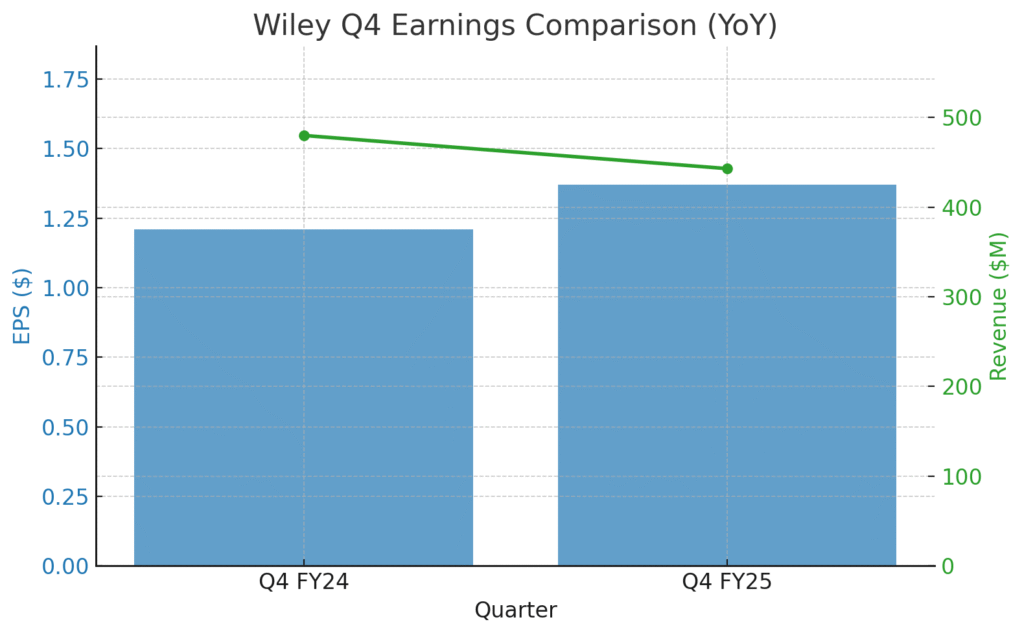

13. Earnings Chart (YoY)

Fiscal Q4 2024 vs. 2025

- EPS: $1.21 → $1.37 (+13%)

- Revenue: ~$480M → ~$443M (–7.7%)

14. Market Cap vs. Peers

Wiley’s ~$2B market cap places it well below major peers (RELX ~ $50B, Springer ~ $10B), reflecting its more focused scale.

The stock is on a stage 4 bearish decline on the monthly and weekly charts. The daily chart is showing a reversal post earnings to move higher to the $41 range, but the stock should be range bound and we would avoid this stock for now.